Is There Vat On Discount Received Best answer Hi Any VAT on discounts received does not make your VAT bill higher just because it is being reported on the VAT return as income instead of a

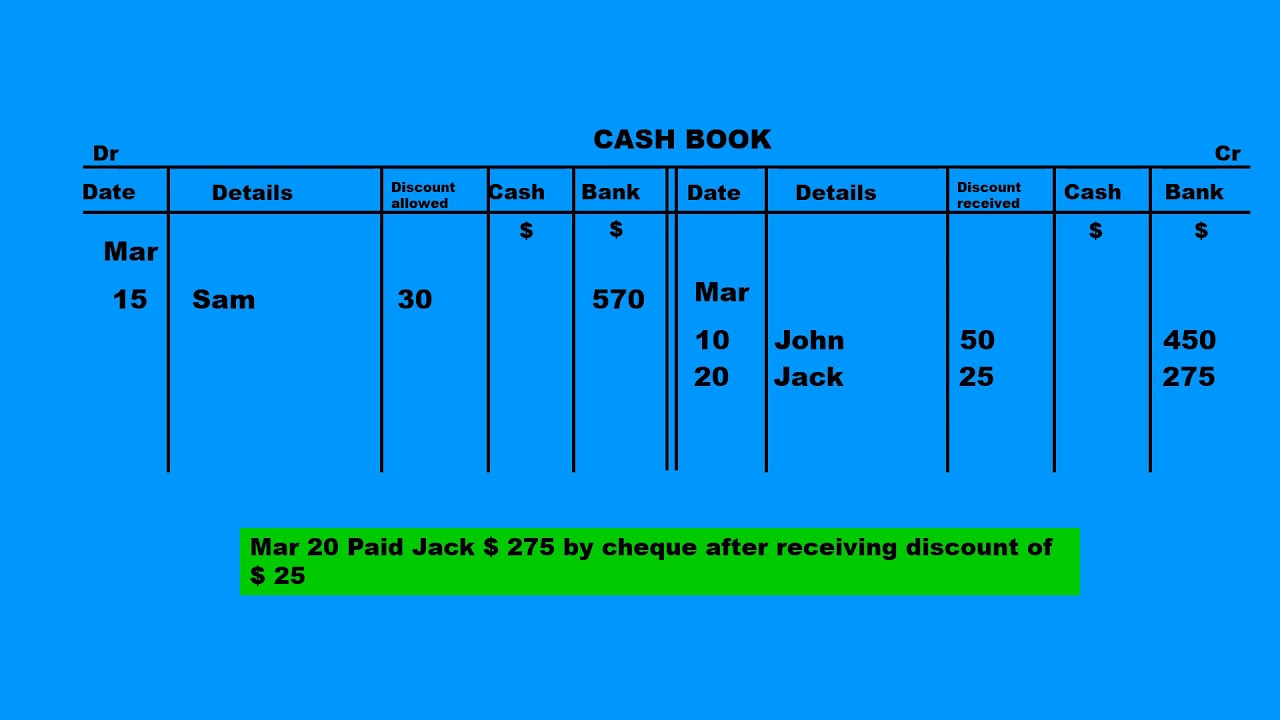

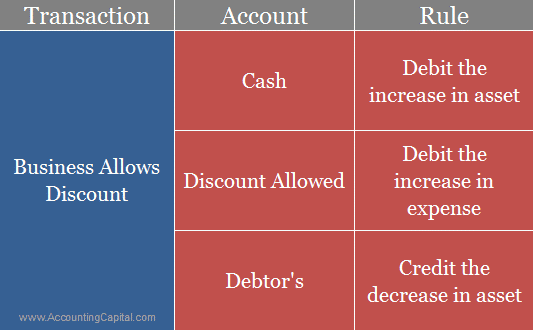

Accounting for the Discount Allowed and Discount Received When the seller allows a discount this is recorded as a reduction of revenues and is typically Recently the South African Revenue Service released Binding General Ruling 6 in which it rather briefly deals with the issue of early settlement discounts in the Fast

Is There Vat On Discount Received

Is There Vat On Discount Received

https://1.bp.blogspot.com/-w5fsH5egYdw/YLCBXdzwZHI/AAAAAAAAAaI/p4bE3hb2MJ8DnoPlgb59oFKIuBtwEgB-gCLcBGAsYHQ/s659/vat%2Band%2Bdiscount%2Bpart%2B3.jpg

Is There VAT On Postage Ultimate Guide To VAT On Postage

https://smallbusinessowneradvice.co.uk/wp-content/uploads/2022/08/Is-there-VAT-on-postage-768x515.jpg

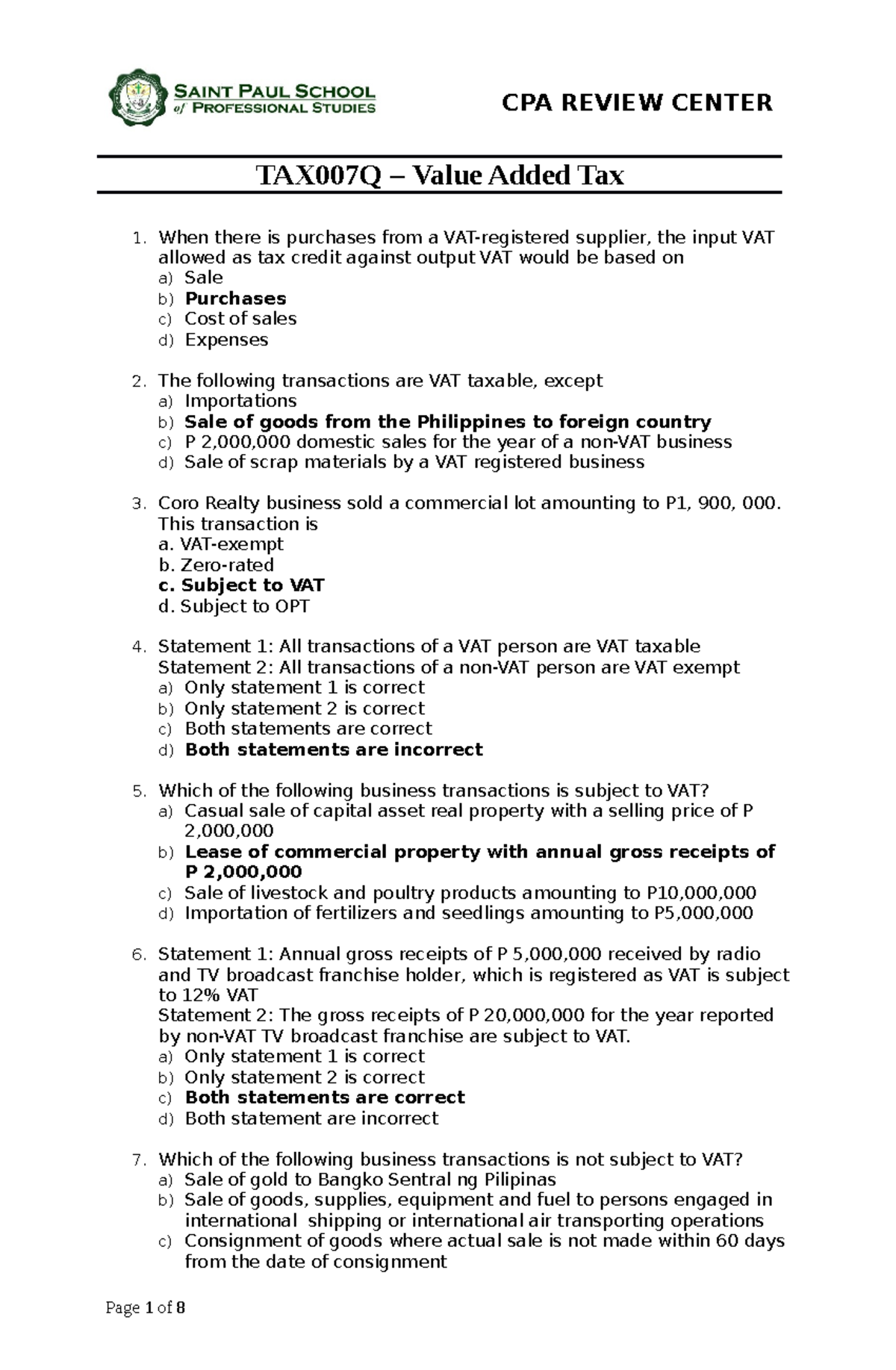

VAT EXAMINATION TEST BANK CPA REVIEW CENTER TAX007Q Value Added Tax

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/0b2565937b7ff836462146bb494d08b4/thumb_1200_1835.png

Suppliers must now account for VAT on the amount they actually receive and customers may recover the amount of VAT that is actually paid to Where a retailer offers a discount to customers VAT is only due on the amount actually received Therefore if a retailer offers money off coupons or buy one get one free

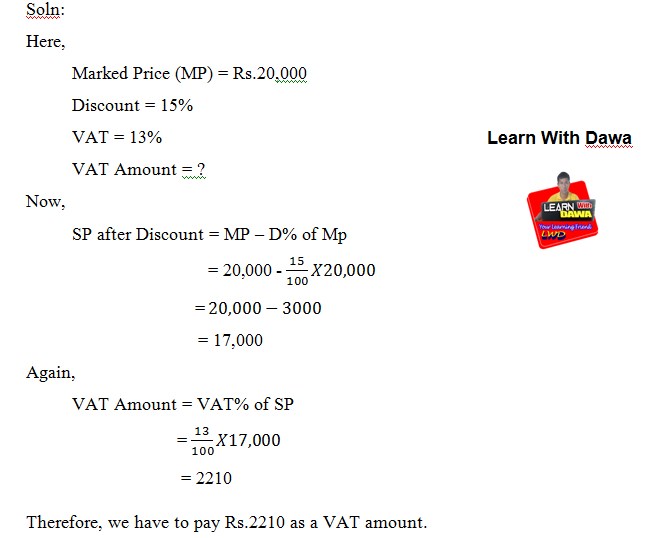

The issue Differences in the classification of allowances including discounts rebates and incentives in the retail industry have resulted in VAT difficulties Calculating VAT on discounts can be done in one of the two ways Extracts in the attached invoices contain discounts shown as follows Option 1 Issue an invoice An invoice is prepared for the full amount In this

Download Is There Vat On Discount Received

More picture related to Is There Vat On Discount Received

Uae How To Calculate Municipality Fee Service Charge And VAT For

https://i.stack.imgur.com/sPdNt.jpg

Cash Discount Discount Allowed And Discount Received YouTube

https://i.ytimg.com/vi/iNdpSQEATEg/maxresdefault.jpg

Is There VAT On Rent Deposits Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2018/09/vat-on-rent-deposits.jpg

For VAT purposes there is no distinction between revenue and capital items as there is for income tax and corporation tax Output VAT is charged on the actual VAT Guidance Business promotions VAT Notice 700 7 Find out how to account for VAT schemes on business gifts samples and promotional schemes From

There are different rules for charging VAT on discounts gifts and free services Charging VAT on discounts For basic discounts for example a 20 off discount charge VAT Discounts and incentives the VAT implications July 26 2021 In VAT HMRC Pandemic By galleytindle Some businesses are concerned they will lose

Is There Vat On Training Barry Accountants

https://barryaccountants.ie/wp-content/uploads/2019/07/vat-on-training-2-1200x1800.jpg

Is There VAT On Bus Tickets Exempt Zero Rated Answer

https://smallbusinessowneradvice.co.uk/wp-content/uploads/2022/06/bus-tickets-vat-rate.jpg

https://central.xero.com/s/question/0D53m00005XcsqICAR

Best answer Hi Any VAT on discounts received does not make your VAT bill higher just because it is being reported on the VAT return as income instead of a

https://www.accountingtools.com/articles/what-is...

Accounting for the Discount Allowed and Discount Received When the seller allows a discount this is recorded as a reduction of revenues and is typically

Is There VAT On Parking Charges Fines Exempt Zero Rated

Is There Vat On Training Barry Accountants

Is There VAT On Postage

VAT TV 2022 Top 10 Global Developments Vatcalc

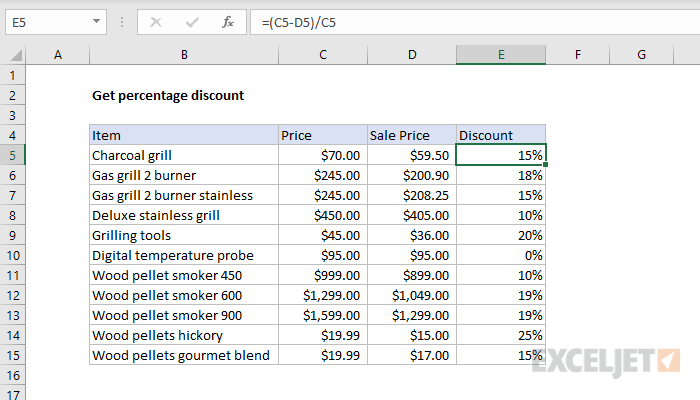

Get Percentage Discount Excel Formula Exceljet

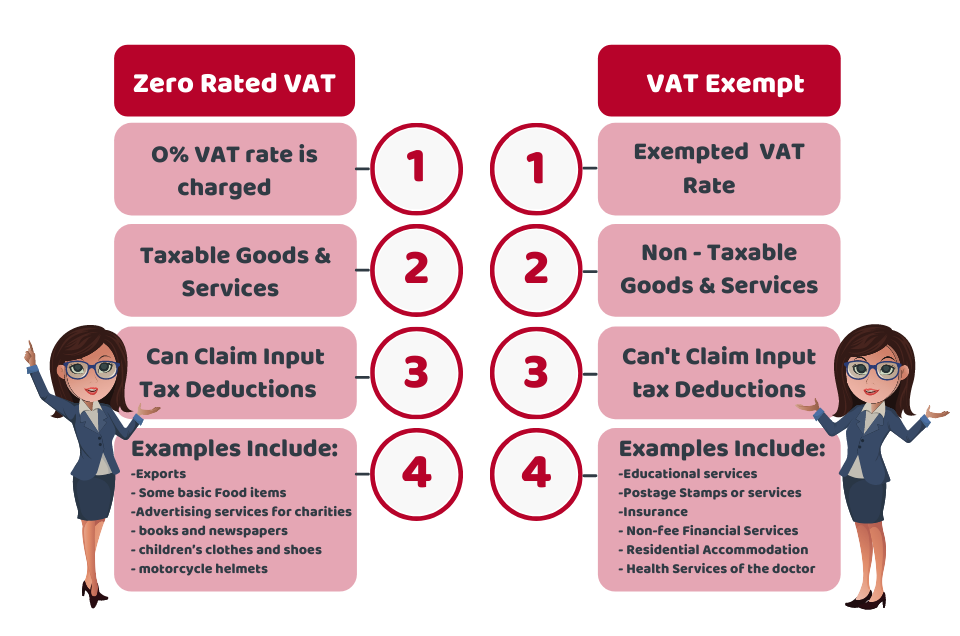

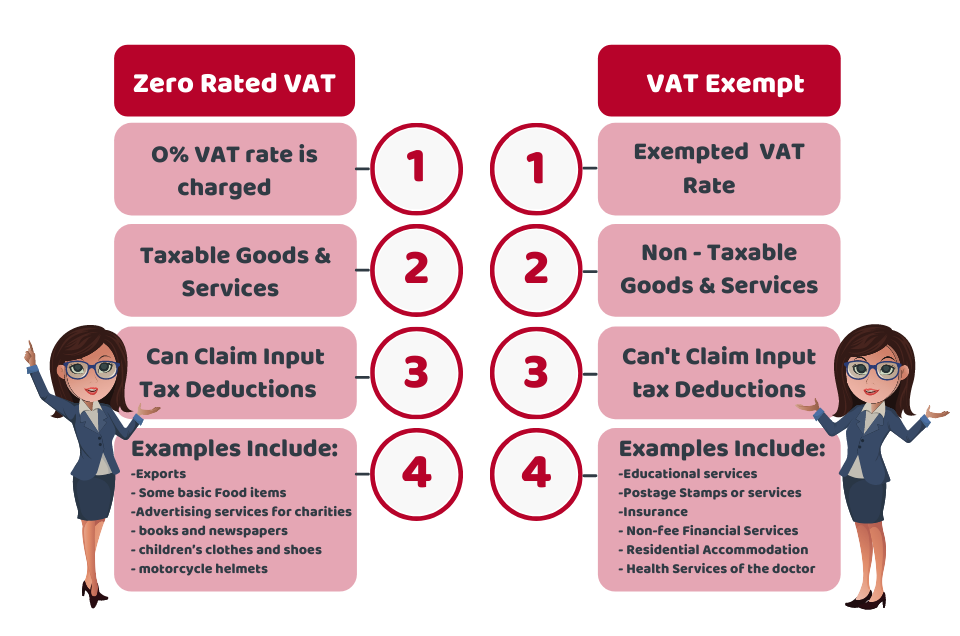

Whats The Difference Between Exempt Items And Zero Rated Vat Items

Whats The Difference Between Exempt Items And Zero Rated Vat Items

Discount Received Journal Entry KaydenceminJoyce

Vat Questions Is There VAT On This UAccountancy

Is There VAT On Delivery Charges Know The Facts

Is There Vat On Discount Received - Calculating VAT on discounts can be done in one of the two ways Extracts in the attached invoices contain discounts shown as follows Option 1 Issue an invoice An invoice is prepared for the full amount In this