Is There Sales Tax On Hotel Rooms In California Lodging is subject to state sales tax and may also be subject to certain additional county sales taxes depending on the definition of hotel within that county Many cities and counties also have tourism taxes in addition to sales taxes

Tax and fee laws can be complex and difficult to understand If you have specific questions regarding how tax applies to your venue rental business we recommend that you get answers in writing from us This will enable us to give you the best advice and may protect you from owing tax interest or penalties should we give you erroneous advice You ll see the exact amount of tax on your receipt or if you re reserving a hotel the taxes will be shown as separate line items before you reserve There is a base California state sales tax rate of 7 5 but it can go up

Is There Sales Tax On Hotel Rooms In California

Is There Sales Tax On Hotel Rooms In California

https://www.salestaxdatalink.com/wp-content/uploads/2023/05/AdobeStock_384632145.jpeg

Featured Archives Ansari Law Firm

https://ansaritax.com/wp-content/uploads/2019/01/ansaritax-georgia-sales-tax-1024x662.jpg

A Babe From The 716 On Twitter Excuse Me But Why Is There Sales Tax

https://pbs.twimg.com/media/FcZxCs1XwAEhQHg.jpg:large

What transactions are generally subject to sales tax in California California requires that a sales tax be collected on all personal property that is being sold to the end consumer for storage use or consumprion within the state of California Most leases are considered continuing sales by California and are thus also subject to sales Title 18 Public Revenues Division 2 California Department of Tax and Fee Administration Business Taxes State Board of Equalization Business Taxes See Chapters 6 and 9 9 Chapter 4 Sales and Use Tax Article 15 Leases of Tangible Personal Property 1660 Leases of Tangible Personal Property in General

08 18 2021 Understanding Lodging Taxes for Your Next FedRooms Stay FedRooms travelers may have come across an unexpected charge for a state sales tax on a past hotel stay Prior to booking your next trip it is important to understand that sales tax policies differ from state to state This publication is designed to help you understand California s Sales and Use Tax Law as it applies to businesses that sell meals or alcoholic beverages or both such as restaurants bars hotels and catering operations You will also find information on complimentary food and beverages provided to guests at lodging facilities

Download Is There Sales Tax On Hotel Rooms In California

More picture related to Is There Sales Tax On Hotel Rooms In California

Is There Sales Tax On Gift Cards By NewsWeekMe Oct 2023 Medium

https://miro.medium.com/v2/resize:fit:1000/1*WWRAoOIWk1BSpPJw6F5dlA.jpeg

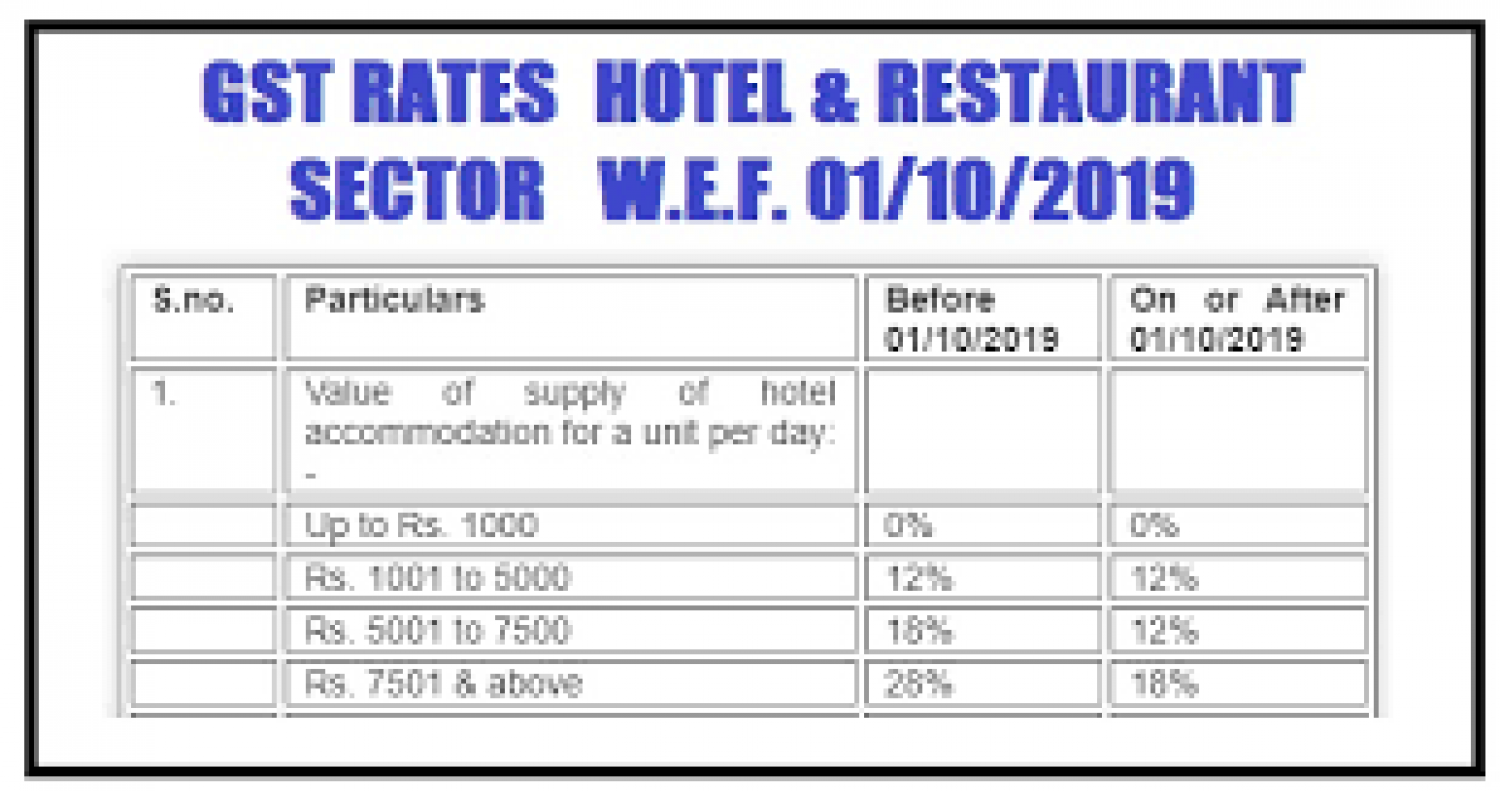

Gst On Hotels Restaurant Industry Gst On Hotel

https://carajput.com/art_imgs/faqs-on-gst-on-hotels-and-restaurant-industry.jpg

Sales Tax What Is It And How Does It Work ThemeBin

https://mebincdn.themebin.com/is_there_sales_tax_on_wallpaper_engine.jpg

Many services are taxable in California This includes services such as restaurant meals haircuts car repairs dry cleaning hotel stays rental cars and tickets to sporting events and concerts However there are some services that are exempt from sales tax such as medical services and financial services While both hospitality tax and lodging tax impact the hospitality industry they serve different purposes and are applied differently Hospitality tax usually targets services like prepared meals and beverages whereas lodging tax specifically focuses on guest room accommodations Confusing them can lead to misfiling and financial

Retail sales of tangible items in California are generally subject to sales tax Examples include furniture giftware toys antiques and clothing Some labor services and associated costs are subject to sales tax if they are involved in the creation or manufacturing of new tangible personal property Some items are exempt from sales and use Cities and counties can levy hotel taxes A hotel tax levied by a county applies to unincorporated areas of the county 1 Voter approval is required to impose a new hotel tax or to increase an existing tax A hotel tax may be a general tax or a special tax 2

Is There Sales Tax On Consulting Services

https://lytaxadvisors.com/wp-content/uploads/2023/09/Is-There-Sales-Tax-on-Consulting-Services.png

Is There Sales Tax On Puppies In Pa

https://hips.hearstapps.com/hmg-prod/images/urban-architecture-blight-royalty-free-image-1591717116.jpg

https://www. avalara.com /mylodgetax/en/resources/...

Lodging is subject to state sales tax and may also be subject to certain additional county sales taxes depending on the definition of hotel within that county Many cities and counties also have tourism taxes in addition to sales taxes

https://www. cdtfa.ca.gov /industry/venue-rental-businesses

Tax and fee laws can be complex and difficult to understand If you have specific questions regarding how tax applies to your venue rental business we recommend that you get answers in writing from us This will enable us to give you the best advice and may protect you from owing tax interest or penalties should we give you erroneous advice

Is There Sales Tax On Puppies In Pa

Is There Sales Tax On Consulting Services

United States In NYC Is There Sales Tax On Services Like Computer

Should You Charge Sales Tax On Rental Equipment Quipli

Is There Sales Tax On Shipping Charges AccurateTax

Louis Vuitton The Gardens Sales Tax Semashow

Louis Vuitton The Gardens Sales Tax Semashow

Louis Vuitton The Gardens Sales Tax Semashow

Is There Sales Tax On Gift Cards News Week Me

How To Pay Business Taxes As A Concrete Construction Company

Is There Sales Tax On Hotel Rooms In California - What transactions are generally subject to sales tax in California California requires that a sales tax be collected on all personal property that is being sold to the end consumer for storage use or consumprion within the state of California Most leases are considered continuing sales by California and are thus also subject to sales