Is There Estate Tax In Massachusetts Massachusetts levies an estate tax on estates worth more than 2 million The progressive estate tax rates top out at 16 Estate planning can take a lot of work

Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts computed using the Internal Revenue Code in effect on There have been recent law changes to the estate tax for decedents dying on or after January 1 2023 See St 2023 c 50 The new law amended the estate tax by providing

Is There Estate Tax In Massachusetts

Is There Estate Tax In Massachusetts

https://www.damore-law.com/wp-content/uploads/2023/10/Untitled-design-4.jpg

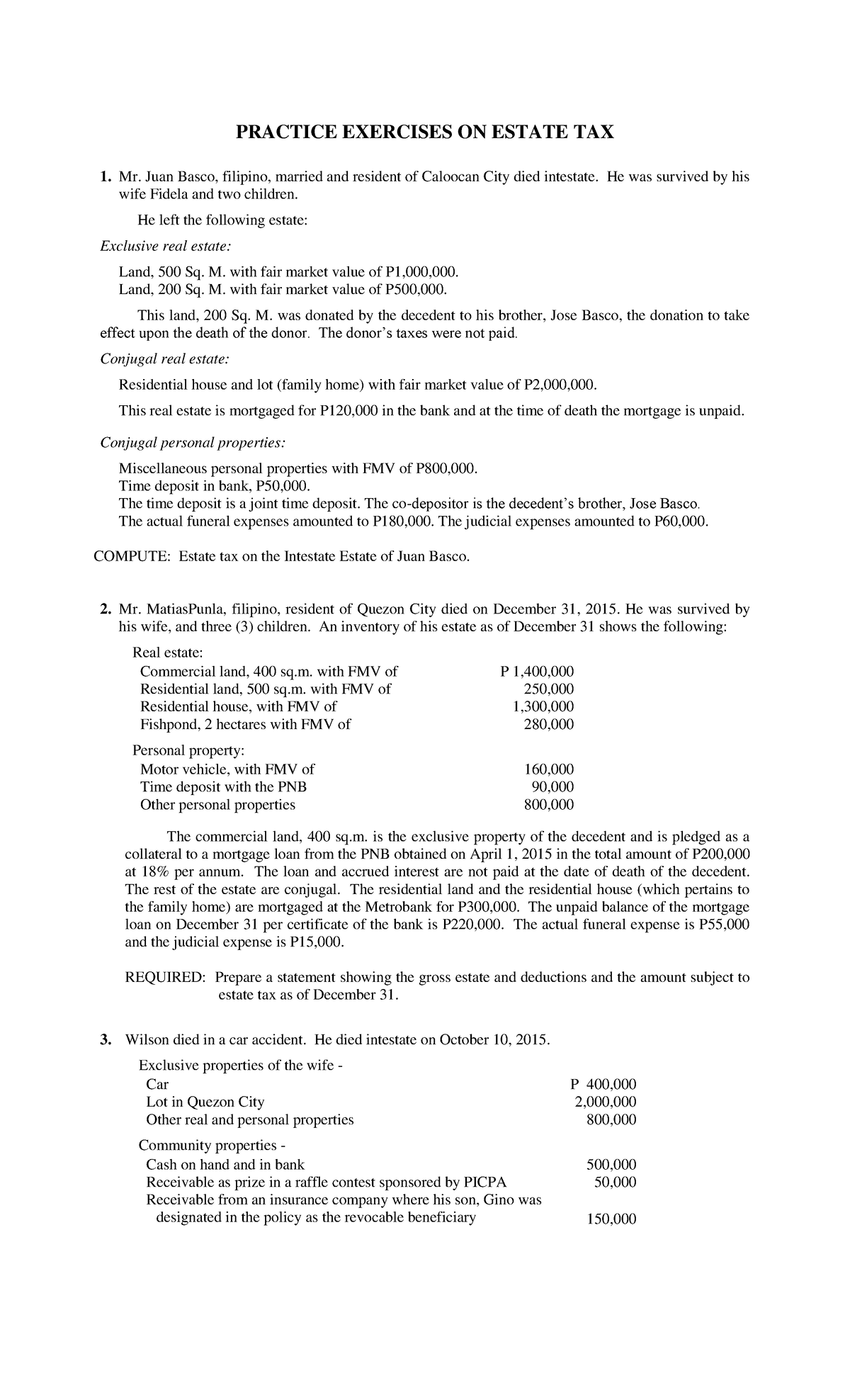

Estate TAX ESTATE TAX Topic Outline A Estate Tax B Deductions From

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/7f73025fd2a1ea0af2e8b1ef1555ac70/thumb_1200_1553.png

Assigned PDF PDF Probate Estate Tax In The United States

https://imgv2-2-f.scribdassets.com/img/document/475883197/original/92ccc9cb5a/1703908191?v=1

Massachusetts also imposes an estate tax on non residents who own real estate in Massachusetts based on the value that real estate bears to the owner s total With this change Massachusetts residents and non residents who own property in Massachusetts that have a gross estate valued over 2 million will be

In Massachusetts an estate tax is generally applied to estates which exceed 1 million based on a progressive rate scale with rates starting at 08 and increasing to 16 If you re a resident of Massachusetts and leave behind more than 2 million for deaths occurring in 2024 your estate might have to pay Massachusetts estate

Download Is There Estate Tax In Massachusetts

More picture related to Is There Estate Tax In Massachusetts

Frequently Asked Questions PDF Trust Law Estate Tax In The United

https://imgv2-1-f.scribdassets.com/img/document/324813388/original/bb890178ce/1707710797?v=1

Is There Estate Tax In Singapore GetArrange

https://d33v4339jhl8k0.cloudfront.net/docs/assets/5eaa6adc042863474d19e35d/images/63edd128fd897d5b05cda7e0/file-0CWbK45dLF.png

Chapter 9 Estate Tax Deductions PDF Taxes Estate Tax In The

https://imgv2-1-f.scribdassets.com/img/document/647291823/original/81c915122c/1697194121?v=1

In Massachusetts estates must file an estate tax return if the estate value is over 1 million This tax will also apply to the entire estate value not just the portion Any Massachusetts resident who has an estate valued at more than 2 million between property and adjusted taxable gifts is required to file a Massachusetts estate tax return The estate tax rule

Connect with Matthew Karr Esq at The Heritage Law Center today by calling 617 299 6976 or completing the online form below Knowing what your estate tax The Massachusetts estate tax differs from other states levying a similar tax in two major ways The low dollar threshold at which an estate is subject to tax and The application

2023 State Income Tax Rates And Brackets Tax Foundation

https://files.taxfoundation.org/20230217151820/2023-state-individual-income-tax-rates-2023-state-income-taxes-by-state.png

Why Is Washington Estate Tax Not Indexed To Inflation

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https://substack-post-media.s3.amazonaws.com/public/images/461151b9-4258-42a1-821c-36667ecb537b_1123x846.jpeg

https://smartasset.com/estate-planning/massachusetts-estate-tax

Massachusetts levies an estate tax on estates worth more than 2 million The progressive estate tax rates top out at 16 Estate planning can take a lot of work

https://www.mass.gov/estate-tax

Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts computed using the Internal Revenue Code in effect on

Tax Benefits The Glenwood

2023 State Income Tax Rates And Brackets Tax Foundation

Pdfcoffee The Estate Tax In The Philippines Is 6 Of The Net Estate

Gross Estate PDF Estate Tax In The United States Will And Testament

Gross Estate Problems PDF Estate Tax In The United States

Who Are Relatives PDF Estate Tax In The United States Taxes

Who Are Relatives PDF Estate Tax In The United States Taxes

Massachusetts Estate Tax Rates Table

I Estate Tax PDF Estate Tax In The United States Taxation In The

Estate Tax PDF Will And Testament Estate Tax In The United States

Is There Estate Tax In Massachusetts - If you re a resident of Massachusetts and leave behind more than 2 million for deaths occurring in 2024 your estate might have to pay Massachusetts estate