Is Travel Medical Insurance Tax Deductible In Canada Travel Medical Insurance The Canada Revenue Agency CRA offers a range of out of country travel deductions to offset the expenses involved with

What are the travel insurance tax deduction provisions in Canada You can only claim travel medical costs This eliminates other travel insurance related claims 133 rowsHow to claim eligible medical expenses on your tax return You can claim

Is Travel Medical Insurance Tax Deductible In Canada

Is Travel Medical Insurance Tax Deductible In Canada

http://static1.squarespace.com/static/623b48a3293e2847ebe155cc/625e95a79c5ec522c5f3c38d/628632b30484eb3b330be95b/1654612213254/are-health-insurance-premiums-tax-deductible.png?format=1500w

:max_bytes(150000):strip_icc()/Are-health-insurance-premiums-tax-deductible-4773286_v1-dbe23582da6346498c4596ab0bfa05f2.jpg)

Comparing Insurance Agencies Factors To Consider Real Estate News

https://www.investopedia.com/thmb/uVW69A5-IxRl3yfuvq_2YWvhq0g=/4000x2700/filters:no_upscale():max_bytes(150000):strip_icc()/Are-health-insurance-premiums-tax-deductible-4773286_v1-dbe23582da6346498c4596ab0bfa05f2.jpg

Homeowners Insurance Deductible Explained TGS Insurance Agency

https://tgsinsurance.com/wp-content/uploads/understanding-your-homeowners-insurance-deductible-1-1024x576.jpg

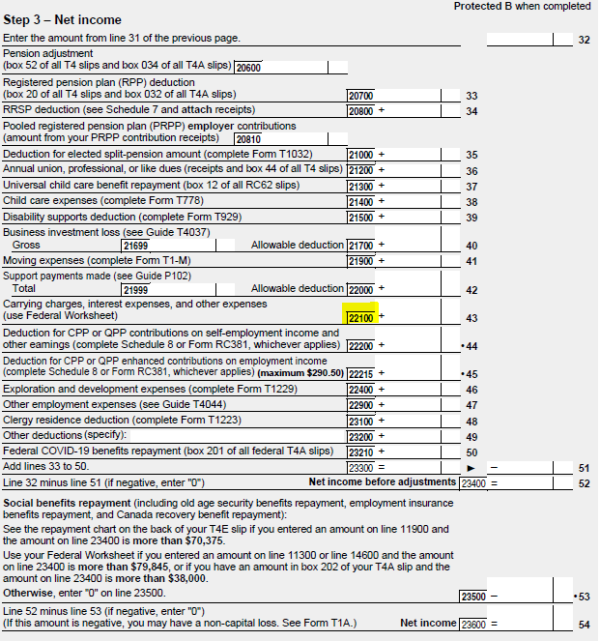

You can claim the travel deduction for a trip for medical or other reasons such as vacation that started from a prescribed zone and was taken either by you or by an eligible family That s right the premium paid for your travel medical insurance is part of your medical expenses and can give you a tax credit Travel insurance premiums of non medical protections such as trip

Travel medical insurance is tax deductible as a medical expense in Canada in this article we discuss how to access your documents Answer Yes Canadian snowbirds and other travellers may be eligible to recoup some of the cost of their travel medical insurance premium by claiming it as a Medical Expense

Download Is Travel Medical Insurance Tax Deductible In Canada

More picture related to Is Travel Medical Insurance Tax Deductible In Canada

Is Medical Insurance Tax Deductible Grants For Medical

https://www.grantsformedical.com/wp-content/uploads/2022/11/Is-Medical-Insurance-Tax-Deductible.jpg

Medical Insurance Premium Receipt 2019 20 PDF Deductible Insurance

https://imgv2-2-f.scribdassets.com/img/document/442594448/original/090873fdc7/1704447541?v=1

Health Insurance Deduction U S 80D Income Tax Deductions Exemptions

https://cms.careinsurance.com/cms/public/assets/media/tax-benefit.jpg

You can claim medical expenses for any 12 month period ending in the taxation year but in order for you to make a claim your total eligible medical expenses Generally life health and disability insurance premiums aren t tax deductible for individuals or businesses So you can assume the answer is no until you find out whether your specific situation is an

Did you know you can claim a portion of your family s health expenses and your health insurance premiums on your tax return Here s how it works Most Canadians know that they can claim some of their medical expenses but many are unsure of what and how much they can claim In this article we ll go over

Is Medical Cannabis Tax deductible In Canada We Have The Answer Leafly

https://leafly-cms-production.imgix.net/wp-content/uploads/2020/05/25114507/Canada-taxes.jpg

Is Medical Insurance Tax Deductible Grants For Medical

https://www.grantsformedical.com/wp-content/uploads/2022/11/Is-Medical-Insurance-Tax-Deductible-Medical-Insurance.jpg

https://turbotax.intuit.ca/tips/what-are-some-out...

Travel Medical Insurance The Canada Revenue Agency CRA offers a range of out of country travel deductions to offset the expenses involved with

:max_bytes(150000):strip_icc()/Are-health-insurance-premiums-tax-deductible-4773286_v1-dbe23582da6346498c4596ab0bfa05f2.jpg?w=186)

https://www.surex.com/blog/travel-insurance-tax-deductible-canada

What are the travel insurance tax deduction provisions in Canada You can only claim travel medical costs This eliminates other travel insurance related claims

Tax Deductible Medical Expenses In Canada GroupEnroll ca

Is Medical Cannabis Tax deductible In Canada We Have The Answer Leafly

Here s What You Need To Know About Travel Medical Insurance Business News

KTP Company PLT Audit Tax Accountancy In Johor Bahru

Is Private Health Insurance Tax Deductible In The UK

Reviews Of The Best Travel Medical Insurance For Canadians Including

Reviews Of The Best Travel Medical Insurance For Canadians Including

How To Make Your Canadian Mortgage Interest Tax Deductible

Is Medical Health Insurance Tax Deductible By Healthinsurance22 Issuu

Advisorsavvy Are Financial Advisor Fees Tax Deductible In Canada

Is Travel Medical Insurance Tax Deductible In Canada - You can use the benefit for medical travel in the calculation in Step 3 Chart B column 3 of Form T2222 only if the medical services were for you or an eligible family member