Kansas Tax On Vehicle Rebates Web 16 mars 2023 nbsp 0183 32 Kansas charges 100 to register electric vehicles an annual penalty of 60 or 70 and 50 for hybrids and plug in hybrids a yearly penalty of 10 or 20 What

Web rebates are now subject to tax From July 1 2006 through June 30 2009 K S A 2008 Supp 79 3602 ll 3 E excluded manufacturer s rebates from the tax base for the sale Web Kansas Sales Tax 7 3 2 97 Vehicle Rental Excise Tax 3 5 1 43 TOTAL 45 14 RATE OF TAX ON LEASES AND RENTALS The rate of sales tax due on leases and

Kansas Tax On Vehicle Rebates

Kansas Tax On Vehicle Rebates

https://printablerebateform.net/wp-content/uploads/2023/03/Kansas-Tax-Rebate-2023-768x672.png

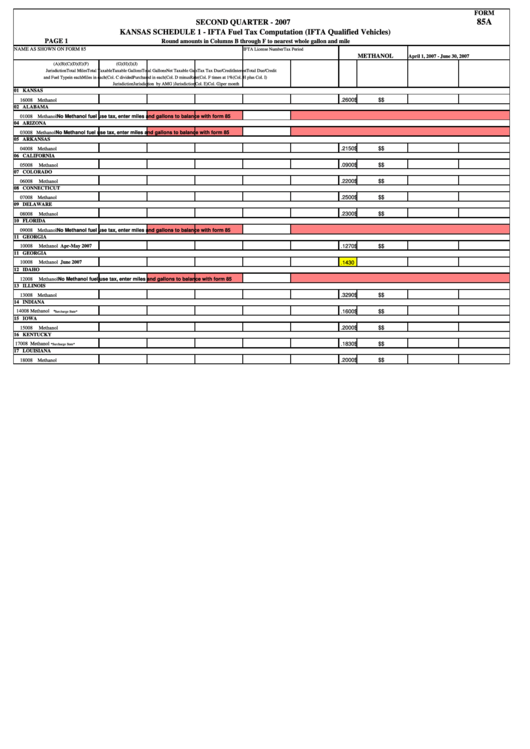

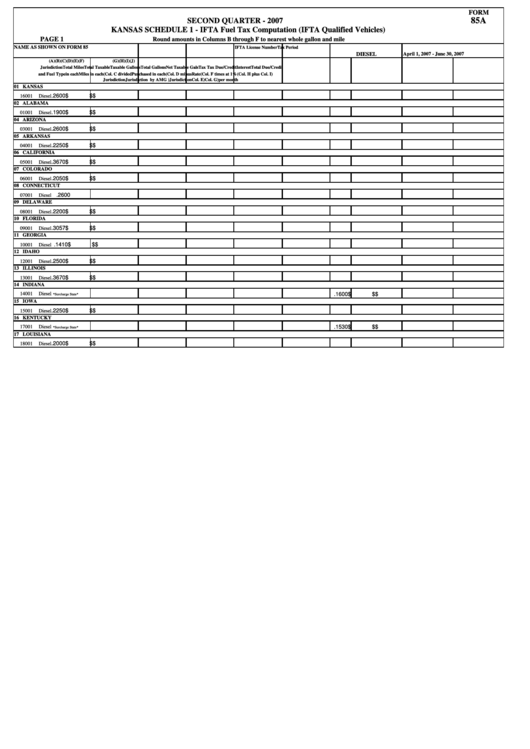

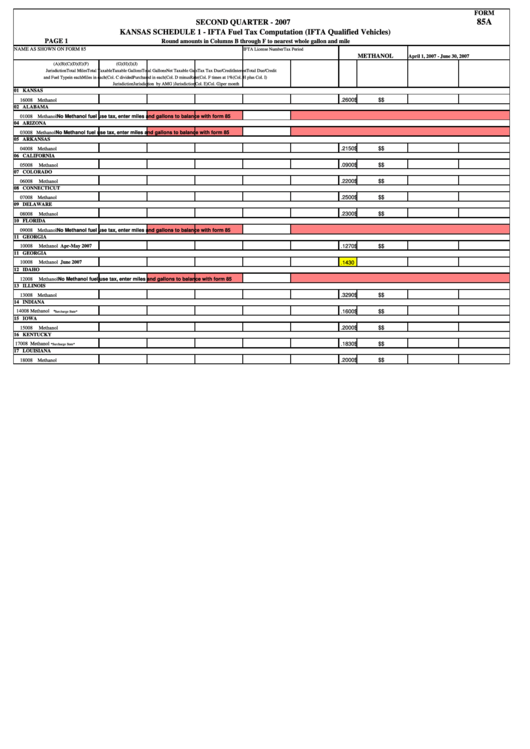

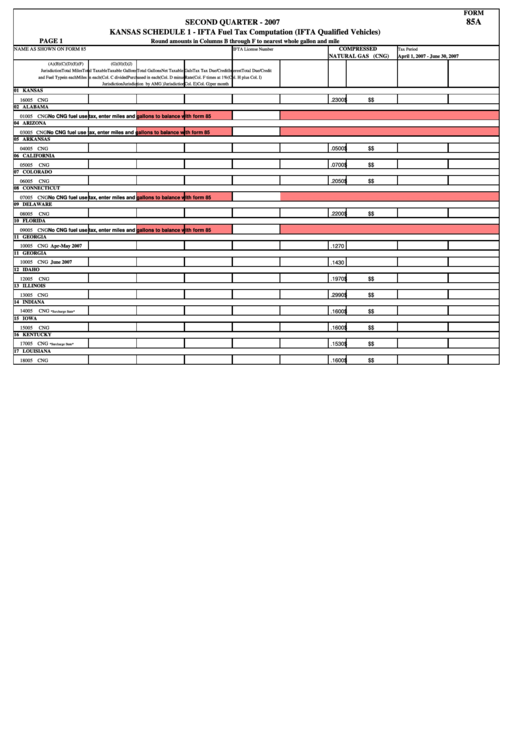

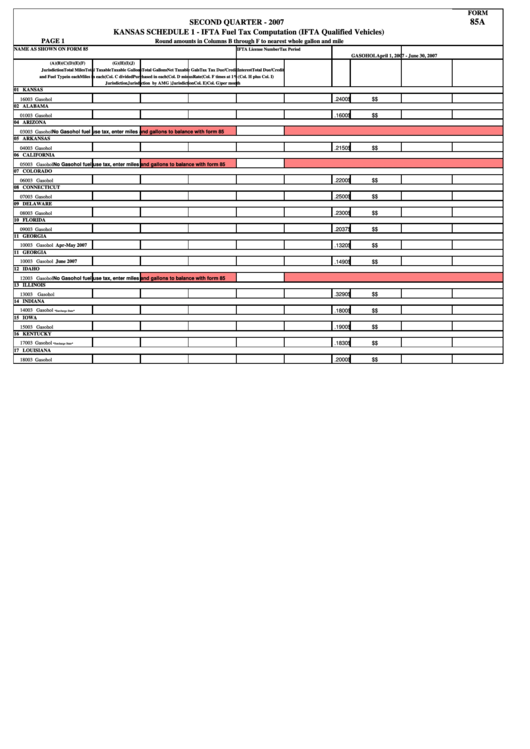

Form 85a Kansas Schedule 1 Ifta Fuel Tax Computation Ifta

https://data.formsbank.com/pdf_docs_html/273/2738/273826/page_1_thumb_big.png

Kansas Electric Vehicle Incentives Rebates And Tax Credits

https://i0.wp.com/evtaxincentives.com/wp-content/uploads/2022/06/kansas-city-downtown-building-244682.jpg?resize=1024%2C576&ssl=1

Web 1 sept 2023 nbsp 0183 32 Alaska The Chugach Electric Association offers a 200 bill credit per residential charger Each residence can claim up to two chargers Alaska Power and Telephone also provides a one time 1 000 Web Use this tool to find Kansas tax credits incentives and rebates that may apply to your purchase or lease of an electric vehicle You ll find the latest federal Kansas local

Web Kansas Electric Vehicle incentives include one utility rebate Evergy now offers a 250 rebate for the purchase of a Level 2 home EV charger Depending on the vehicle you may also qualify for a 7500 federal tax Web Compare 40 Top Insurers Home Kansas Green Driver State Incentives Green Driver State Incentives in Kansas Green driver incentives abound in Kansas for those with fuel

Download Kansas Tax On Vehicle Rebates

More picture related to Kansas Tax On Vehicle Rebates

Form 85a Kansas Schedule 1 Ifta Fuel Tax Computation Ifta

https://data.formsbank.com/pdf_docs_html/227/2272/227226/page_1_thumb_big.png

Kansas St 8 Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/5/422/5422661/large.png

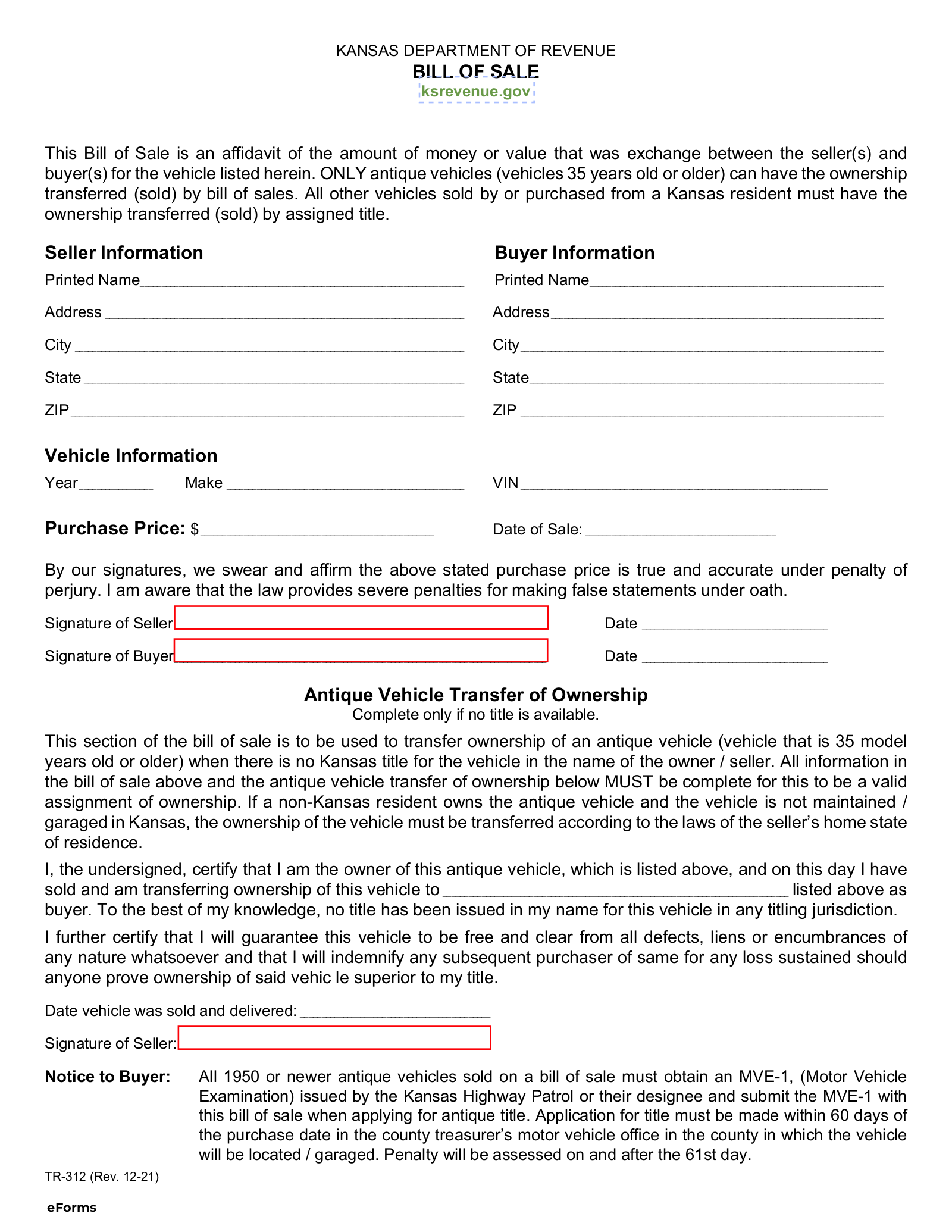

Free Kansas Bill Of Sale Forms PDF EForms

https://eforms.com/images/2015/12/Kansas-Vehicle-Bill-of-Sale-Form-TR-312.png

Web 27 janv 2022 nbsp 0183 32 Motor Vehicle Tax revenues account for 24 of the state s transportation revenues currently the second largest source of road funding But by 2045 that is Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed

Web 18 mars 2023 nbsp 0183 32 Used EV Rebates up to 4 000 The Clean Vehicle Credit provides a tax credit for the purchase of a pre owned EV or FCEV HOV Lane Exemptions In Kansas Web 30 juin 2023 nbsp 0183 32 Kansas EV charging station tax rebates Electric Vehicle Charging Station Rebate and Time Of Use TOU Rate Evergy

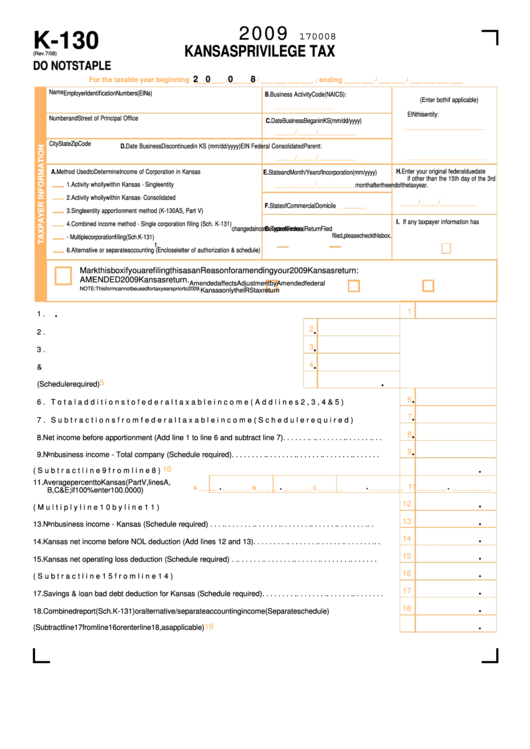

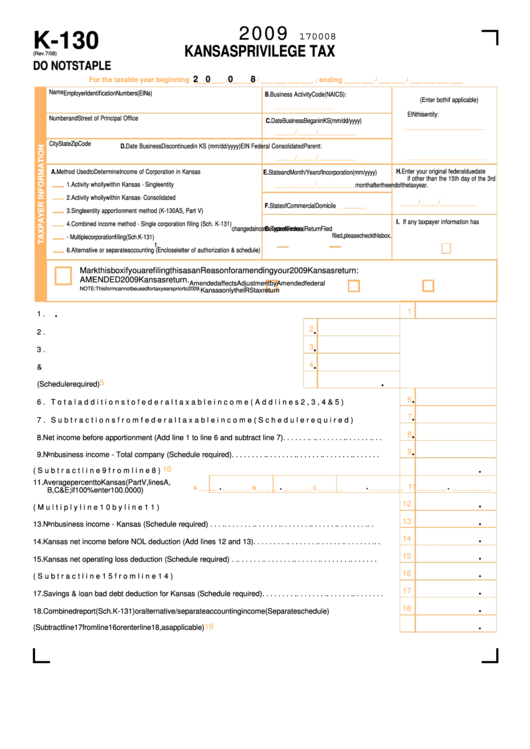

Form K 130 Kansas Privilege Tax Form 2009 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/173/1732/173269/page_1_thumb_big.png

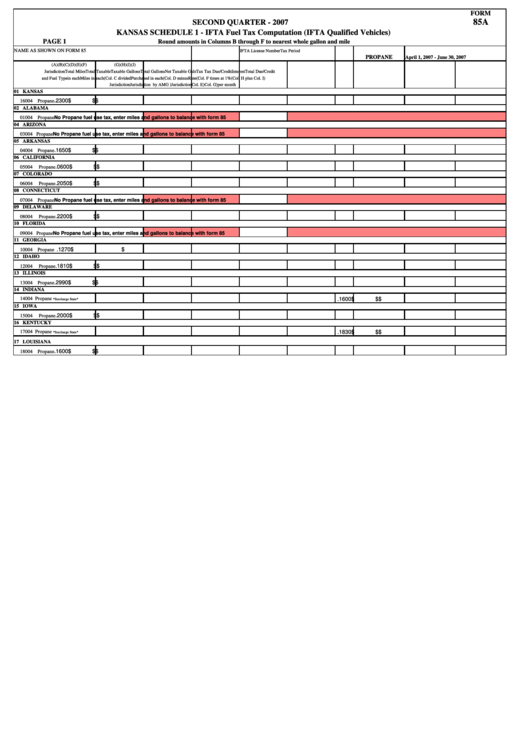

Form 85a Kansas Schedule 1 Ifta Fuel Tax Computation Ifta

https://data.formsbank.com/pdf_docs_html/231/2311/231190/page_1_thumb_big.png

https://cars.usnews.com/cars-trucks/advice/kansas-ev-tax-credits

Web 16 mars 2023 nbsp 0183 32 Kansas charges 100 to register electric vehicles an annual penalty of 60 or 70 and 50 for hybrids and plug in hybrids a yearly penalty of 10 or 20 What

https://ksrevenue.gov/pdf/edu32a.pdf

Web rebates are now subject to tax From July 1 2006 through June 30 2009 K S A 2008 Supp 79 3602 ll 3 E excluded manufacturer s rebates from the tax base for the sale

Form 85a Kansas Schedule 1 Ifta Fuel Tax Computation Ifta

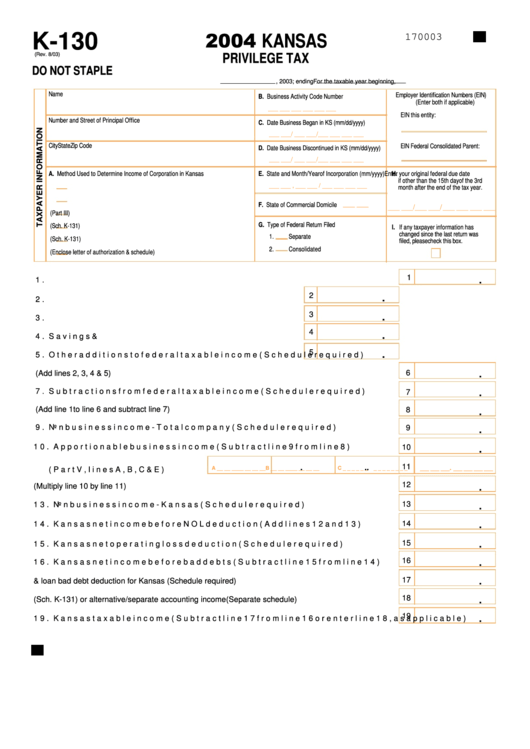

Form K 130 Kansas Privilege Tax Form 2009 Printable Pdf Download

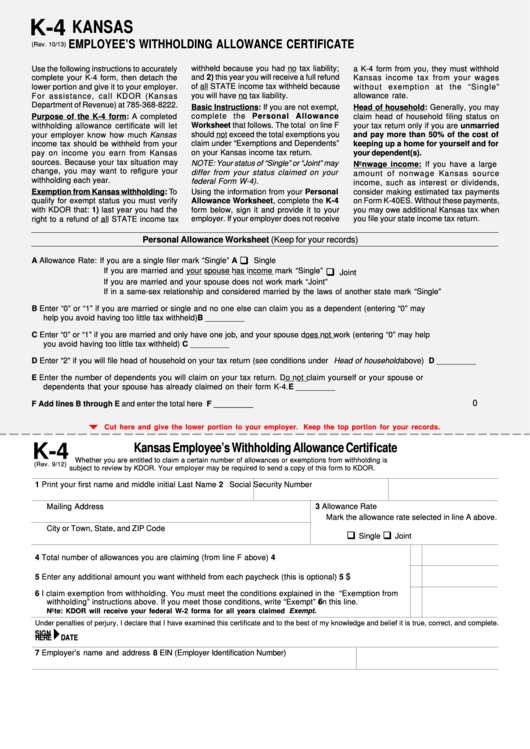

Kansas Withholding Form K 4 2022 W4 Form

Free Kansas Bill Of Sale Forms PDF

Form K 130 Kansas Privilege Tax 2004 Printable Pdf Download

2020 Form KS DoR KS 1216 Fill Online Printable Fillable Blank

2020 Form KS DoR KS 1216 Fill Online Printable Fillable Blank

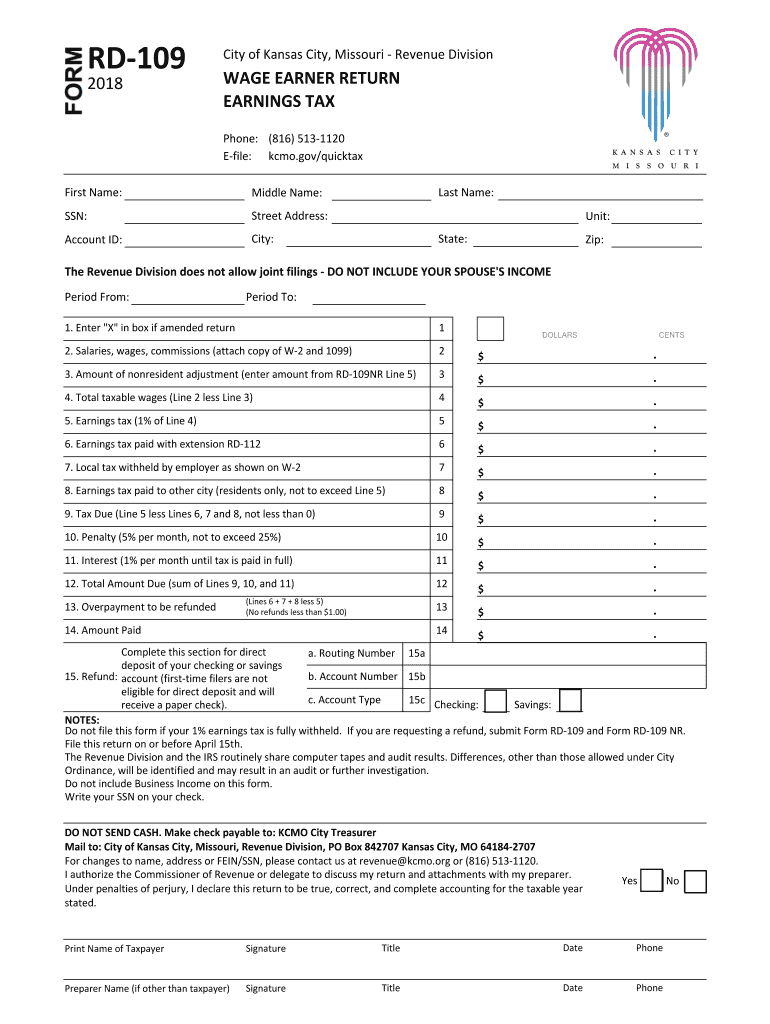

Form Rd 109 2019 Fill Out And Sign Printable PDF Template SignNow

VyStates

Form 85a Kansas Schedule 1 Ifta Fuel Tax Computation Ifta

Kansas Tax On Vehicle Rebates - Web Kansas Electric Vehicle incentives include one utility rebate Evergy now offers a 250 rebate for the purchase of a Level 2 home EV charger Depending on the vehicle you may also qualify for a 7500 federal tax