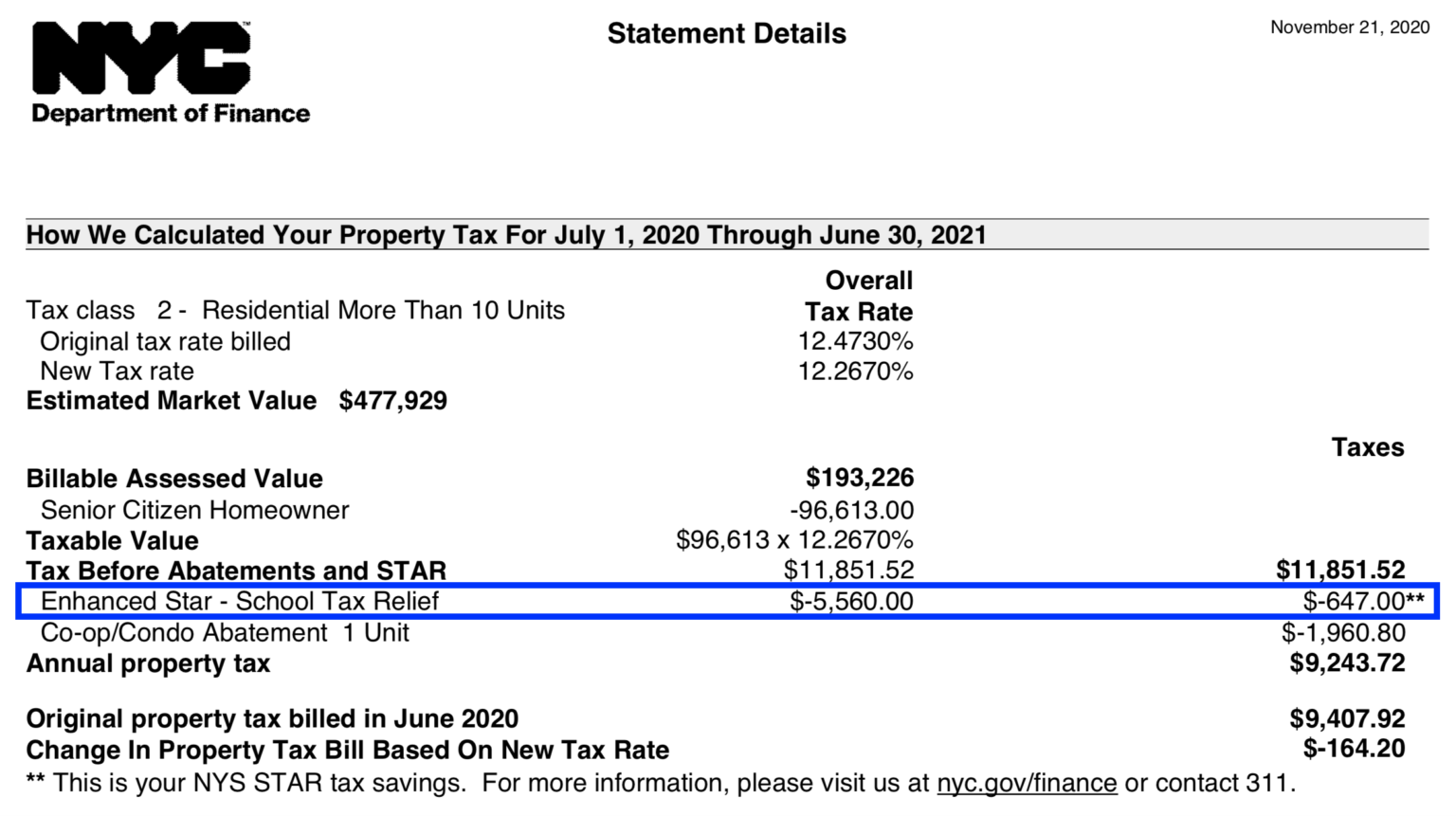

Is The Nys Star Credit Taxable Income The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners If you are eligible and enrolled in the STAR program you ll receive your benefit each year in

If you are a STAR recipient you receive the benefit in one of two ways The STAR credit program open to any eligible homeowner whose income is 500 000 The School Tax Relief STAR program provides eligible homeowners in New York State with relief on their property taxes 2024 STAR Handout PDF Register

Is The Nys Star Credit Taxable Income

Is The Nys Star Credit Taxable Income

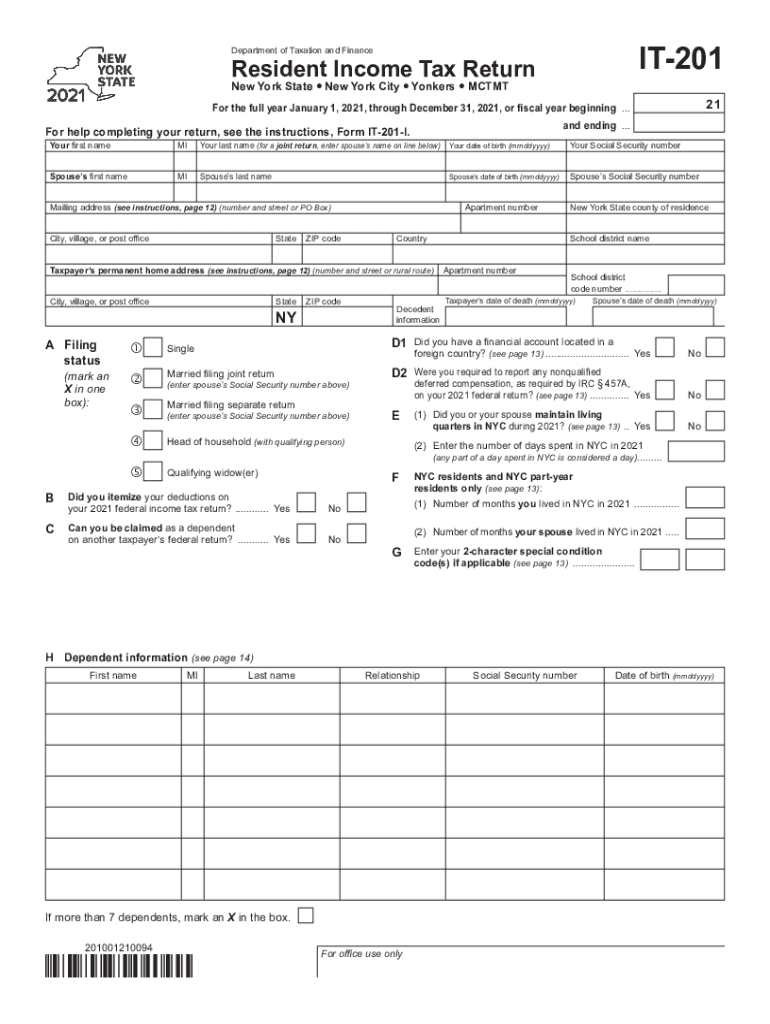

https://www.pdffiller.com/preview/584/982/584982095/large.png

A Short Story Why I Think The NYS Star Program Is Great YouTube

https://i.ytimg.com/vi/rsUnSmqYmqA/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AYwCgALgA4oCDAgAEAEYZSBgKFIwDw==&rs=AOn4CLDCAZKk2jNqz74WnplCH_WcijT4-g

Nys Star Rebate Check 2023 RebateCheck

https://i0.wp.com/www.rebatecheck.net/wp-content/uploads/2023/04/new-york-state-star-rebate-checks-latestrebate-63.jpg?w=2048&ssl=1

Enhanced STAR is for homeowners 65 and older whose total household income for all owners and residents spouses is 98 700 or less The benefit is estimated The School Tax Relief STAR and Enhanced School Tax Relief E STAR benefits offer property tax relief to eligible New York homeowners STAR and E STAR can be issued

To be eligible you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for the 2020 income tax year and a school tax Typically the STAR program offers a reduction on your tax bill and the homeowner pays a lesser amount whenever they pay their tax bill The big change is that if your income is greater than 250 000 00

Download Is The Nys Star Credit Taxable Income

More picture related to Is The Nys Star Credit Taxable Income

Is The Employee Retention Credit Taxable Income ERC Bottom Line Savings

https://erc.bottomlinesavings.com/wp-content/uploads/2022/10/Is-the-Employee-Retention-Credit-Taxable-Income.jpg

Is The Nys Healthcare Bonus Taxable Health Blog

https://www.drexrx.com/wp-content/uploads/2023/05/taewabasileqerofira.jpg

Nys Withholding Tax Forms 2022 WithholdingForm

https://www.withholdingform.com/wp-content/uploads/2022/08/where-to-find-and-how-to-read-1040-tax-tables-1.jpg

Does a NYS Property Tax Relief credit check count as taxable federal income If you received a check for the School Tax Relief STAR credit you do not Q What is the income requirement for Enhanced STAR A The Enhanced STAR plan for seniors automatically adjusts income limits based on the annual federal

Here is a table from NYS Department of Taxation and Finance that summarizes the eligibility requirements for the Basic STAR and Enhanced STAR credit The income limit for the Basic STAR credit is 500 000 the income limit for the Basic STAR exemption is 250 000 based on the first 30 000 of the full value of a

STAR EXEMPTION CHANGE IN NYS 2016 BUDGET Bordeau Builders

https://www.bordeaubuilders.com/wp-content/uploads/2016/04/star2.jpg

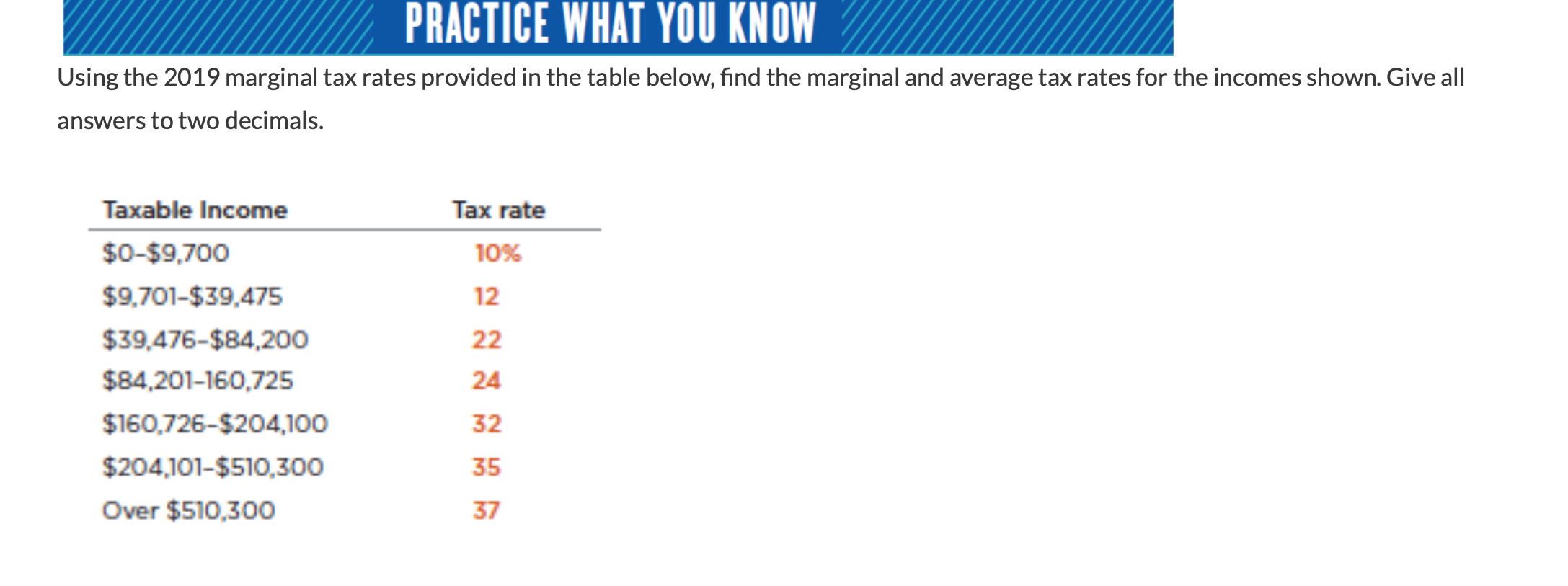

Solved What Would Be Your Federal Income Tax If Your Taxable Chegg

https://media.cheggcdn.com/media/306/3064aa3f-45d1-4e88-91fc-d613aac9f0ab/phpjplfSo

https://www.tax.ny.gov/star

The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners If you are eligible and enrolled in the STAR program you ll receive your benefit each year in

https://www.nysenate.gov/newsroom/articles/2021/...

If you are a STAR recipient you receive the benefit in one of two ways The STAR credit program open to any eligible homeowner whose income is 500 000

Income Tax In New York INVOMERT

STAR EXEMPTION CHANGE IN NYS 2016 BUDGET Bordeau Builders

Tax Rebate Checks Come Early This Year Yonkers Times

Flight Of Affluent Taxpayers Catches Up With New York Bloomberg

NY Sends Tiny Checks To Pay Interest On Last Year s Tax Refund

Is The Employee Retention Credit Taxable Income

Is The Employee Retention Credit Taxable Income

What Is The Enhanced STAR Property Tax Exemption In NYC Hauseit

How To Find Average Income Tax Rate Parks Anderem66

What Is Taxable Income Explanation Importance Calculation Bizness

Is The Nys Star Credit Taxable Income - Typically the STAR program offers a reduction on your tax bill and the homeowner pays a lesser amount whenever they pay their tax bill The big change is that if your income is greater than 250 000 00