Is There A 2024 Recovery Rebate Credit Fewer vehicles qualify for the 7 500 federal tax rebate in 2024 but it s now easier to access the credit at the time of purchase Tesla and Rivian have the most vehicles on the list of qualifying EVs for the tax rebate in 2024 The automotive world is in the middle of a seismic change Electric cars are becoming ever more prominent on our

What s new for 2024 instant rebate Starting in January EV buyers won t have to wait until the following year s tax season to claim and pocket the clean vehicle tax credit Instead The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000 in 2025 as well as apply an inflation adjustment in 2025 that would make the cap match the credit maximum of 2 100 It would also quicken the phase in for taxpayers with multiple children and allow taxpayers an election to use

Is There A 2024 Recovery Rebate Credit

Is There A 2024 Recovery Rebate Credit

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-3.png?fit=633%2C623&ssl=1

Does A Tax Credit Give You Money Leia Aqui Do You Get Money From Tax Credit

https://img.money.com/2022/03/News-Recovery-Rebate-Credit.jpg

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

https://www.gannett-cdn.com/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?crop=2015,1134,x0,y75&width=2015&height=1134&format=pjpg&auto=webp

The 2020 RRC can be claimed for someone who died in 2020 The 2020 RRC and 2021 RRC can be claimed for someone who died in 2021 or later Filing deadlines if you haven t yet filed a tax return To claim the 2020 Recovery Rebate Credit file a tax return by May 17 2024 2021 Recovery Rebate Credit file a tax return by April 15 2025 Get free help The Clean Vehicle Tax Credit up to 7 500 for electric vehicles can now be used at the point of sale like an instant rebate Effective this year the changes may help steer more potential

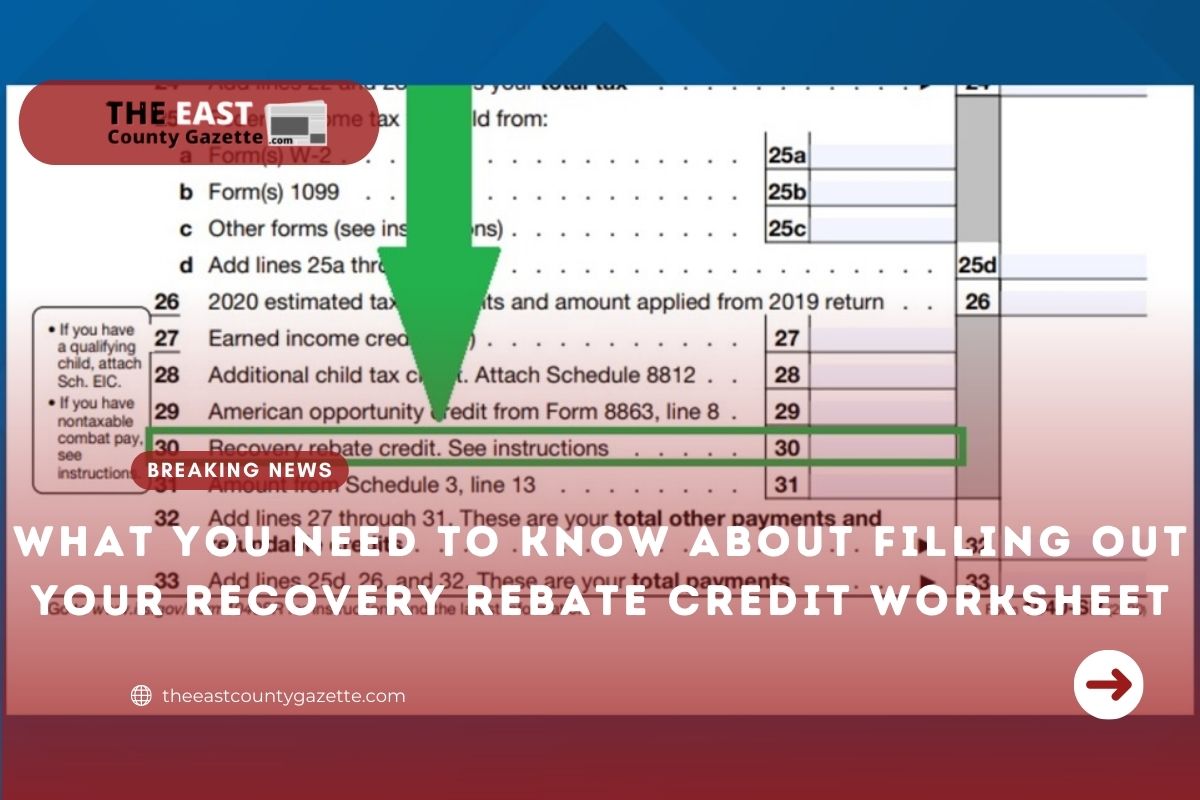

On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax Your Recovery Rebate Credit will be included in your tax refund If you re eligible to claim the 2020 Recovery Rebate Credit you must file a tax return by May 17 2024 to claim the credit If you re eligible to claim the 2021 Recovery Rebate credit you must file a tax return by April 15 2025 to claim the credit

Download Is There A 2024 Recovery Rebate Credit

More picture related to Is There A 2024 Recovery Rebate Credit

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

IRS Updates Info On Recovery Rebate Credit And Pandemic Response Scott M Aber CPA PC

https://www.abercpa.com/wp-content/uploads/2022/01/irs-updates-info-on-recovery-rebate-credit-and-pandemic-response.jpg

9 Easy Ways What Is The Recovery Rebate Credit 2021 Alprojectalproject

https://i1.wp.com/www.gannett-cdn.com/presto/2022/01/31/PDTF/ed4d450c-c21d-4e0c-8df6-4637a89241b9-Lett_6475.jpg

What s the Recovery Rebate Credit If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on your 2021 tax return to 2020 Recovery Rebate Credit file a tax return by May 17 2024 2021 Recovery Rebate Credit file a tax return by April 15 2025 Get free help The IRS reminds taxpayers that there is no penalty for claiming a refund on a tax return filed after its due date The fastest and easiest way to get a refund is to choose direct deposit

Starting Jan 1 the tax credit will also become redeemable as a point of sale rebate among dealers registered with the IRS whereas previously car buyers needed to claim it on their taxes the In 2024 Gov Josh Shapiro said that older residents would receive more financial help courtesy of his signed Act 7 of 2023 The law expanded the Property Tax Rent Rebate to provide a larger

Do Dependents Get Recovery Rebate Credit Leia Aqui Why Did I Get A Letter From The IRS About

https://www.kitces.com/wp-content/uploads/2021/04/01-Three-Checkpoints-When-The-IRS-Will-Determine-And-Issue-2021-Recovery-Rebates.png

How To Claim Recovery Rebate Credit With No Income Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/it-s-not-too-late-claim-a-recovery-rebate-credit-to-get-your-27.png

https://www.hotcars.com/evs-7500-federal-tax-rebate-2024/

Fewer vehicles qualify for the 7 500 federal tax rebate in 2024 but it s now easier to access the credit at the time of purchase Tesla and Rivian have the most vehicles on the list of qualifying EVs for the tax rebate in 2024 The automotive world is in the middle of a seismic change Electric cars are becoming ever more prominent on our

https://www.npr.org/2023/12/28/1219158071/ev-electric-vehicles-tax-credit-car-shopping-tesla-ford-vw-gm

What s new for 2024 instant rebate Starting in January EV buyers won t have to wait until the following year s tax season to claim and pocket the clean vehicle tax credit Instead

The Recovery Rebate Credit Calculator ShauntelRaya

Do Dependents Get Recovery Rebate Credit Leia Aqui Why Did I Get A Letter From The IRS About

Recovery Rebate Credit Stimulus Check 2022 Turbotax Recovery Rebate

What Is The Recovery Rebate Credit 2023 Detailed Information

Recovery Rebate Credit 2023 2024 Credits Zrivo

2021 Recovery Rebate Credit R R Accountants RC SD

2021 Recovery Rebate Credit R R Accountants RC SD

Recovery Rebate Credit Form Printable Rebate Form

Recovery Rebate Credit 2023

What You Need To Know About Filling Out Your Recovery Rebate Credit Worksheet

Is There A 2024 Recovery Rebate Credit - Your Recovery Rebate Credit will be included in your tax refund If you re eligible to claim the 2020 Recovery Rebate Credit you must file a tax return by May 17 2024 to claim the credit If you re eligible to claim the 2021 Recovery Rebate credit you must file a tax return by April 15 2025 to claim the credit