Is Water Softener Tax Deductible Sorry no The water softener is not deductible on a tax return for a personal residence not used as a rental or in a business

Can I deduct a water softener purifier system Unfortunately there is no such deduction credit for a personal residence If installed for a rental property the cost is All qualifying capital improvements are tax deductible However you can t claim the deduction until you sell the home

Is Water Softener Tax Deductible

Is Water Softener Tax Deductible

https://www.puragainwater.com/wp-content/uploads/2023/05/Puragain-Water-Commercial-and-Industrial-Water-treatment-service-Escondido-Where-Should-a-Water-Softener-Be-Installed.jpg

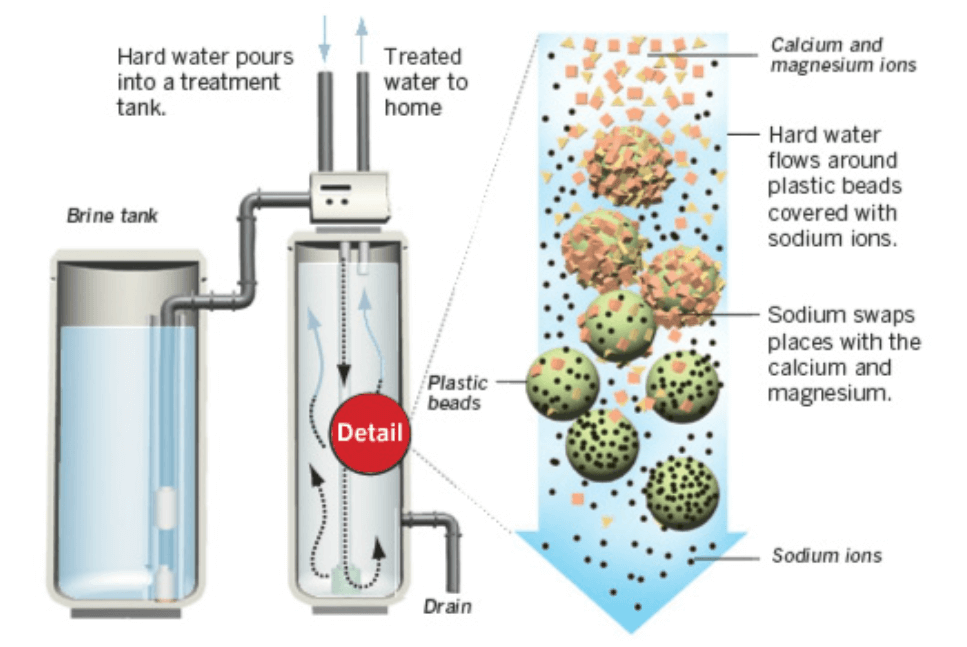

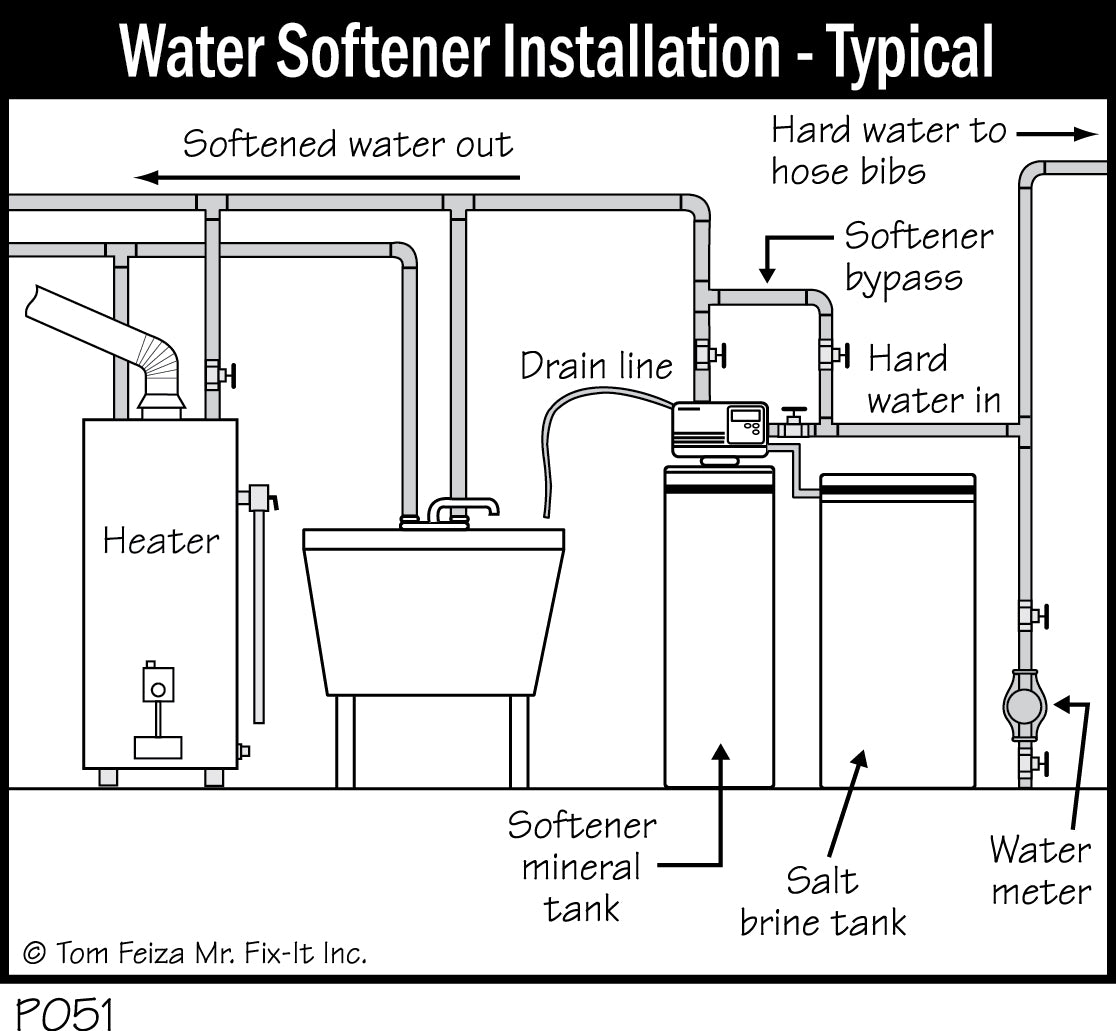

What Are Water Softener And How Does It Work Benefits Eureka Forbes

https://www.eurekaforbes.com/media/wysiwyg/updated-banner/water-softner/water-softeners-03.jpg

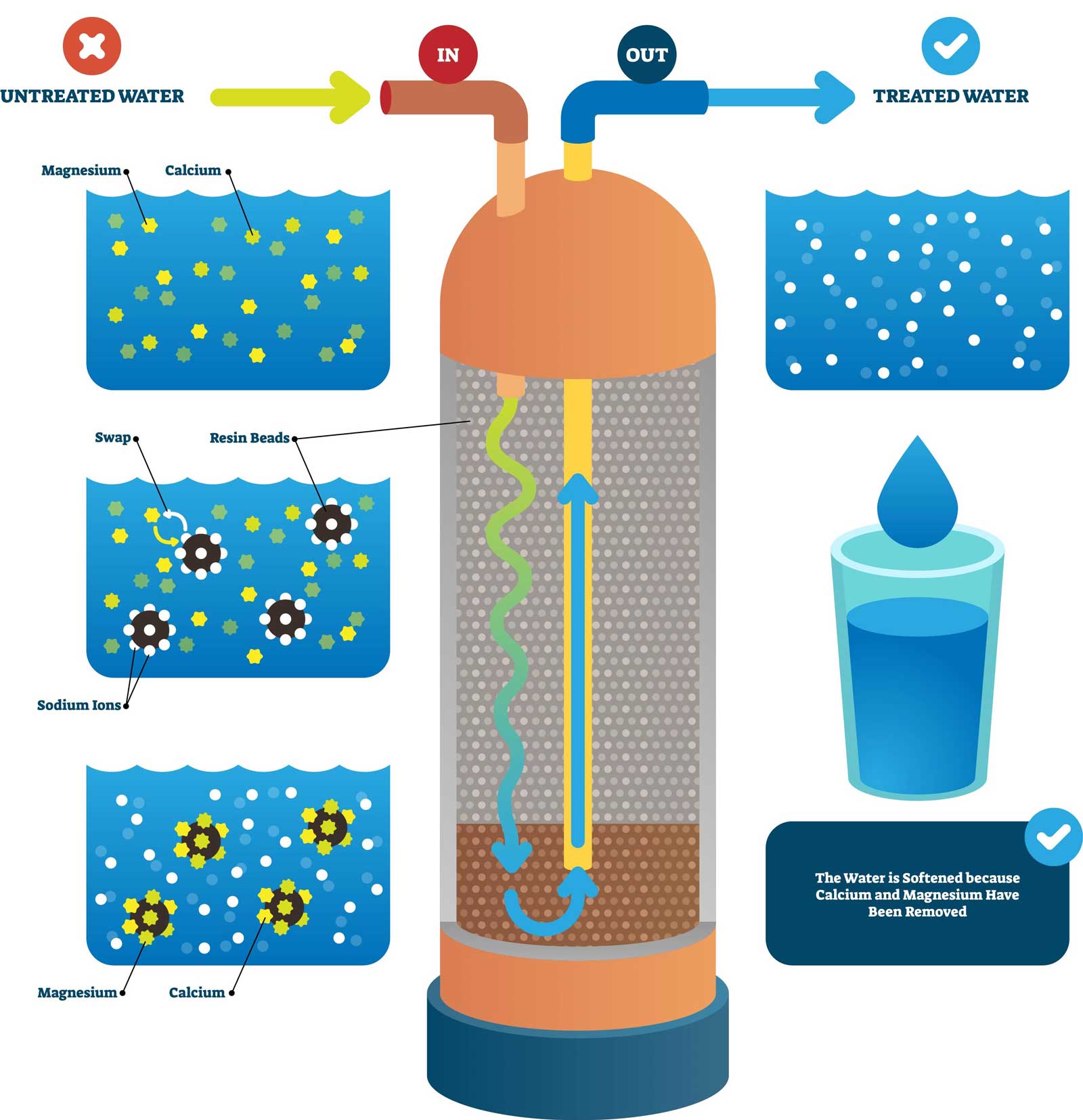

Should I Install My Whole House Water Filter Before Or After The Water

https://dropconnect.com/wp-content/uploads/2023/02/DROP-duplex-smart-water-softener-install-scaled.jpg

So your water filtration system is tax deductible as long as it meets these guidelines How To Write Off Your Filtration System First you need to determine what kind of tax write off your Yes There is a 1 200 aggregate yearly tax credit maximum for all building envelope components home energy audits and energy property Electric or natural gas heat pump

Is The Water Filtration System Tax Deductible Water filtration systems can increase a home s value extend its life or help it meet specific needs such as addressing The safe harbor for small taxpayers SHST allows landlords to currently deduct all annual expenses for repairs maintenance improvements and other costs for a rental

Download Is Water Softener Tax Deductible

More picture related to Is Water Softener Tax Deductible

Do Water Softeners Have Filters Hint They Should

https://waterfilterguru.com/wp-content/uploads/2022/07/Springwell-Water-Filter-and-Salt-Based-Water-Softener-System-combo-water-treatment-system-1024x941.jpg

Different Types Of Water Softener Salt How To Choose

https://waterdefense.org/wp-content/uploads/2022/04/water-softener-salt-guide-different-types-and-uses.jpg

What Is A Water Softener And How Does It Work

https://waterdefense.org/wp-content/uploads/2022/04/what-is-a-water-softener-and-how-does-it-work.jpg

Tax Deductions By depreciating the water softener you reduce your net income which in turn decreases your tax liability Recovery Period Typically a water softener is Most energy efficiency related tax benefits that were set to expire at the end of 2021 are extended under existing rules through 2022 and then change to their expanded amounts from 2023 into

While home improvements aren t tax deductible in the year that they are done they can be added to the value of your primary residence to raise your tax basis Your tax basis is R D Tax Credits Helping the Water Treatment Industry Grow with the U S Population Posted by William Mehi on 10 12 22 With the growth of U S cities and increasing

Is A Water Softener Tax Deductible Quick Answer

https://www.incardtech.com/wp-content/uploads/2023/12/Is-A-Water-Softener-Tax-Deductible-930x620.jpg

Water Softener Salt Delivery Culligan Inver Grove Heights

https://www.culligan4water.com/wp-content/uploads/2013/08/Saltbagsstack.jpg

https://ttlc.intuit.com/community/tax-credits...

Sorry no The water softener is not deductible on a tax return for a personal residence not used as a rental or in a business

https://ttlc.intuit.com/community/tax-credits...

Can I deduct a water softener purifier system Unfortunately there is no such deduction credit for a personal residence If installed for a rental property the cost is

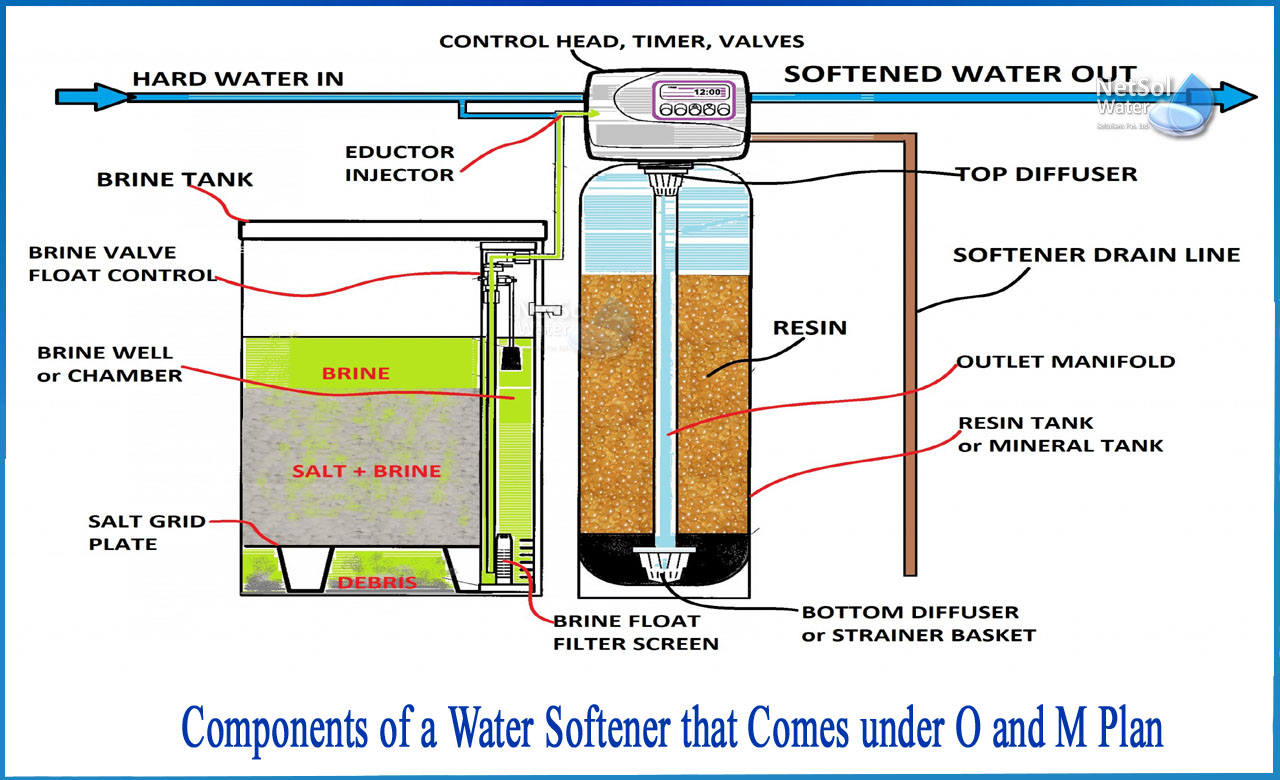

What Are The Components Of A Water Softener Under O And M Plan

Is A Water Softener Tax Deductible Quick Answer

Are Home Improvements Tax Deductible Capital One

2023 Water Softener Cost System Installation Prices 43 OFF

How Long Does A Water Softener Last Rain Of Las Vegas

Water Softener Basics How To Operate Your Home

Water Softener Basics How To Operate Your Home

Is Your Water Filtration System Tax Deductible

Ablandadores De Agua Urbanagua Soluciones En Tratamientos De Agua

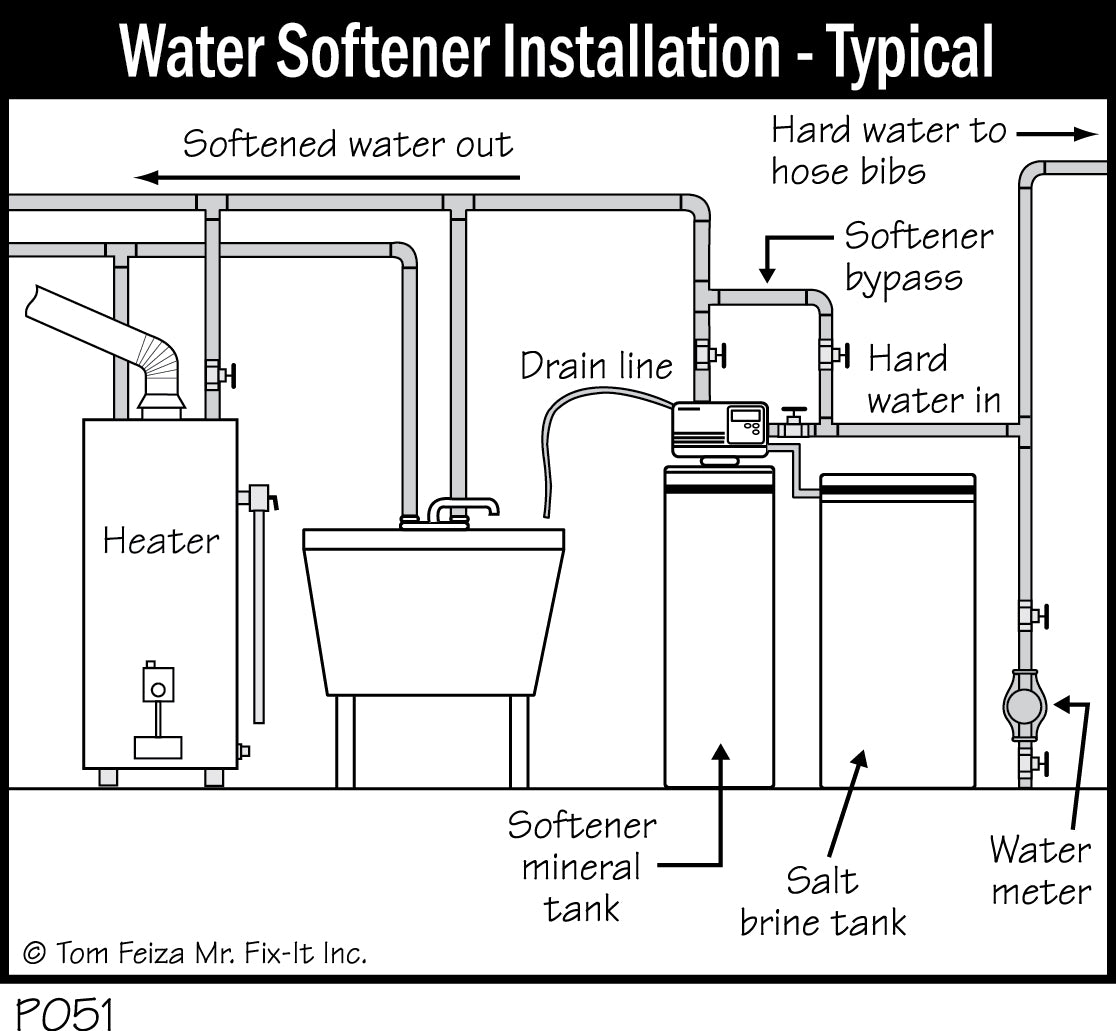

What Is The Correct Way Of Installation Of A Water Softener

Is Water Softener Tax Deductible - The safe harbor for small taxpayers SHST allows landlords to currently deduct all annual expenses for repairs maintenance improvements and other costs for a rental