Is Uniform Allowance Exempt From Tax Income tax Act contains provisions for taxability of various allowances received by a taxpayer These allowances are either in the nature of income which is exempt from tax or is

Knowing the relevant fringe benefits regulations for clothing and clothing allowances provided to employees can help tax exempt organizations reduce their tax burden and avoid potential penalties Employer provided There is no limit to the maximum uniform allowance exempt under the Income Tax Act The reimbursement received against the actual expense incurred on buying and

Is Uniform Allowance Exempt From Tax

Is Uniform Allowance Exempt From Tax

https://www.pdffiller.com/preview/541/304/541304812/large.png

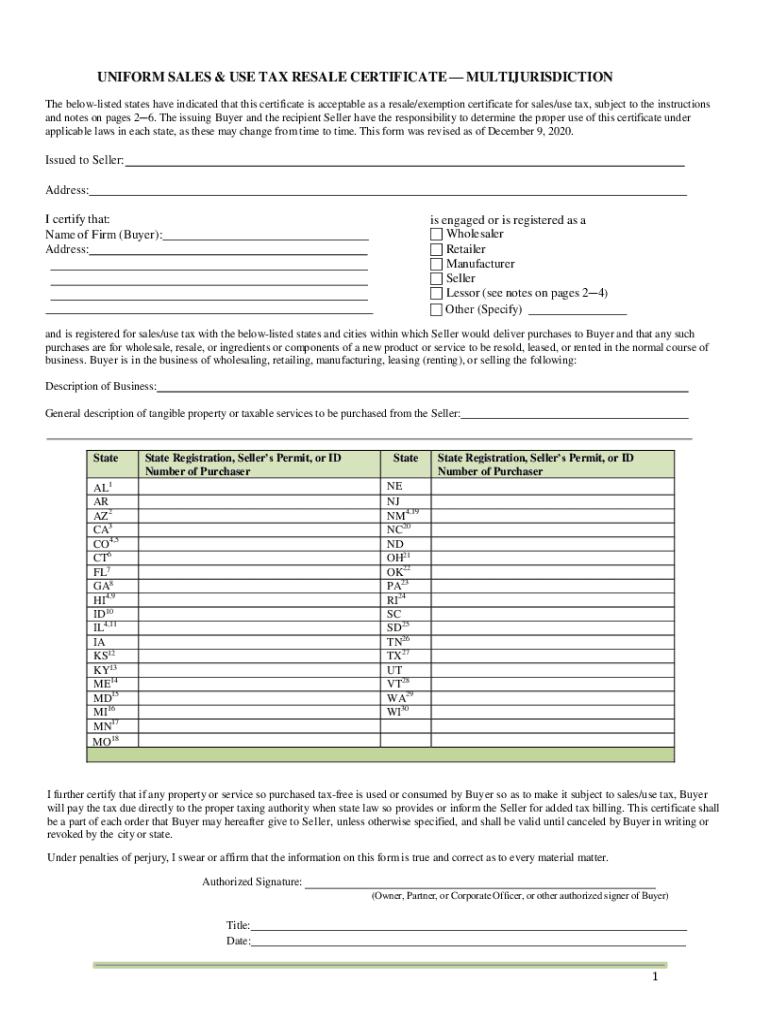

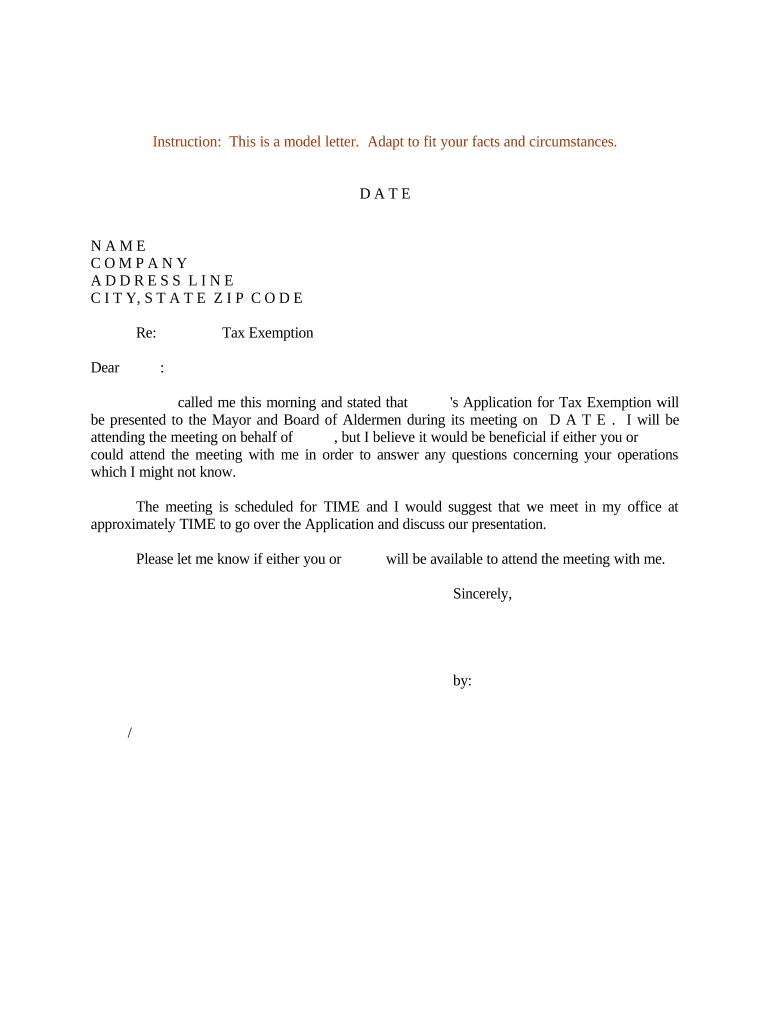

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/332/497332566/large.png

Uniform Allowance Claim Tax Back Now

https://claimtaxbacknow.com/wp-content/uploads/2020/11/shutterstock_732352393-scaled.jpg

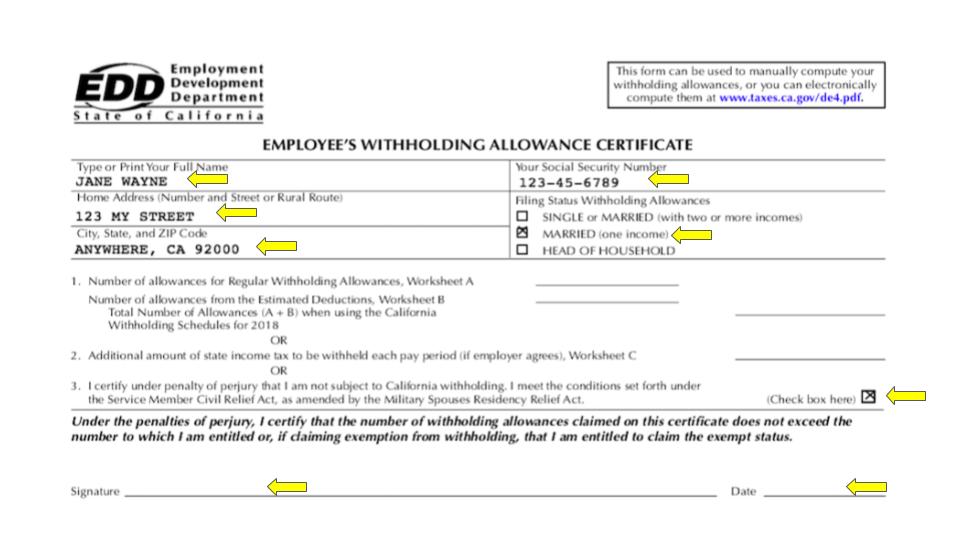

You must follow the relevant withholding and reporting requirements to allow your employees to correctly complete their income tax return For reporting of allowances in STP 84 rows Flat rate expenses sometimes known as a flat rate deduction allow you to claim tax relief for an agreed fixed amount each tax year to cover what you spend on

Taxable Includible in gross income not excluded under any IRC section If the recipient is an employee this amount is includible as wages and reported by the employer on Form W 2 and 17 rowsIf you are a salaried person you have a right to claim the benefits of an exemptions available on your few parts of the salary components given either in the form of

Download Is Uniform Allowance Exempt From Tax

More picture related to Is Uniform Allowance Exempt From Tax

Tax Exempt Donation Letter Sample Form Fill Out And Sign Printable

https://www.signnow.com/preview/497/332/497332572/large.png

Tax Exempt Tax Bind Consulting

https://taxbind.net/application/uploads/2018/09/tax-exempt.jpg

Uniform Allowance Claim Tax Back Now

https://claimtaxbacknow.com/wp-content/uploads/2020/11/shutterstock_196039457-scaled.jpg

An allowance is a separate amount your employer pays you in addition to your salary and wages It s an estimate of costs you might incur for expenses or compensation for Special allowances are fixed sums of money added to an employee s basic salary for various reasons with tax exempt and taxable components They fluctuate based on the employee s

Armed Personnel who need to purchase or maintain their uniforms while on duty usually receive a uniform allowance This allowance is exempt up to the amount actually spent on the uniform To claim this Uniform Allowance Allowance when given for the purchase or maintenance of uniform required to be worn while on duty is referred to as uniform allowance This allowance

Uniform Tax Allowance Claim My Tax Back

https://claimmytaxback.co.uk/wp-content/uploads/2021/05/Copy-of-Copy-of-Untitled.png

Uniform Tax Allowance Tax Rebate On Uniform

https://claimmytaxback.co.uk/wp-content/uploads/2021/06/7.png

https://taxguru.in › income-tax › allowances...

Income tax Act contains provisions for taxability of various allowances received by a taxpayer These allowances are either in the nature of income which is exempt from tax or is

https://www.mossadams.com › articles › …

Knowing the relevant fringe benefits regulations for clothing and clothing allowances provided to employees can help tax exempt organizations reduce their tax burden and avoid potential penalties Employer provided

State Tax Exemption Map National Utility Solutions

Uniform Tax Allowance Claim My Tax Back

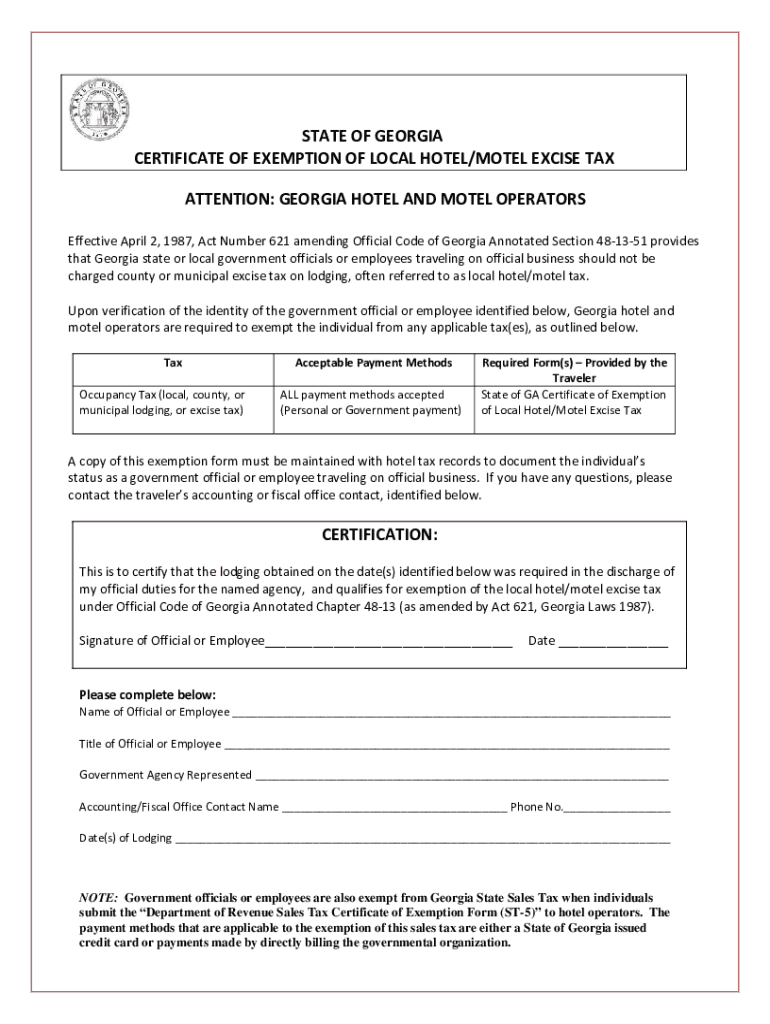

Georgia Hotel Tax Exempt Form Fill Out Sign Online DocHub

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

How To Complete Forms W 4 Attiyya S Ingram AFC

Writing Religious Exemption Letters

Writing Religious Exemption Letters

Tax Exemptions For Property Managers Landlords First Light Property

Accumulated Earnings Tax Personal Holding Company Gee Whiz Record Art

Payment Of Uniform Allowance In Lieu Of Uniform To Group C D Employees

Is Uniform Allowance Exempt From Tax - Taxable Includible in gross income not excluded under any IRC section If the recipient is an employee this amount is includible as wages and reported by the employer on Form W 2 and