Is There A Tax Credit For Purchasing Energy Efficient Appliances If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032

WASHINGTON The Internal Revenue Service today updated frequently asked questions in Fact Sheet 2024 15 PDF to address the federal income tax treatment of amounts paid for the purchase of energy efficient property and improvements The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you may be eligible to claim them on your taxes when you file for 2022

Is There A Tax Credit For Purchasing Energy Efficient Appliances

Is There A Tax Credit For Purchasing Energy Efficient Appliances

https://adalawcompliance.com/wp-content/uploads/2021/08/TAX-CREDIT-AND-DEDUCTIONS.png

What Are The Best Energy Efficient Appliances For A New Home

https://nlhomestampa.com/wp-content/uploads/2020/08/energy-efficient-appliances.jpeg

17 Best Energy Saving Devices For Your Home 2022 How To Save Money In

https://images.hellomagazine.com/imagenes/homes/20220413137710/energy-saving-devices-for-home/0-670-534/energy-saving-devices-t.jpg

Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q What do consumers do to get the credit s A Fill out IRS Form 5695 following IRS instructions and include it when filing your tax return Include any relevant product receipts Several energy related tax credits are available for 2023 including two major energy tax credits for homeowners the Energy Efficient Home Improvement Credit and the Residential Clean Energy

Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent The Inflation Reduction Act will make it more affordable for families to purchase energy efficient equipment when they need to make repairs to their homes and save money on their utility bills each month

Download Is There A Tax Credit For Purchasing Energy Efficient Appliances

More picture related to Is There A Tax Credit For Purchasing Energy Efficient Appliances

Federal Energy Efficiency Tax Credits A Policy That Sounds Better Than

https://miro.medium.com/v2/resize:fit:1024/1*8yMjnNsblSvLnLFq0F83Ow.jpeg

Is There A Tax Credit For Energy Efficient Appliances

https://www.benefyd.com/wp-content/uploads/2022/01/Energy-Efficient-Appliance-Rebates.jpg

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

https://udwa.org/wp-content/uploads/TaxCredit.png

Solar panels wind power systems and geothermal heat pumps may get you a tax break for up to 30 percent of the cost For residential systems the tax credit is called the Non business Energy Property Credit and can be claimed for your main home and a second home at least for the 2019 tax year The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

[desc-10] [desc-11]

Is There A Tax Credit For Energy Efficient Appliances

https://www.benefyd.com/wp-content/uploads/2022/01/Tax-Credit-for-Energy-Efficient-Appliances.jpg

Canada Looks To Introduce Tax Credits To Support Clean Hydrogen

https://www.h2-view.com/wp-content/files/3282/canadaflagswavingatthewindinmountainscenario._1091163974_263736-scaled.jpg

https://www.irs.gov/credits-deductions/energy-efficient-home...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032

https://www.irs.gov/newsroom/irs-updates-frequently-asked...

WASHINGTON The Internal Revenue Service today updated frequently asked questions in Fact Sheet 2024 15 PDF to address the federal income tax treatment of amounts paid for the purchase of energy efficient property and improvements

3 Tax Credits To Maximize Your Refund The Motley Fool

Is There A Tax Credit For Energy Efficient Appliances

Another Way To Save New Tax Credit For Plan Participants

Proposal Next 4 000 Stimulus Check Might Be A Tax Credit For Skills

What Is The New Consolidated Caregiver Tax Credit Filing Taxes

Guide To Buying Energy Efficient Appliances Constellation

Guide To Buying Energy Efficient Appliances Constellation

Claim Energy Efficiency Tax Credit For Homeowners Before It s Gone Inman

Give To OMRF Get A Tax Credit

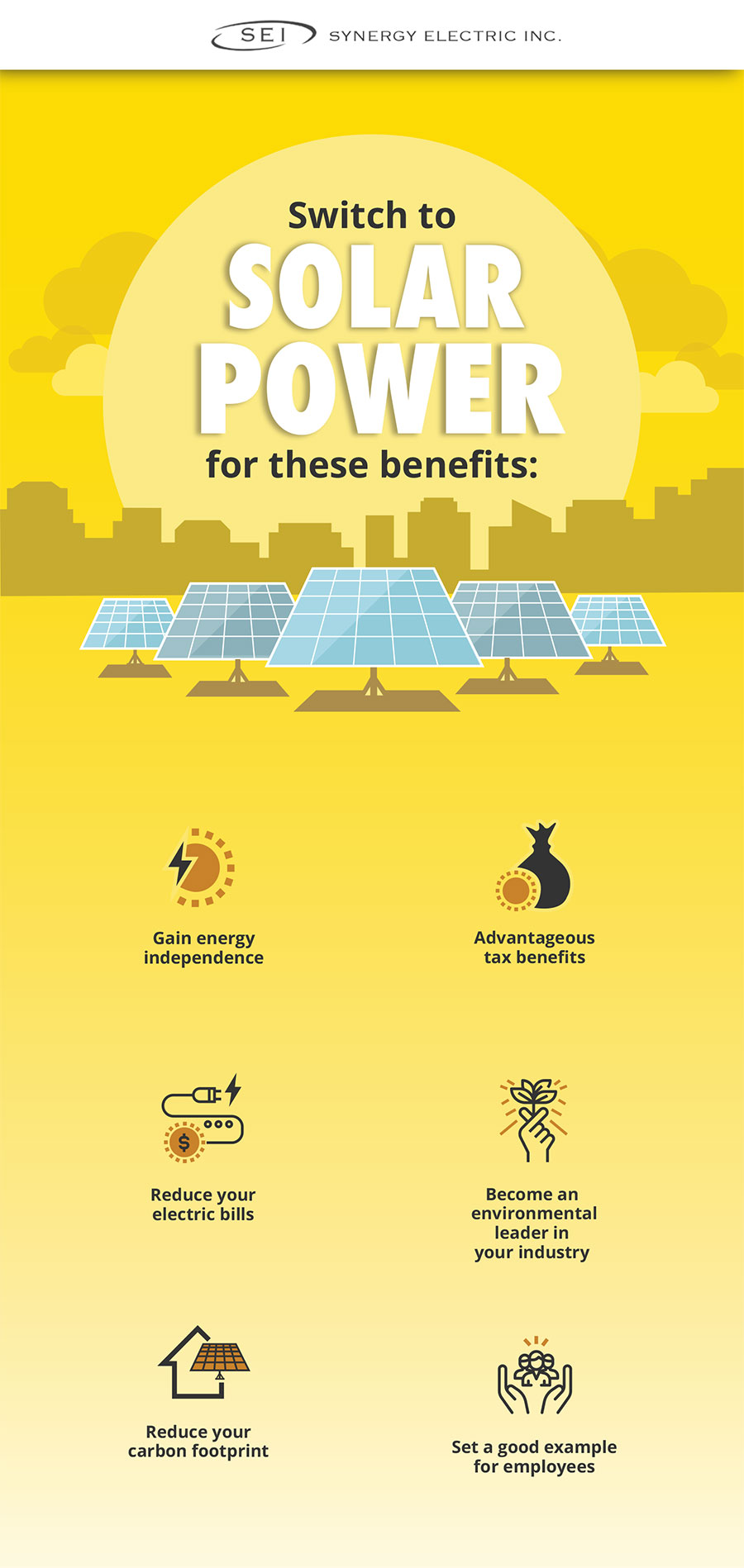

Switch To Solar For Better Company Tax Benefits Synergy Electric

Is There A Tax Credit For Purchasing Energy Efficient Appliances - [desc-12]