Kansas Tax Rebate 2024 TOPEKA Governor Kelly announced yesterday her proposal to spend Kansas one time budget surplus on a tax rebate of 450 for individuals and 900 for married taxpayers filing jointly The proposal for a one time tax rebate provides relief to all Kansas resident taxpayers without breaking the bank or jeopardizing funds for our public schools

34 states have 2024 state tax changes taking effect on January 1st including state income tax changes and state business tax changes Updated to include additional changes in Kansas and Missouri See Full Timeline Thirty four states will ring in the new year with notable taxA tax is a mandatory payment or charge collected by local Fiscal year 2024 which started July 1 is projected to have an ending balance of 2 8 billion plus 1 7 billion in the rainy day fund That s off an estimated 12 7 billion in available revenue

Kansas Tax Rebate 2024

Kansas Tax Rebate 2024

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

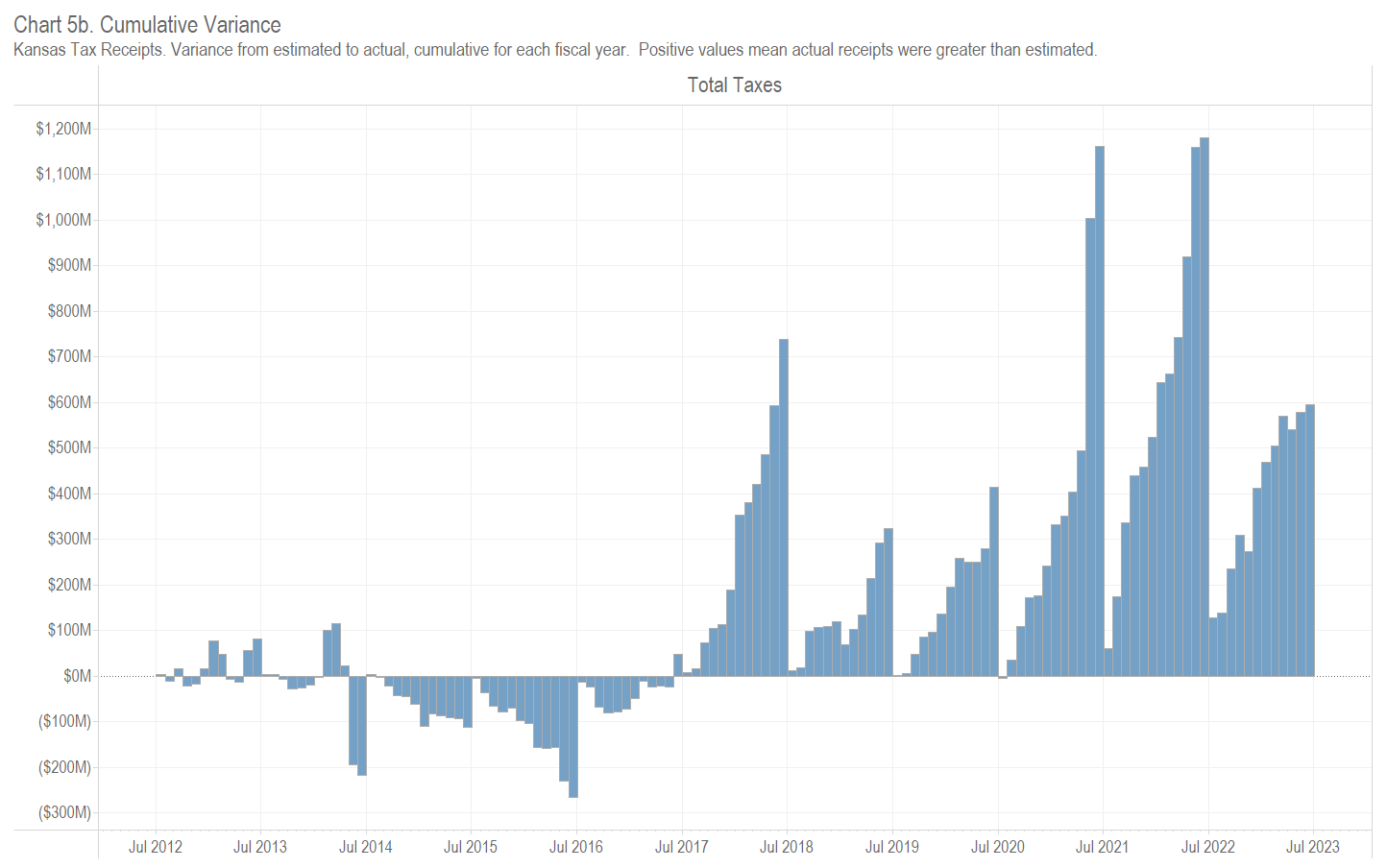

Kansas Tax Revenue June 2023

https://www.wichitaliberty.org/wp-content/uploads/2023/07/Kansas-Tax-Collections-through-2023-06-chart-5b.png

Senior Tax Rebate Program Downtown KCK 701 N 7th St Trfy Kansas City KS 66101 3035 United

https://cdn.happeningnext.com/events3/banners/88a6c08cb461e0a2bc73142167fed1d1dbc2767f53f1ff5d5e647f6ec938c417-rimg-w960-h799-gmir.jpg?v=1675207298

TOPEKA KSNT On Monday the first day of the 2024 legislative session Governor Laura Kelly unveiled a new tax cut proposal The plan seeks to cut state property taxes eliminate taxes on PERSONAL TAX Tax forms File your state taxes online Homestead information and forms Where is my refund K 4 Withholding form Make a tax payment Name and address change Payment plan requests Pay Delinquent Tax Debt Online Copy of prior year tax documents Tax Practitioners Resolve tax issues Tax clearance Frequently asked questions

Servicemember Civil Relief Act File Electronically Safe secure fast and free 2023 Forms Individual Income Tax K 40 Original and Amended 2023 Individual Income Tax Supplemental Schedule Schedule S 2023 Kansas Itemized Deduction Schedule Schedule A 2023 Kansas Payment Voucher K 40V 2023 Posted Feb 3 2022 02 58 PM CST Updated Feb 3 2022 07 26 PM CST SHARE TOPEKA KSNT Kansans could be eligible for a tax rebate of up to 500 as soon as this summer Governor Laura

Download Kansas Tax Rebate 2024

More picture related to Kansas Tax Rebate 2024

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A-1024x536.jpg

Utility and Sales Tax Rebate Program Residents living in Kansas City Kansas who are at least age sixty five or disabled on January 1 2024 with an income of 40 500 or below may be eligible for this program to receive a rebate on franchise fees collected on gas Internet cable or phone bills Sarah Motter Posted November 14 2023 Last updated November 15 2023 TOPEKA Kan WIBW Kansas lawmakers on both sides are formulating separate plans for tax relief following recent

Posted April 23 2022 Governor Kelly announced an additional 460 million through a Governor s Budget Amendment GBA for a one time 250 tax rebate to all Kansas residents who filed a 2020 tax return in 2021 Resident tax filers who filed as married and filing jointly will be eligible for a 500 direct payment The Tax tables below include the tax rates thresholds and allowances included in the Kansas Tax Calculator 2024 Kansas provides a standard Personal Exemption tax deduction of 2 250 00 in 2024 per qualifying filer and 2 250 00 per qualifying dependent s this is used to reduce the amount of income that is subject to tax in 2024

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/01/Alcon-Rebate-Form-2023.png

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

https://www.moneymgmnt.com/wp-content/uploads/tax-rebate-thailand-2023-1024x565.png

https://governor.kansas.gov/governor-kelly-calls-for-450-tax-rebate-to-kansas-resident-taxpayers-heres-what-theyre-saying/

TOPEKA Governor Kelly announced yesterday her proposal to spend Kansas one time budget surplus on a tax rebate of 450 for individuals and 900 for married taxpayers filing jointly The proposal for a one time tax rebate provides relief to all Kansas resident taxpayers without breaking the bank or jeopardizing funds for our public schools

https://taxfoundation.org/research/all/state/2024-state-tax-changes/

34 states have 2024 state tax changes taking effect on January 1st including state income tax changes and state business tax changes Updated to include additional changes in Kansas and Missouri See Full Timeline Thirty four states will ring in the new year with notable taxA tax is a mandatory payment or charge collected by local

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

Kansas Tax Reform Agenda Goes Far Beyond Food Sales Tax And One time Cash Rebate

Property Tax Rebate Pennsylvania LatestRebate

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

Get Up To A 300 Rebate On Bausch Lomb Contact Lenses Sunshine Optometry

Get Up To A 300 Rebate On Bausch Lomb Contact Lenses Sunshine Optometry

Kansas Sales Tax Rates By City County 2024

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

Missouri State Tax Rebate 2023 Printable Rebate Form

Kansas Tax Rebate 2024 - PERSONAL TAX Tax forms File your state taxes online Homestead information and forms Where is my refund K 4 Withholding form Make a tax payment Name and address change Payment plan requests Pay Delinquent Tax Debt Online Copy of prior year tax documents Tax Practitioners Resolve tax issues Tax clearance Frequently asked questions