Itin Recovery Rebate Credit Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

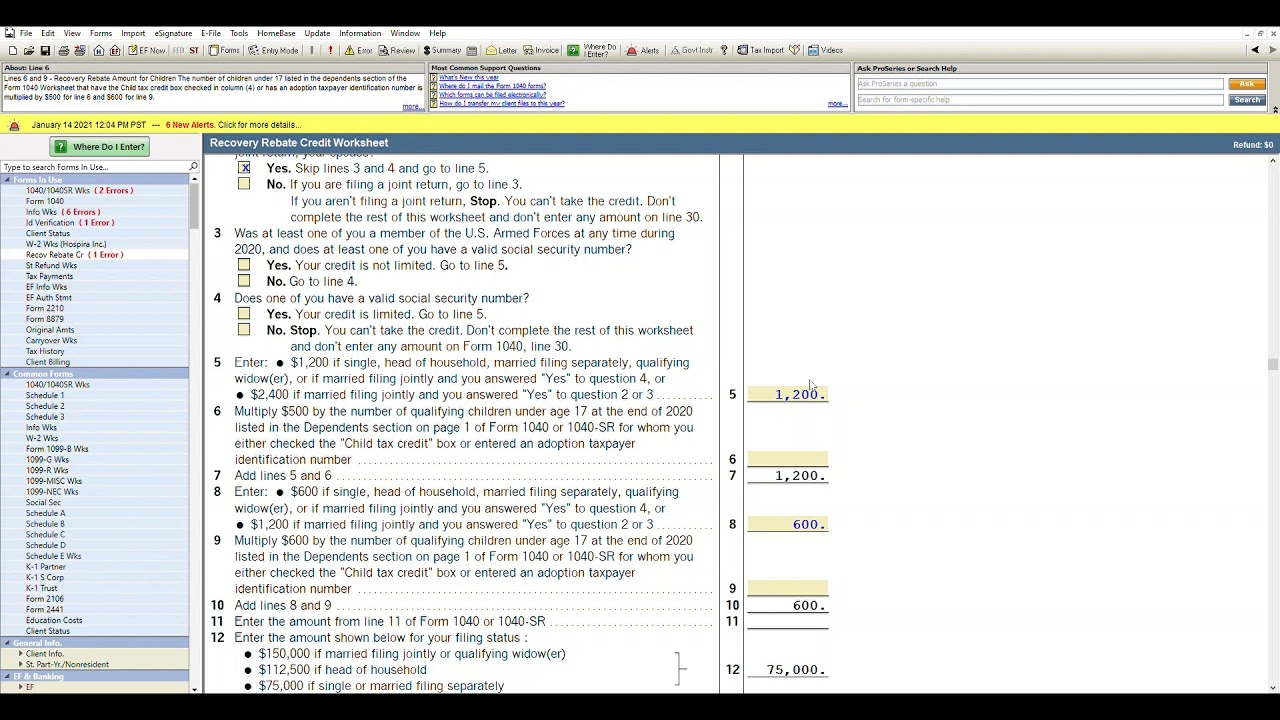

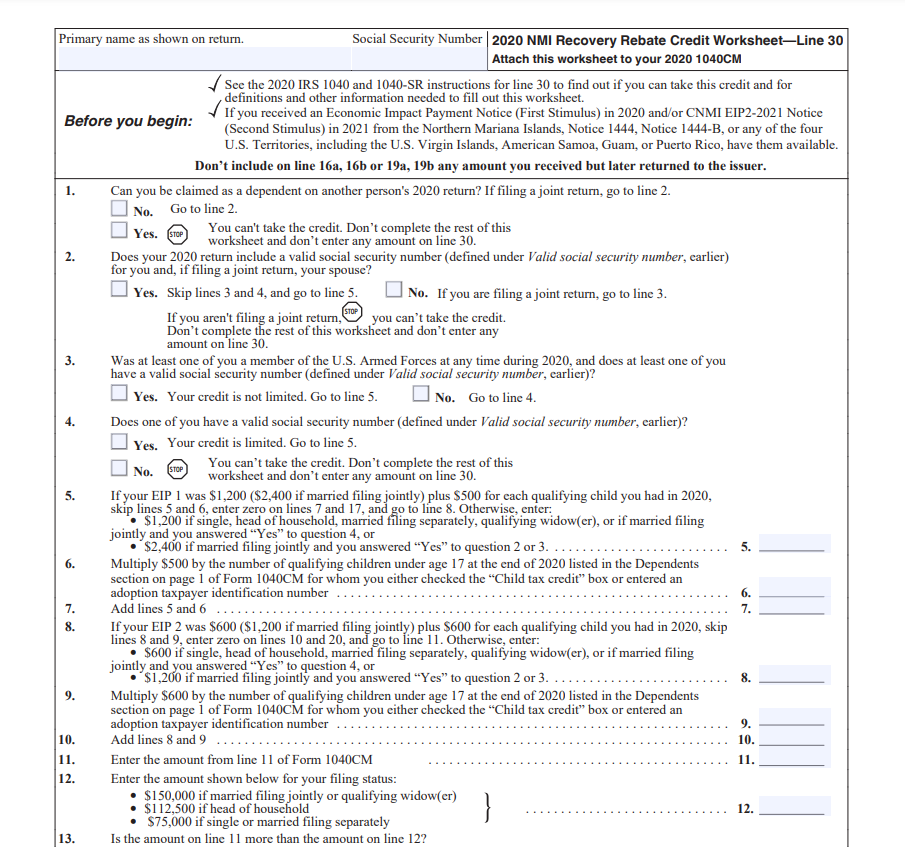

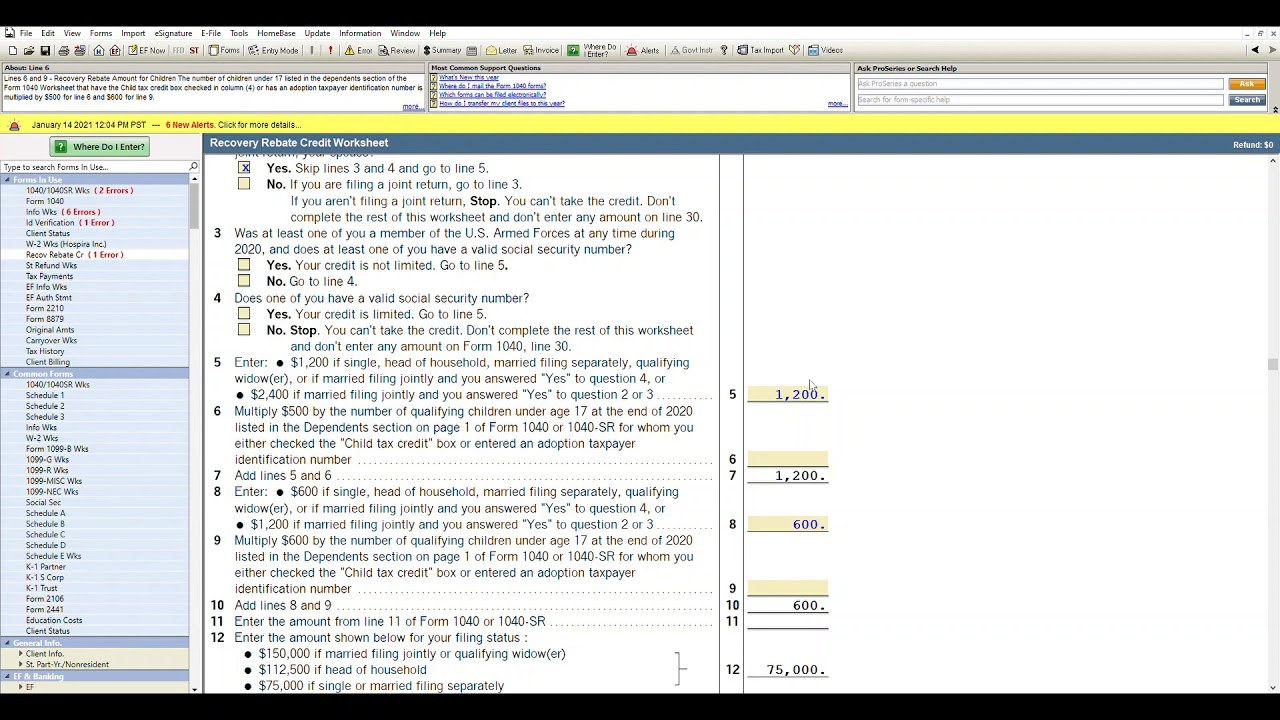

Web 1 mai 2020 nbsp 0183 32 The Internal Revenue Service IRS refers to these payments issued in 2020 as Economic Impact Payments For more detailed information on these payments see Web 21 janv 2021 nbsp 0183 32 I ve just looked and the worksheet does NOT calculate this correctly If you enter an ITIN it still calculates as if they get the payment So you must over ride the

Itin Recovery Rebate Credit

Itin Recovery Rebate Credit

https://printablerebateform.net/wp-content/uploads/2022/10/What-Does-The-Recovery-Rebate-Form-Look-Like.png

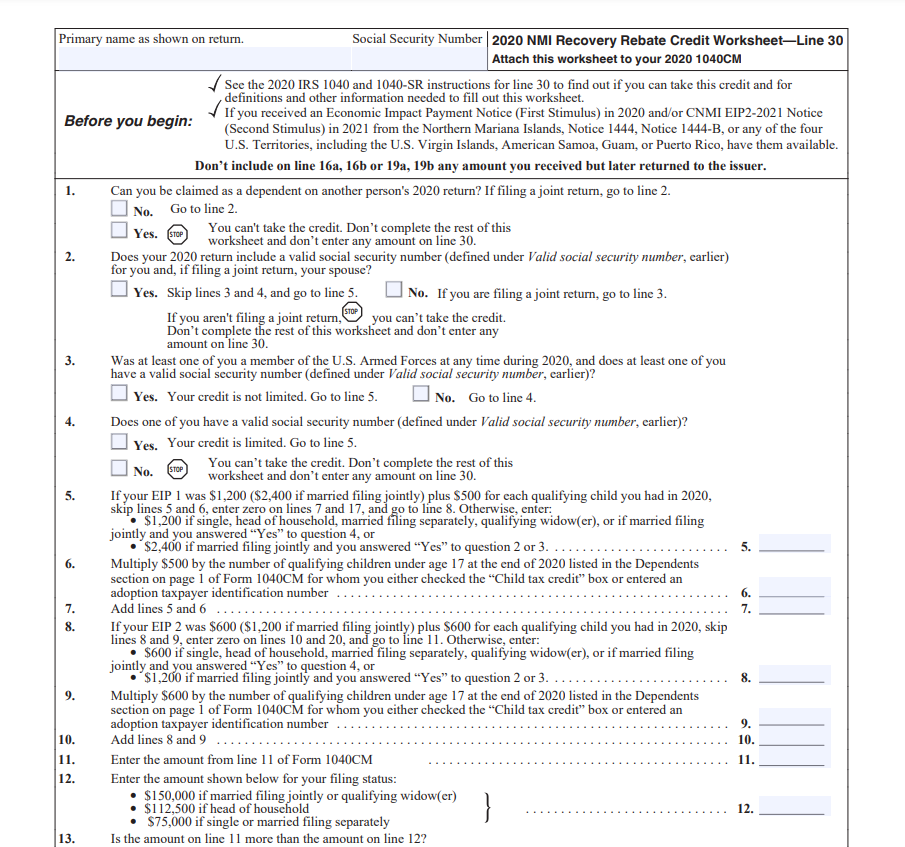

Recovery Rebate Credit Worksheet 2022 Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/01/recovery-rebate-credit-worksheet-youtube.jpg

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-recovery-rebate-3.png?w=530&ssl=1

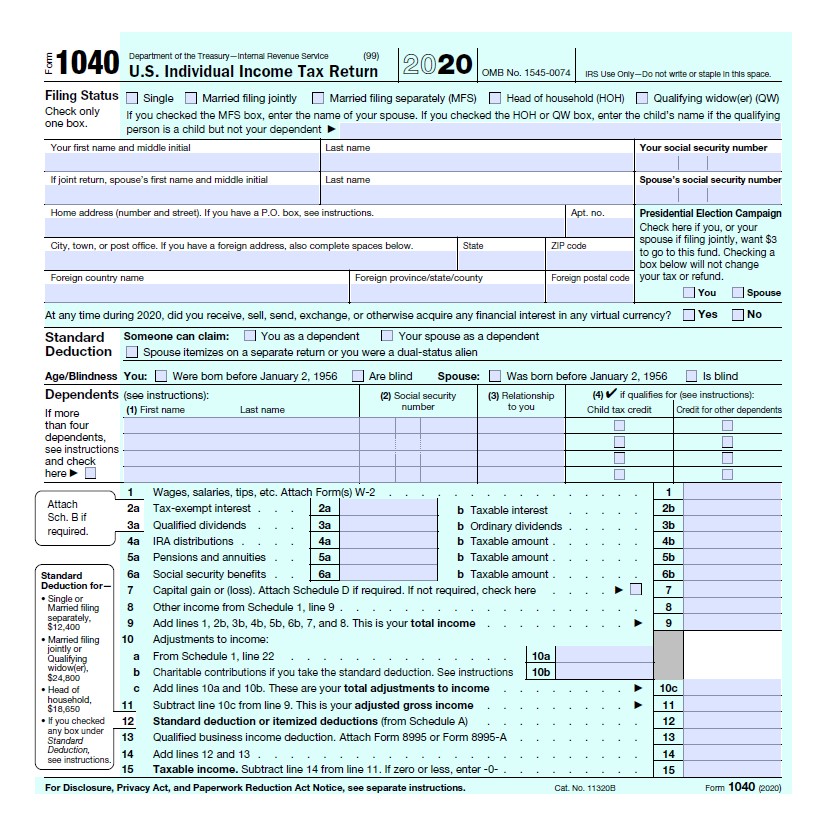

Web 10 d 233 c 2021 nbsp 0183 32 If you either didn t receive any first or second Economic Impact Payments or received less than these full amounts you may be eligible to claim the Recovery Rebate Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

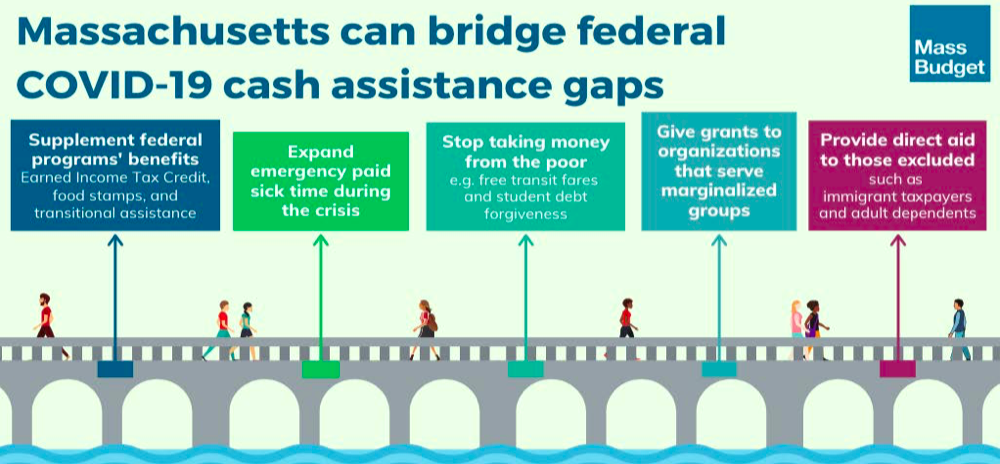

Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form Web 10 avr 2020 nbsp 0183 32 The Solution Provide a state funded benefit to families in Massachusetts who are ITIN taxpayers This legislation directs the Department of Revenue to provide a cash

Download Itin Recovery Rebate Credit

More picture related to Itin Recovery Rebate Credit

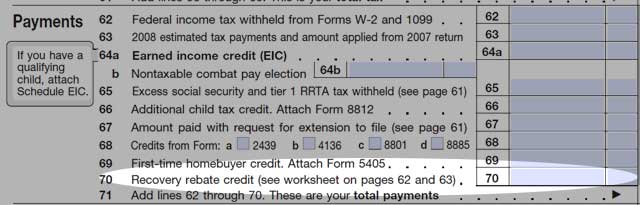

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

https://www.consumerismcommentary.com/wp-content/uploads/2009/01/recovery-rebate-credit-1040.jpg

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/02/solved-recovery-rebate-credit-error-on-1040-instructions-6.png

Recovery Rebate For ITIN Taxpayers And Their Families Massachusetts

http://static1.squarespace.com/static/5930ccefbe6594842fe981ce/59851570e48aee9084e6f2ad/5eb9c3614a67d30048820acb/1606833202197/Screen+Shot+2020-05-11+at+5.29.16+PM.png?format=1500w

Web 15 mars 2023 nbsp 0183 32 Sign in to your Online Account Didn t Get the Full Third Payment Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Web 29 d 233 c 2022 nbsp 0183 32 In 2021 Federal income tax returns will be eligible for the Recovery Rebate You could receive up to 1 400 per tax dependent who is eligible married

Web 15 nov 2022 nbsp 0183 32 The Recovery Rebate can be applied to federal income tax returns up to 2021 For married couples with at least two children you could receive up to 1 400 or Web 9 avr 2020 nbsp 0183 32 Specifically the CARES Act provides for the issuance of one time payments called recovery rebates or commonly referred to as stimulus checks to help

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

https://crsreports.congress.gov/product/pdf/IN/IN11376

Web 1 mai 2020 nbsp 0183 32 The Internal Revenue Service IRS refers to these payments issued in 2020 as Economic Impact Payments For more detailed information on these payments see

Track Your Recovery Rebate With This Worksheet Style Worksheets

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

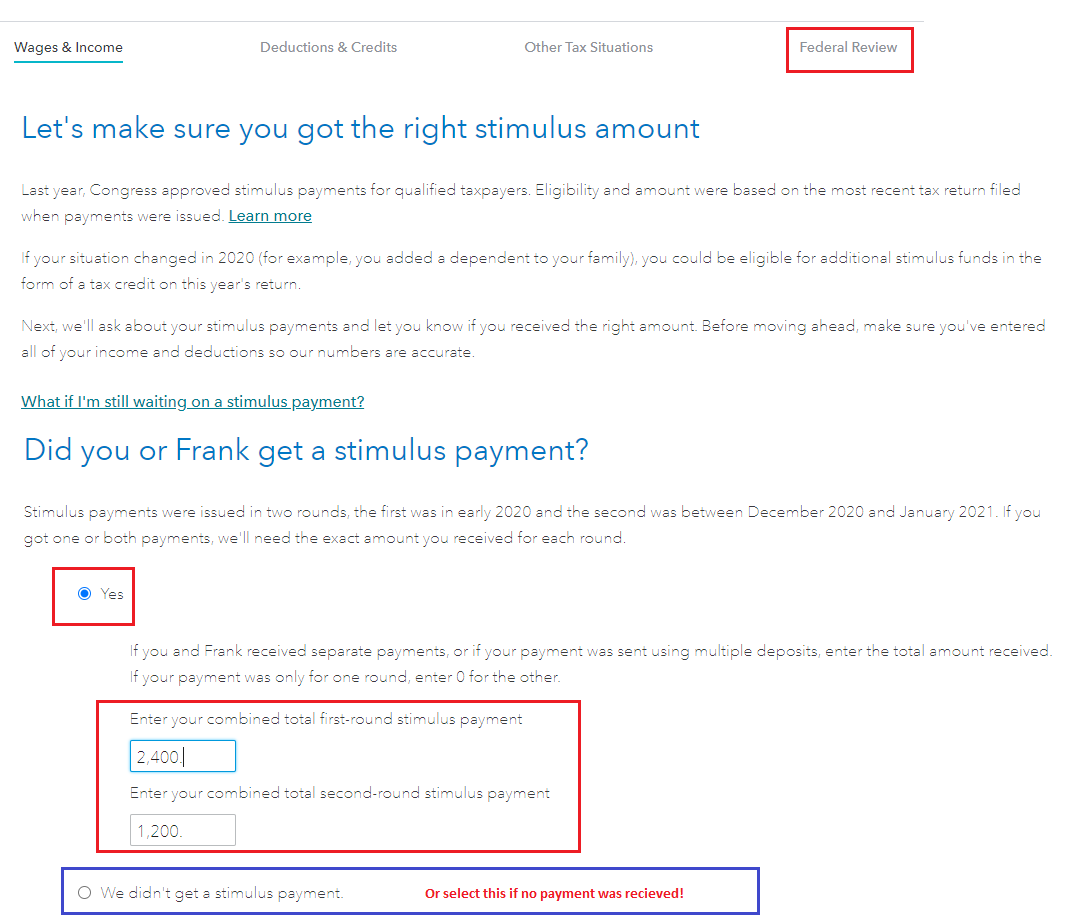

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

Recovery Rebate Credit Form Printable Rebate Form

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

Child Tax Credit Worksheet Claiming The Recovery Rebate Credit

Child Tax Credit Worksheet Claiming The Recovery Rebate Credit

1040 Line 30 Recovery Rebate Credit Recovery Rebate

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

How Do I Claim The Recovery Rebate Credit On My Ta

Itin Recovery Rebate Credit - Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form