Is The Renewable Energy Tax Credit Refundable The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on

The solar tax credit can save you money on your tax bill but the amount of your credit can t exceed the total amount you owe That s because the credit is nonrefundable in tax speak Refundability can be done through a direct cash grant or as a refundable tax credit claimed on a tax return so the entity can get a tax refund in the year they are filing for the unused

Is The Renewable Energy Tax Credit Refundable

Is The Renewable Energy Tax Credit Refundable

https://i.pinimg.com/originals/39/9e/55/399e5509105983b931911f5b36afce98.jpg

Tax Credits Extended For Renewable Energy Urban Solar

https://urbansolar.com/wp-content/uploads/2015/12/tax-credits-extended-for-renewable-energy.jpg

Renewable Energy And Solar Energy In York PA King Of Prussia PA

https://www.trifectasolar.com/assets/images/content/1.jpg

Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 If you ve already installed a system in The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar

The final regulations add significant flexibility to the proposed rules including Expanding the types of tax exempt entities and electric cooperatives that can elect a Jump to How do renewable energy tax credits work What renewable energy tax incentives does the IRS offer for individuals vs businesses Overview of clean energy credits by energy type Helping clients

Download Is The Renewable Energy Tax Credit Refundable

More picture related to Is The Renewable Energy Tax Credit Refundable

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

Renewable Energy Tax Credits Iowa Utilities Board

https://iub.iowa.gov/sites/default/files/banner/renewable_tax_credits.jpg

A Little known Government Program Called The Residential Renewable

https://i.pinimg.com/736x/50/c8/e1/50c8e1d08105c2449f117aa7f5e69029.jpg

In December 2020 Congress passed an extension of the ITC which provides a 26 tax credit for systems installed in 2020 2022 and 22 for systems installed in 2023 4 The tax credit The energy tax credit isn t a refundable credit that would result in you receiving money The energy credit is a nonrefundable credit that can only reduce the tax you owe to 0 You won t

The Inflation Reduction Act of 2022 IRA allows so called applicable entities to elect to treat certain renewable energy tax credits as payments of federal income tax generating a refund payment from the IRS A refundable tax credit is one which if the credit exceeds the taxes due the government pays back to the taxpayer solar hydropower biomass and marine and hydrokinetic renewable

A Little known Government Program Called The Residential Renewable

https://i.pinimg.com/736x/0b/19/5c/0b195c861489bd01c4019028733b3a88.jpg

Renewable Energy Studies SI Sealy

http://www.sisealy.co.uk/wp-content/uploads/2021/09/Renewable-Energies.png

https://www.irs.gov/newsroom/irs-releases...

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on

https://www.nerdwallet.com/.../taxes/s…

The solar tax credit can save you money on your tax bill but the amount of your credit can t exceed the total amount you owe That s because the credit is nonrefundable in tax speak

Form 5695 Which Renewable Energy Credits Apply For The 2023 Tax

A Little known Government Program Called The Residential Renewable

A Little known Government Program Called The Residential Renewable

A Little known Government Program Called The Residential Renewable

Tax Credits Save You More Than Deductions Here Are The Best Ones

A Little known Government Program Called The Residential Renewable

A Little known Government Program Called The Residential Renewable

Energy From Renewable Sources EOS European Organisation Of The

2019 Renewable Energy Tax Credits In The U S SolarFeeds Magazine

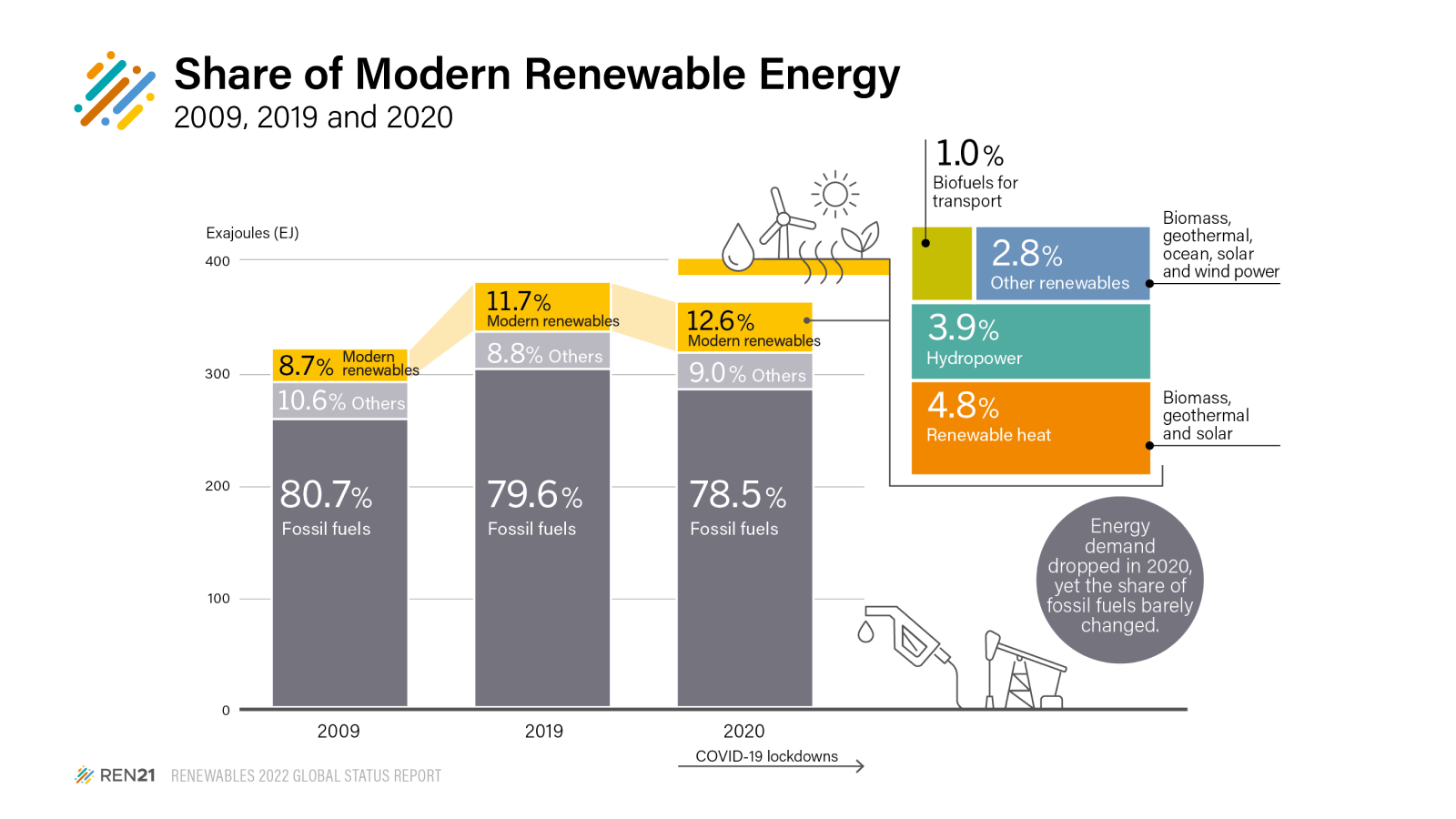

The Renewables 2022 Global Status Report In 150 Words REN21

Is The Renewable Energy Tax Credit Refundable - The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of 2 5 cents per kilowatt hour in 2021 dollars adjusted for inflation annually