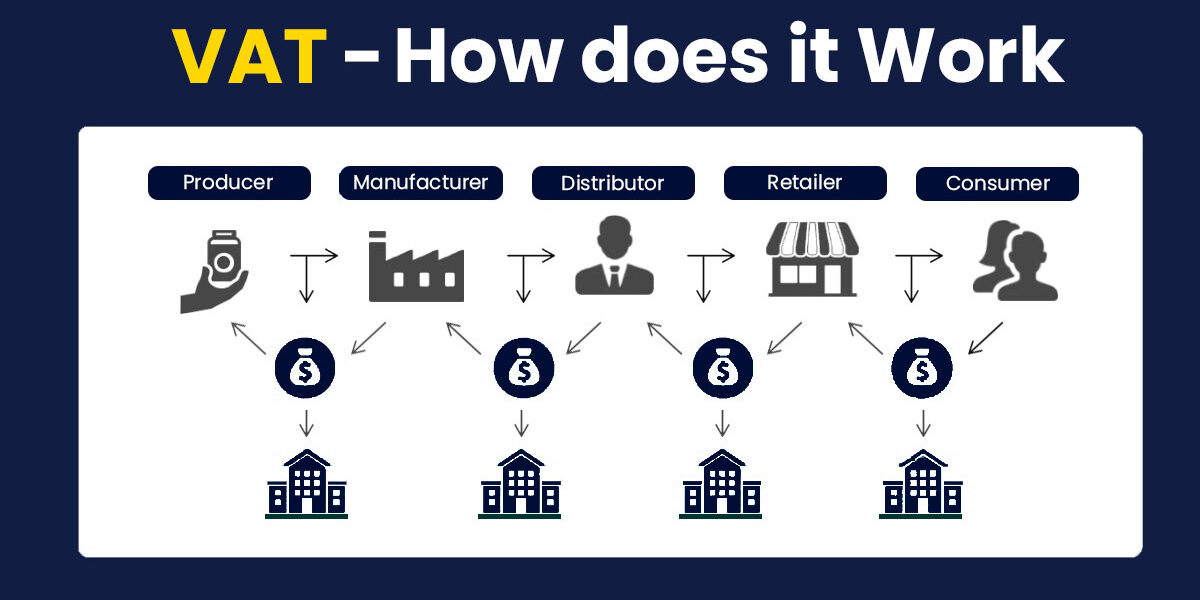

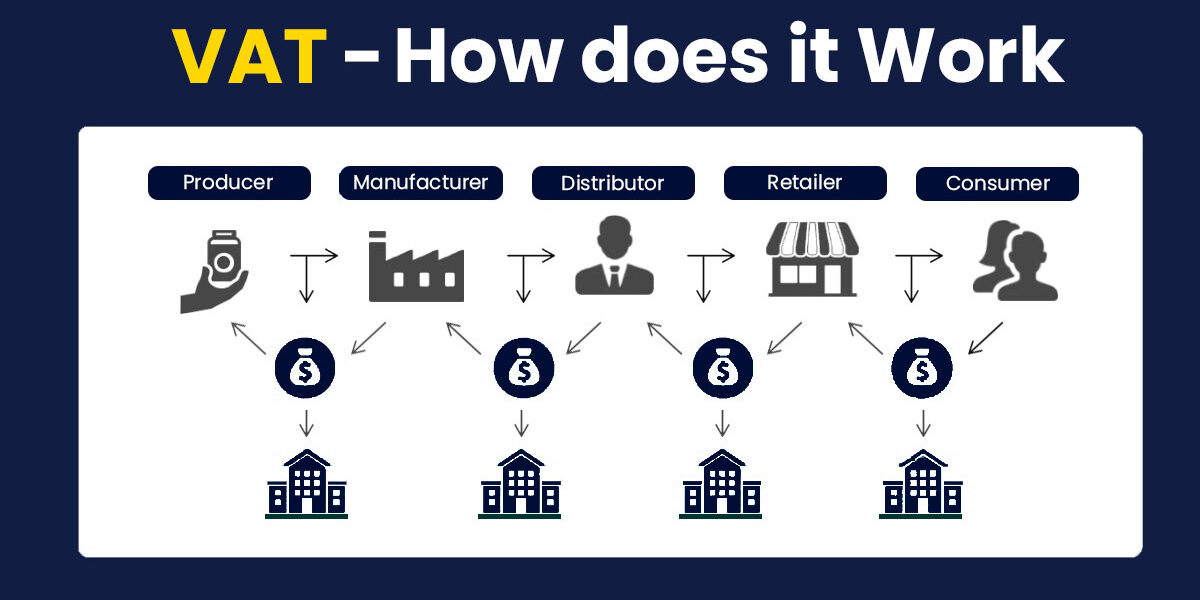

Is Vat Mandatory In Uae It is mandatory for businesses to register for VAT in the following two cases If the taxable supplies and imports of a UAE based business exceed AED 375 000 per annum If a non

All businesses in the UAE need to record their financial transactions and ensure that their financial records are accurate and up to date Businesses that meet the minimum annual In the UAE every VAT registered seller must issue a tax invoice when selling taxable goods or services VAT in UAE Understand the basics of VAT in the UAE including

Is Vat Mandatory In Uae

Is Vat Mandatory In Uae

https://www.koonco.com/wp-content/uploads/2021/08/vat-page1.jpg

Why Is VAT Consultancy Essential For Boutiques In Dubai AccountSights

https://accountsightshome.files.wordpress.com/2019/11/why-is-vat-consultancy-essential-for-boutiques-in-dubai.jpg?w=768

VAT Registration UAE Fees Cost And Penalties

https://farahatco.com/wp-content/uploads/2019/07/vat-deregistration-in-UAE.jpg

A business must register for VAT if the taxable supplies and imports exceed the mandatory registration threshold of AED 375 000 Furthermore a business may choose to register This is the Taxable Person Guide for Value Added Tax VAT in the United Arab Emirates UAE You might also hear or see it referred to as the VAT Guide 1 or the VATG001

Businesses registered for VAT in the UAE are required to file VAT returns every quarter VAT returns must be submitted online through the Federal Tax Authority s FTA online Your business must register for VAT if it is registered in the UAE and your annual turnover exceeds AED 375 000 This is based on your revenue activities over the last twelve

Download Is Vat Mandatory In Uae

More picture related to Is Vat Mandatory In Uae

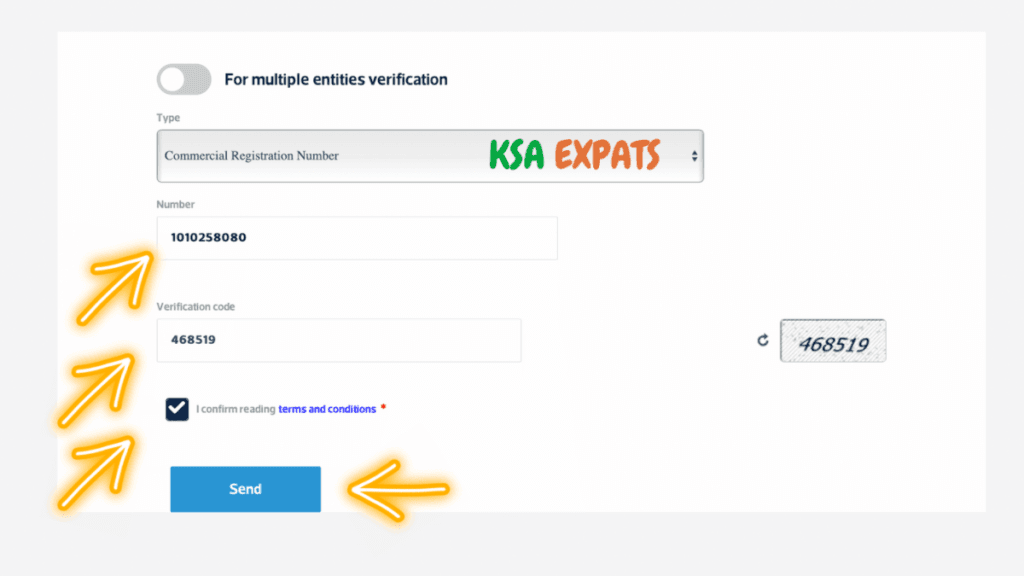

How To Find VAT Number In Saudi Arabia KSAexpats

https://ksaexpats.com/wp-content/uploads/2022/04/how-to-get-VAT-number-in-Saudi-Arabia-1024x576.png

Guide To Voluntary VAT Registration Definition With Pros Cons The

https://images.prismic.io/the-hoxton-mix/b00382a4-fe01-4d86-b748-4c864067b218_Guide-to-Voluntary-VAT-Registration--Definition-with-Pros-and-Cons.jpg?auto=compress,format&rect=120,0,720,480&w=960&h=640

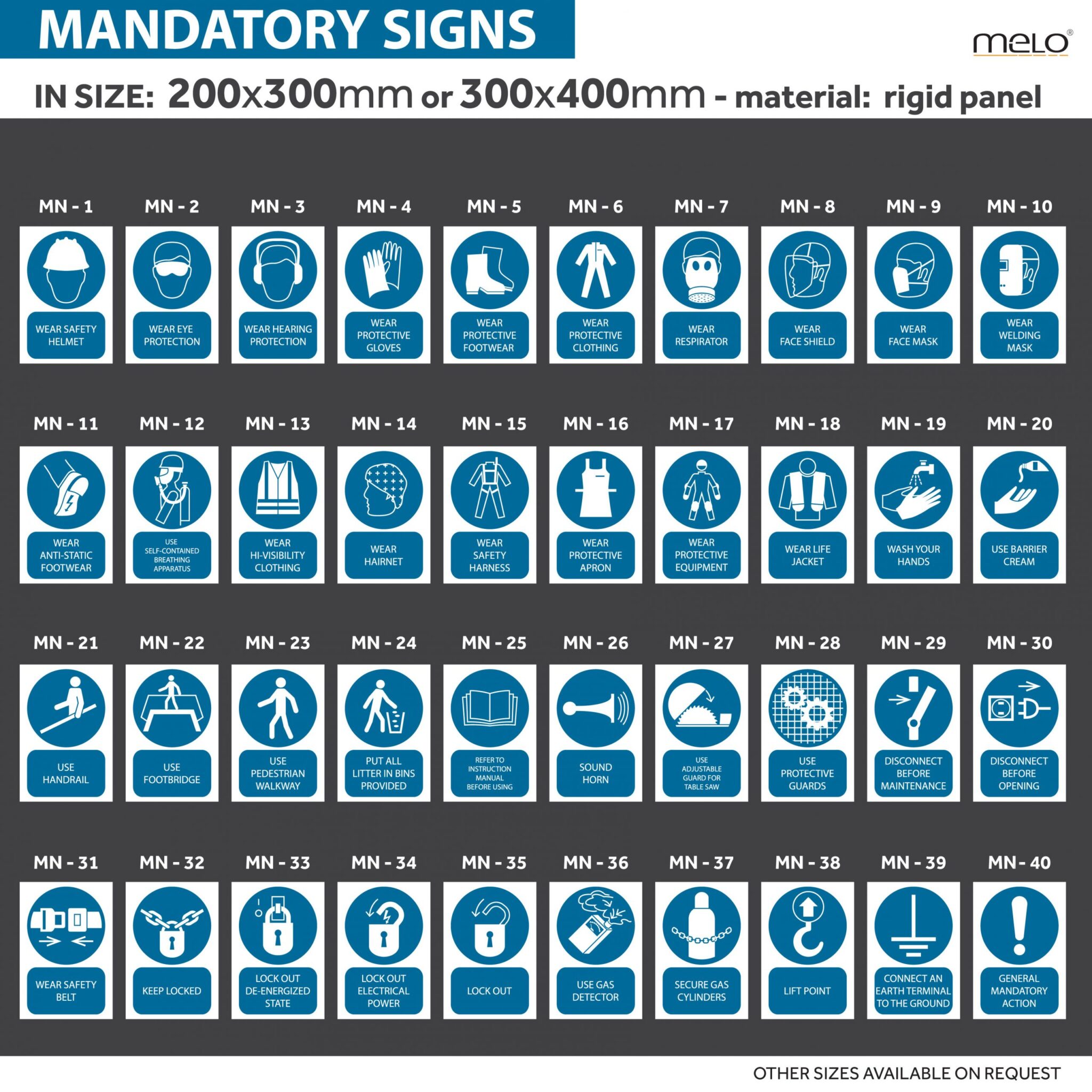

Safety Outlet

https://safetyoutlet.co.uk/wp-content/uploads/2021/03/BLUEe-200x300-1-scaled-1-2048x2048.jpg

Mandatory VAT Registration in UAE All the businesses who have a place of residence in the state of UAE and whose value of supplies in the member states in previous 12 VAT applies equally on tax registered businesses managed on the UAE mainland and in the free zones However if the UAE Cabinet defines a certain free zone as a

Overall VAT registration is vital for UAE companies that fall under the threshold criteria and it is essential to understand and fulfill the obligations under the VAT regime to avoid The following businesses are required to register for VAT in the UAE Businesses with an annual turnover exceeding AED 375 000 Businesses that make taxable supplies to non

VAT Services In UAE Vat Registration Services Dubai

https://elevateauditing.com/wp-content/uploads/2021/05/How-vat-Chain-works-01-1200x600.jpg

VAT UAE Readiness Mandatory Record keeping

https://media.licdn.com/dms/image/C4E12AQHLDoPUj21K5g/article-cover_image-shrink_600_2000/0/1520113402292?e=2147483647&v=beta&t=mkS1YXaTeo7icdhPIgpqEuzE0JFyu68wZXf2Ihih_pA

https://u.ae/.../taxation/vat/valueaddedtaxvat

It is mandatory for businesses to register for VAT in the following two cases If the taxable supplies and imports of a UAE based business exceed AED 375 000 per annum If a non

https://mof.gov.ae/vat

All businesses in the UAE need to record their financial transactions and ensure that their financial records are accurate and up to date Businesses that meet the minimum annual

VAT In The UAE Are You Prepared Www questsearch co uk

VAT Services In UAE Vat Registration Services Dubai

All About VAT Exemptions In The UAE And Zero Rate MyBayut

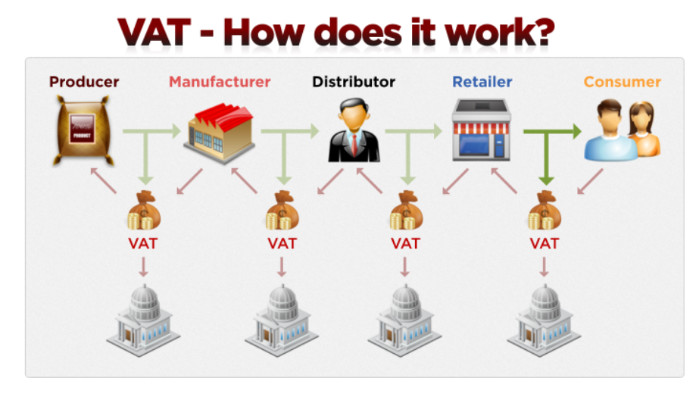

How Does VAT Work For A Business In The UAE

1 General Questions On VAT

UAE Releases Its Domestic VAT Law All About TAX In UAE

UAE Releases Its Domestic VAT Law All About TAX In UAE

UAE VAT VAT Applicability In Dubai

Tips To Avoid UAE Corporate Tax Penalties

New Era In UAE As VAT Takes Effect

Is Vat Mandatory In Uae - Your business must register for VAT if it is registered in the UAE and your annual turnover exceeds AED 375 000 This is based on your revenue activities over the last twelve