Is There A Federal Gas Tax Tom Barkley Updated January 08 2024 Reviewed by Ebony Howard Fact checked by Vikki Velasquez Gas taxes are excise taxes that you pay when you fill up your car with gas The federal

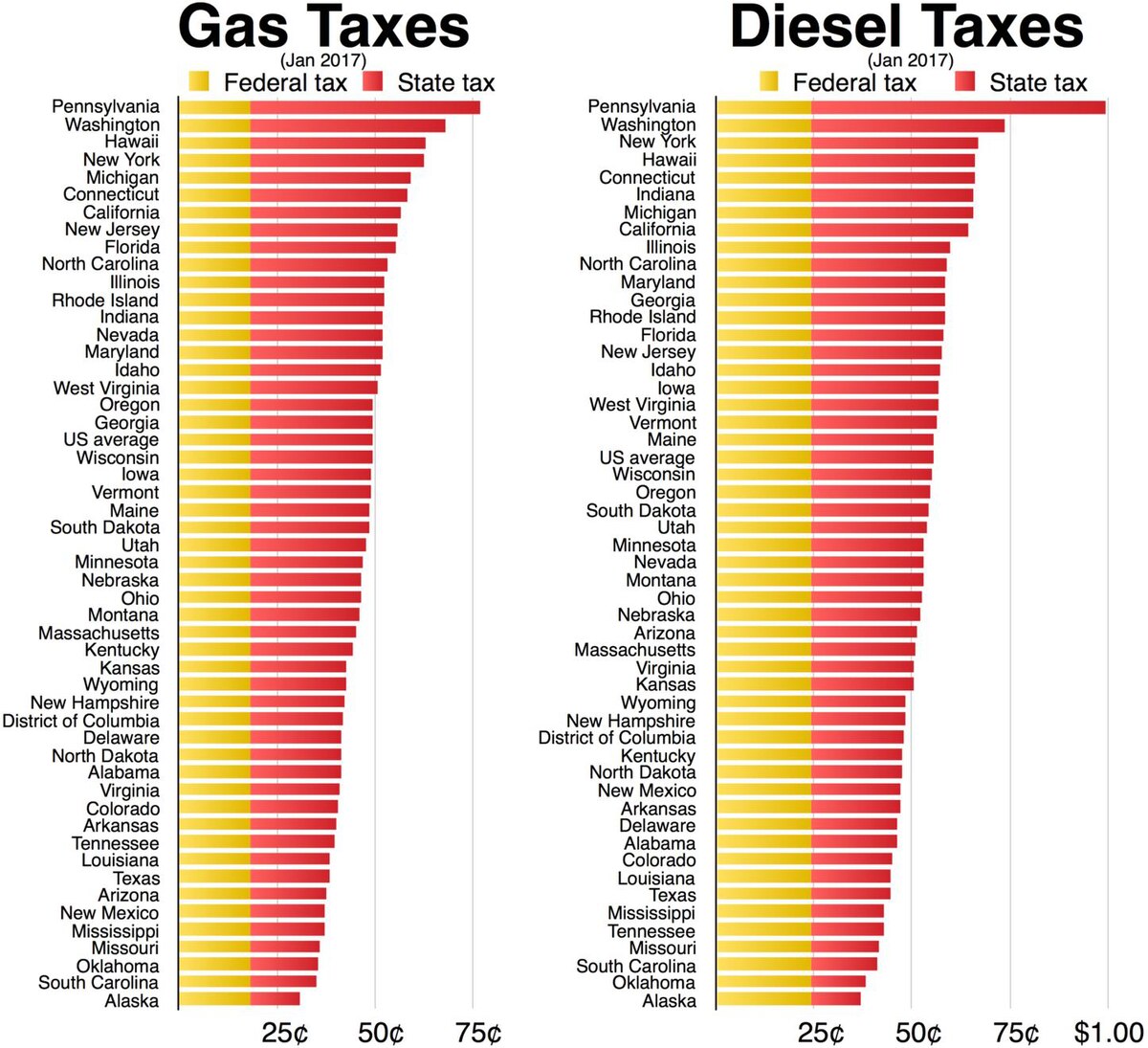

The taxes and other fees on retail gasoline and diesel fuel in cents per gallon as of January 1 2024 are Federal taxes include excises taxes of 18 3 cents per gallon on gasoline and 24 3 cents per gallon on diesel fuel and a Leaking Underground Storage Tank fee of 0 1 cents per gallon on both fuels State taxes include rates of general Right now the federal government charges an 18 cent tax per gallon of gasoline and a 24 cent tax per gallon of diesel Those taxes fund critical highways and public transportation through the

Is There A Federal Gas Tax

Is There A Federal Gas Tax

https://creditkarma-cms.imgix.net/wp-content/uploads/2019/04/what-is-federal-gas-tax_481115338.jpg

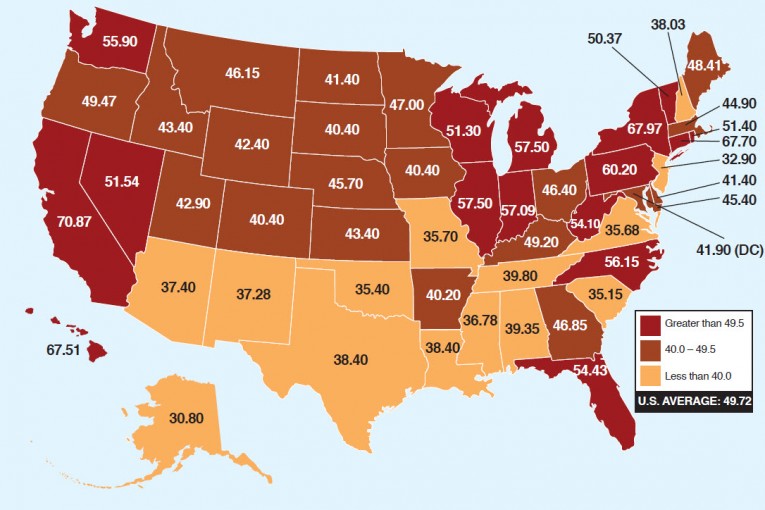

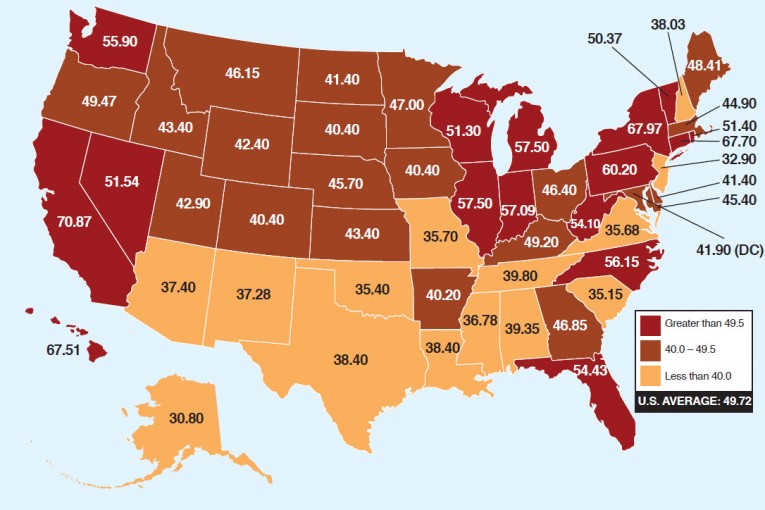

Map Of Gasoline Tax Rates By State The Bull Elephant

http://thebullelephant.com/wp-content/uploads/2014/09/Gas-tax-map-765x510.jpg

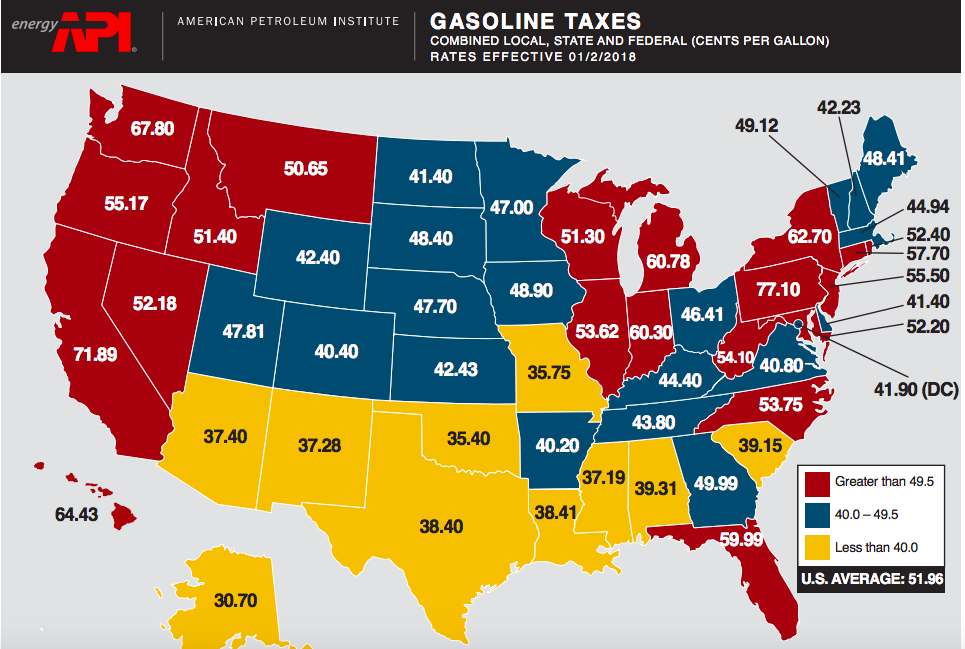

Gasoline Is Already Taxed Too Much IER

http://instituteforenergyresearch.org/wp-content/uploads/2018/02/2018.02.27-Map-gas-tax.png

The current federal tax on gas is about 18 cents per gallon while the federal tax on diesel stands at 24 cents per gallon Even if savings from lifting those taxes were passed directly to As fuel prices soar in the U S President Biden called on Congress to temporarily lift the federal gas tax about 18 cents per gallon of gasoline and 24 cents per gallon of diesel through the

President Joe Biden on Wednesday called on Congress to pass legislation that would create a federal tax holiday on gas and diesel fuel for three months to lower prices at the pump The pause June 23 2022 5 30 am ET Share Resize Listen 1 min The tax holiday is intended to provide relief to millions of Americans by temporarily pausing the 18 4 cent tax on every gallon of gasoline

Download Is There A Federal Gas Tax

More picture related to Is There A Federal Gas Tax

The Federal Gas Tax Is Old And Broken

https://imageio.forbes.com/specials-images/imageserve/654509161/0x0.jpg?format=jpg&width=1200

Federal Excise Motor Fuel Tax 2022 Tax Policy Center

https://www.taxpolicycenter.org/sites/default/files/fiscal-facts/ff_screenshot_11.21.2022_1.png

What A Federal Gas Tax Holiday Could Mean For Prices At The Pump

https://image.cnbcfm.com/api/v1/image/107078713-1655841882805-gettyimages-1241216449-US_GAS_PRICES.jpeg?v=1674683156&w=1920&h=1080

The federal gas tax is 18 4 cents per gallon and for diesel fuel 24 4 cents per gallon Revenue from the gas tax goes to the Highway Trust Fund to pay for construction and The federal tax on gas is about 18 cents per gallon while the federal tax on diesel stands at 24 cents per gallon Biden s proposal would lift those taxes through the end of September

Facing stubbornly high gas prices that average about 5 a gallon nationwide President Joe Biden on Wednesday urged Congress to suspend federal gasoline and diesel taxes for three months If President Joe Biden on June 22 will call on Congress to suspend the federal gasoline and diesel taxes for three months It s a move meant to ease financial pressures at the pump that also reveals the political toxicity of high gas prices in an election year AP Photo Marta Lavandier File Read More

Gas Tax Rates July 2018 State Gas Tax Rankings Tax Foundation

https://files.taxfoundation.org/20180808093450/Gas-Tax-July-2018.png

State Gasoline Tax Rates By The Tax Foundation Best Places To Move

https://i.pinimg.com/originals/d2/3d/05/d23d05dd573fdd1c848a7c5c7bfca612.png

https://www.investopedia.com/gas-taxes-and-what...

Tom Barkley Updated January 08 2024 Reviewed by Ebony Howard Fact checked by Vikki Velasquez Gas taxes are excise taxes that you pay when you fill up your car with gas The federal

https://www.eia.gov/tools/faqs/faq.php?id=10&t=5

The taxes and other fees on retail gasoline and diesel fuel in cents per gallon as of January 1 2024 are Federal taxes include excises taxes of 18 3 cents per gallon on gasoline and 24 3 cents per gallon on diesel fuel and a Leaking Underground Storage Tank fee of 0 1 cents per gallon on both fuels State taxes include rates of general

Fuel Taxes In The United States Wikipedia

Gas Tax Rates July 2018 State Gas Tax Rankings Tax Foundation

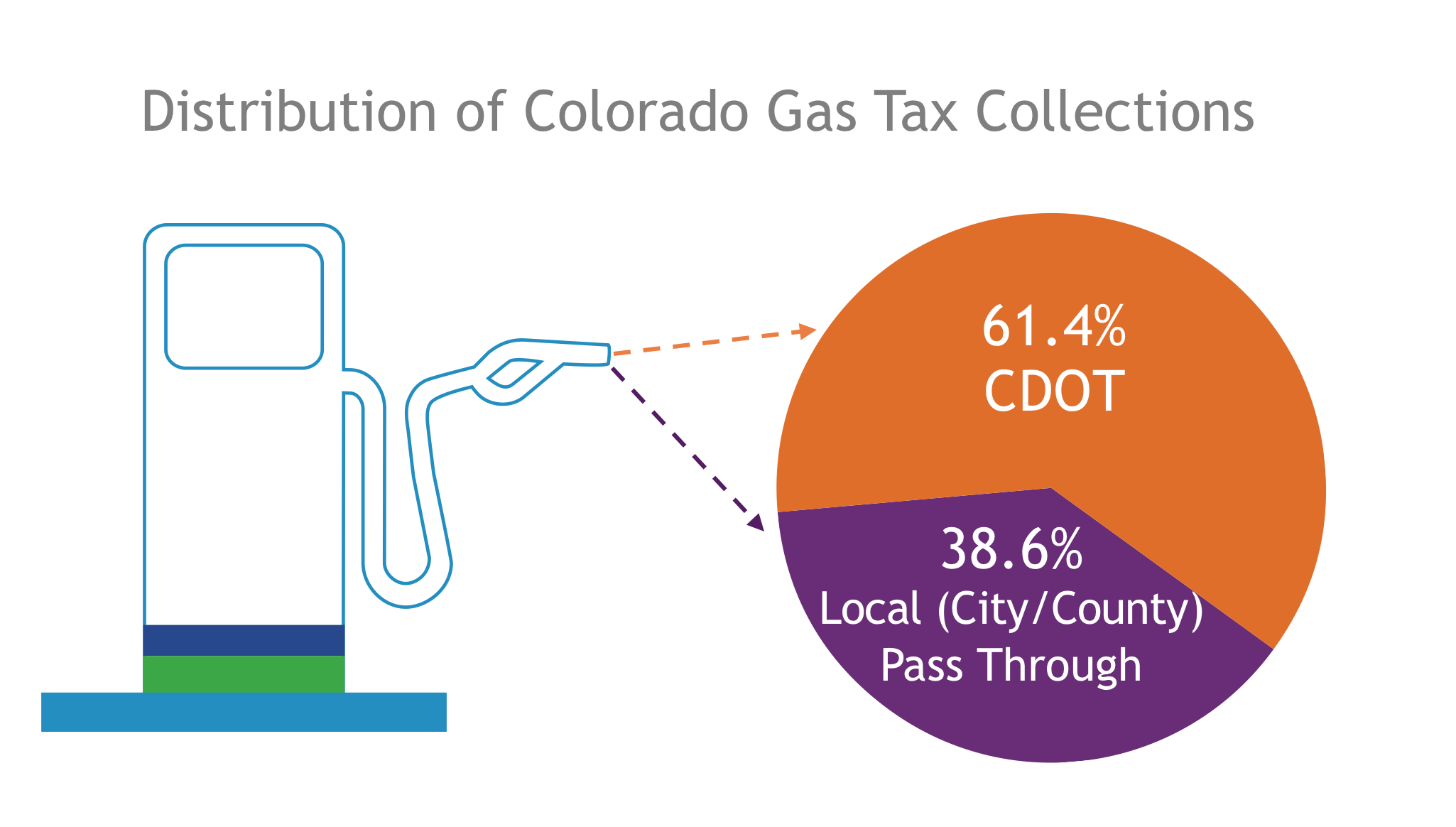

Transportation Funding Colorado Department Of Transportation

Opinion States Are Doing It So Why Hasn t Congress Increased The

Stop The Gas Tax Food Tax Connecticut Senate Republicans

Proposed Law Would Hurt Georgia School Systems Revenue Sowega Live

Proposed Law Would Hurt Georgia School Systems Revenue Sowega Live

Raise Federal Gas Tax A Dem Pushes This Increase

Gas Tax Increase Appears Stalled At Federal Level As States Plan Hikes

A Federal Gas Tax Will Only Fuel Bureaucracy Foundation For Economic

Is There A Federal Gas Tax - Updated on November 9 2022 Reviewed by David Kindness Fact checked by Hilarey Gould Photo FG Trade Getty Images Definition The federal gasoline excise tax rate applies to gasoline and diesel It helps pay for infrastructure projects and mass transportation in the U S Learn how it works