Is Training Tax Deductible Find out if you could claim the cost of training as an allowable business expense if you are a self employed individual

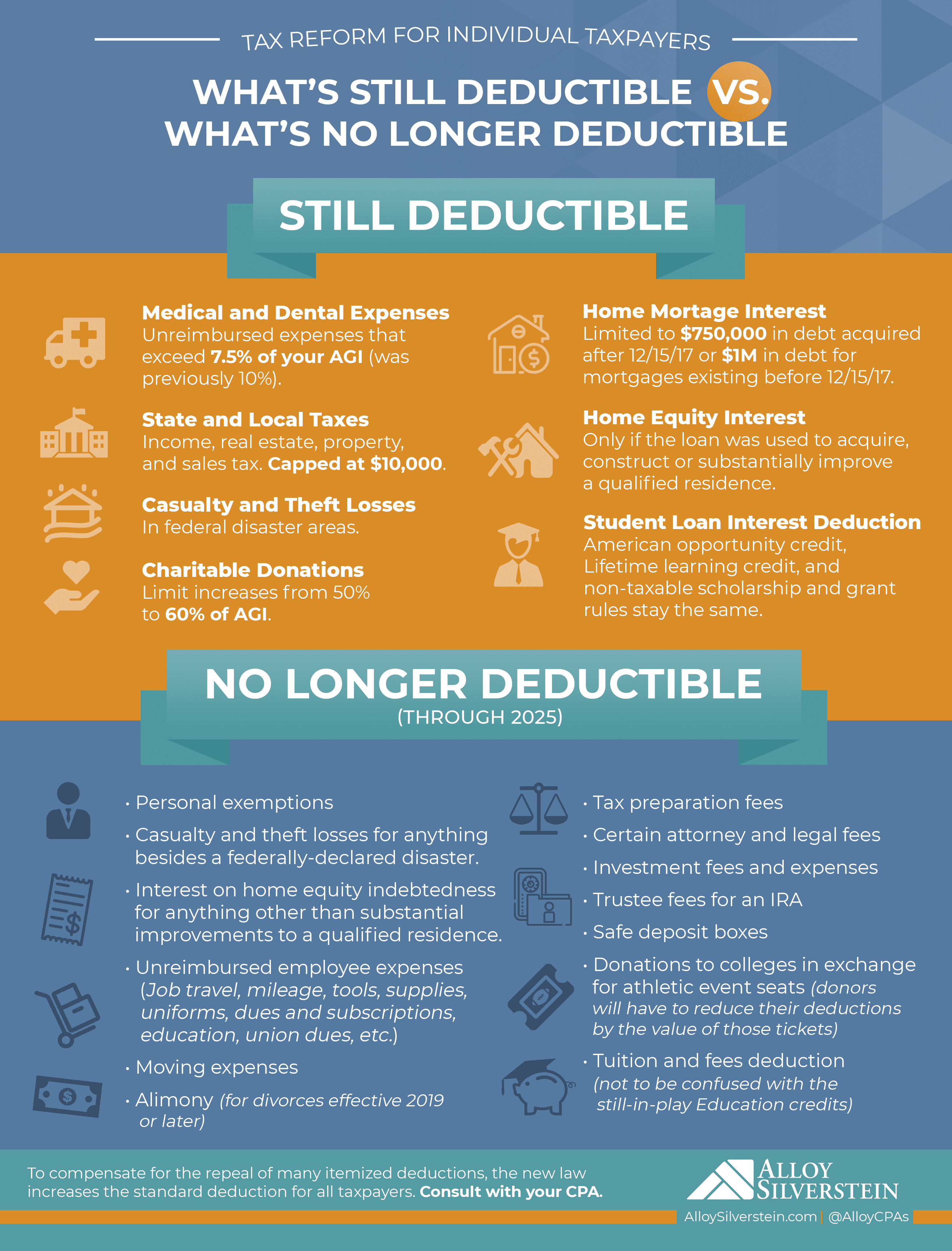

For tax years 2018 through 2025 all employee expenses are no longer deductible even if the employee can itemize deductions However if the taxpayer is self You can claim allowable business expenses for training that helps you improve skills and knowledge you currently use for your business keep up to date with technology used in your

Is Training Tax Deductible

Is Training Tax Deductible

https://accountinglogic.co.uk/wp-content/uploads/2022/10/8-3-1024x536.png

Is Training Tax Deductible Taxes On Work Related Training That People

https://accountinglogic.co.uk/wp-content/uploads/2022/10/16-3.png

Is Personal Training Tax Deductible YouTube

https://i.ytimg.com/vi/sXdfYMEKf0Y/maxresdefault.jpg

In most cases training costs incurred by an employee will not be allowable for tax This is because an expense cannot be deducted under the general rule for employees expenses in Most business owners think that training costs aimed at improving skills or business profits automatically qualify for tax relief but that s not necessarily the case In order to consider whether training is tax deductible we have to look

Find out more about the rules which exempt work related training provided for employees from tax Chapter 5 gives an outline of the rules which exempt from tax the cost of Training that helps you do this is tax deductible That goes for classes and self study programs For example say you pay for a class that walks you through massive updates to the software you use to provide design services

Download Is Training Tax Deductible

More picture related to Is Training Tax Deductible

Are Training Costs Tax Deductible For The Self Employed

https://goselfemployed.co/wp-content/uploads/2019/01/training-courses-tax-deductible.jpg

Stock Written Off Tax Deductible Dec 13 2021 Johor Bahru JB

https://cdn1.npcdn.net/image/1639399835e281476dd194aa9f2a74cd92e0a2ce07.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

13 Tax Deductible Expenses Business Owners Need To Know About CPA

https://gurianco.com/wp-content/uploads/2018/11/tax-deductions.png

Training costs are tax deductible if these educational expenses meet the strict criteria defined by the Internal Revenue Service Publication 970 states that employees can deduct training If you as an employee are required to pay your own training costs it s notoriously difficult to obtain HMRC s agreement The taxman will generally not allow a tax deduction unless you can prove these were incurred wholly necessarily and

If the training is wholly and exclusively for the purposes of the trade it will be tax deductible This is therefore a much wider definition than that which applies to employees You can claim tax relief on training expenditure for directors and employees providing the training is aimed at improving the skills needed in the business Allowable

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

https://alloysilverstein.com/wp-content/uploads/2019/03/Tax-Reform-Deductible-vs-Non-Deductible-Infographic-2019.png

What Does Tax Deductible Mean And How Do Deductions Work

https://s.yimg.com/ny/api/res/1.2/4oVLwF5RIk.VRMeiL2y7jA--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD02NzU-/https://media.zenfs.com/en-US/homerun/gobankingrates_644/1782921ec4434716597a5408c994ca28

https://www.gov.uk › guidance › check-if-the-cost-of...

Find out if you could claim the cost of training as an allowable business expense if you are a self employed individual

https://ttlc.intuit.com › community › tax-credits...

For tax years 2018 through 2025 all employee expenses are no longer deductible even if the employee can itemize deductions However if the taxpayer is self

Tax Deductible Items For Entrepreneurs Fujn

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

Tax Deductible Donations FAQs

Sars 2022 Weekly Tax Tables Brokeasshome

Tax Deductible Bricks R Us

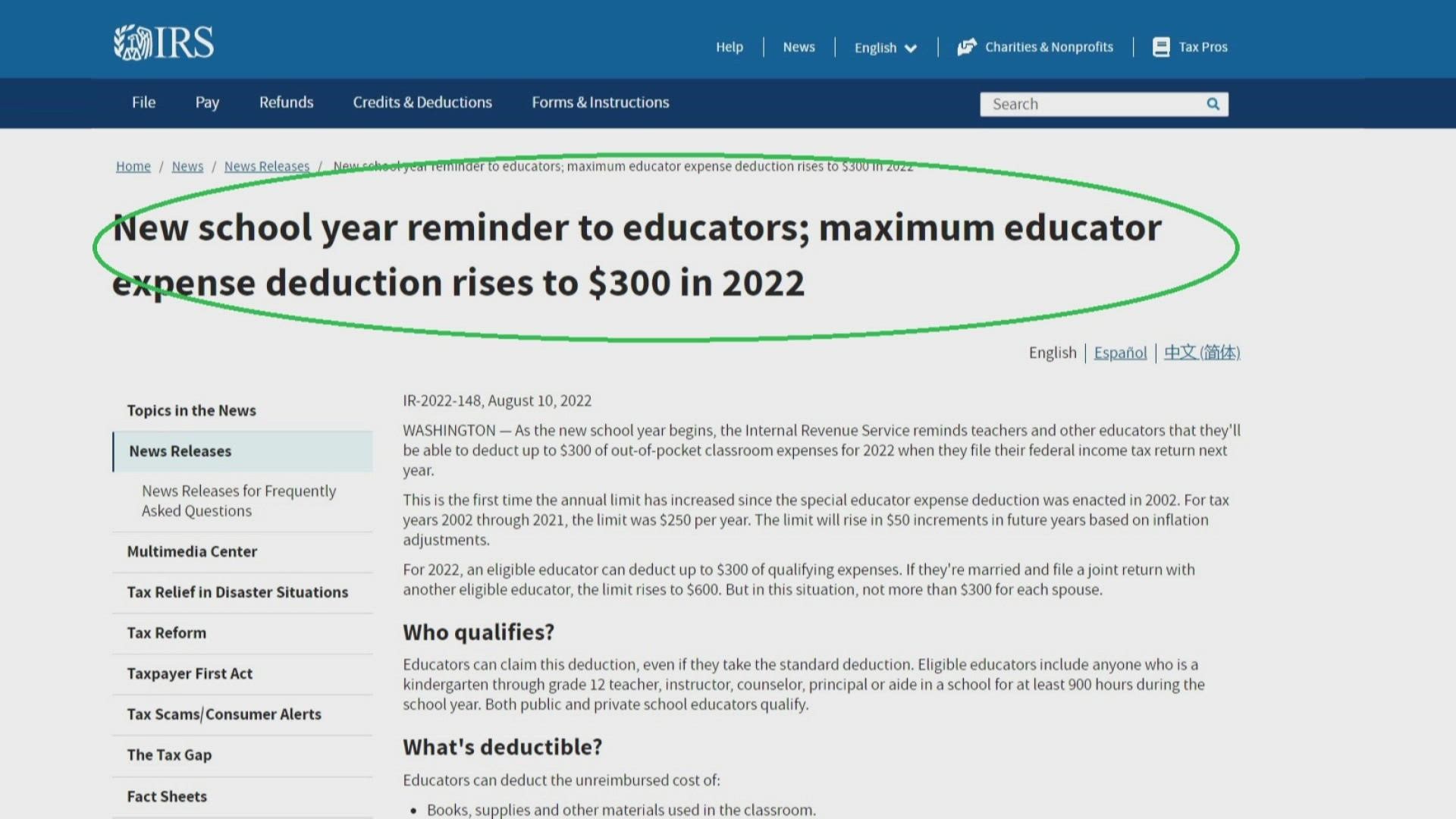

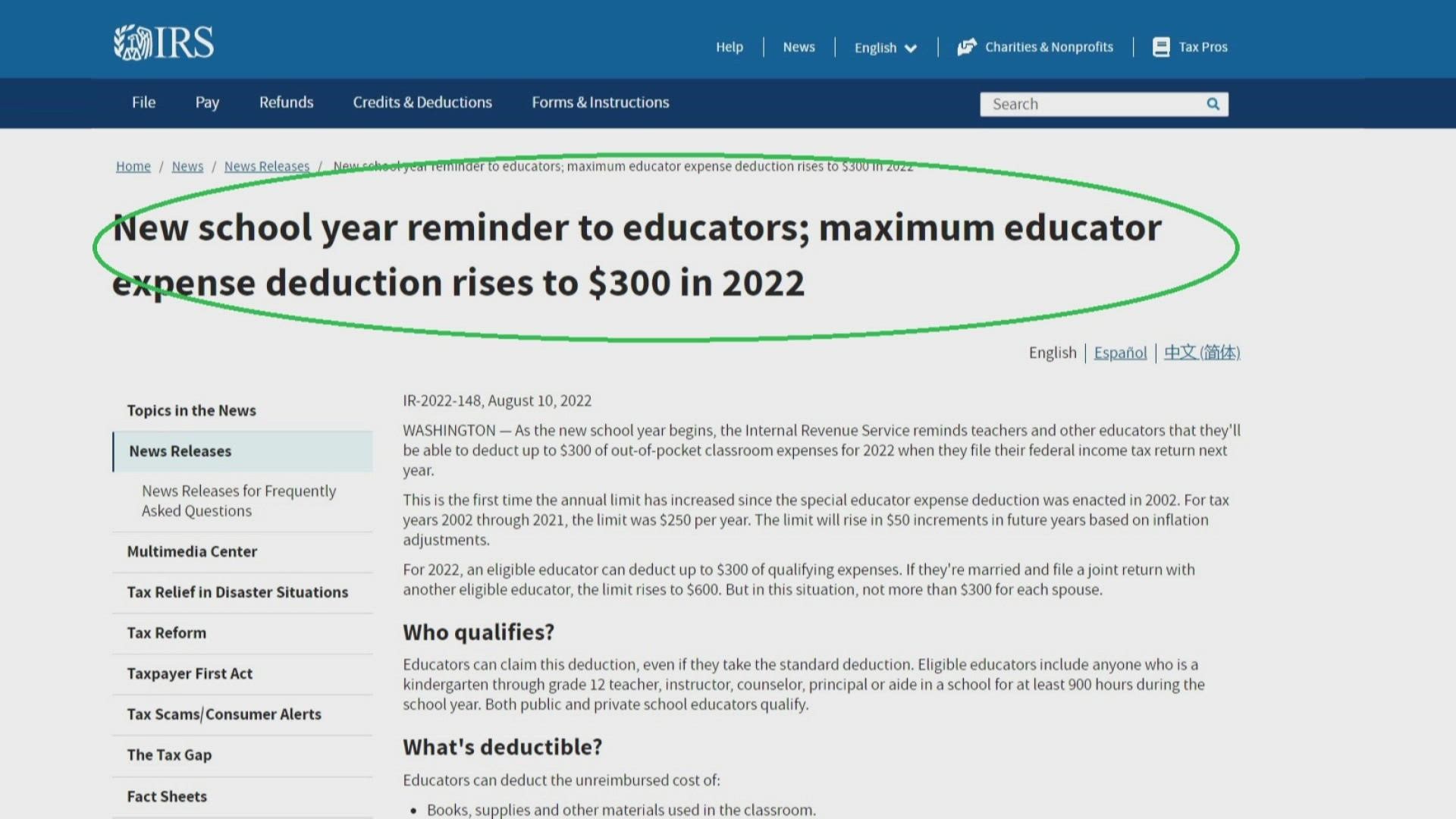

School Supplies Are Tax Deductible Wfmynews2

School Supplies Are Tax Deductible Wfmynews2

How To Form An Organization That Accepts Tax Deductible Donations YouTube

Tax Deductible Donations Greenpeace Australia Pacific

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

Is Training Tax Deductible - Training that qualifies you for a new career regardless of your intention is not tax deductible This criterion is tricky but the burden of proof is on you If you want to take the