Joint Home Loan Tax Benefits Verkko 28 jouluk 2023 nbsp 0183 32 You must be a co applicant and a joint owner to claim tax benefits on a joint home loan There are three types of joint home loan tax benefits that you

Verkko 18 jouluk 2023 nbsp 0183 32 Both of you can claim deduction under Section 80C up to Rs 1 5 lakh from your total income If the house is jointly owned both you and your spouse can Verkko 26 hein 228 k 2019 nbsp 0183 32 1 Income Tax benefits on a joint home loan can be claimed by all the joint owners 2 Ownership is required for joint owners i e Co owner 3 Joint

Joint Home Loan Tax Benefits

Joint Home Loan Tax Benefits

https://i.ytimg.com/vi/VJM60Cgc2qw/maxresdefault.jpg

Wife Joint Home Loan Joint Property

https://i.ytimg.com/vi/yg0Z_FIK2JM/maxresdefault.jpg

Does It Make Sense To Make Your Spouse The Co applicant When Taking A

https://im.indiatimes.in/content/2022/Jan/shutterstock_tax-benefits_61e95fee53c4d.jpg?w=720&h=480&cc=1

Verkko 22 huhtik 2022 nbsp 0183 32 It helps in keeping track of contributions and facilitates reimbursement When a husband and wife jointly own a home inheritance and other legal concerns Verkko 28 helmik 2023 nbsp 0183 32 Last Updated February 28th 2023 While many house purchasers choose a joint home loan to increase their eligibility the loan repayment and tax

Verkko 3 Jan 2024 Income tax benefits on joint home loans are available under Section 24 b for interest paid and under Section 80C for the principal repayment subject to certain conditions is that you must be the co Verkko There are two important benefits of a joint home loan They are Higher loan eligibility By pooling their incomes together while making a joint home loan application the

Download Joint Home Loan Tax Benefits

More picture related to Joint Home Loan Tax Benefits

Joint Home Loan Eligibility Rules And Income Tax Benefits Invested

https://invested.in/wp-content/uploads/2020/11/Joint-Home-Loan-Eligibility-Rules-And-Income-Tax-Benefits-1-1200x385.jpg

How To Avail Joint Home Loan Tax Benefit Houssed

https://www.houssed.com/blog/wp-content/uploads/2022/08/how-to-avail-joint-home-loan-tax-benefit_blogimage.jpg

Joint Home Loan Eligibility Tax Benefit Guide

https://assetyogi.com/wp-content/uploads/2017/06/joint-home-loan-eligibility-joint-home-loan-tax-benefit-889x500.jpg

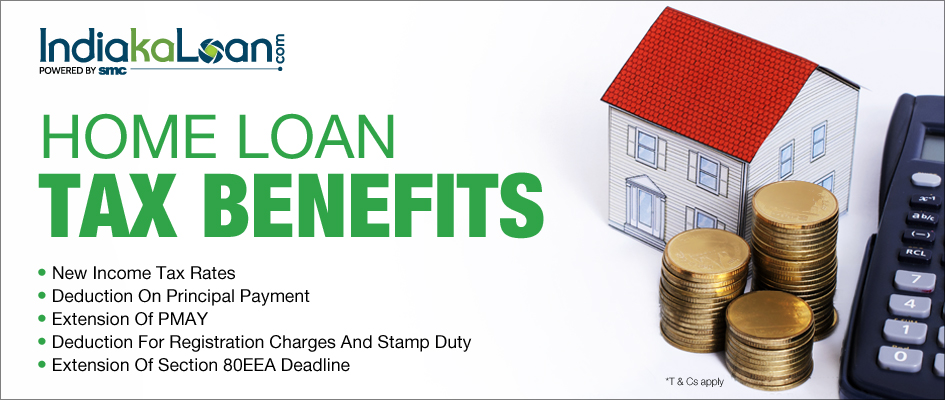

Verkko 3 tammik 2024 nbsp 0183 32 Why taking a joint home loan in India is beneficial Tax Benefit both or all co borrowers can claim tax deductions Large loan amount for a large house Verkko 12 jouluk 2023 nbsp 0183 32 3 Joint Home Loan Tax Benefits Taking a joint home loan can also lead to increased tax benefits Under Section 24 b and Section 80C of the Income

Verkko 10 hein 228 k 2023 nbsp 0183 32 Tax benefits are a great way to reduce tax liability These benefits range from tax credits and deductions to exemptions and exclusions Tax benefits Verkko 27 huhtik 2020 nbsp 0183 32 Tax Benefit on Principal Payment The co applicants can individually claim a maximum of 1 5 lakhs in tax returns for the principal component of the joint

Home Loan Tax Benefit 8 Ways To Avail Tax Benefits On Home Loans

https://life.futuregenerali.in/media/ldbnmvyr/home-loan-tax-benefit.jpg

Joint Home Loan Tax Benefit 3 Ways To Claim Tax Benefits For Joint Owners

https://images.moneycontrol.com/static-mcnews/2020/01/Home-loan-770x433.jpg

https://tax2win.in/guide/joint-home-loan-tax

Verkko 28 jouluk 2023 nbsp 0183 32 You must be a co applicant and a joint owner to claim tax benefits on a joint home loan There are three types of joint home loan tax benefits that you

https://cleartax.in/s/home-loan-tax-benefits

Verkko 18 jouluk 2023 nbsp 0183 32 Both of you can claim deduction under Section 80C up to Rs 1 5 lakh from your total income If the house is jointly owned both you and your spouse can

Joint Property Ownership Joint Home Loan Tax Benefits In India YouTube

Home Loan Tax Benefit 8 Ways To Avail Tax Benefits On Home Loans

Joint Home Loan Tax Benefits On Joint Home Loan YouTube

Joint Home Loan Tax Know All Tax Benefits Of Joint Home Loan

Home Loan Tax Benefits As Per Union Budget 2020 IndiakaLoans

Home Loan Tax Benefit 2023 24 Deduction Joint Home Loan Tax Benefit

Home Loan Tax Benefit 2023 24 Deduction Joint Home Loan Tax Benefit

Home Loan Tax Benefits You Need To Know KS Group

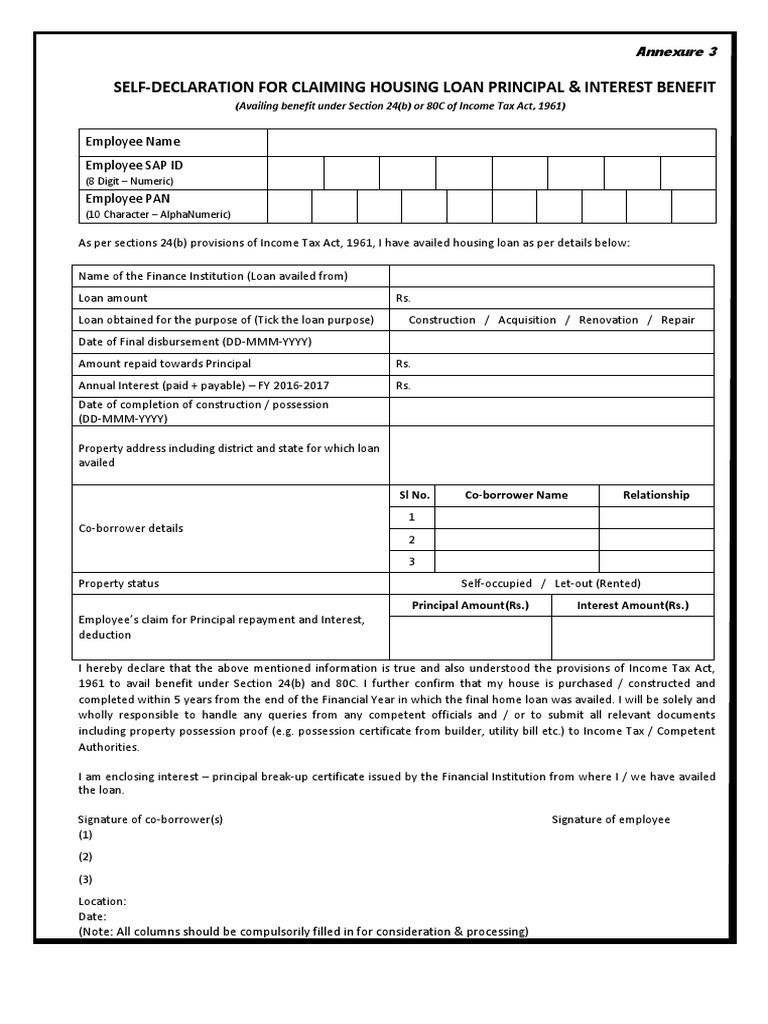

Self Declaration For Claiming Housing Loan Principal Interest Benefit

5 Benefits Of Joint Home Loan In India Tax Benefits 2023

Joint Home Loan Tax Benefits - Verkko Taking a joint loan can help you increase the home loan amount and the chances of getting your home loan application approved are also higher Another significant