Kentucky Low Income Housing Tax Credits The Low Income Housing Tax Credits Program promotes the development of low income rental housing through tax incentives Tax Exempt Bond Financing KHC expanded funding

The Home Buyer Tax Credit program is designed to help low to moderate income families afford home ownership It allows income eligible homebuyers to claim a dollar for dollar tax credit Statewide the Housing Credit has provided more than 44 800 affordable homes for low income families seniors veterans and people with disabilities See the state fact sheet to learn more

Kentucky Low Income Housing Tax Credits

Kentucky Low Income Housing Tax Credits

https://cdn.arcgis.com/sharing/rest/content/items/83750598bd92465e86404dd077860f99/resources/qjnd2XlzZAJ2jpi-XHNf-.png?w=400

Low Income Housing Tax Credits NHLP Are na

https://images.are.na/eyJidWNrZXQiOiJhcmVuYV9pbWFnZXMiLCJrZXkiOiI1ODQ0MTk2L29yaWdpbmFsX2JkMzcyYzhlODgxYzkzZWQ4Y2IyYTk3OGM1ZGJkZGQ1LnBuZyIsImVkaXRzIjp7InJlc2l6ZSI6eyJ3aWR0aCI6MTIwMCwiaGVpZ2h0IjoxMjAwLCJmaXQiOiJpbnNpZGUiLCJ3aXRob3V0RW5sYXJnZW1lbnQiOnRydWV9LCJ3ZWJwIjp7InF1YWxpdHkiOjkwfSwianBlZyI6eyJxdWFsaXR5Ijo5MH0sInJvdGF0ZSI6bnVsbH19?bc=0

Low Income Housing Tax Credits NHLP

https://www.nhlp.org/wp-content/uploads/2017/09/LIHTC-736x490.jpg

Low to moderate income residents in the state of Kentucky This manual addresses the requirements for one of those programs Low Income Housing Tax Credit LIHTC The With a Tax Credit from KHC you will get a direct dollar for dollar reduction in your federal income taxes worth 20 percent of the mortgage interest you pay on your mortgage each year

In wages business income generated 2 825 billion in tax revenue generated 96 481 low income households served The Housing Credit is our nation s most successful tool for The KHC keeps rec ords of all the properties in Kentucky that receive tax credits You can ask the KHC for a list of these properties either through their website link https

Download Kentucky Low Income Housing Tax Credits

More picture related to Kentucky Low Income Housing Tax Credits

The Disruption Of The Low Income Housing Tax Credit Program

https://s2.studylib.net/store/data/014789917_1-7b548a50c4626fad4c16925151add20b-768x994.png

Twinning 9 And 4 Low Income Housing Tax Credits SVA

https://accountants.sva.com/hs-fs/hubfs/sva-certified-public-accountants-eguide-twinning-9-percent-and-4-percent-low-income-housing-tax-credits-in-the-same-development.png?width=903&height=1005&name=sva-certified-public-accountants-eguide-twinning-9-percent-and-4-percent-low-income-housing-tax-credits-in-the-same-development.png

Introduction To The Low Income Housing Tax Credit LIHTC Program

https://training.ahta.online/CServer/Image/F8524556B6934A3F871607DE7863416B/F8524556B6934A3F871607DE7863416B.png

Legislation introduced in the Kentucky House of Representatives this week would create a state low income housing tax credit LIHTC H B 86 would create the Kentucky Shortage of affordable rental housing by supporting the Low Income Housing Tax Credit 46 350 homes developed or preserved in KY 73 206 jobs supported for one year 8 22 billion

By Christine Serlin Kentucky Housing Corp KHC has awarded 13 7 million in 2019 low income housing tax credits LIHTCs to 19 developments across the state in conjunction with 2 1 million in HOME funds The properties must be utilizing low income housing tax credits LIHTC low interest HUD loans tax exempt bond financing rent subsidies guaranteed loans or

How To Calculate Low Income Housing Tax Credits LIHTC YouTube

https://i.ytimg.com/vi/lSBiboJkhP4/maxresdefault.jpg

Low Income Housing Tax Credit Program 2017 Qualified Allocation Plan

https://azmemory.azlibrary.gov/assets/display/832965-max?u=2022-05-19+02:28:24

https://www.kyhousing.org/Partners/Developers/...

The Low Income Housing Tax Credits Program promotes the development of low income rental housing through tax incentives Tax Exempt Bond Financing KHC expanded funding

https://wapps.kyhousing.org/KHC_Webforms/...

The Home Buyer Tax Credit program is designed to help low to moderate income families afford home ownership It allows income eligible homebuyers to claim a dollar for dollar tax credit

Low Income Housing Tax Credit Program 2016 Qualified Allocation Plan

How To Calculate Low Income Housing Tax Credits LIHTC YouTube

Benefits Of Combining The LIHTC HUD FHA Financing LSG Lending Advisors

Figure 1 From HOW DO LOW INCOME HOUSING TAX CREDIT PROJECTS TRIGGER

Introduction To Low Income Housing Tax Credits By Michael J Novogradac

Housing Readiness Fact Sheet Low Income Housing Tax Credits

Housing Readiness Fact Sheet Low Income Housing Tax Credits

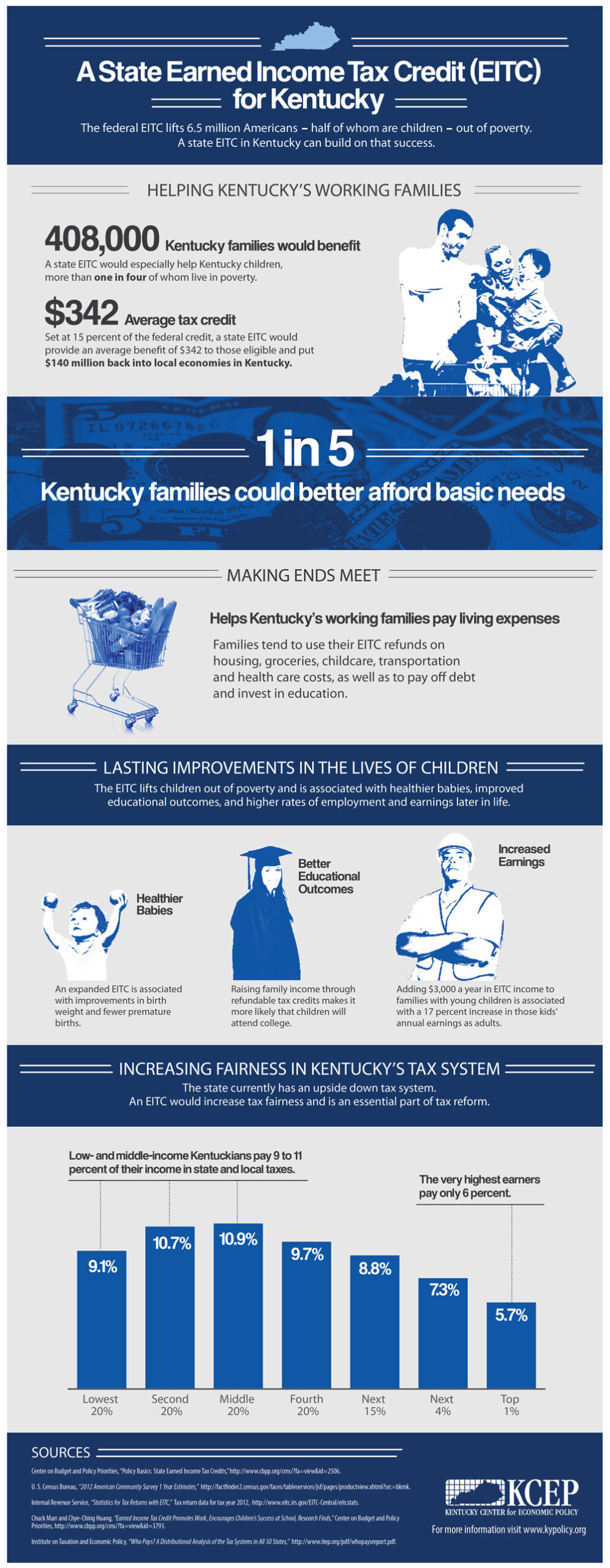

Infographic A State Earned Income Tax Credit EITC For Kentucky

UrbanWorks Architecture Minneapolis MN Architecture And Low Income

Pending Low Income Tax Credit Expiration Could Cost 2 000 Affordable

Kentucky Low Income Housing Tax Credits - FRANKFORT Ky Kentucky Housing Corporation KHC recently awarded more than 12 5 million in Low Income Housing Tax Credits Housing Credits and other