Is There A Penalty For Not Filing A Gift Tax Return There is technically no actual dollar penalty for filing a gift tax return late unless gift tax is due although leave it to the IRS to try to assess something However

You must file a gift tax return within 3 months of the date when the gift was given If you file a gift tax return late or the details on the return are not correct or information is You cannot deduct the value of gifts you make other than gifts that are deductible charitable contributions If you are not sure whether the gift tax or the estate

Is There A Penalty For Not Filing A Gift Tax Return

Is There A Penalty For Not Filing A Gift Tax Return

https://www.thklaw.com/wp-content/uploads/2022/02/estate_planner_blogimg_gift-tax-return.png

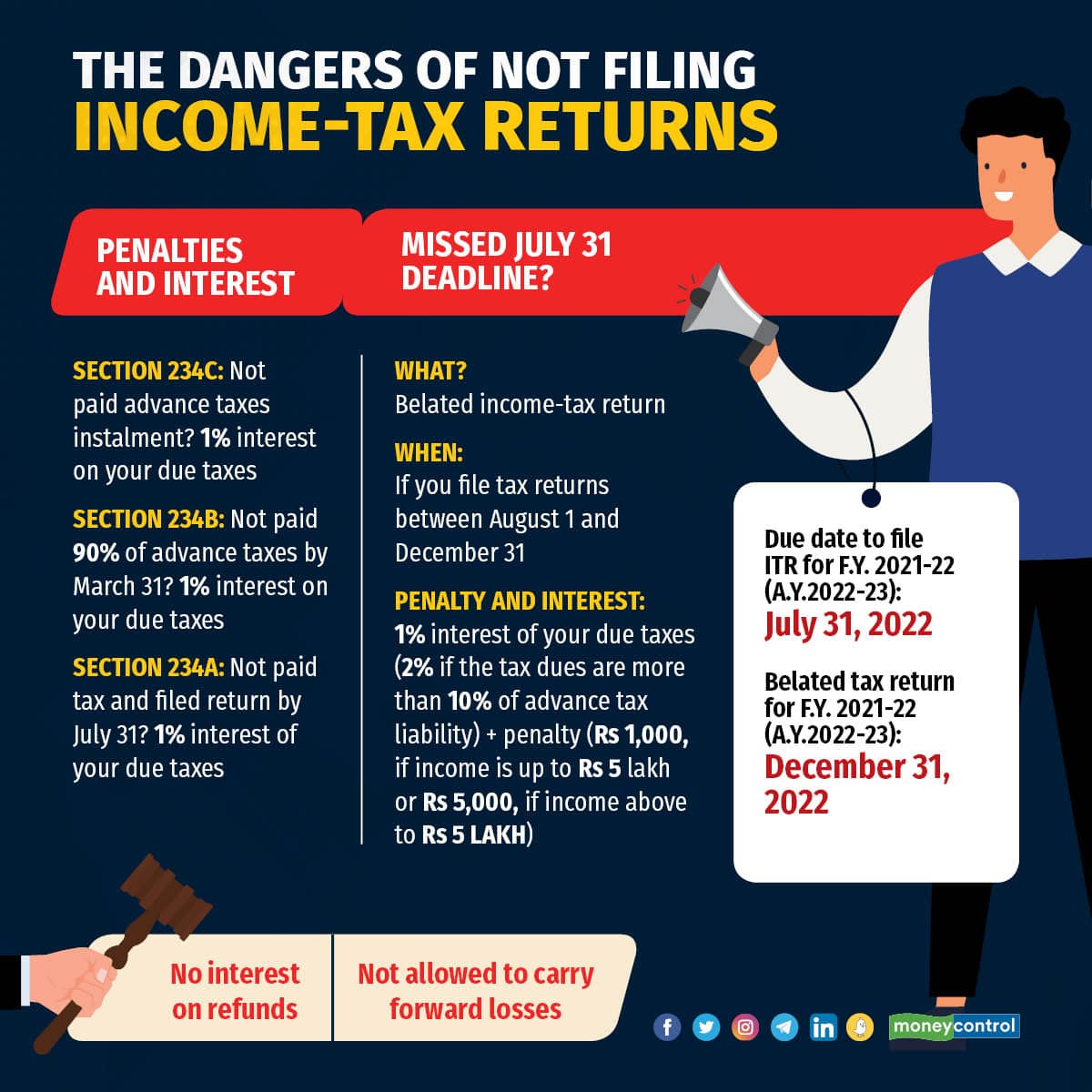

I T Return Filing Interest Penalties On The Cards If Failed To File

https://images.moneycontrol.com/static-mcnews/2022/07/Penalties-2-belate-returns-ITR-.jpg

Do You Need To File A Gift Tax Return Landmark

https://www.landmarkcpas.com/wp-content/uploads/2020/01/Gift-Tax-Return-RS.jpg

There is no penalty for late filing a gift tax return Form 709 if no tax is due The reference to a minimum penalty for failure to file applies to income tax returns Section The penalty for failing to file or filing inaccurately is the greater of 10 000 or 5 of the gross value of trust assets determined to be owned by the U S person

If the IRS finds that the interests were worth 15 million which exceeds the lifetime exemption amount it can assess gift taxes plus penalties and interest If you You must file a gift tax return and pay gift tax if you receive a gift worth 5 000 or more you receive several gifts from the same donor within a period of 3 years and their total value

Download Is There A Penalty For Not Filing A Gift Tax Return

More picture related to Is There A Penalty For Not Filing A Gift Tax Return

2018 Penalty For Not Filing Annual Return IndiaFilings

https://www.indiafilings.com/learn/wp-content/uploads/2018/04/Penalty-for-Not-Filing-Annual-Return.jpg

ITR Filing Penalty These Taxpayers Are Exempt From Paying A Late Fee

https://studycafe.in/wp-content/uploads/2022/07/ITR-Filing-Penalty.jpg

Do I Need To File A Gift Tax Return Hoyle CPA PLLC Business

https://i1.wp.com/hoyle-cpa.com/site/wp-content/uploads/2017/06/gift_tax_irs.jpg?fit=640%2C640&ssl=1

If the total value of the gift or gifts stays below the 5 000 threshold you do not have to file the return unless the Tax Administration has requested that you do so However there Gift tax return preparers who prepare any return or claim for refund that reflects an understatement of tax liability due to an unreasonable position are subject to a penalty

If you fail to file the gift tax return you ll be assessed a gift tax penalty of 5 percent per month of the tax due up to a limit of 25 percent Taxpayers who make taxable gifts are required to file gift tax returns that is Form 709 U S Gift and Generation Skipping Transfer Tax Return 12 A taxpayer who fails to

The Guide To Gift Tax Returns

https://hoshicpa.com/wp-content/uploads/2021/01/157904984_m-1210x423.jpg

Penalty For Late Filing Of Income Tax Return ITR 5paisa

https://storage.googleapis.com/5paisa-prod-storage/files/2023-04/Penalty-for-late-filing-of-income-tax.jpg

https://ttlc.intuit.com/community/taxes/discussion/...

There is technically no actual dollar penalty for filing a gift tax return late unless gift tax is due although leave it to the IRS to try to assess something However

https://www.vero.fi/en/individuals/property/gifts/...

You must file a gift tax return within 3 months of the date when the gift was given If you file a gift tax return late or the details on the return are not correct or information is

IRS Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

The Guide To Gift Tax Returns

How Much Is The IRS Tax Underpayment Penalty Landmark Tax Group

Is There A Penalty If I Pay My Loan Off Early YouTube

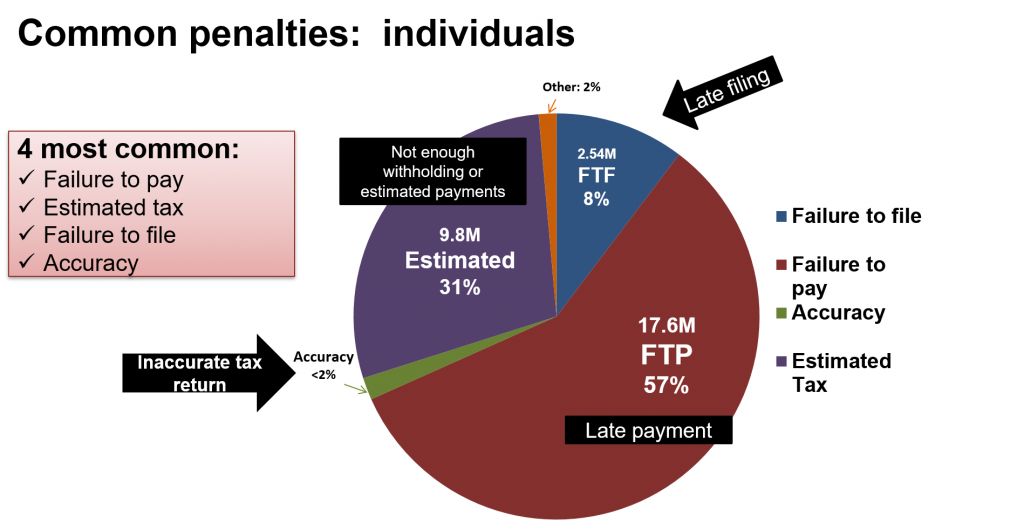

IRS Penalty Rates Common Penalties And What It Will Cost You For

Pay Estimated Tax Payments 2021 TeaganIslay

Pay Estimated Tax Payments 2021 TeaganIslay

Penalty For Late Filing Of Income Tax Return AY 2019 20

IRS Underpayment Penalty And Making Estimated Tax Payments In 2019

Estimated Tax Underpayment Penalty Waiver Rules Internal Revenue

Is There A Penalty For Not Filing A Gift Tax Return - Penalties for failing to file include fines and potential jail time What Is A Gift Tax Return A gift tax return Form 709 is filed whenever you gift one person more than the annual