Is There Gst On Rebates GST on discounts and rebates Charging and accounting for GST when you provide discounts and rebates such as prompt payment discounts and volume rebates On this

If the manufacturer pays a rebate to a customer and indicates in writing that the rebate includes GST HST the manufacturer can claim an ITC in the reporting If you receive or provide a rebate you may need to adjust the amount of GST you ve claimed or paid or treat the rebate as a separate sale depending on the

Is There Gst On Rebates

Is There Gst On Rebates

https://res.cloudinary.com/valuechampion/image/upload/c_limit,dpr_1.0,f_auto,h_1600,q_auto,w_1600/v1/GST_Voucher_pic.png

![]()

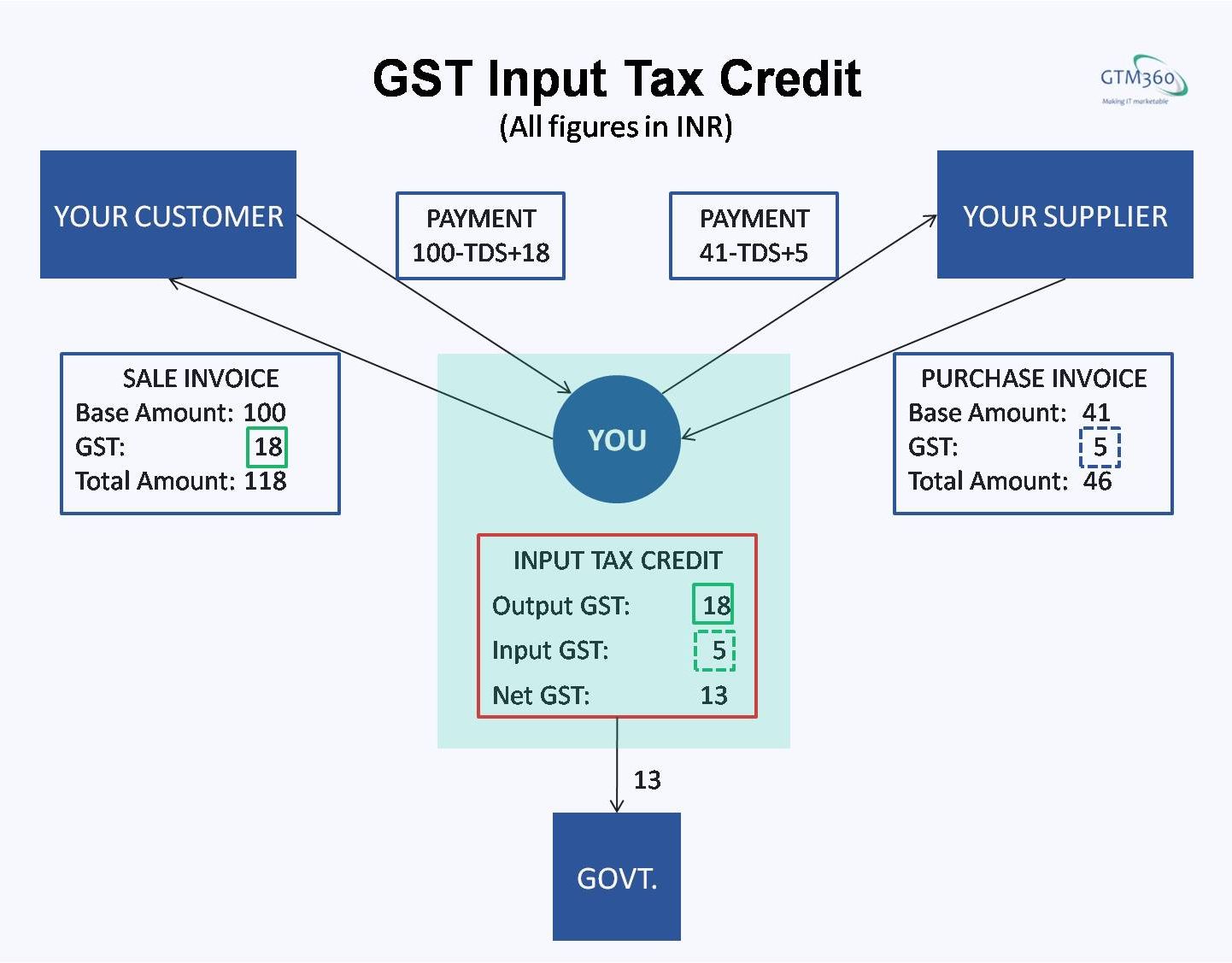

GST In India Current State And Future Expectations Infographic

https://sp-ao.shortpixel.ai/client/to_webp,q_glossy,ret_img,w_1024,h_1017/https://www.instamojo.com/blog/wp-content/uploads/infographic-gst-01-02-1-1024x1017.png

Is There Gst On Residential Property STAETI

https://i.pinimg.com/originals/b7/08/9c/b7089c677fc08f6398b613a063fa5e9e.jpg

Government payments to provide income support to businesses are typically not for a supply and therefore will not have any GST implications Holding an Australian Business If you provide services to your supplier and they give you a rebate as payment for your services then you are making a sale and must pay GST on that sale Generally

On April 5 2024 Canadians who qualify will get their new GST payment from the Canada Revenue Agency CRA The GST payment for April 2024 will be sent on The calculation is correct GST is based on the price of the installation before the discount rebate is applied You can read up more on the GST and Small

Download Is There Gst On Rebates

More picture related to Is There Gst On Rebates

Waste Disposal Taxes And Fees Local Environmental Services

https://localenvironmental.ca/wp-content/uploads/2022/07/Residential-Services.jpg

GST For Techies Part 2 GTM360 Blog

https://gtm360.com/blog/wp-content/uploads/2017/10/gst-input-tax-credit-1.jpg

Is There GST On Overseas Software Subscriptions

https://static.wixstatic.com/media/4fbebf_426e3f46a99446749aa437d2c412225b~mv2.jpg/v1/fill/w_575,h_308,al_c,q_80,enc_auto/4fbebf_426e3f46a99446749aa437d2c412225b~mv2.jpg

Here are the GST HST rebate dates for the 2022 tax year July 5 2023 which you should ve received October 5 2023 January 5 2024 April 5 2024 If your One time GST payment to support Canadians Additional one time GST credit payment To support those most affected by inflation the Government of Canada is issuing an

According to the Canada Revenue Agency s General Information for GST HST Registrants Guide the GST HST you charge depends on the type of discount Single Canadians qualify for a GST HST credit if you earn 60 000 and have 3 or 4 children 50 000 to 55 000 with one child or more Single Canadians who earn

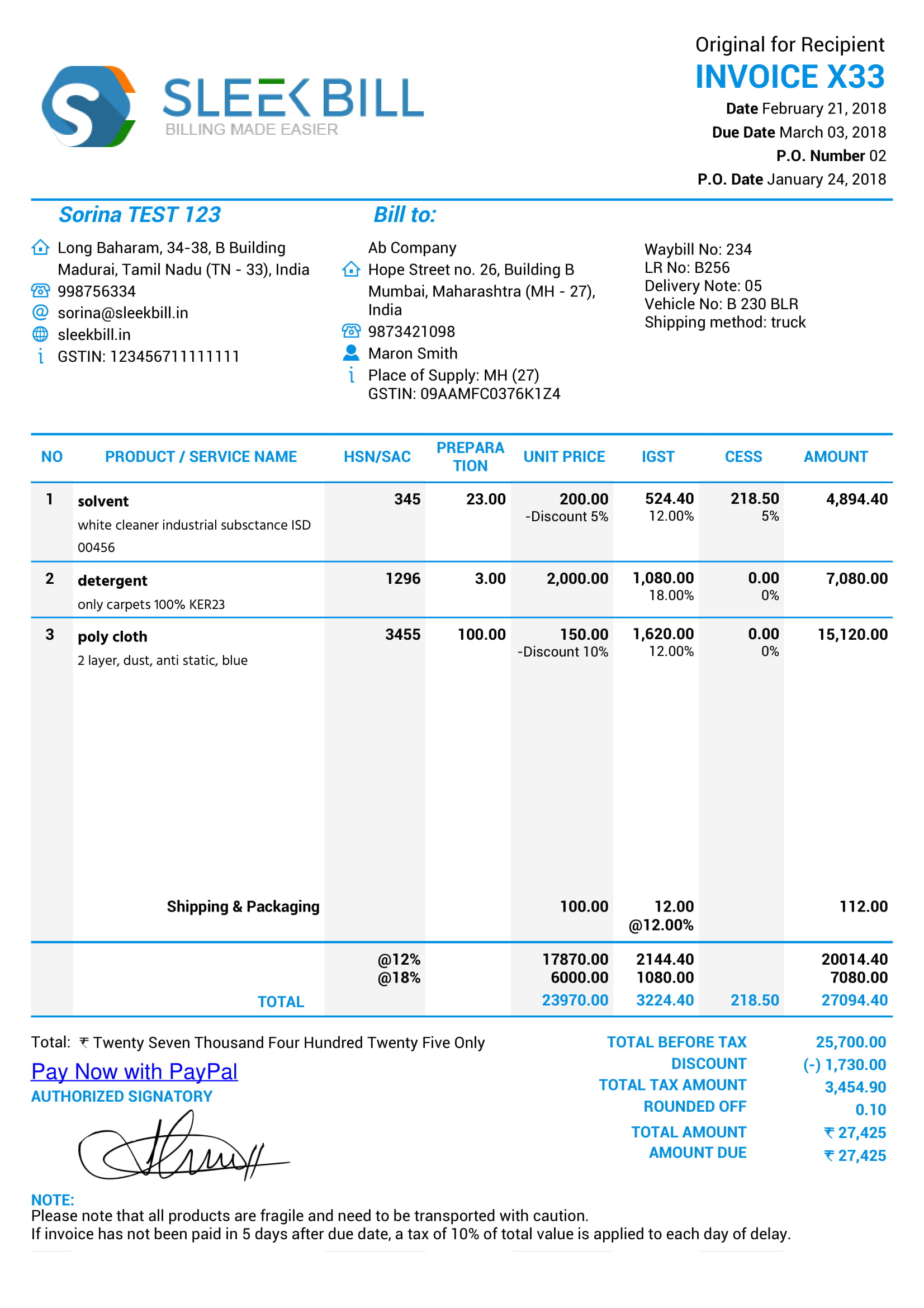

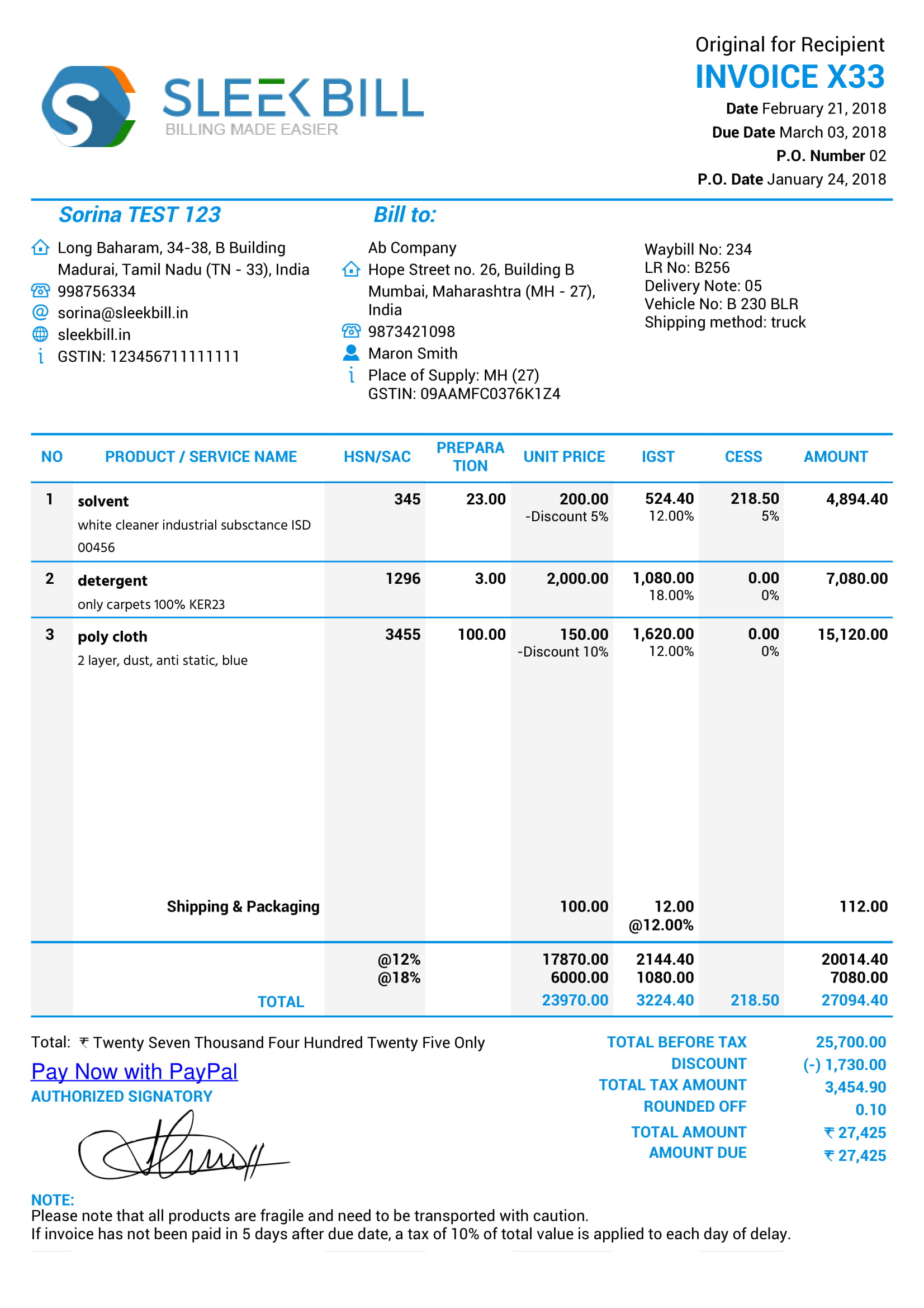

GST Invoice Format

https://www.billingsoftware.in/images/articles/invis1.jpg

GST Rates For Goods Goods And Service Tax Goods And Services Content

https://i.pinimg.com/originals/1a/81/9d/1a819d319f3439d3128e9d8fb8ff7e4b.jpg

https://www.iras.gov.sg/.../gst-on-discounts-and-rebates

GST on discounts and rebates Charging and accounting for GST when you provide discounts and rebates such as prompt payment discounts and volume rebates On this

https://www.canada.ca/en/revenue-agency/services/...

If the manufacturer pays a rebate to a customer and indicates in writing that the rebate includes GST HST the manufacturer can claim an ITC in the reporting

GST Implications On Hotels Restaurant Industry

GST Invoice Format

An Insight Positive Impacts Of GST On Indian Real Estate Industry

Impact Of GST On Insurance Premium And Bank Charges

Ato Gst On Commercial Property Outgoings

Insurance Premiums Set To Go Up Under GST Regime Times Of India

Insurance Premiums Set To Go Up Under GST Regime Times Of India

GST Roll Out Is Fodder For Social Media Jokes

Do I Have To Pay GST On Stripe Fees SpentApp

Hecht Group The Impact Of GST On Commercial Property Transactions In

Is There Gst On Rebates - On April 5 2024 Canadians who qualify will get their new GST payment from the Canada Revenue Agency CRA The GST payment for April 2024 will be sent on