Is Unused Hsa Money Taxable Payroll deductions for contributions are pre tax further reducing taxable income Tax Treatment of Distributions HSA distributions are tax free when used for qualified medical

HSA money cannot generally be used to pay your insurance premiums See exceptions above under Can my HSA be used to pay premiums See IRS Publications 502 Medical and Roll over unused HSA funds to next year Unlike Flexible Spending Accounts FSAs HSAs do not have a use it or lose it provision This means that any funds remaining in your HSA at the end of the year will roll over and

Is Unused Hsa Money Taxable

Is Unused Hsa Money Taxable

https://www.insuranceneighbor.com/wp-content/uploads/sites/2939/2020/11/HSA-Money-Medical-Health.jpg

Money Claim Concept On Craiyon

https://pics.craiyon.com/2023-11-21/DbzR8WCURh6yjMsNJYNibQ.webp

10 Best HSAs For Investing In 2022 Morningstar ThinkAdvisor

https://images.thinkadvisor.com/contrib/content/uploads/sites/415/2021/11/HSA_Coins_Money_Tax_Adobe_640x640.jpg

Interest earned by HSAs is not taxable There s no use it or lose it rule like with an FSA If you don t use all the money in the year it rolls over from year to year and continues earning interest No HSA money is yours to keep Unlike a flexible spending account FSA unused money in your HSA isn t forfeited at the end of the year it continues to grow tax deferred What happens if my employment is terminated HSAs are

Contributions to an HSA are tax deductible and the funds can be used tax free for qualified medical expenses Additionally unused funds roll over year to year allowing your savings to Learn how Health Savings Accounts HSAs can save you money on taxes Discover the tax advantages of HSA contributions and withdrawals qualified medical expenses contribution

Download Is Unused Hsa Money Taxable

More picture related to Is Unused Hsa Money Taxable

SIP Law Firm Latest Tax Regulation 5 Taxable Services Subject

https://siplawfirm.id/wp-content/uploads/2022/12/tax.jpg

Salary Received By A Member Of Parliament Is Taxable Under The Head

https://ttplimages.imgix.net/tax-practice-images/IT-OS-R-1.jpg?w=1200

Will My HSA Expire If I Stop Contributing To It Insurance Neighbor

https://www.insuranceneighbor.com/wp-content/uploads/sites/2939/2020/01/Savings-HSA-Money-Jar.jpg

Contributions made toward your HSA through payroll deductions are excluded from your gross income In addition contributions made to your HSA by your employer may be excluded from your employment taxes like Social Security An HSA is a financial account that provides tax benefits for individuals enrolled in high deductible health plans HDHPs as a means of saving money for eligible medical

Health Savings Accounts HSAs are a great way to save and pay for medical expenses tax free One common question among HSA account holders is what happens to unused HSA funds If Unlike some other types of healthcare accounts HSAs do not have a use it or lose it rule This means that any unused funds in an HSA at the end of the year will roll over

P MONEY

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100062999182867

Have Unused FSA Or HSA Dollars Here s Where You Can Spend It Online So

https://s.yimg.com/ny/api/res/1.2/zzhlEuqOgJj2R4y.myHPpg--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD05MDA-/https://media.zenfs.com/en/sheknows_ecomm_265/a3cbeee8749513e2d7b6fb55e7ac046a

https://accountinginsights.org › hsa-and-taxes-how...

Payroll deductions for contributions are pre tax further reducing taxable income Tax Treatment of Distributions HSA distributions are tax free when used for qualified medical

https://www.hsacenter.com › how-does-an-hsa-work › ...

HSA money cannot generally be used to pay your insurance premiums See exceptions above under Can my HSA be used to pay premiums See IRS Publications 502 Medical and

File Money Cash jpg Wikimedia Commons

P MONEY

90k Salary Effective Tax Rate V s Marginal Tax Rate BI Tax 2024

Money Talks UAE

Gross Pay Vs Net Pay Definitions And Examples Indeed

80k Salary Effective Tax Rate V s Marginal Tax Rate BF Tax 2024

80k Salary Effective Tax Rate V s Marginal Tax Rate BF Tax 2024

ErsoyBilgehan

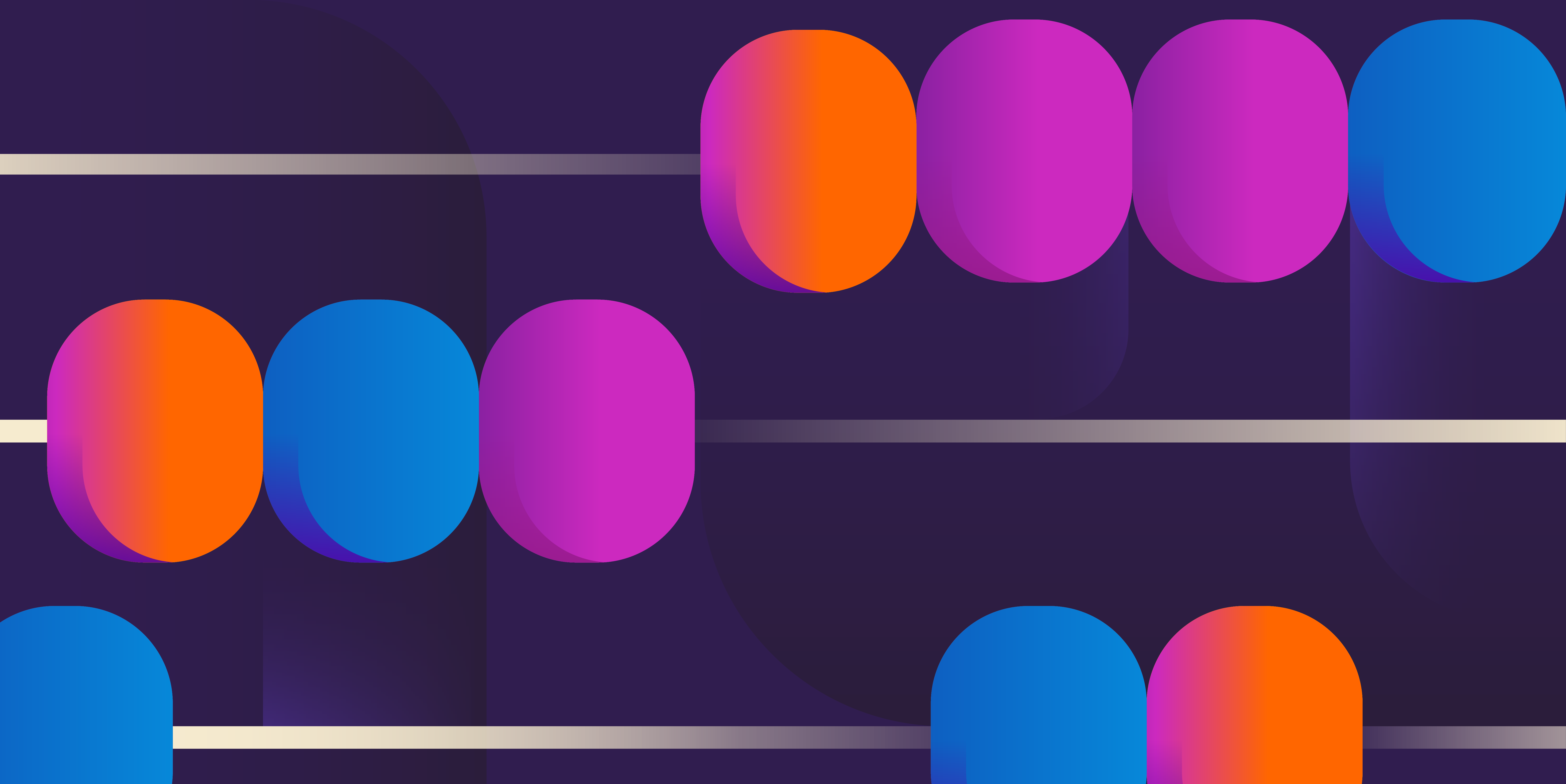

Solved For Tax Purposes gross Income Is All The Money A Chegg

Tax Prep Form 1040 2 Taxable And Non Taxable Income Skill Success

Is Unused Hsa Money Taxable - Contributions to an HSA are tax deductible and the funds can be used tax free for qualified medical expenses Additionally unused funds roll over year to year allowing your savings to