Is There A Nj Homestead Rebate For 2019 We can deduct any amount you owe from future Homestead Benefits or Income Tax refunds or credits before we issue the payment Prior Year Homestead Benefit Information

This program offers property tax relief to New Jersey residents who own or rent property in New Jersey as their main home and meet certain income limits This year s ANCHOR benefit is based on residency income and age from 2021 The deadline to apply is November 30 2024 Previously users could only see the status of their 2019 and 2020 benefits Information about the current benefit for the 2021 tax year wasn t available on the lookup tool until earlier this

Is There A Nj Homestead Rebate For 2019

Is There A Nj Homestead Rebate For 2019

https://ld16nj.com/wp-content/uploads/2022/10/Homeowners-2.jpg

Nj Homestead Rebate 2022 Renters RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/property-tax-rebates-check-if-you-are-eligible-for-anchor-program-3.jpg

Is The Homestead Rebate For Homeowners Running Late Nj

https://www.nj.com/resizer/Z-Lasop-fy7Cz2Lo9wlvlTFVzPw=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/RW7W4DUDE5BIHBJBZMV2YOV254.jpg

The date we issued a benefit including if it was applied to your property tax bill for tax year 2018 To use this service you will need your valid Social Security Number SSN Individual Taxpayer Identification Number ITIN and ZIP code If you have questions visit Are we qualified for Homestead Rebate A Let s go over the basics The Homestead Rebate program provides property tax relief to eligible homeowners

Homeowner benefit amounts will be 1 500 for taxpayers with 2019 gross incomes up to 150 000 or 1 000 for those with 2019 gross income above 150 000 but no higher than 250 000 Tenants with 2019 gross income up to 150 000 will qualify for a 450 benefit If you did not itemize deductions in the year that the rebate pertains to instead taking the standard deduction then this does not apply to you The rebate is not taxable Wolfe said the IRS issued guidance back in 2006 specifically to New Jersey

Download Is There A Nj Homestead Rebate For 2019

More picture related to Is There A Nj Homestead Rebate For 2019

What Happens To The Homestead Rebate And My Tax Return NJMoneyHelp

http://njmoneyhelp.com/wp-content/uploads/2019/03/Homestead-968x643.jpg

Is This Estate Eligible For The Homestead Rebate NJMoneyHelp

https://njmoneyhelp.com/wp-content/uploads/2021/11/backyard-1825423_960_720-768x574.jpg

Do I Have To Report The Homestead Rebate On My Federal Taxes Nj

https://www.nj.com/resizer/qG0TiwqaYedsqil8w-me4KcPNjI=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/OMRUQX7ZHBAUZCM7CJOPVJU344.jpg

The New Jersey homestead rebate is a property tax credit that the state pays to municipalities on behalf of eligible homeowners to help reduce their property tax bills Most people who qualify for the rebate will get it as a credit on their property tax The Homestead Rebate program provides property tax relief to eligible homeowners The benefit doesn t come to you as a check but it s paid directly to your municipality as an offset on your property tax bill said Michael Maye a certified financial planner and certified public accountant with MJM Financial in Gillette

To help seniors with the high costs the state offers the Homestead Rebate to those who qualify To qualify you must be a New Jersey resident you must own and occupy the property as a principal residence and you must meet income requirements said Bernie Kiely a certified financial planner and certified public accountant with Kiely Capital There was a maximum rebate this past May 2019 for 500 Does the recently approved state budget provide funds for maximum rebates for November 2019 and May 2020 Homeowner A Good question

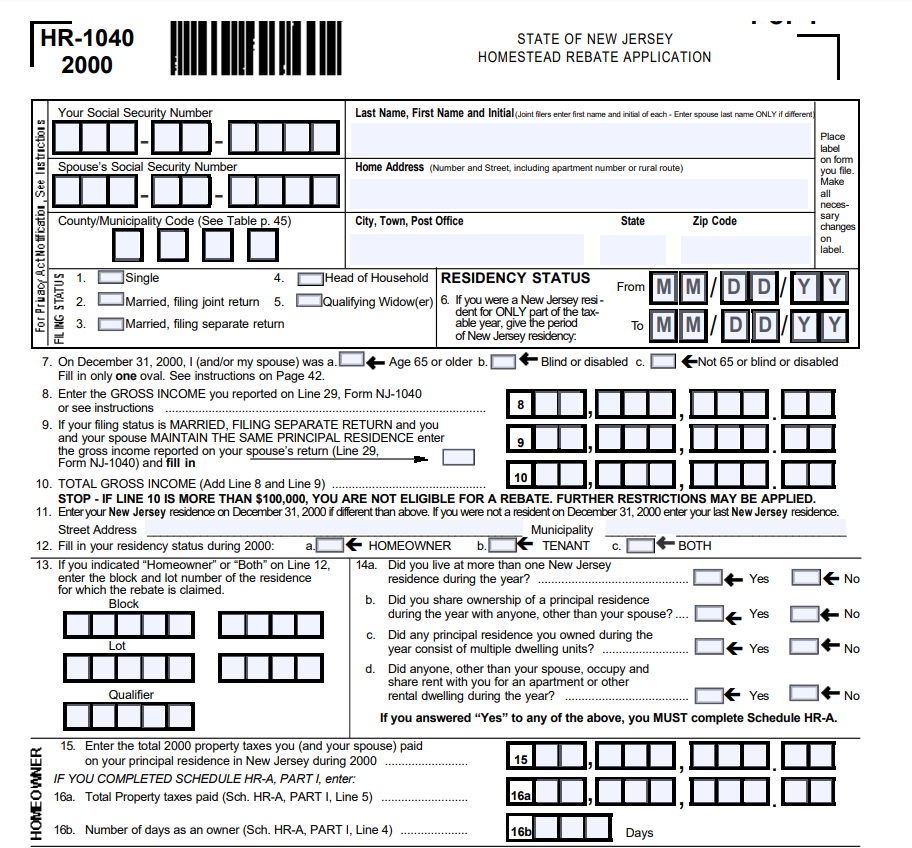

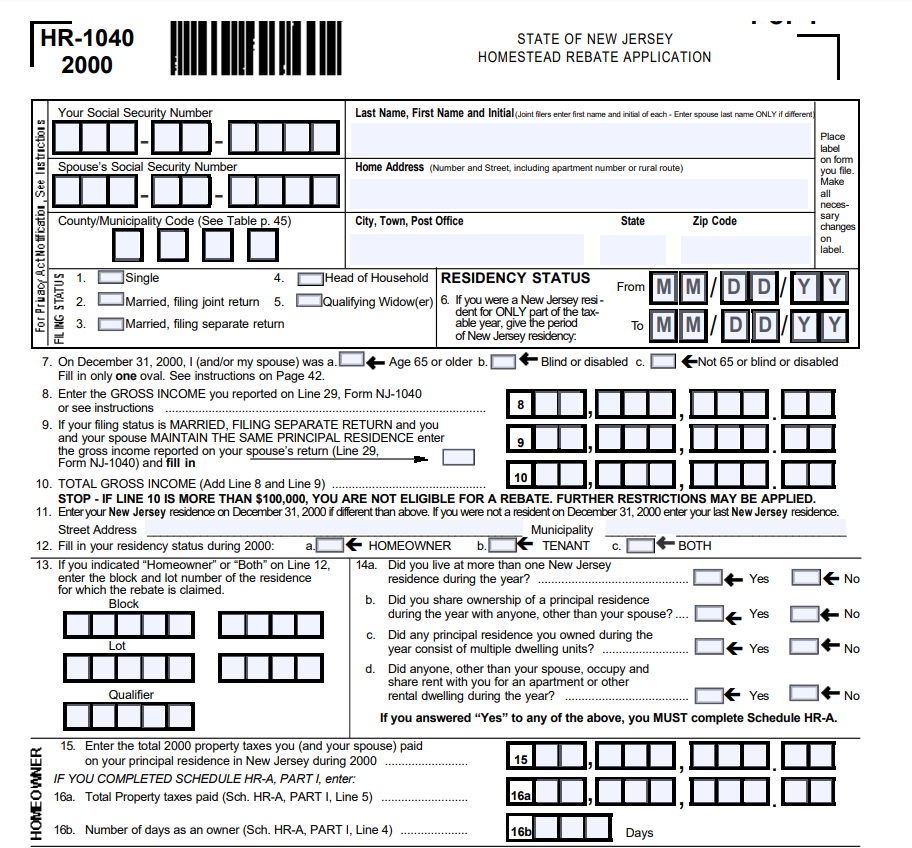

NJ Homestead Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/File-NJ-Homestead-Rebate-Form-Online.png

What Happened To My Homestead Rebate Nj

https://www.nj.com/resizer/YBH6_5GrDFwkGpufG-YhRgbK53g=/1280x0/smart/advancelocal-adapter-image-uploads.s3.amazonaws.com/image.nj.com/home/njo-media/width2048/img/business_impact/photo/old-man-3617304-1920jpg-452fcfe731a60d12.jpg

https://www.nj.gov/treasury/taxation/homestead/prioryear.shtml

We can deduct any amount you owe from future Homestead Benefits or Income Tax refunds or credits before we issue the payment Prior Year Homestead Benefit Information

https://nj.gov/treasury/taxation/anchor/index.shtml

This program offers property tax relief to New Jersey residents who own or rent property in New Jersey as their main home and meet certain income limits This year s ANCHOR benefit is based on residency income and age from 2021 The deadline to apply is November 30 2024

NJ Homestead Rebate What To Know Credit Karma

NJ Homestead Printable Rebate Form

Can I Submit A Paper Application For The Homestead Rebate Nj

Can I File An Appeal For The Homestead Rebate NJ

Homestead Rebate Senior Freeze And Taxes NJMoneyHelp

Who Qualifies For NJ Homestead Rebate 2022 YouTube

Who Qualifies For NJ Homestead Rebate 2022 YouTube

When Can I Apply For The Homestead Rebate Nj

Will I Ever Get My Homestead Rebate NJMoneyHelp

Homestead Rebate Vs Senior Freeze NJMoneyHelp

Is There A Nj Homestead Rebate For 2019 - She said if you owned a house in New Jersey and lived in it as your primary residence in 2017 the deadline for that filing was Oct 1 2019 There is generally a lag in paying the rebates but last year it was exacerbated by COVID 19 McKnight said