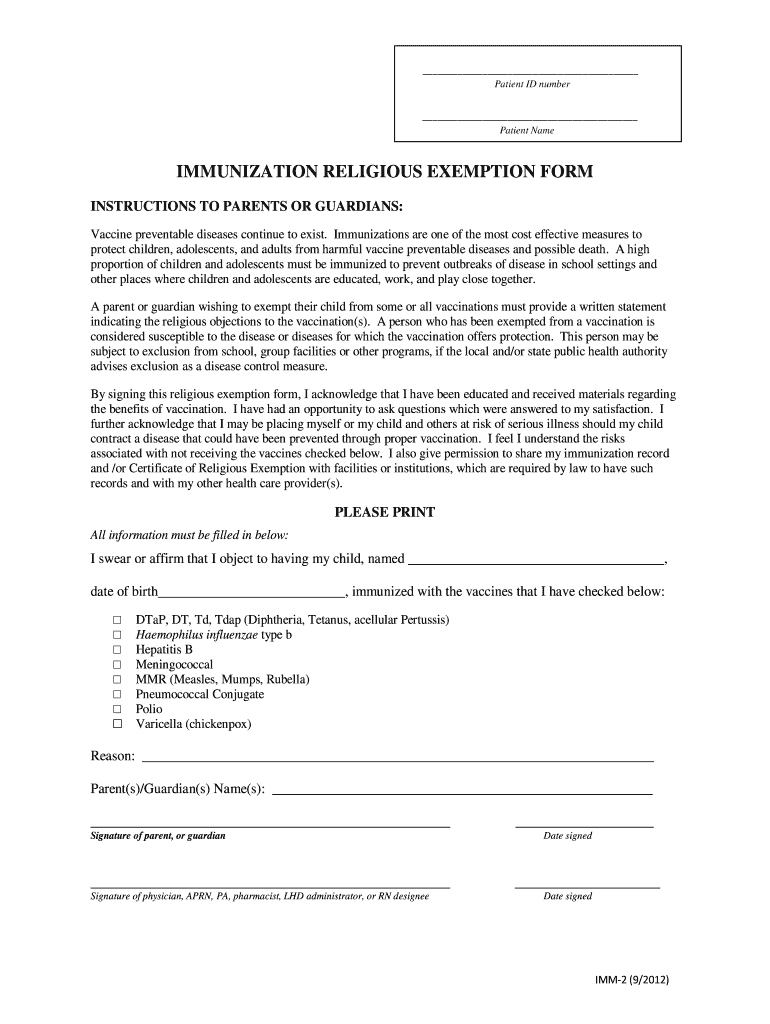

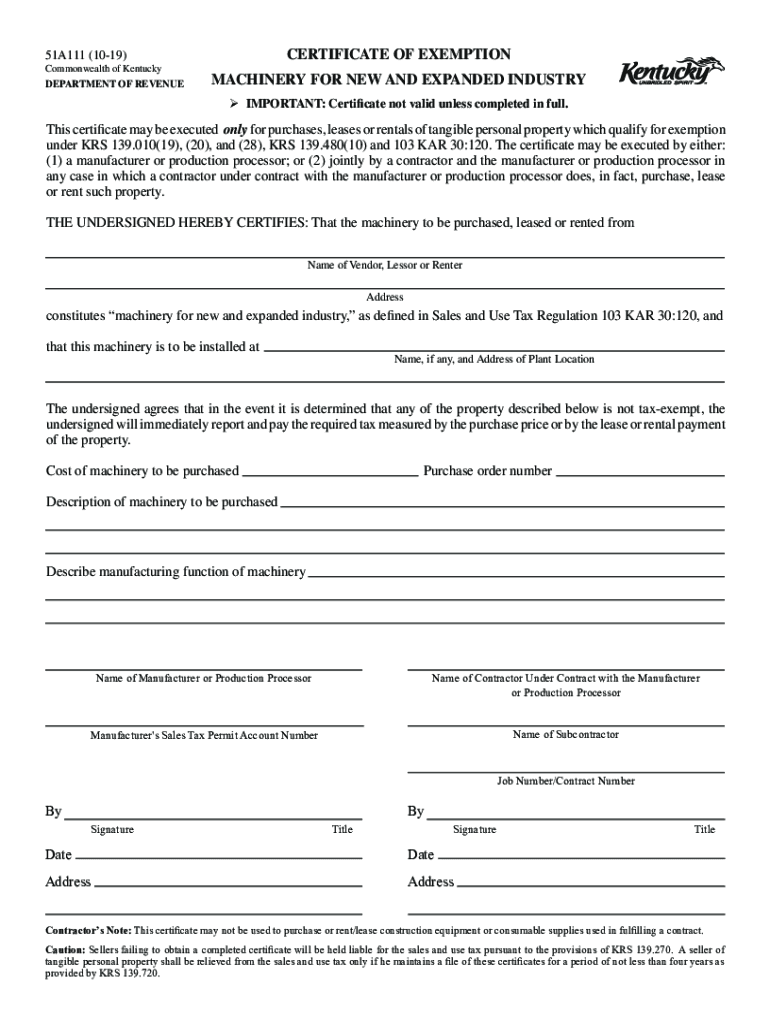

Kentucky Sales Tax Exemption Manufacturing Web 51A111 9 21 CERTIFICATE OF EXEMPTION Commonwealth of Kentucky DEPARTMENT OF REVENUE MACHINERY FOR NEW AND EXPANDED INDUSTRY IMPORTANT Certificate not valid unless completed in full

Web 2 Sept 2021 nbsp 0183 32 Kentucky s sales and use tax exemptions for machinery equipment and supplies used in the manufacturing process are one fickle beast Kentucky courts have grappled with the intricacies of placing definitions on what can and cannot fall under these exemptions for decades often leaving taxpayers to reconcile conflicting or at least Web In summary the following four 4 specific requirements must be met before machinery qualifies for exemption It must be machinery It must be used directly in the manufacturing process It must be incorporated for the first time into plant facilities established in this state It must not replace other machinery Section 2

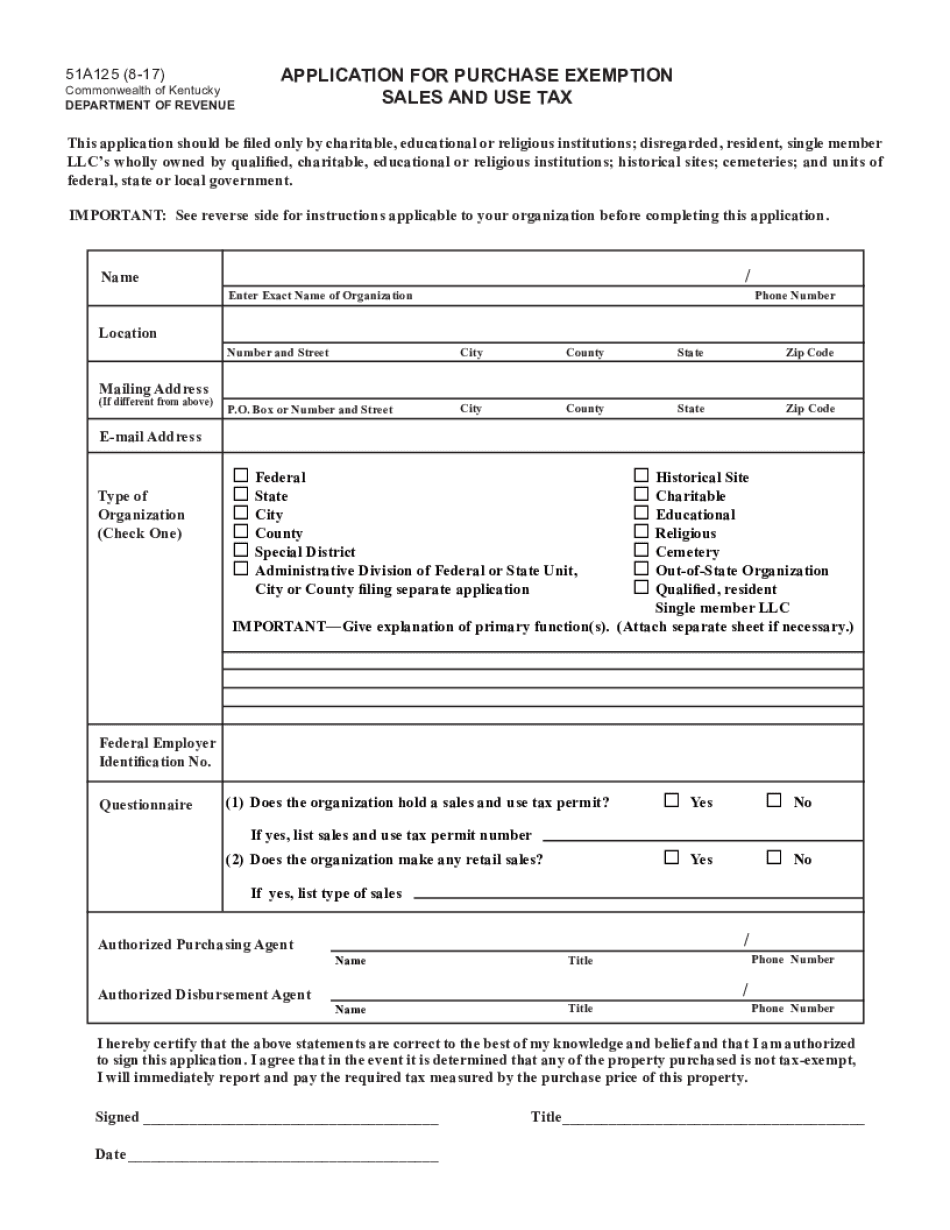

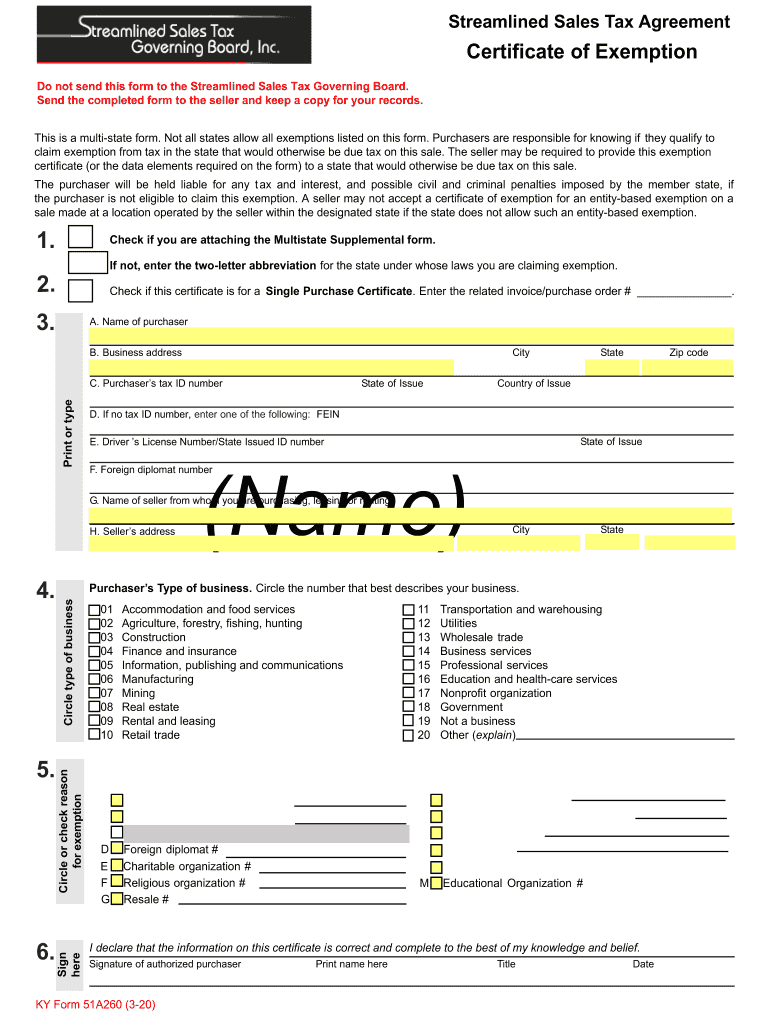

Kentucky Sales Tax Exemption Manufacturing

Kentucky Sales Tax Exemption Manufacturing

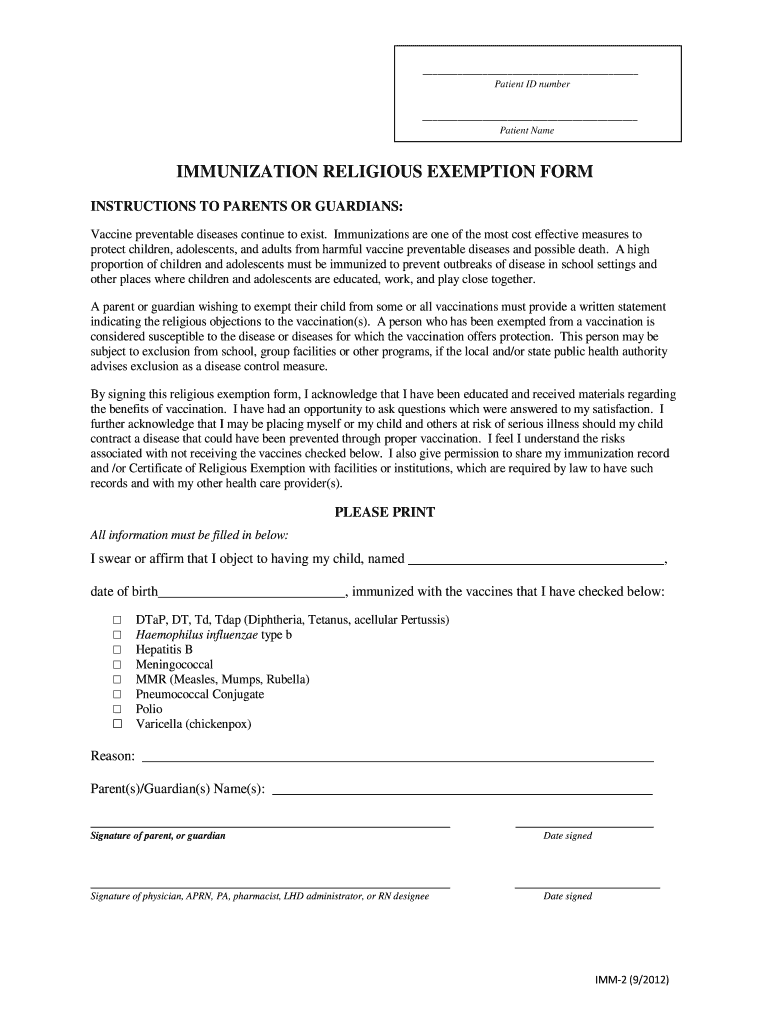

https://www.signnow.com/preview/17/739/17739250/large.png

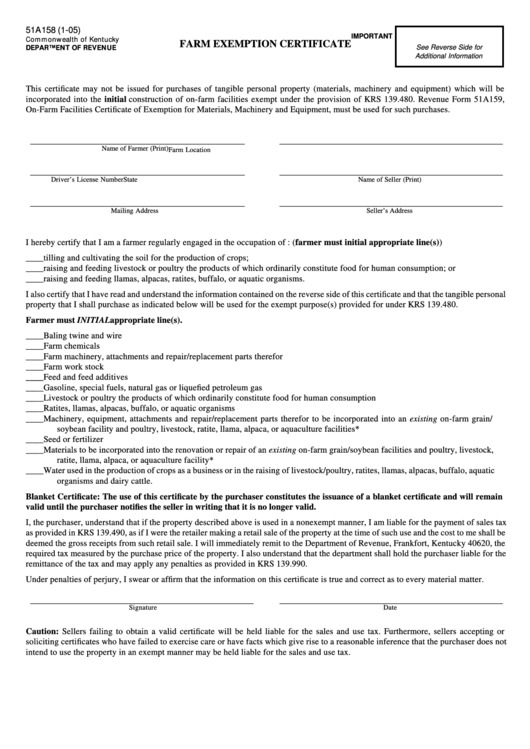

Kentucky Sales Tax Exemption Form ExemptForm

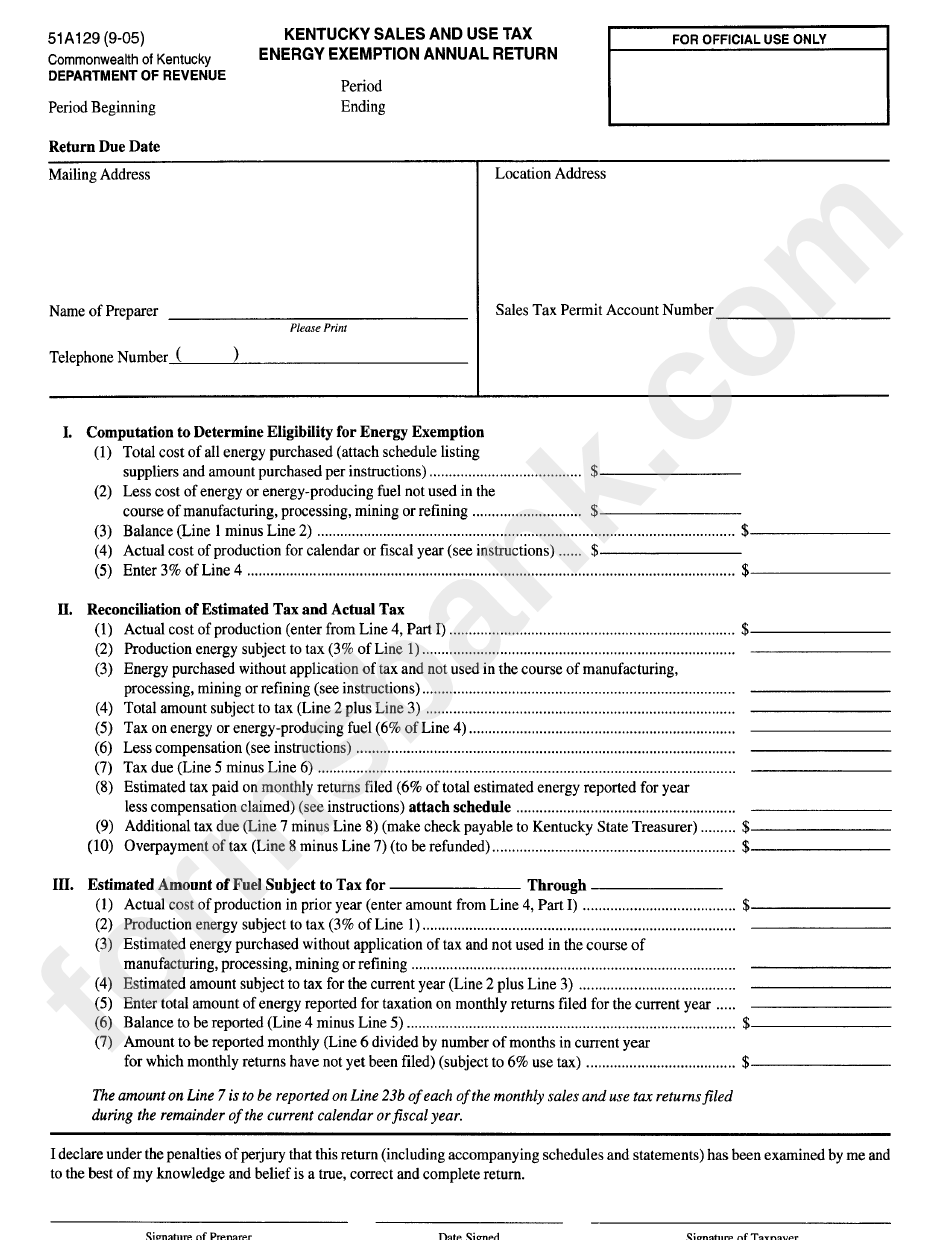

https://www.exemptform.com/wp-content/uploads/2022/08/kentucky-sales-and-use-tax-energy-exemption-annual-return-form.png

Kentucky Sales Tax Farm Exemption Form Fill Online Printable

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/kentucky-sales-tax-farm-exemption-form-fill-online-printable-4.png?fit=770%2C1024&ssl=1

Web 15 Juli 2019 nbsp 0183 32 DOR has also created a new certificate Form 51A360 for manufacturers and industrial processors to claim the exemption found in KRS 139 470 22 This exemption applies to separately stated charges for labor or services to apply install repair or maintain tangible personal property directly used in the manufacturing or industrial Web ultimately pay sales or use taxes on the sale at retail of such manufactured goods Anti pyramiding provisions like the manufacturing supplies exemption the materials exemption for ingredients and component parts the industrial tools exemption manufacturing machinery exemptions and resale exemptions are what make a

Web a public digital ledger All sales and use tax exemptions related to manufacturers New amp Expanded Industry Industrial Tools amp Supplies and Energy Direct Pay require the manufacturing or industrial processing of tangible personal property for the production of a tangible product for sale See KRS 139 480 3 Web 16 Dez 2022 nbsp 0183 32 The exemption exists to encourage manufacturing in Kentucky and to avoid tax pyramiding in which taxes are layered on top of other taxes and function to inflate prices for end consumers Under this same law items that qualify as replacement repair or spare parts are excluded from the exemption meaning they are subject to

Download Kentucky Sales Tax Exemption Manufacturing

More picture related to Kentucky Sales Tax Exemption Manufacturing

Tax Exempt Forms San Patricio Electric Cooperative

https://www.sanpatricioelectric.org/sites/default/files/inline-images/SPEC SALES TAX FORM Example.jpg

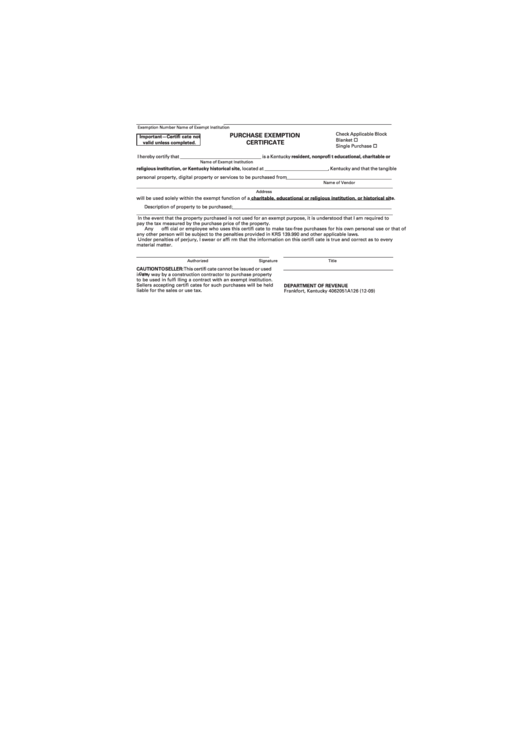

Purchase Exemption Certificate Kentucky Form 51a143 Purchase Exemption

https://data.formsbank.com/pdf_docs_html/114/1146/114631/page_1_thumb_big.png

Sst Manufacturer Who Are Exempted From Sales Tax Part 2

https://blog.treezsoft.com/upload/blog/353/mysstfinalFix.jpg

Web KRS 139 480 exempts specified property from sales and use taxes This administrative regulation interprets the sales and use tax law as it applies to exemption qualification for quot machinery for new and expanded industry quot Section 1 Definitions 1 quot Directly used in the manufacturing or industrial processing process quot is defined by KRS 139 010 12 Web 19 Dez 2022 nbsp 0183 32 The Kentucky Supreme Court has ruled to protect an important manufacturing sales tax exemption from becoming hollowed out in an opinion released last week

Web 25 Okt 2021 nbsp 0183 32 Every manufacturer with a plant in Kentucky purchases supplies used in their manufacturing operations to which the manufacturing supplies exemption of KRS 139 470 9 b 2 b may apply to exempt such supplies for sales and use tax purposes Accordingly this particular exemption is of widespread application and importance to Web In the state of Kentucky any sorts of energy and energy producing fuels which are used in manufacturing processing refining or fabricating are considered to be exempt to the extent that the cost of the energy or fuel exceeds 3 of the cost of production gt Back to Kentucky Sales Tax Handbook Top

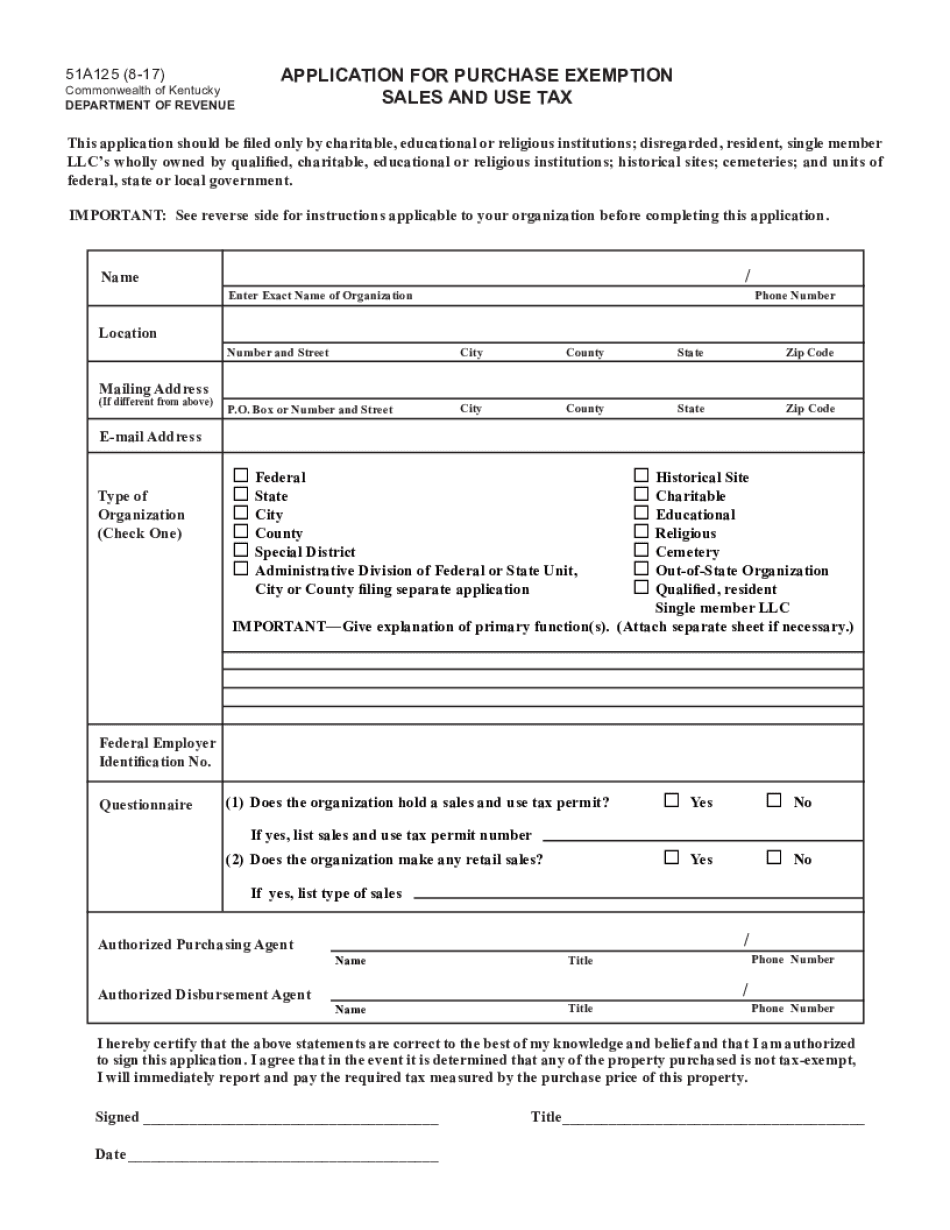

Kentucky Tax Exempt 2017 2023 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/522/624/522624636/big.png

Affidavit Of Tax Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/affidavit-of-exemption-kentucky-tax-exemption-printable-pdf-download.png

https://revenue.ky.gov/Forms/51A111 (9-21).pdf

Web 51A111 9 21 CERTIFICATE OF EXEMPTION Commonwealth of Kentucky DEPARTMENT OF REVENUE MACHINERY FOR NEW AND EXPANDED INDUSTRY IMPORTANT Certificate not valid unless completed in full

https://frostbrowntodd.com/kentucky-tax-talk-confusion-over...

Web 2 Sept 2021 nbsp 0183 32 Kentucky s sales and use tax exemptions for machinery equipment and supplies used in the manufacturing process are one fickle beast Kentucky courts have grappled with the intricacies of placing definitions on what can and cannot fall under these exemptions for decades often leaving taxpayers to reconcile conflicting or at least

Wisconsin Sales And Use Tax Exemption Certificate Fillable

Kentucky Tax Exempt 2017 2023 Form Fill Out And Sign Printable PDF

Ky Tax Exempt Form Pdf Fill Out Sign Online DocHub

Kentucky Streamlined Tax 2020 2023 Form Fill Out And Sign Printable

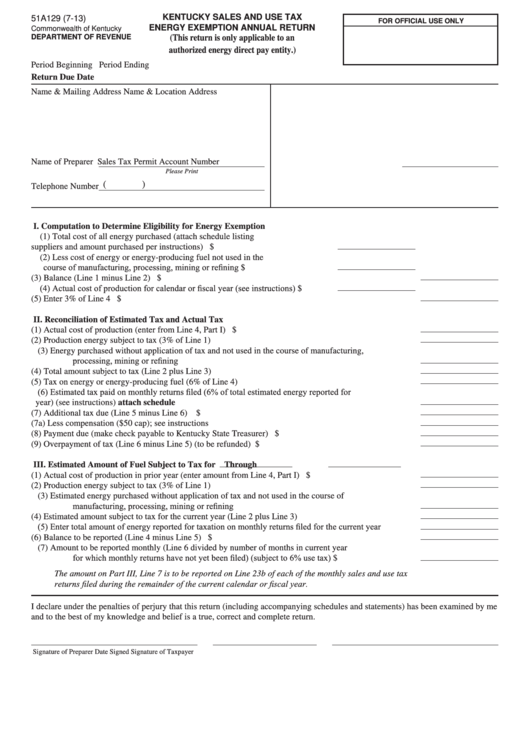

Fillable Form 51a129 Kentucky Sales And Use Tax Energy Exemption

Kentucky Sales Tax Exemption Form ExemptForm

Kentucky Sales Tax Exemption Form ExemptForm

Kentucky Sales Tax Form Pdf How To Fill Out And Use Return Db excel

Kentucky Sales Tax Exemption For Farmers Farmer Foto Collections

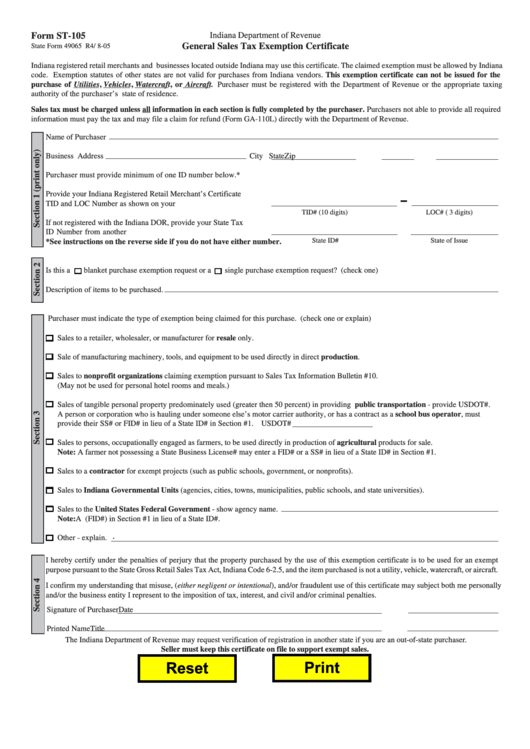

Form St 105 General Sales Tax Exemption Certificate Indiana

Kentucky Sales Tax Exemption Manufacturing - Web ultimately pay sales or use taxes on the sale at retail of such manufactured goods Anti pyramiding provisions like the manufacturing supplies exemption the materials exemption for ingredients and component parts the industrial tools exemption manufacturing machinery exemptions and resale exemptions are what make a