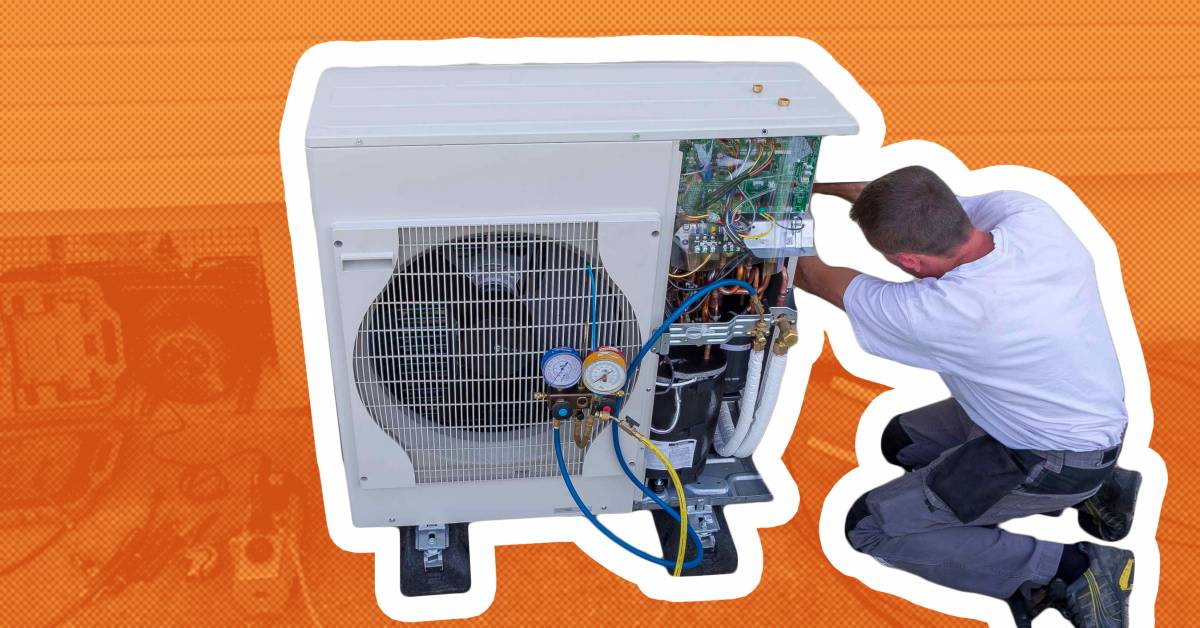

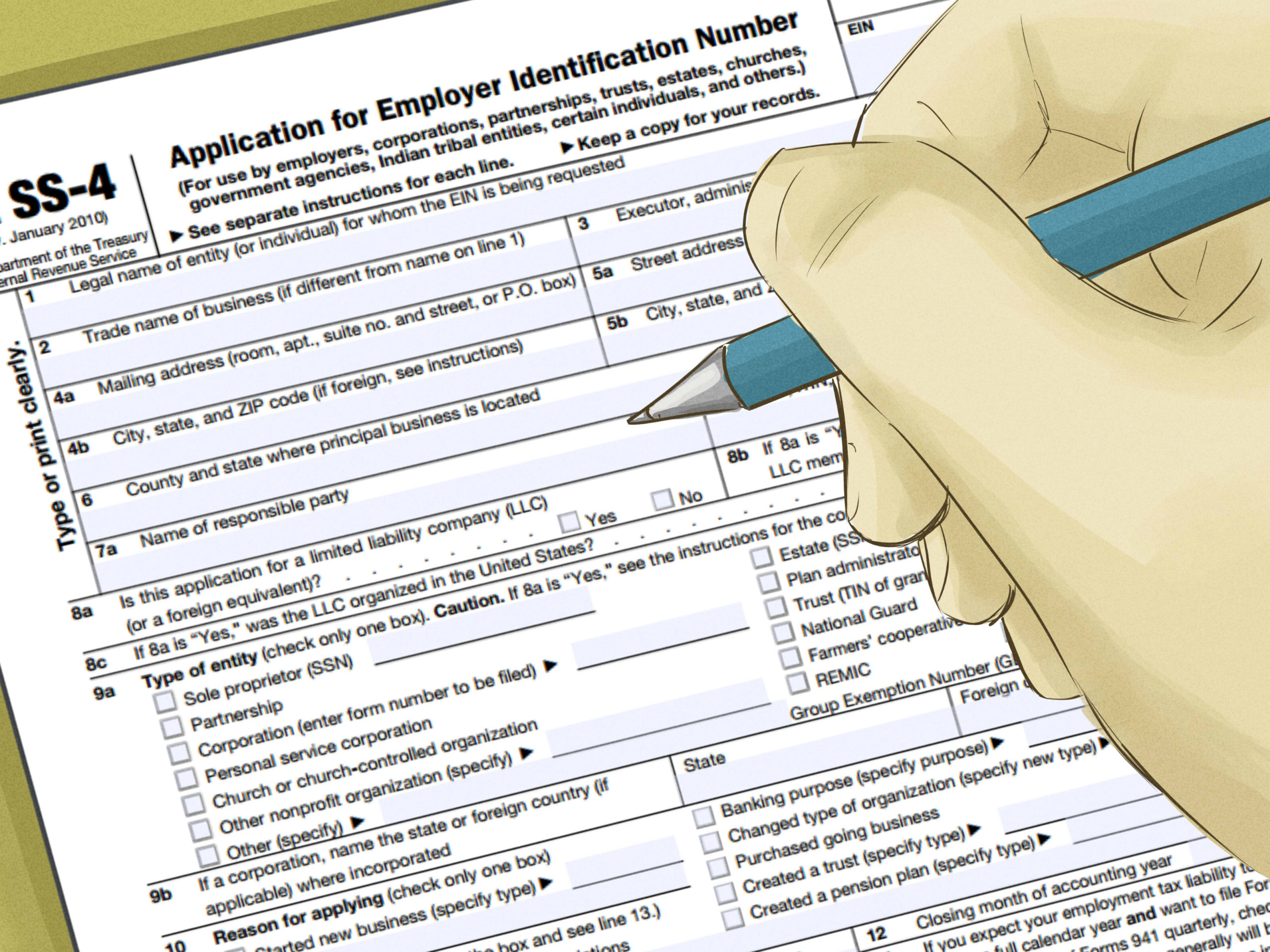

Is There A Federal Tax Credit For Heat Pumps Air Source Heat Pumps Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings

2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Thanks to the IRA if you made or are planning to make certain qualified energy efficient improvements to your home after January 1 2023 you may qualify for a tax credit from the

Is There A Federal Tax Credit For Heat Pumps

Is There A Federal Tax Credit For Heat Pumps

https://raviniaplumbing.com/wp-content/uploads/2023/08/Are-There-Federal-Tax-Credits-Available-for-Heat-Pumps_-1-scaled.jpg

Heat Pump Tax Credits And Rebates Continue In 2024 Moneywise

https://media1.moneywise.com/a/23311/heat-pump-tax-credit-rebate_facebook_thumb_1200x628_v20220927160351.jpg

300 Federal Tax Credit For Heat Pumps Alaska Heat Smart

https://akheatsmart.org/wp-content/uploads/2022/04/heat-pump-indoor_300.jpg

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit If you install an efficient heat pump you are eligible for a federal tax credit that will cover 30 up to 2 000 of the heat pump cost and installation This tax credit through the Inflation Reduction Act is available through 2032 and is

Save Up to 2 000 on Costs of Upgrading to Heat Pump Technology These energy efficient home improvement credits are available for 30 of costs up to 2 000 and can be combined with credits up to 1 200 for other qualified upgrades made in one tax year If you opt to install a heat pump you ll be eligible for a federal tax credit for models that achieve the Consortium for Energy Efficiency s CEE highest tier for efficiency

Download Is There A Federal Tax Credit For Heat Pumps

More picture related to Is There A Federal Tax Credit For Heat Pumps

What You Need To Know About The Federal Tax Credit For Heat Pumps In 2023

https://www.rescueairtx.com/images/blog/iStock-1444118278.jpg

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

Under the Consolidated Appropriations Act of 2021 the renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps now feature a gradual step down in the credit value the same as those for solar energy systems Tax Credit 30 for systems placed in service by 12 31 2019 Starting in 2023 continuing this year and through the end of 2032 all homeowners will be eligible for a 30 federal tax credit on the total cost of buying and installing their new heat pump with a maximum credit of 2 000

The heat pump tax credit is a dollar for dollar tax credit that reduces what you owe when you file your federal tax return It s worth 30 of your total heat pump or ductless mini split heat pump installation costs up to 2 000 For example let s say you owe 3 000 in federal taxes Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency tier products up to a maximum of 600 for qualified air conditioners and furnaces and a maximum of 2 000 for qualified heat pumps

300 Federal Tax Credit For Heat Pumps Alaska Heat Smart

https://i0.wp.com/akheatsmart.org/wp-content/uploads/2022/04/commons-irs-tax-forms.jpeg?ssl=1

Heat Pumps Wattsmart Savings

https://wattsmartsavings.net/wp-content/uploads/2019/05/thumbnail_measures_heat_pumps-1.png

https://www.energystar.gov/about/federal-tax...

Air Source Heat Pumps Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings

https://www.irs.gov/credits-deductions/home-energy-tax-credits

2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov

Want To Lease An EV There s A Tax Credit Loophole For That

300 Federal Tax Credit For Heat Pumps Alaska Heat Smart

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Federal Tax Incentives May Be Next For E Bikes

Federal Tax Credits For Air Conditioners Heat Pumps 2023

Tax Credits On Electric Cars Heat Pumps Will Help Low Income

Tax Credits On Electric Cars Heat Pumps Will Help Low Income

2023 Federal Tax Credit For Heat Pumps Accurate Home Services

How To Find Tax ID Number TIN Number

Expired Tax Credits Expected To Be Renewed 2022 04 14 ACHR News

Is There A Federal Tax Credit For Heat Pumps - Save Up to 2 000 on Costs of Upgrading to Heat Pump Technology These energy efficient home improvement credits are available for 30 of costs up to 2 000 and can be combined with credits up to 1 200 for other qualified upgrades made in one tax year