Is There 50000 Standard Deduction In New Tax Regime 2022 23 With effect from FY 2024 25 under the new tax regime the standard deduction is increased to Rs 75 000 There has been no change to the old tax regime with respect to the standard deduction Thus

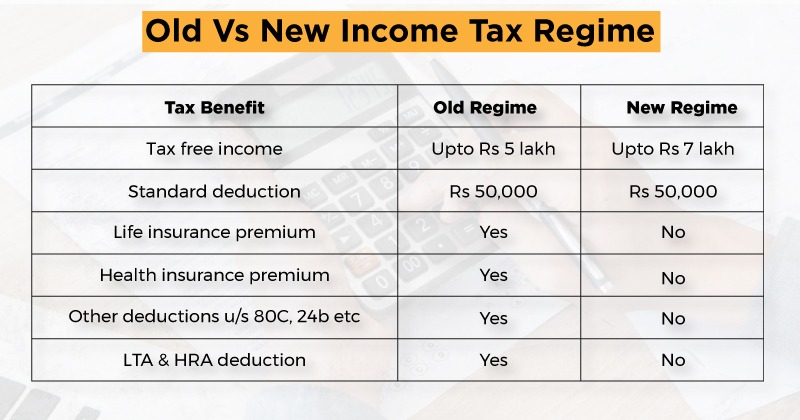

5 Am I eligible for Rs 50 000 standard deduction in the new tax regime Yes Standard deduction of Rs 50 000 or the amount of salary whichever is lower is available for both old and new tax regimes from AY 2024 25 onwards The standard deduction is not allowed in new tax regime until FY 2022 23 AY 2023 24 However as per Budget 2023 proposal standard deduction of Rs 50 000 is allowed for salaried persons from FY 2023 24 AY 2024 25 onwards

Is There 50000 Standard Deduction In New Tax Regime 2022 23

Is There 50000 Standard Deduction In New Tax Regime 2022 23

https://imgk.timesnownews.com/story/Work_from_home_1.jpg

New Income Tax Slabs 2023 24 How Much Standard Deduction Can Salaried

https://img.etimg.com/thumb/msid-97775581,width-640,resizemode-4,imgsize-436692/budget-2023-who-can-avail-of-the-standard-deduction-under-the-new-income-tax-regime.jpg

Old Vs New Tax Regime Which One To Pick

https://im.indiatimes.in/content/2023/Feb/Old-Vs-New-Tax-Regime-Which-One-To-Pick-After-Budget-2023_63db747264d86.jpg

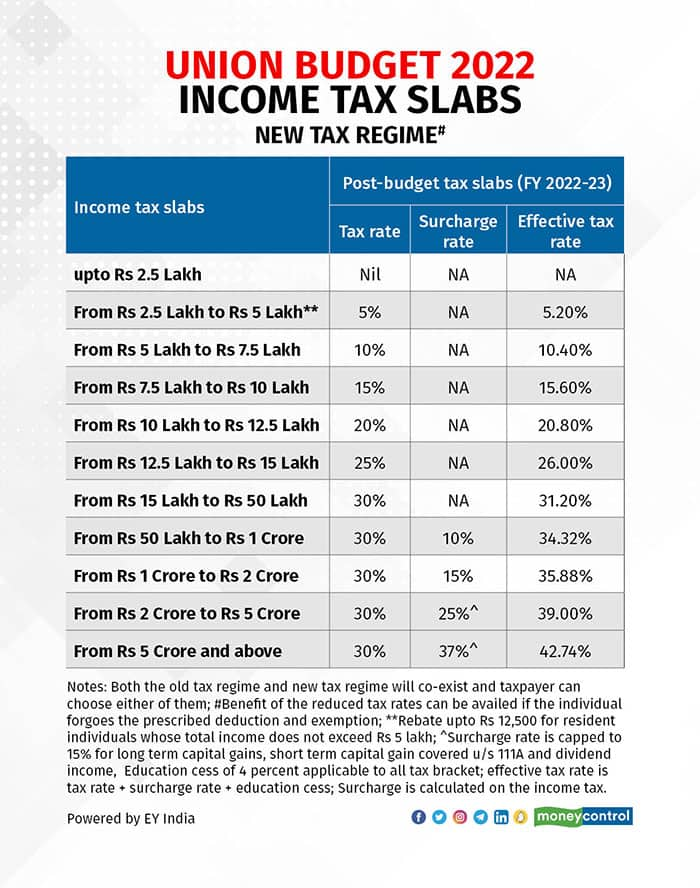

For FY 2022 23 the limit of the standard deduction is Rs 50 000 Q How much Standard deduction can I claim without receipts Standard Deduction is a flat deduction amounting to Rs 50 000 and is available without any receipt or any Budget 2023 Who can avail of the standard deduction under the new income tax regime In post Budget clarification Nitin Gupta Chairman of the Central Board of Direct Taxes CBDT said that standard deduction has been made available in the new

Under the new tax structure a standard deduction of Rs 50 000 has been implemented for salaried and pensioners only The Section 87A rebate has been increased under the new tax regime for taxable incomes up to Rs 7 lakh Budget 2024 has increased the standard deduction limit under the new tax regime from 50 000 to 75 000 for the AY 2025 26 FY 2024 25 However taxpayer has to keep in mind that for the AY 2024 25 standard deduction for salaried individuals will remain

Download Is There 50000 Standard Deduction In New Tax Regime 2022 23

More picture related to Is There 50000 Standard Deduction In New Tax Regime 2022 23

Rs 50000 Standard Deduction From FY 2019 20 AY 2020 21 Impact

https://www.relakhs.com/wp-content/uploads/2019/07/Rs-50000-Standard-Deduction-FY-2019-20-AY-2020-21-impact-on-your-net-salary-income-how-much-tax-can-you-save.jpg

How To Choose Between The New And Old Income Tax Regimes Chandan

https://images.moneycontrol.com/static-mcnews/2022/02/New-vs-old-tax-regime-Make-a-wise-choice-R.jpg

Budget 2023 24 No Tax On Income Up To Rs 7 Lakh Standard Deduction

https://www.dailyexcelsior.com/wp-content/uploads/2023/02/INCOME-TAX.jpg

A crucial update in this matter was made in the Union Budget 2023 where the Standard Deduction of Rs 50 000 on Salary Income was also made available to those individuals opting for the New Regime of Taxation This move was done to ensure parity of Income The only deduction that is allowed under the new income regime in FY 2022 23 is Section 80CCD 2 This deduction is linked to the employer s contribution to the employee s NPS account The maximum deduction

As per the Budget proposal salaried individuals will get a standard deduction of Rs 50 000 if they opt for the New Tax Regime How much standard deduction pensioners will get However as per the Finance Bill and the CBDT Central Board of Direct Taxes the standard deduction is 50 000 and not 52 500 Confirming the same CBDT chairman Nitin Gupta in his post budget clarifications said that standard deduction would be

Budget 2023 Deduction Allowed In New Tax Regime YouTube

https://i.ytimg.com/vi/JKETsczpxc4/maxresdefault.jpg

Standard Deduction In New Tax Regime EXPLAINED FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2023/02/standard-deduction-and-tax-rebate-in-new-tax-regime-video-1024x576.webp

https://cleartax.in/s/standard-deduction-salary

With effect from FY 2024 25 under the new tax regime the standard deduction is increased to Rs 75 000 There has been no change to the old tax regime with respect to the standard deduction Thus

https://www.incometax.gov.in/iec/foportal/sites...

5 Am I eligible for Rs 50 000 standard deduction in the new tax regime Yes Standard deduction of Rs 50 000 or the amount of salary whichever is lower is available for both old and new tax regimes from AY 2024 25 onwards

Deductions Under The New Tax Regime Budget 2020 Blog By Quicko

Budget 2023 Deduction Allowed In New Tax Regime YouTube

Changes In New Tax Regime All You Need To Know

What Is New Tax Regime Slabs Benefits Section 115BAC

Income Tax Rs 50 000 Standard Deduction By Swipe May 2023 Medium

New Income Tax Regime Vs Old Tax Regime FY 2022 23 Deductions Salaried

New Income Tax Regime Vs Old Tax Regime FY 2022 23 Deductions Salaried

How To Choose Between The New And Old Income Tax Regimes

No Tax On Income Up To Rs 7 Lakh Standard Deduction Allowed Under New

2022 Federal Tax Brackets And Standard Deduction Printable Form

Is There 50000 Standard Deduction In New Tax Regime 2022 23 - Standard deduction of 50 000 will be available to salaried class and the pensioners and standard deduction of 15 000 or 1 3rd of the family pension whichever is lower will be available to family pensioners irrespective of any level of income