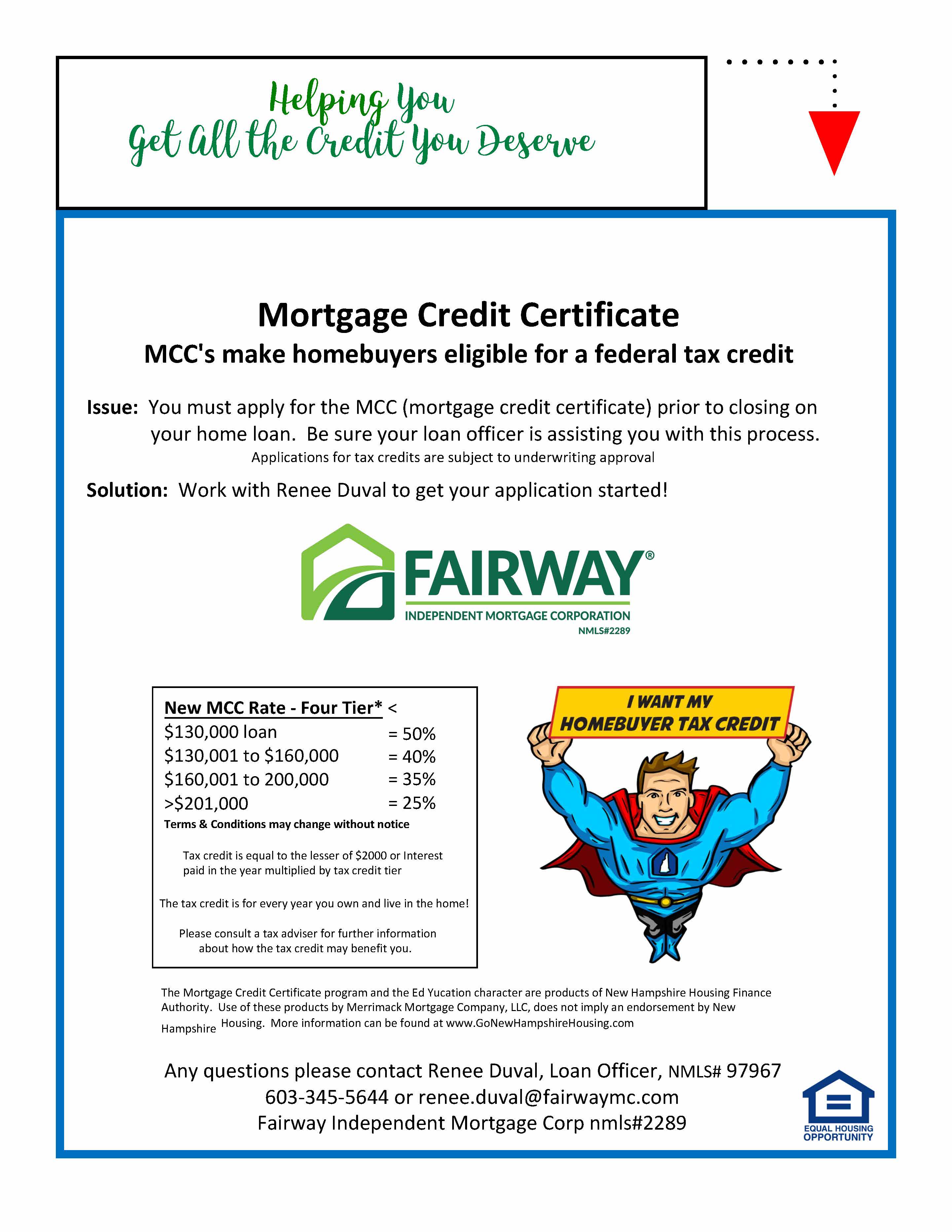

Is There A New Home Buyer Tax Credit MCCs are issued by state housing finance agencies and allow home buyers to take a portion of the mortgage interest they pay annually as a federal tax credit up to a 2 000 limit The tax

First time homebuyer tax credits don t currently exist but there are other breaks deductions down payment aid grants and other programs Most home buyers take out a mortgage loan to buy their home and then make monthly payments to the mortgage holder This payment may include several costs of owning a home The only costs the homeowner can deduct are state and local real estate taxes subject to the 10 000 limit

Is There A New Home Buyer Tax Credit

Is There A New Home Buyer Tax Credit

https://showmethegreen.mystagingwebsite.com/wp-content/uploads/2018/08/First-Time-Home-Buyer-Tax-Credit-2018.jpg

Homebuyer Tax Credit Changes For Both First Time Homebuyers And Current

http://activerain.com/image_store/uploads/6/0/3/8/7/ar126289228178306.png

First Time Home Buyer Tax Credit Explained

https://image.slidesharecdn.com/firsttimehomebuyertaxcreditexplained-124698638976-phpapp01/95/first-time-home-buyer-tax-credit-explained-5-728.jpg?cb=1246968465

First time homebuyers would qualify for an annual tax credit of 5 000 per year for two years for a total of 10 000 The one year tax credit for current homeowners would be available to On the heels of the 2008 financial crisis the Housing and Economic Recovery Act established a first time homebuyer tax credit of up to 7 500 to assist new buyers in purchasing homes

There is no specific broad federal tax credit in the United States solely for buying a new house Tax credits and incentives related to homeownership can vary over time and may depend on specific circumstances such as being a first time homebuyer or making energy efficient improvements Simply put it offered homebuyers a significant tax credit for the year in which they purchased their home Unfortunately this credit no longer exists However legislation to create a new refundable tax credit of up to 15 000 for first time homebuyers was introduced in April 2021

Download Is There A New Home Buyer Tax Credit

More picture related to Is There A New Home Buyer Tax Credit

First Time Home Buyer Tax Credit

https://u.realgeeks.media/lifeinbonitasprings/old_wp/_wp-content_uploads_2009_02_first-time-home-buyer-tax-credit.png

The First Time Home Buyer Tax Credit NerdWallet

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2017/06/what-happened-first-time-home-buyer-tax-credit-story-e1583353367710-1440x864.jpg

Can You Still Get A First Time Home Buyer Tax Credit HFH

https://www.homesforheroes.com/wp-content/uploads/2018/03/First-Time-Home-Buyer-Tax-Credit.jpg

First time home buyers who acquire a qualifying home can claim a non refundable tax credit of up to 750 The value of the HBTC is calculated by multiplying 5 000 by the lowest personal income tax rate 15 in 2022 The tax credit you can claim if you received a mortgage credit certificate when you bought your home Why you should keep track of adjustments to the basis of your home Your home s basis is generally what it cost adjustments include the

Information to help you look up a first time homebuyer credit account Before accessing the tool please read through these questions and answers to determine the requirements for repaying the credit A tax credit for first time homebuyers was launched in 2008 after the Great Recession caused the housing market to crash Unfortunately the credit isn t available any more It expired

First Time Home Buyers Tax Credit Explained Tax Credits First Home

https://i.pinimg.com/originals/e2/f4/ec/e2f4ec2d4674a47334cfd3c5aa8d0193.png

How The Proposed 15 000 First Time Home Buyer Tax Credit Works PMR Loans

https://www.pmrloans.com/wp-content/uploads/2022/02/How-the-Proposed-15000-First-Time-Home-Buyer-Tax-Credit-Works.jpg

https://finance.yahoo.com › personal-finance

MCCs are issued by state housing finance agencies and allow home buyers to take a portion of the mortgage interest they pay annually as a federal tax credit up to a 2 000 limit The tax

https://www.bankrate.com › mortgages › first-time...

First time homebuyer tax credits don t currently exist but there are other breaks deductions down payment aid grants and other programs

Do I Have To Pay Back First Time Homebuyer Tax Credit Tax Credits

First Time Home Buyers Tax Credit Explained Tax Credits First Home

First Time Home Buyer Tax Credit 2009 Highlights HomesMSP Real

Canada s New Home Buyer Tax Credit Cornerstone

H R 3221 First Time Home Buyer Tax Credit

Biden s 25 000 First Time Home Buyer Tax Credit Downpayment Toward

Biden s 25 000 First Time Home Buyer Tax Credit Downpayment Toward

Home Buyer Tax Credit In Nh

First Time Home Buyer Tax Credit 2016 800 Buy Kwik

Obama s Extended First Time Home Buyer Tax Credit

Is There A New Home Buyer Tax Credit - Presently there is no federal first time home buyer tax credit available Learn when that may change and explore other tax breaks you can benefit from