Is Working Tax Credit A Benefit Working tax credit is a means tested benefit paid by HMRC to support people on a low income Find out how to claim working tax credit whether you re eligible to receive payments and how to calculate how much you ll get

Working Tax Credit how much money you get hours you need to work eligibility claim tax credits when you stop work or go on leave Working Tax Credit WTC is a state benefit in the United Kingdom made to people who work and receive a low income It was introduced in April 2003 and is a means tested benefit Despite the name tax credits are not to be confused with tax credits linked to a person s tax bill because they are used to top up

Is Working Tax Credit A Benefit

Is Working Tax Credit A Benefit

https://accountinglogic.co.uk/wp-content/uploads/2022/10/42-3-1024x536.png

What Is Working Tax Credit The Business View

https://www.thebusinessview.co.uk/wp-content/uploads/2023/01/What-is-Working-Tax-Credit-1536x864.jpg

What Is Working Tax Credit And Are You Entitled To It Growth Business

https://growthbusiness-production.s3.amazonaws.com/uploads/2022/10/AdobeStock_36149935-scaled.jpeg

You can get working tax credits if you re in paid work that s expected to last at least 4 weeks This doesn t include being paid expenses while volunteering Working Tax Credit is money provided to boost the income of working people who are on a low income It does not matter whether you are working for someone else or are self employed Working Tax Credit counts as income when working out your entitlement to most other means tested benefits

The Working Tax Credit WTC is a state benefit offered to individuals living in the United Kingdom who work and have a low income It was introduced in April 2003 as a means tested Working Tax Credit is usually paid every four weeks but you can choose to have it paid weekly by asking HMRC to change your payments Working Tax Credit and other benefits Working Tax Credit counts as income when working out your entitlement to most other means tested benefits Updated June 2022

Download Is Working Tax Credit A Benefit

More picture related to Is Working Tax Credit A Benefit

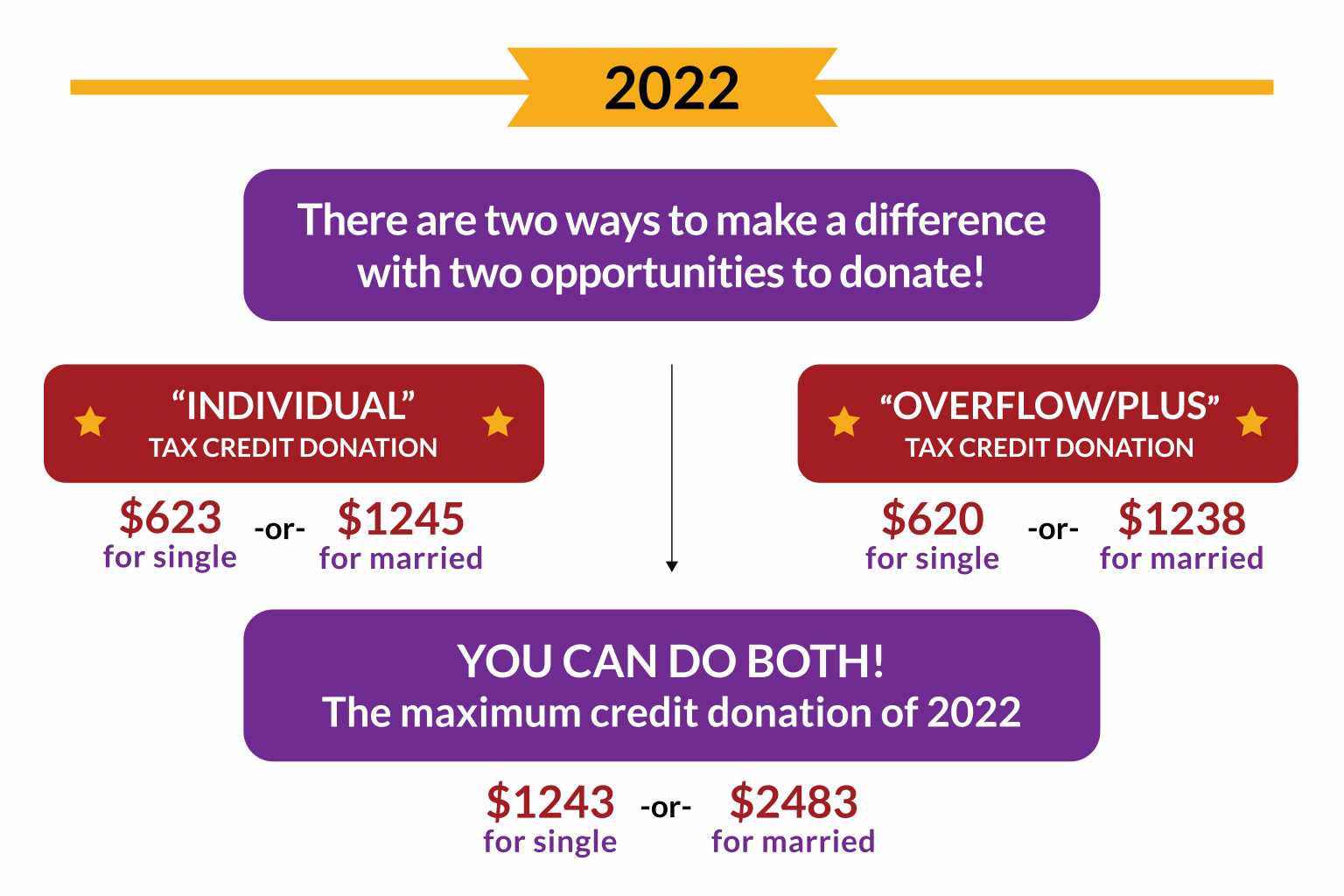

Donate To Arizona Tax Credit To Help Children Receive

https://aztxcr.org/wp-content/uploads/2022/07/1402525_TaxCreditPoster_V1P1_063022-3-1536x1024.png

What Is Working Tax Credit

http://www.carvedculture.com/cdn/shop/articles/working_tax_credit_benefit.jpg?v=1624134118

Earned Income Tax Credit A Break Families Should Not Overlook

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/BB1h95q4.img?w=1601&h=994&m=4&q=100

A tax credit is an amount taxpayers claim on their tax return generally to reduce their income tax Eligible taxpayers can use them to potentially reduce their tax bill and increase their refund Working Tax Credit is designed to top up your earnings if you work and are on a low income But it s being replaced and most people now have to claim Universal Credit instead If you get Working Tax Credit find out how this change affects you

Working Tax Credit and Universal Credit Working Tax Credit is being replaced by Universal Credit You will only able to get Working Tax Credit in the situations listed below Otherwise you won t be able to make a new claim for tax credits Use our Benefits Calculator to see what benefits you might be able to get State benefits that are taxable The most common benefits that you pay Income Tax on are Bereavement Allowance previously Widow s pension Carer s Allowance or in Scotland only Carer Support

What Is Working Tax Credit A Comprehensive Guide IBusiness Talk

https://www.ibusinesstalk.co.uk/wp-content/uploads/2022/06/What-is-Working-Tax-Credit.png

Working Tax Credit The Definitive Guide AccountingFirms

https://www.accountingfirms.co.uk/wp-content/uploads/2023/07/working-tax-credit.png

https://www.which.co.uk › money › tax › tax-credits-and...

Working tax credit is a means tested benefit paid by HMRC to support people on a low income Find out how to claim working tax credit whether you re eligible to receive payments and how to calculate how much you ll get

https://www.gov.uk › working-tax-credit › what-youll-get

Working Tax Credit how much money you get hours you need to work eligibility claim tax credits when you stop work or go on leave

Working Tax Credit Customers Must Report Changes To Working Hours

What Is Working Tax Credit A Comprehensive Guide IBusiness Talk

How To Apply For The Working Tax Credit London Business Mag

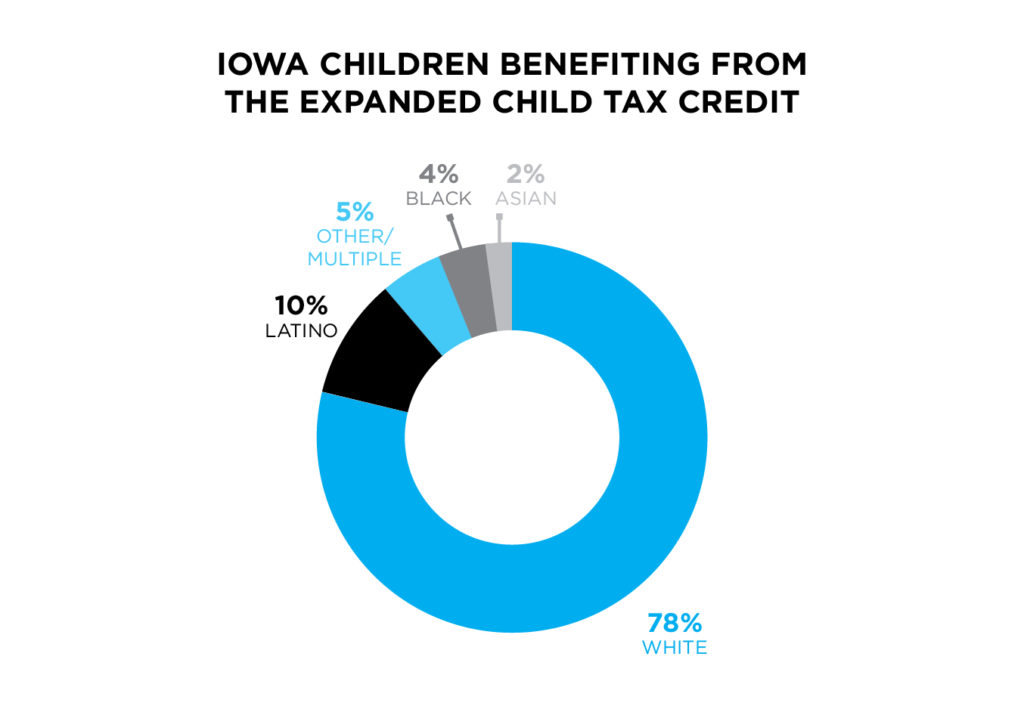

Expanded Child Tax Credit A great Step Forward To Reducing Poverty In

Work Opportunity Tax Credit Available To Employers

Working Tax Credit In 2022 Everything You Need To Know

Working Tax Credit In 2022 Everything You Need To Know

Working Tax Credit FAQs That You Wanted

What Is Working Tax Credit DNS Accountants

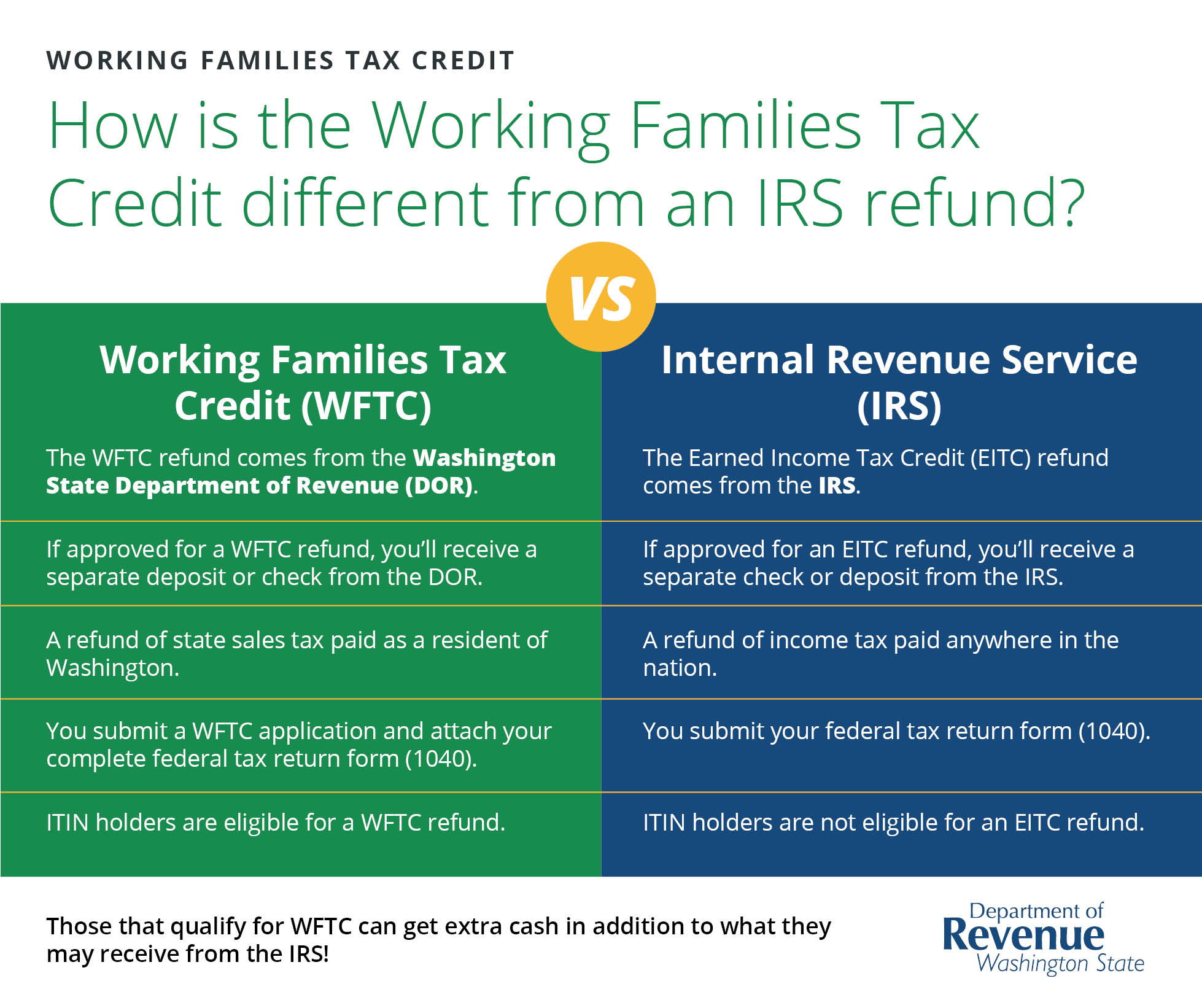

Working Families Tax Credit PIM Savvy

Is Working Tax Credit A Benefit - The Working Tax Credit WTC is a state benefit offered to individuals living in the United Kingdom who work and have a low income It was introduced in April 2003 as a means tested