Is There A Recovery Rebate Credit For 2024 The Recovery Rebate Credit is a refundable credit for those who missed out on one or more Economic Impact Payments Economic Impact Payments also referred to as stimulus payments were issued in 2020 and 2021 The IRS estimates that some individuals and families are still eligible for the payment s

If you re one of the many who are owed stimulus money you may be able to claim the amount as a recovery rebate tax credit on your 2020 or 2021 federal tax return Featured Partner Offers The 2020 Recovery Rebate Credit is actually a tax year 2020 tax credit The government sent payments beginning in April of 2020 and a second round beginning in late December of 2020 and into 2021 The credit is available to those who did not receive the Economic Impact Payments or who received less than the full amount that they were eligible for

Is There A Recovery Rebate Credit For 2024

Is There A Recovery Rebate Credit For 2024

https://phantom-marca.unidadeditorial.es/d6b6bb8dde4d78d0f51f6bbc03766e1e/resize/1320/f/jpg/assets/multimedia/imagenes/2022/01/31/16436644359926.jpg

2023 Tax Rebate Credit Tax Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-3.png?fit=633%2C623&ssl=1

Does A Tax Credit Give You Money Leia Aqui Do You Get Money From Tax Credit

https://img.money.com/2022/03/News-Recovery-Rebate-Credit.jpg

The big difference is that eligibility for the stimulus check was typically based on information found on your 2019 or 2020 tax return while eligibility for the recovery rebate credit is based What s new for 2024 instant rebate Starting in January EV buyers won t have to wait until the following year s tax season to claim and pocket the clean vehicle tax credit Instead

What Was the Recovery Rebate Credit The Recovery Rebate Credit was authorized by the Coronavirus Aid Relief and Economic Security CARES Act and paid in advance to most eligible citizens in We will see the Recovery Rebate Credit again for our 2021 tax return filed in 2022 because of the third stimulus payment How much should I have received as a third stimulus payment You should have received 1 400 per qualifying individual for this year s third stimulus payment

Download Is There A Recovery Rebate Credit For 2024

More picture related to Is There A Recovery Rebate Credit For 2024

The Recovery Rebate Credit Explained Expat US Tax

https://www.expatustax.com/wp-content/uploads/2021/03/Recovery-Rebate.jpg

Recovery Rebate Credit Santa Barbara Tax Products Group

https://www.sbtpg.com/wp-content/uploads/2021/01/recovery-rebate-credit.jpg

Recovery Rebate Credit 2023 2024 Credits Zrivo

https://www.zrivo.com/wp-content/uploads/2022/05/Recovery-Rebate-Credit-zrivo-1.jpg

Residents should be eligible based on their 2023 2024 property taxes if their property qualifies as a homestead and they meet other criteria The amount available depends on several factors but If you file your 2021 tax credit before April 18 2025 you will automatically score the tax credit boost Colorado Those living in Colorado won t miss out on rebate payments in 2024

The Tax Relief Act of 2020 enacted in late December 2020 authorized additional payments of up to 600 per adult for eligible individuals and up to 600 for each qualifying child under age 17 The 2020 Recovery Rebate Credit file a tax return by May 17 2024 2021 Recovery Rebate Credit file a tax return by April 15 2025 Get free help The IRS reminds taxpayers that there is no penalty for claiming a refund on a tax return filed after its due date The fastest and easiest way to get a refund is to choose direct deposit

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

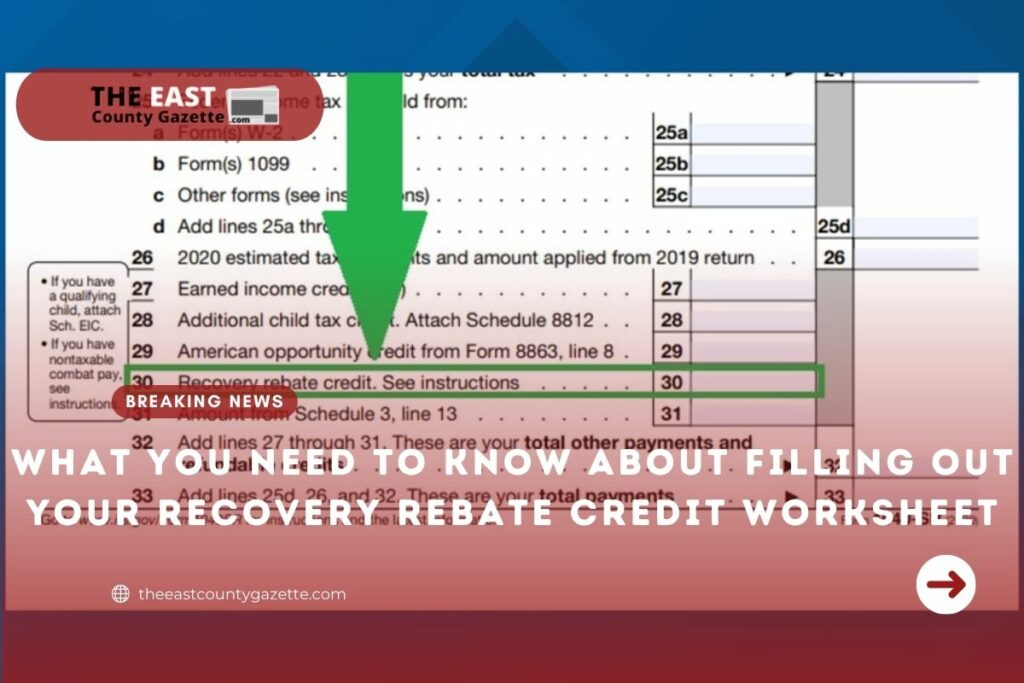

What You Need To Know About Filling Out Your Recovery Rebate Credit Worksheet The East County

https://theeastcountygazette.com/wp-content/uploads/2022/02/2-20-2-1024x683.jpg

https://www.irs.gov/newsroom/irs-reminds-eligible-2020-and-2021-non-filers-to-claim-recovery-rebate-credit-before-time-runs-out

The Recovery Rebate Credit is a refundable credit for those who missed out on one or more Economic Impact Payments Economic Impact Payments also referred to as stimulus payments were issued in 2020 and 2021 The IRS estimates that some individuals and families are still eligible for the payment s

https://www.forbes.com/advisor/taxes/how-to-use-the-recovery-rebate-credit-to-claim-your-missing-stimulus-payments/

If you re one of the many who are owed stimulus money you may be able to claim the amount as a recovery rebate tax credit on your 2020 or 2021 federal tax return Featured Partner Offers

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

IRS Updates Info On Recovery Rebate Credit And Pandemic Response Scott M Aber CPA PC

The Recovery Rebate Credit Calculator ShauntelRaya

Recovery Rebate Credit Cg Tax Audit Advisory

What Is The Recovery Rebate Credit 2023 Detailed Information

What Is The Recovery Rebate Credit 2023 Detailed Information

Can I Claim Recovery Rebate Credit In 2023 Recovery Rebate

How To Claim Recovery Rebate Credit With No Income Recovery Rebate

2020 Recovery Rebate Credits Bayshore CPA s P A

Is There A Recovery Rebate Credit For 2024 - To claim a recovery rebate credit taxpayers will need to reconcile their economic impact payment with any recovery rebate credit amount for which they are eligible on their 2020 Form 1040 U S Individual Income Tax Return page 2 line 30 draft version The credit will be added to any refund or reduce any tax due on the 2020 individual return