Kentucky Income Tax Filing Requirements Please click here to see if you are required to report Kentucky use tax on your individual income tax return Also see line 27 of Form 740 and the optional use tax table and use tax

Federal State Electronic Filing Individuals who use a professional tax practitioner to prepare their Kentucky income tax return can file both their state and federal returns by using the E What are Kentucky s Filing Requirements According to Kentucky Instructions for Form 740 If you were a Kentucky resident for the entire year your filing requirement depends upon your

Kentucky Income Tax Filing Requirements

Kentucky Income Tax Filing Requirements

https://www.signnow.com/preview/568/283/568283324/large.png

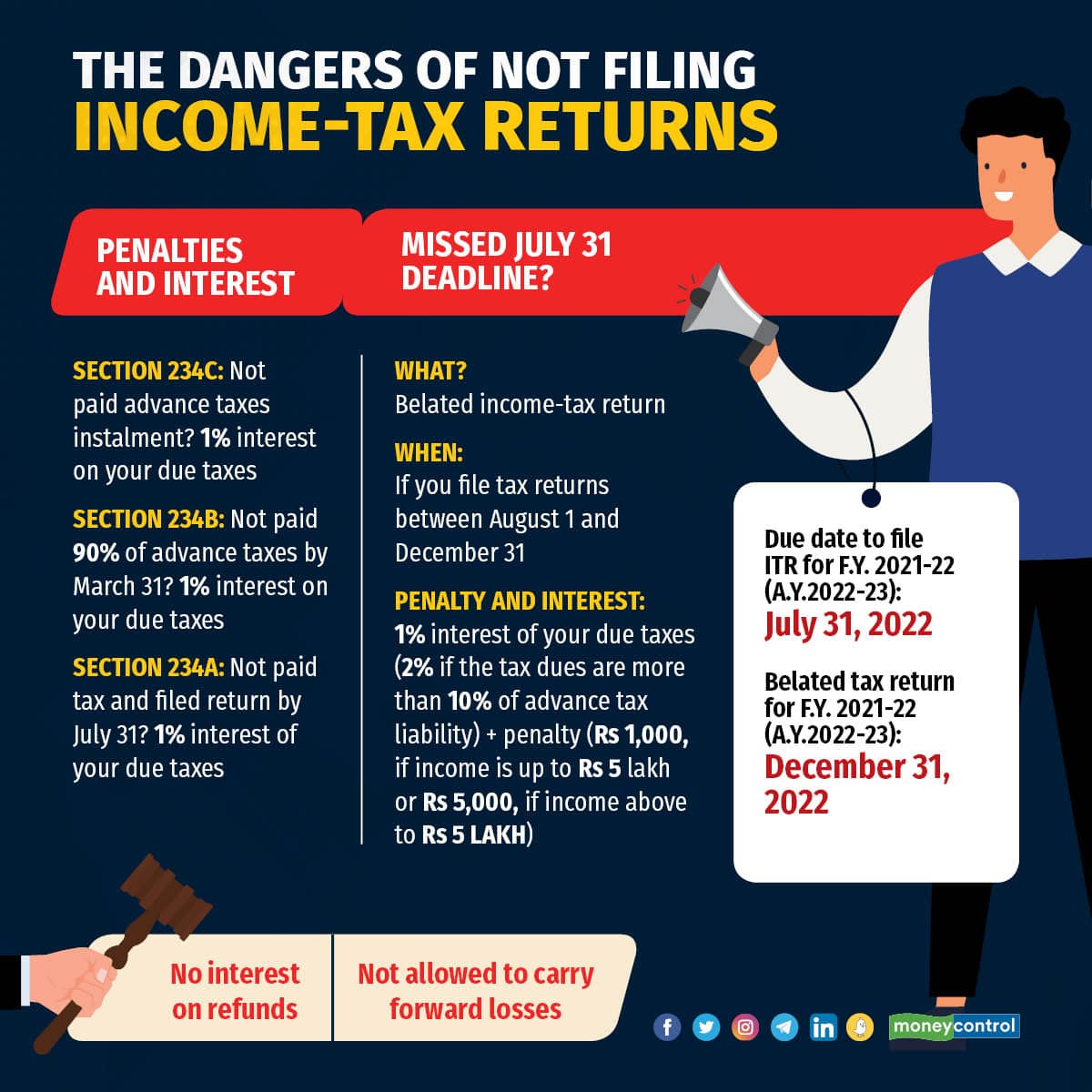

I T Return Filing Interest Penalties On The Cards If Failed To File

https://images.moneycontrol.com/static-mcnews/2022/07/Penalties-2-belate-returns-ITR-.jpg

.jpg?width=1667&name=tax graphic_2020 (1).jpg)

What To Expect When Filing Your Taxes This Year

https://www.churchillmortgage.com/hs-fs/hubfs/tax graphic_2020 (1).jpg?width=1667&name=tax graphic_2020 (1).jpg

KY File will allow you to file your returns electronically and receive a paper check sooner Direct deposit is not an option with KY File You may also choose to use KY File and Yes estimated tax payments are required to cover this potential liability However as a general rule estimated tax payments are not required if you owe less than 500 in tax I am retired

The Kentucky Department of Revenue is committed to helping you understand Kentucky income tax law changes keeping you updated and answering your questions Links to the Taxpayers in the 16 designated counties have until Monday May 16 2022 to file Kentucky income tax returns and submit tax payments for the following taxes individual

Download Kentucky Income Tax Filing Requirements

More picture related to Kentucky Income Tax Filing Requirements

2023 Income Tax Filing Threshold Printable Forms Free Online

https://www.taxestalk.net/wp-content/uploads/a-reader-asks-im-dying-to-vote-in-the-u-s-prez-election-but-will.jpeg

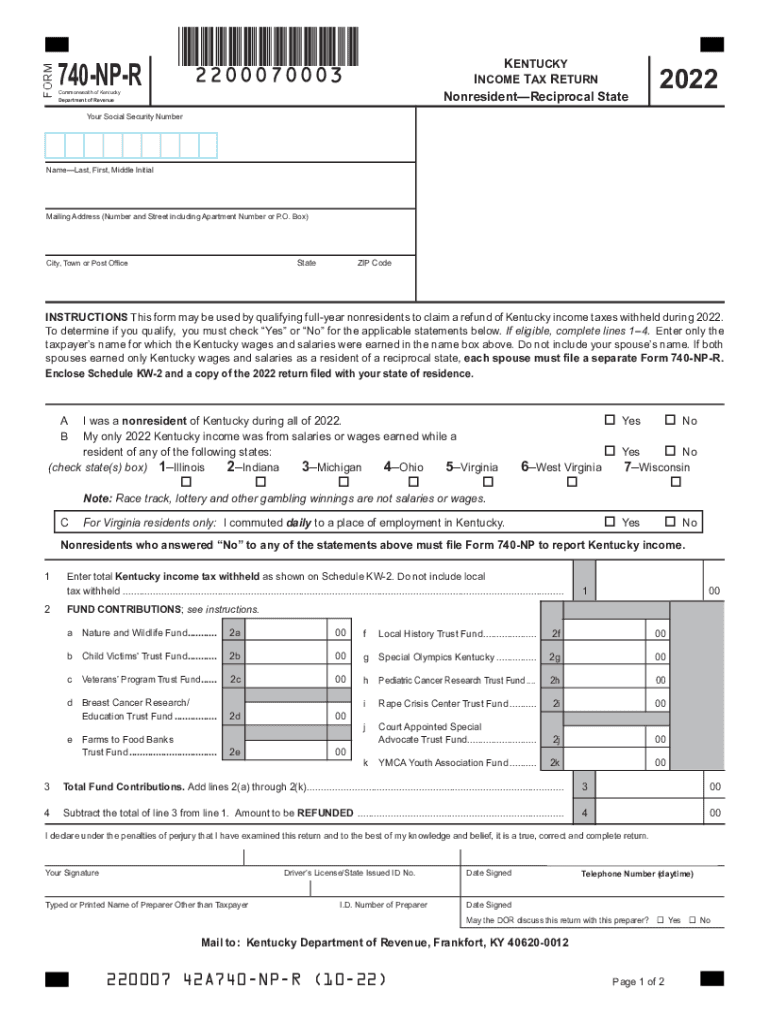

Kentucky Nonresident Filing Requirements Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/625/173/625173001/large.png

Income Tax Return Know Why Taxpayers Shouldn t File ITR For FY 2021 22

https://studycafe.in/wp-content/uploads/2022/04/Income-Tax-Return-Filing.jpg

This is a detailed guide on how to file your federal taxes in Kentucky how to know if you qualify how to file them and more Download or print the 2023 Kentucky Income Tax Instructions Form 740 Individual Full Year Resident Income Tax Instructions Packet for FREE from the Kentucky Department of Revenue

The updated IRC date means that Kentucky does conform to the IRC Section 174 changes requiring taxpayers to capitalize and amortize R E expenses for taxable years beginning on or The deadline for Kentuckians to file 2023 returns is Monday April 15 2024 The Internal Revenue Service IRS will also begin accepting federal individual income tax returns

State Income Tax Filing Deadline Is Monday

https://www.shreveporttimes.com/gcdn/-mm-/56a8801fe06a19e55d35e1cf70d32bdba23183ab/c=0-248-4752-2921/local/-/media/2016/02/18/Shreveport/B9320987364Z.1_20160218004432_000_G2FDG5CBA.1-0.jpg?width=3200&height=1801&fit=crop&format=pjpg&auto=webp

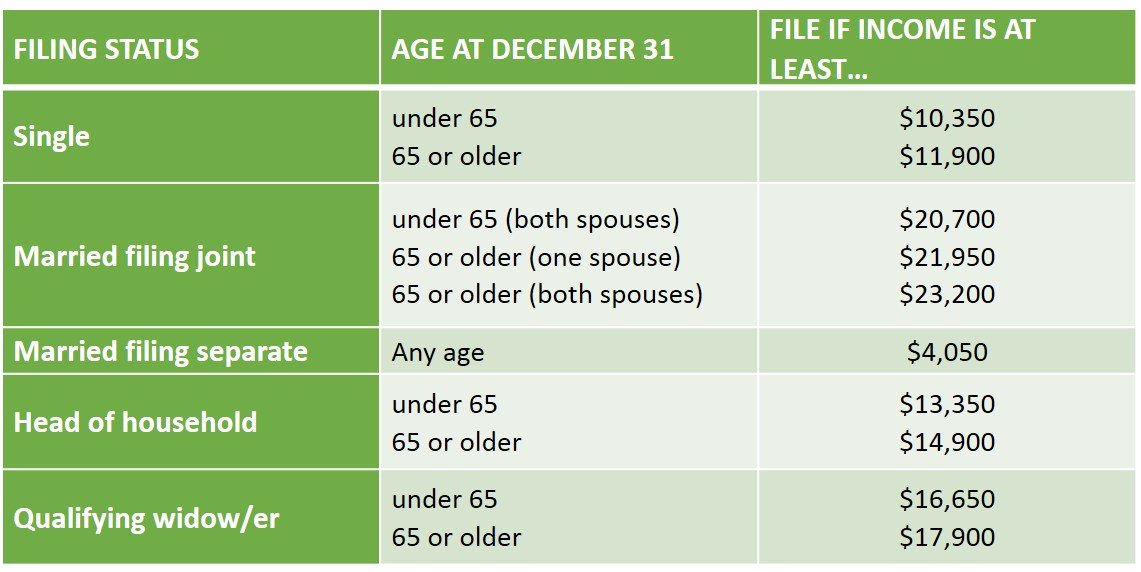

Income Tax Return Filing Requirements Explained How To Know When To

https://i.ytimg.com/vi/f99735nYVm0/maxresdefault.jpg

https://revenue.ky.gov/Individual/Individual-Income-Tax

Please click here to see if you are required to report Kentucky use tax on your individual income tax return Also see line 27 of Form 740 and the optional use tax table and use tax

https://revenue.ky.gov/Forms/740 Packet...

Federal State Electronic Filing Individuals who use a professional tax practitioner to prepare their Kentucky income tax return can file both their state and federal returns by using the E

ITR How To File Income Tax Return In Just 30 Minutes

State Income Tax Filing Deadline Is Monday

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

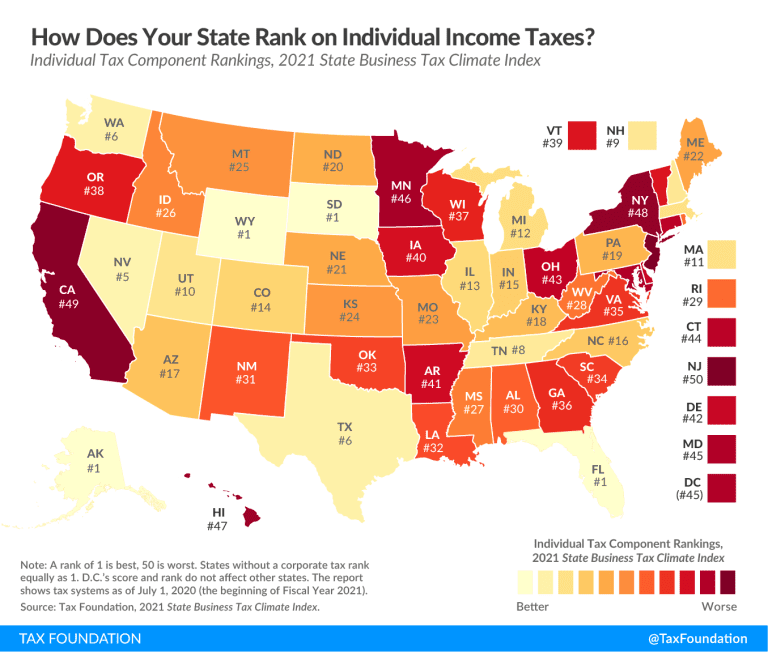

Best Worst State Income Tax Codes Tax Foundation

IRS Tax Charts 2021 Federal Withholding Tables 2021

Income Tax Filing Requirements For Retirees In Good Health Central

Income Tax Filing Requirements For Retirees In Good Health Central

Federal Tax Filing Us Federal Tax Filing Status

:max_bytes(150000):strip_icc()/TaxFilingChart-b3b0026b04464a8da66bcf7c9e479b65.jpg)

168 168

ITR Filing For AY 2023 24 Begins With CBDT s Excel Utilities For ITR 1

Kentucky Income Tax Filing Requirements - Distilling the complex codes jurisdictions and requirements is complex This guide will provide a 101 overview of each of Kentucky s taxes and explain how they work