Kansassales Tax Rebate Web 22 d 233 c 2021 nbsp 0183 32 Sherman Smith Kansas Reflector TOPEKA Gov Laura Kelly said the flow of state tax revenue was sufficient to propose Wednesday a 445 million tax rebate

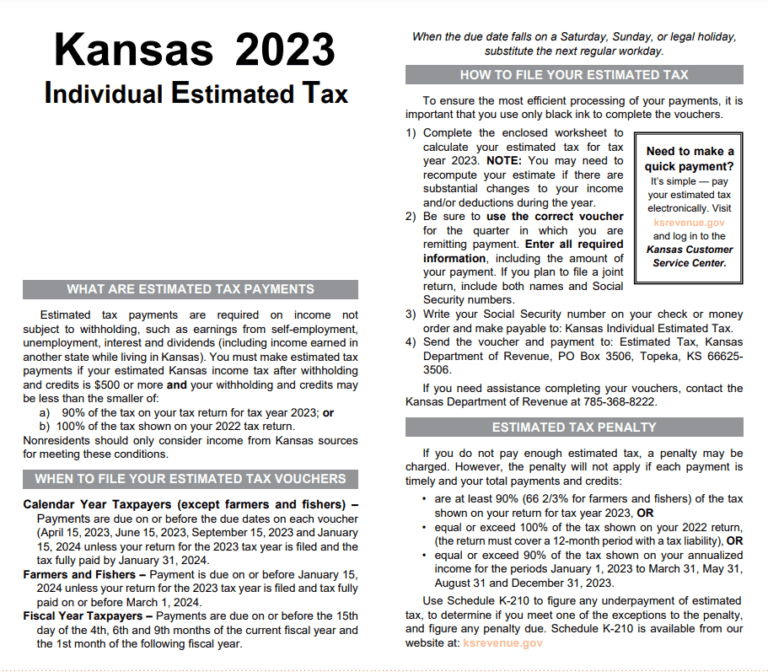

Web 8 janv 2022 nbsp 0183 32 TOPEKA The top tax reform priority of Gov Laura Kelly is elimination of the state s 6 5 sales tax on groceries and she s put a shoulder behind plans for a one time tax rebate to more than one million Web Starting on January 1 2024 the state sales tax rate will be reduced to 2 0 And starting on January 1 2025 the state sales tax rate will be reduced to 0 0 It is important to

Kansassales Tax Rebate

Kansassales Tax Rebate

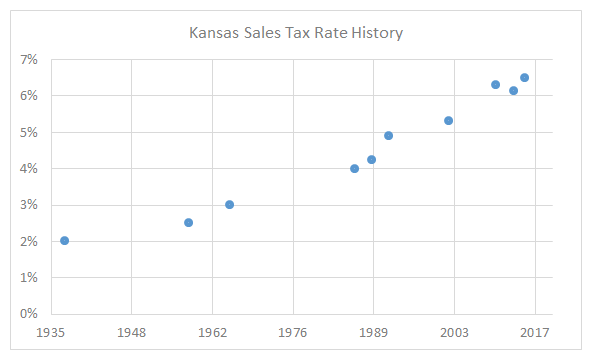

http://wichitaliberty.org/wp-content/uploads/2015/07/Kansas-Sales-Tax-Rate-History-2015-07.png

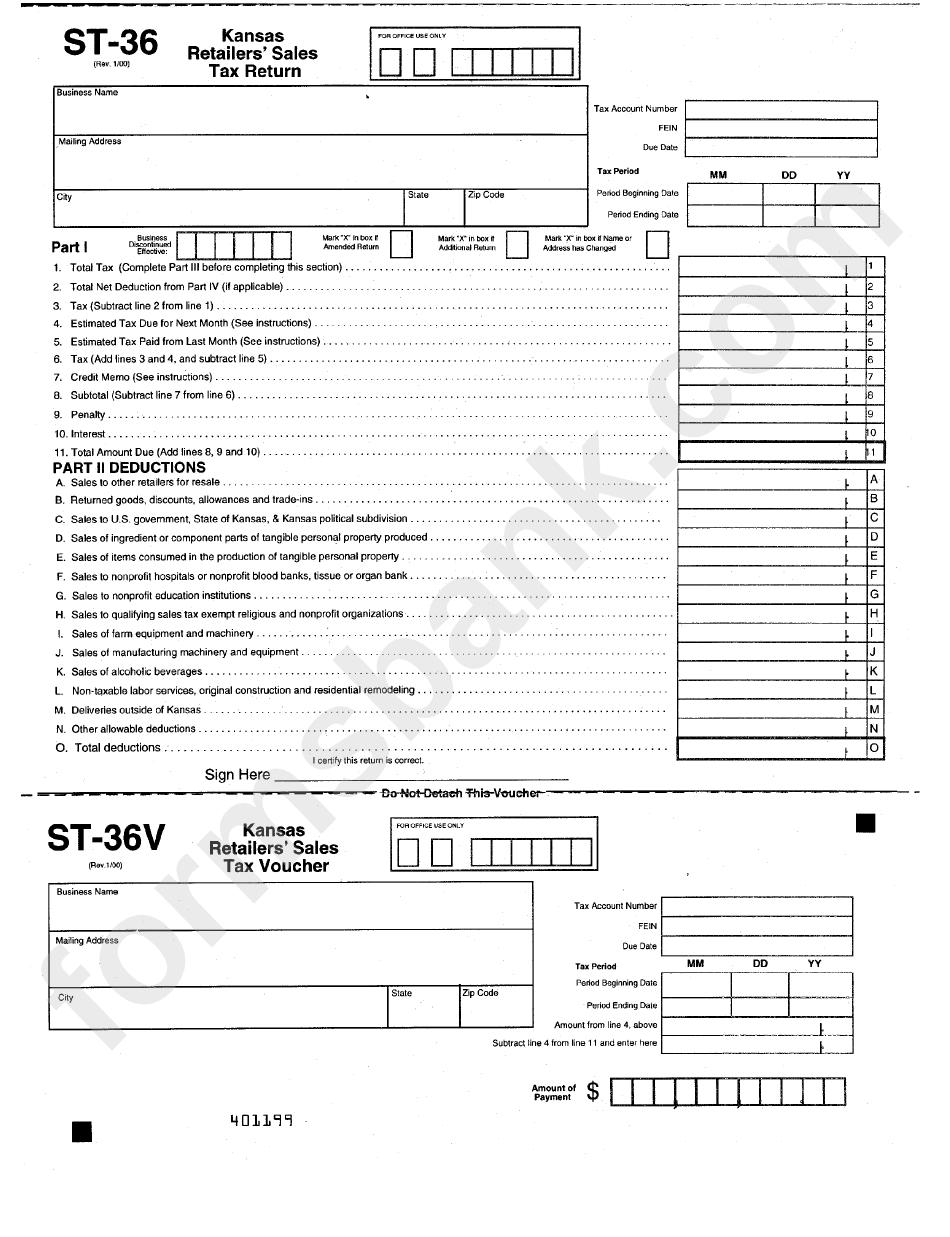

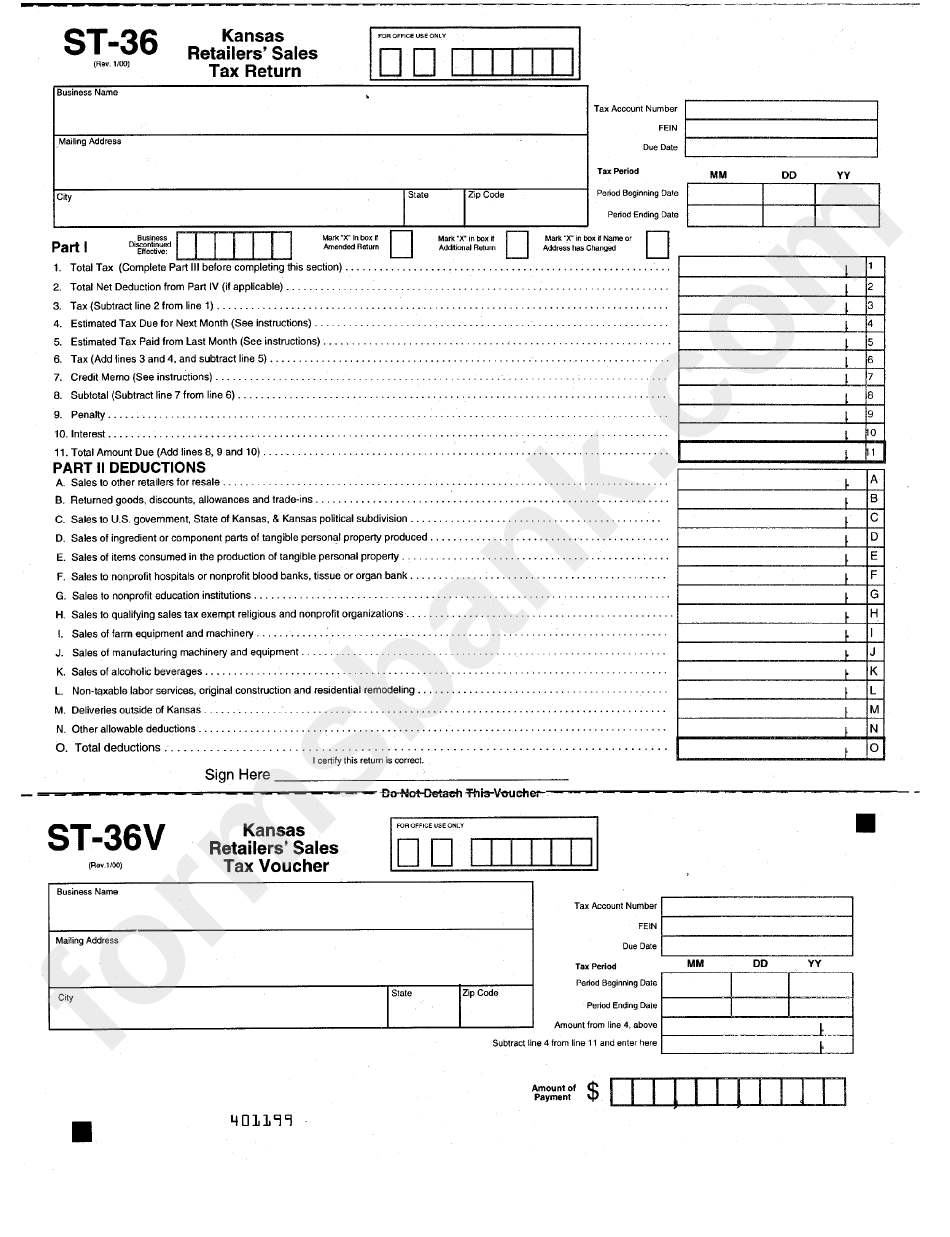

Form St 36 Kansas Retailer S Sales Tax Return Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/282/2826/282664/page_1_bg.png

Kansas Tax Rebate 2023 Eligibility Application Deadline Printable

https://printablerebateform.net/wp-content/uploads/2023/03/Kansas-Tax-Rebate-2023-768x672.png

Web Return Due Date 0 400 Annual On or before January 25th ofthe following year 400 01 4 000 Quarterly On or before the 25th of themonth following the end of the Web 3 f 233 vr 2022 nbsp 0183 32 TOPEKA KSNT Kansans could be eligible for a tax rebate of up to 500 as soon as this summer Governor Laura Kelly announced her plans for the rebate in her State of the State address last

Web Electronic Services for Sales Retailer Sales Tax Online ST 36 and ST 16 Zero based reporting no business activity Sales Tax Online ST 36 and ST 16 Payment Web The Food Sales tax refund program has been revised to become an Income tax credit See Notice 13 12 Food Sales Tax Credit for more information on this credit

Download Kansassales Tax Rebate

More picture related to Kansassales Tax Rebate

Kansas Sales Tax Update Remote Seller Guidance Wichita CPA

https://www.adamsbrowncpa.com/wp-content/uploads/2021/12/sales-tax-kansas.png

Tips For Collecting Sales Tax In Kansas

http://blog.taxjar.com/wp-content/uploads/2013/07/kansas-sales-tax-table.png

Kansas Retail Sales Tax Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/423/934/423934096/large.png

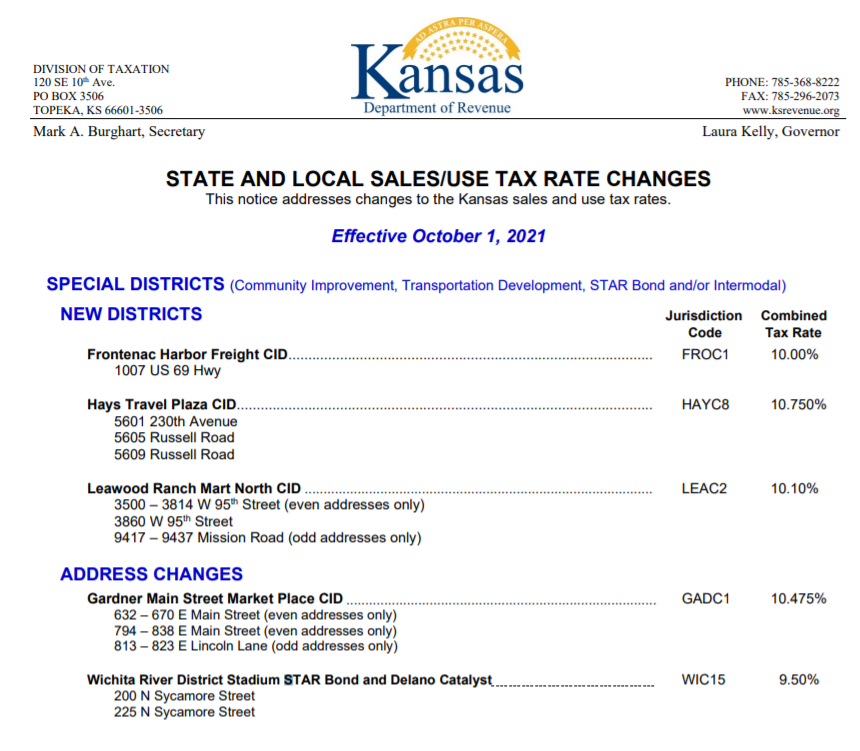

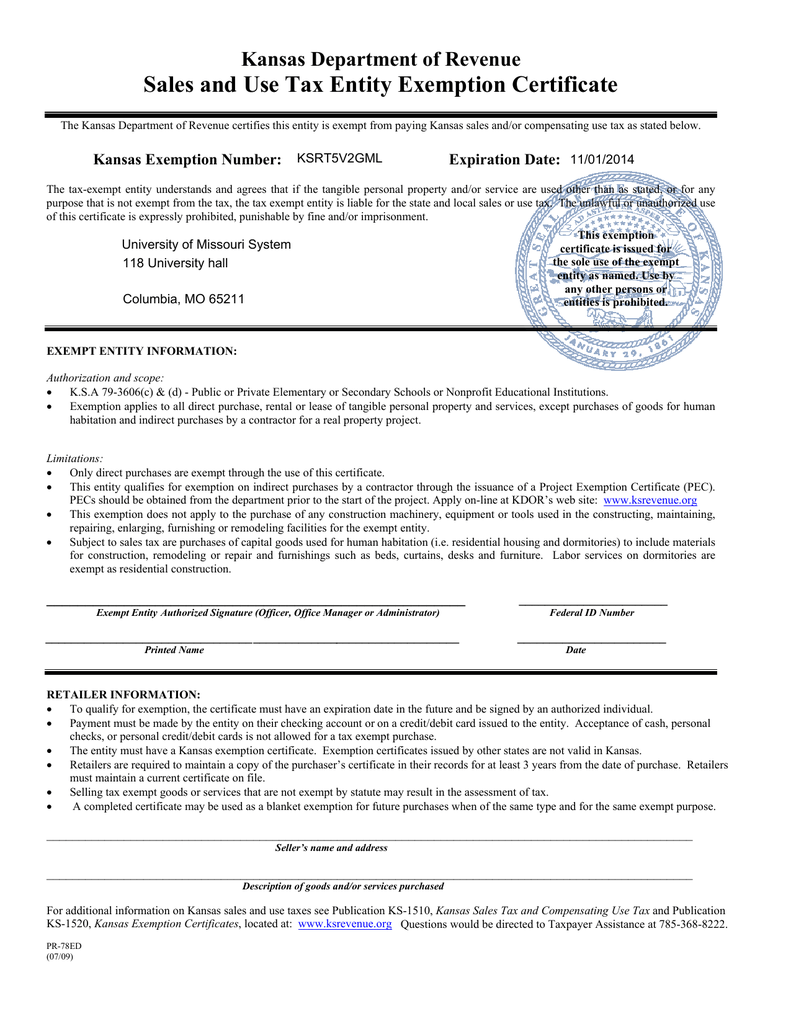

Web Certificates Pub KS 1520 Rev 11 15 This booklet is designed to help businesses properly use Kansas sales and use tax exemption certificates as buyers and as sellers It Web The Kansas Department of Revenue provides refunds for individuals or businesses that paid sales or use tax directly to the Kansas Department of Revenue in error This publication

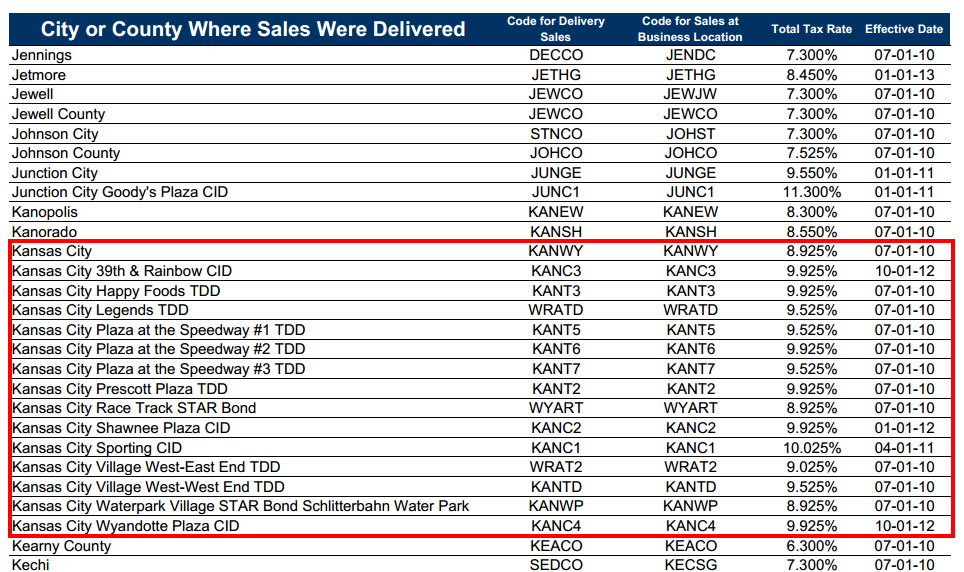

Web presents to a retailer to claim exemption from Kansas sales or use tax It shows why sales tax was not charged on a retail sale of goods or taxable services The buyer completes Web Kansas imposes a 6 5 percent effective July 1 2015 percent state retailers sales tax plus applicable local taxes on the Retail sale rental or lease of tangible personal property

Kansas W9 Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/1/229/1229923/large.png

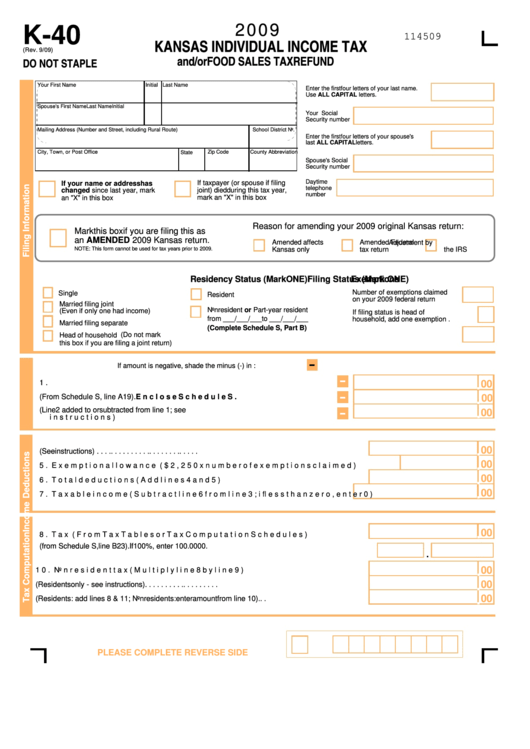

Fillable Form K 40 Kansas Individual Income Tax And or Food Sales Tax

https://data.formsbank.com/pdf_docs_html/171/1711/171164/page_1_thumb_big.png

https://kansasreflector.com/2021/12/22/kelly-recommending-one-time-44…

Web 22 d 233 c 2021 nbsp 0183 32 Sherman Smith Kansas Reflector TOPEKA Gov Laura Kelly said the flow of state tax revenue was sufficient to propose Wednesday a 445 million tax rebate

https://kansasreflector.com/2022/01/08/kansa…

Web 8 janv 2022 nbsp 0183 32 TOPEKA The top tax reform priority of Gov Laura Kelly is elimination of the state s 6 5 sales tax on groceries and she s put a shoulder behind plans for a one time tax rebate to more than one million

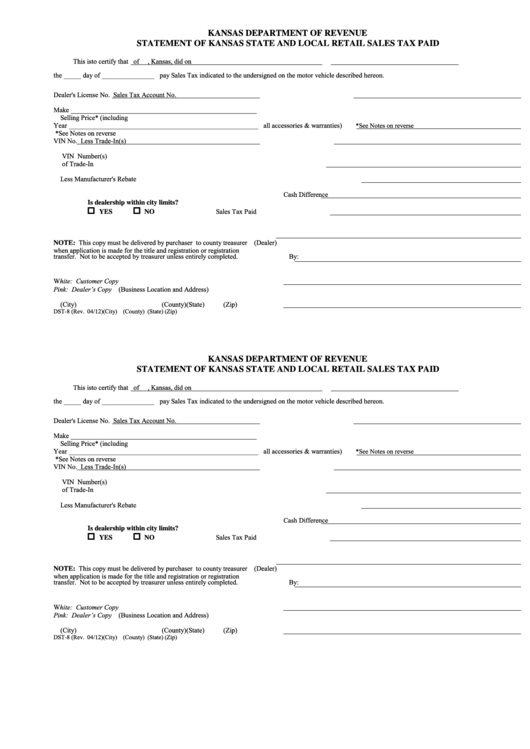

Form Dst 8 Statement Of Kansas State And Local Retail Sales Tax Paid

Kansas W9 Form Fill Out Sign Online DocHub

Kansas Sales Tax Exemption Certificate Loudly Diary Image Library

Kansas Sales Tax Exemption Certificate Expiration

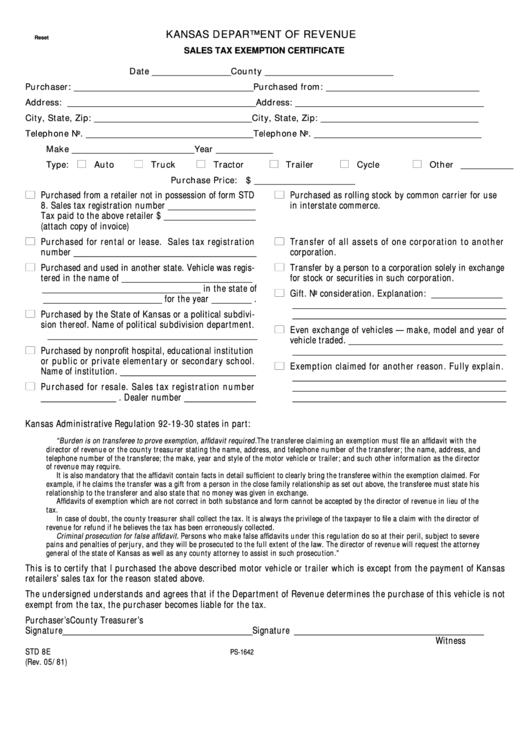

Fillable Form Std 8e Sales Tax Exemption Certificate Kansas

Kansas Sales Tax On Car Purchase Car Sale And Rentals

Kansas Sales Tax On Car Purchase Car Sale And Rentals

Kansas Exemption Form Fill Out And Sign Printable PDF Template SignNow

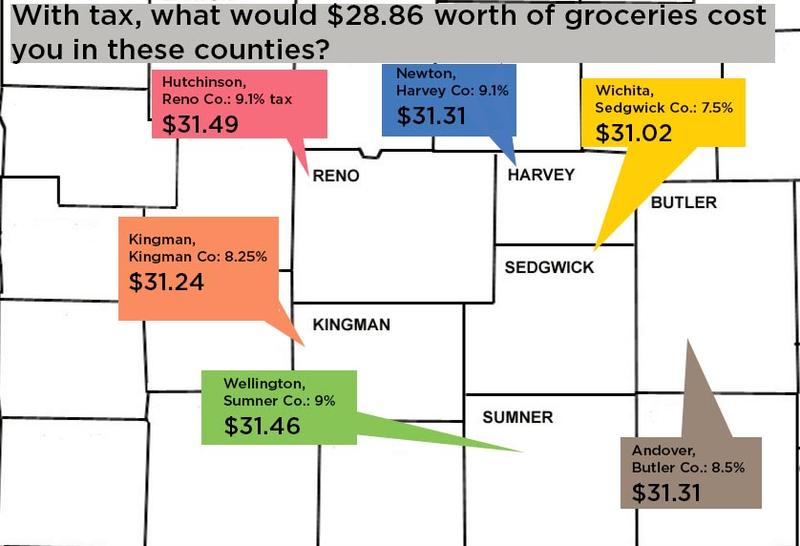

Kansas Sales Tax Pushes Shoppers Across State County Lines KMUW

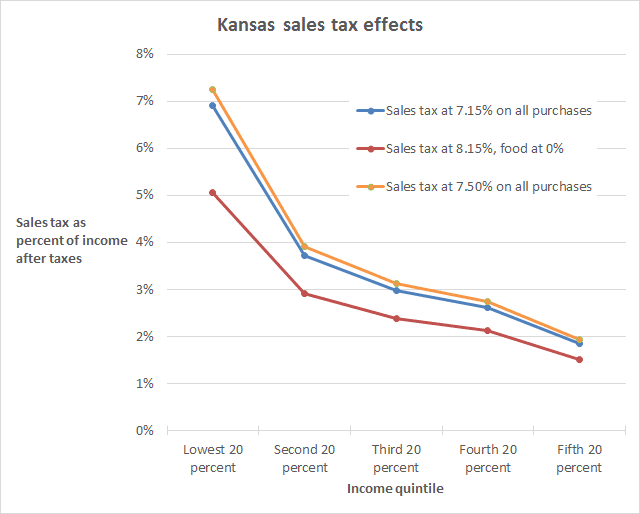

Kansas Should Adopt Food Sales Tax Amendment

Kansassales Tax Rebate - Web Return Due Date 0 400 Annual On or before January 25th ofthe following year 400 01 4 000 Quarterly On or before the 25th of themonth following the end of the