Is Washington State Sales Tax Deductible The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A

As a result Washington State residents may deduct state and local general sales tax on their federal income returns for tax year 2015 and succeeding tax years The deduction You deduct the tax in the taxable year you pay them The categories of deductible taxes are State local and foreign income taxes or state and local general

Is Washington State Sales Tax Deductible

Is Washington State Sales Tax Deductible

https://3.bp.blogspot.com/-lcL0AJdrPRw/WrSZFFSEdBI/AAAAAAABff0/yQ2YEJugJzkHK-BmB0upfpAVS18byYskACK4BGAYYCw/s1600/Sales%2BTaxes%2BIn%2BThe%2BUnited%2BStates%2B-%2BWashington%2BState%2BSales%2BTax%2BCalculator-706948.png

Transaction Privilege Tax Vs Sales Tax What s The Difference TaxJar

https://www.taxjar.com/wp-content/uploads/TAX_Transaction-Privilege-Tax-vs-Sales-Tax_Blog_L1R1.jpg

State Corporate Income Tax Rates And Brackets For 2020

https://files.taxfoundation.org/20200127173134/linkedin-In-Stream_Wide___2020-State-Corporate-Income-Tax-Rates-01.png

The sales tax deduction lets you write off all state and local sales taxes for the year It reduces your tax bill dollar for dollar When you file your taxes you can either write off sales tax or state and local Marketplace sellers may claim a retail sales tax deduction for sales where they or a marketplace facilitator will notify their customers of Washington s use tax reporting

For example Washington state offers a retail sales tax deduction for exempt food sales feminine hygiene products and trade in allowances It also offers deductions Retail sales tax includes both state and local components Sales tax amounts collected are considered trust funds and must be remitted to the Department of Revenue The seller is

Download Is Washington State Sales Tax Deductible

More picture related to Is Washington State Sales Tax Deductible

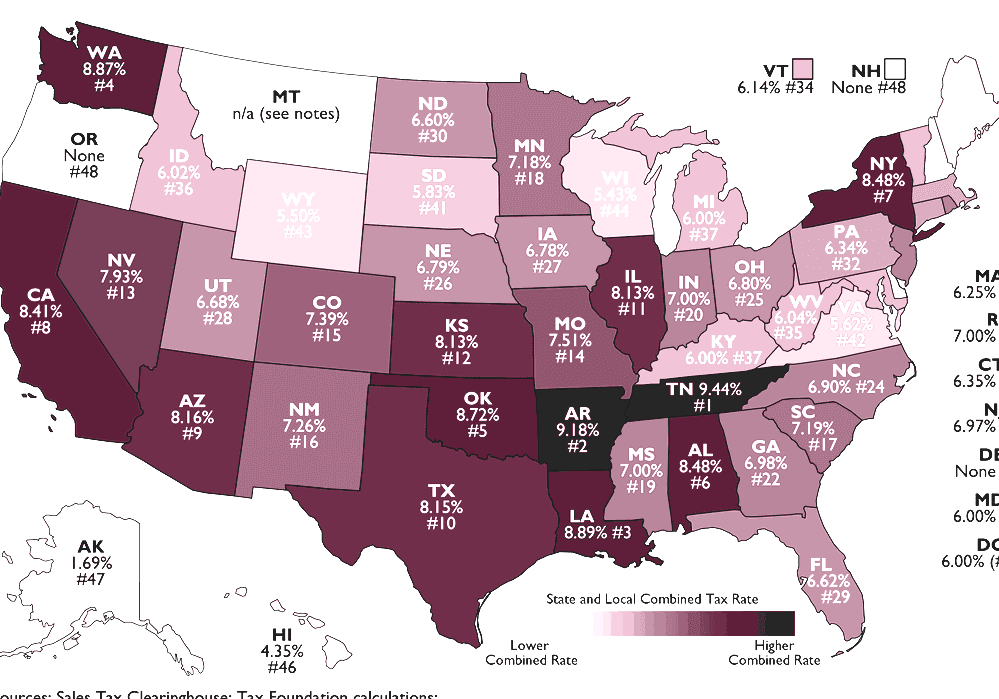

State And Local Sales Tax Rates Midyear 2021 Laura Strashny

https://files.taxfoundation.org/20210707180628/2021-sales-taxes-by-state-2021-sales-tax-rates-by-state-2021-state-and-local-sales-tax-rates-July-2021-1200x1033.png

New Washington State Sales And Use Tax Deferral Program

https://mossadamsproduction.blob.core.windows.net/cmsstorage/mossadams/media/images/insights/2022/05/22-slt-0572_alert_washington_state_sales_tax_deferral_smsi.jpg

Top 3 Which States Do Not Collect Sales Tax In 2022 G u y

https://www.taxjar.com/wp-content/uploads/TAX_States-Without-Sales-Tax_Blog_L1R1-copy.jpg

The sales tax deduction gives taxpayers the opportunity to reduce their tax liability when they deduct state and local sales taxes or state and local income taxes that they paid in In the state of Washington legally sales tax is required to be collected from tangible physical products being sold to a consumer Several exceptions to this tax are certain

Municipal governments in Washington are also allowed to collect a local option sales tax that ranges from 1 to 4 1 across the state with an average local tax of 2 395 for a For tax year 2023 filed in 2024 the standard deduction ranges from 13 850 to 27 700 If the SALT deduction and your other write offs don t add up to more than the

Interchange Paid On Sales Tax In The US 2022

https://cmspi.com/media/jhnn4nrw/state-sales-tax-01.png

What Is Washington State Sales Tax

https://ygacpa.com/wp-content/uploads/2018/07/what-is-washington-state-sales-tax.png

https://www.irs.gov/credits-deductions/individuals/...

The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A

https://dor.wa.gov/taxes-rates/income-tax/federal-sales-tax-deduction

As a result Washington State residents may deduct state and local general sales tax on their federal income returns for tax year 2015 and succeeding tax years The deduction

What Is The Washington State Vehicle Sales Tax

Interchange Paid On Sales Tax In The US 2022

.png)

Monday Map Combined State And Local Sales Tax Rates Tax Foundation

Expiring Tax Deductions Could Mean Less Revenue For States

Washington Sales Tax Calculator Step By Step Business

Sales Tax Finevolution

Sales Tax Finevolution

Washington State Sales Tax Rate USgeocoder Blog

It s The Law Now Online Retailers Must Collect MI Sales Tax Moody On

Printable Sales Tax Chart

Is Washington State Sales Tax Deductible - Marketplace sellers may claim a retail sales tax deduction for sales where they or a marketplace facilitator will notify their customers of Washington s use tax reporting