Kentucky State Income Tax Exemption Form Web Current Individual Income Tax Forms Schedule P Kentucky Pension Income Exclusion For all individuals who are retired from the federal government the Commonwealth of Kentucky or a Kentucky local government with service performed prior to January 1 1998 you may be able to exclude more than 31 110

Web No you do not have file a Kentucky return because your Kentucky adjusted gross income will be below the threshold amount given for filing a return Kentucky allows a pension exclusion of 31 110 and none of the Social Security income is taxable therefore your Kentucky adjusted gross income is 0 Q Web If you expect to owe more income tax for the year than will be withheld you may increase the withholding by claiming a smaller number of exemptions or you may enter into an agreement with your employer to have additional amounts withheld

Kentucky State Income Tax Exemption Form

Kentucky State Income Tax Exemption Form

https://www.certificateof.com/wp-content/uploads/2018/06/2017-PAFPI-Certificate-of-TAX-Exemption.jpg

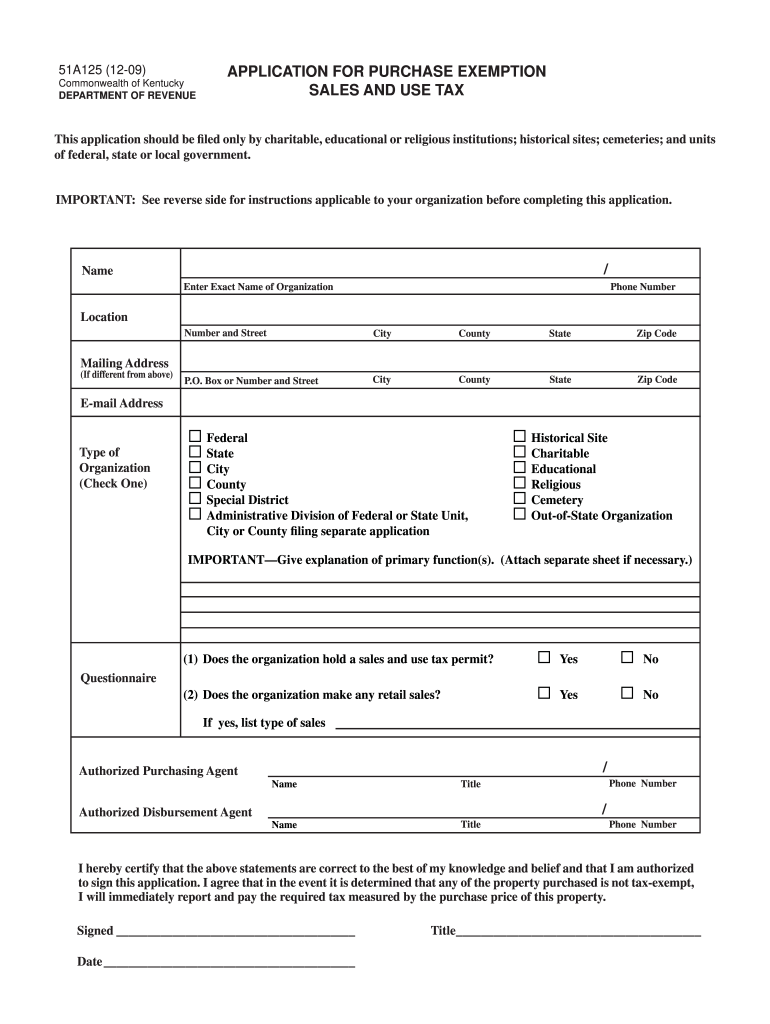

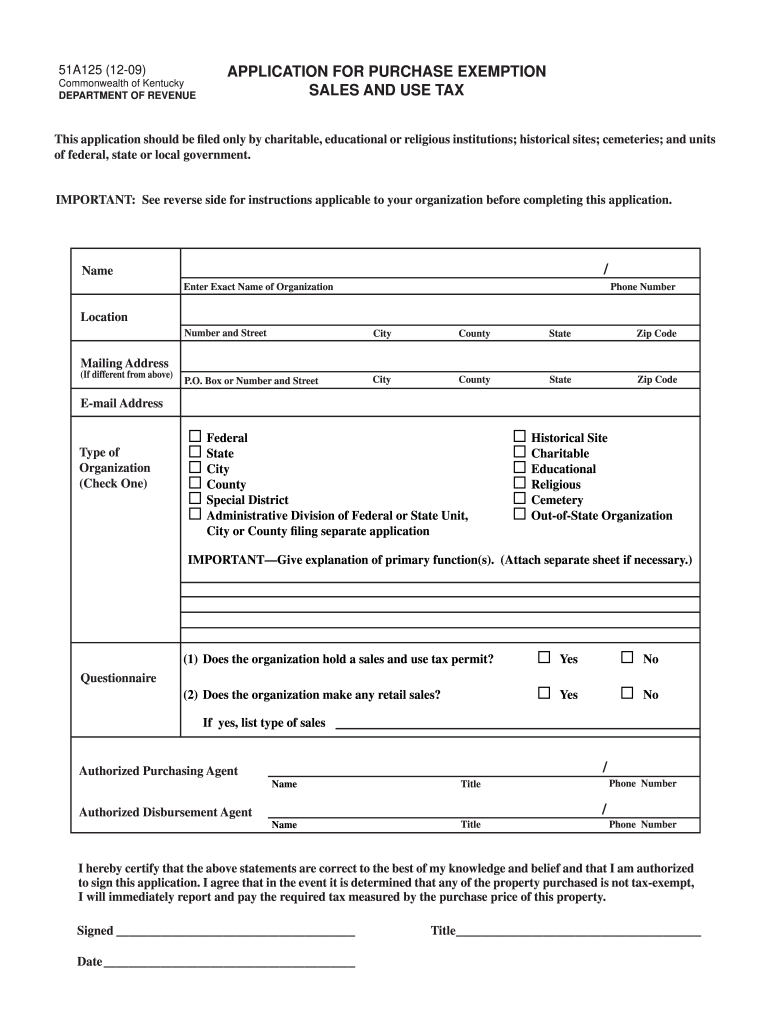

Kentucky State Exemption 2009 2024 Form Fill Out And Sign Printable

https://www.signnow.com/preview/5/503/5503386/large.png

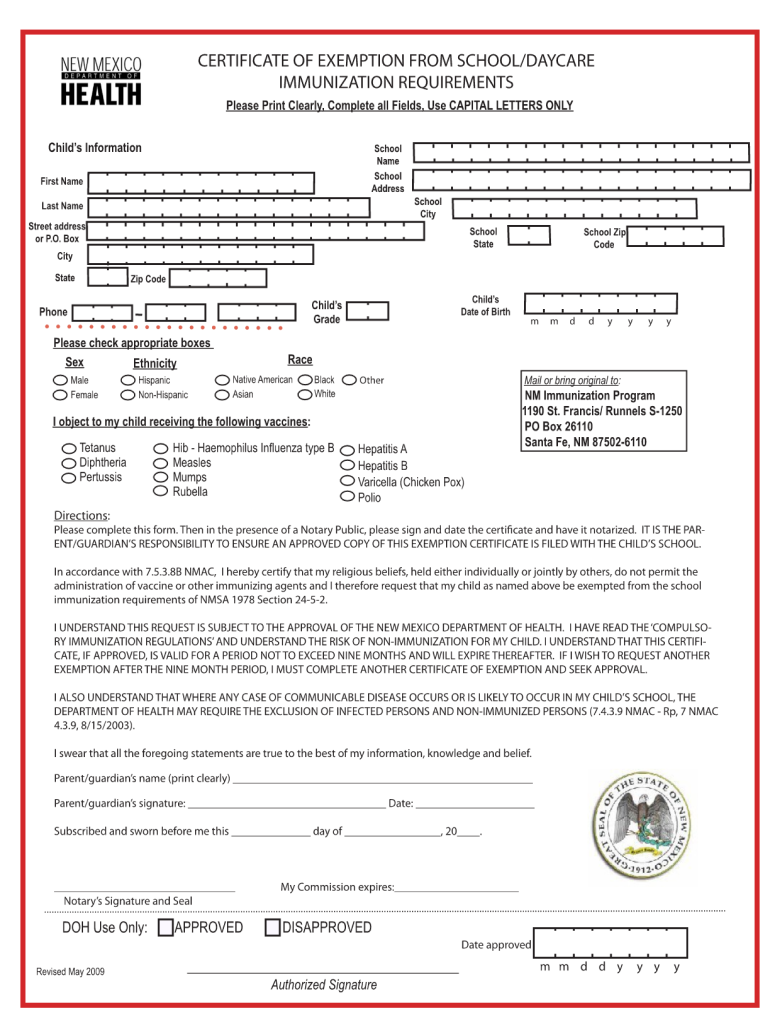

New Mexico Immunization Exemption Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/0/211/211468/large.png

Web Income Tax Liability Thresholds The 2020 filing threshold amount based upon federal poverty level is expected to be 12 760 for a family size of one singe or married living apart from your spouse for the entire year 17 240 for a family of two single with one dependent child or a married couple 21 720 for a family of three single with t Web All Kentucky wage earners are taxed at a flat 4 rate with a standard deduction allowance of 3 160 The Department of Revenue annually adjust the standard deduction in accordance with KRS 141 081 2 a Check if exempt 1 Kentucky income tax liability is not expected this year see instructions 2

Web A disaster response business is exempt from income tax under KRS 141 040 corporations and KRS 141 020 sole proprietorships if the disaster response business has no presence in Kentucky and conducts no business in Kentucky except for disaster or emergency related work Web the amount of exempt retirement income For assistance calculating your exempt percentage you may visit revenue ky gov Worksheet for Federal Kentucky State and Kentucky Local Government Retirees Who Retired After 12 31 97 Complete this worksheet to determine what percentage of your pension income is exempt This

Download Kentucky State Income Tax Exemption Form

More picture related to Kentucky State Income Tax Exemption Form

Ky Tax Exempt Form Pdf Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/100/59/100059081/large.png

Fill Free Fillable Application For Sales Tax Certificate Of Exemption

https://images.sampletemplates.com/wp-content/uploads/2016/12/19155835/Sales-and-Use-Tax-Exemption-Certificate-Form.jpg

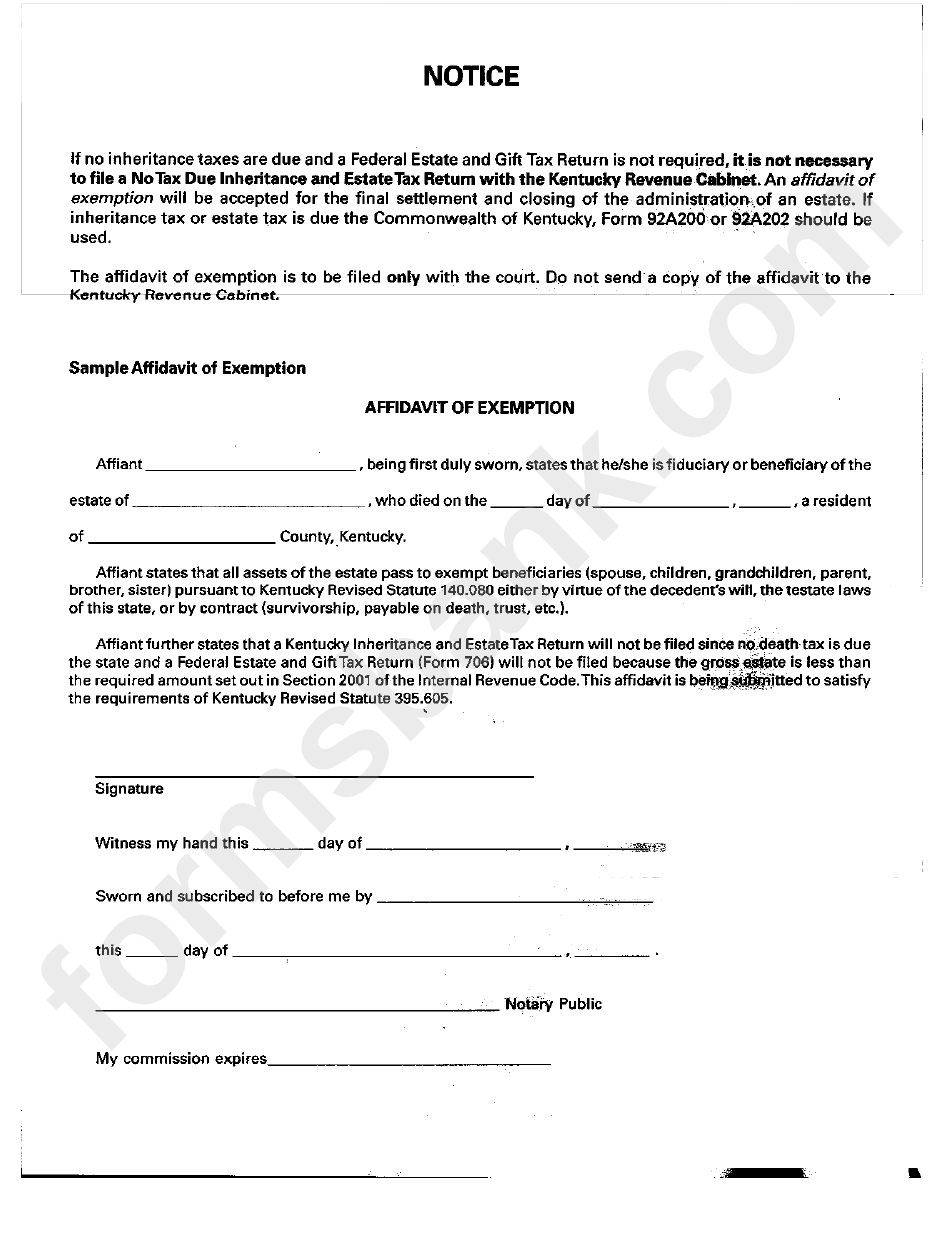

Affidavit Of Exemption Kentucky Tax Exemption Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/266/2664/266406/page_1_bg.png

Web The Kentucky Department of Revenue released the draft 2021 income tax withholding tables and computer formulato its website A draft 2021 Form K 4 Kentucky s Withholding Certificate has also been released The final versions are expected to be published in December 2020 Web The Kentucky K 4 Form for Withholding Exemption Explore the Kentucky K 4 Withholding Exemption Form its relevance in state tax eligibility criteria and ASAP Payroll s Solutions help Explore the Kentucky K 4 Withholding Exemption Form its relevance in state tax eligibility criteria and ASAP Payroll s Solutions help

Web Active Duty Military Pay Income Tax Exemption Kentucky does not tax active duty military pay All military pay received by members of the Armed Forces while on active duty can be excluded from Kentucky income KRS 141 019 1 I KRS 141 175 1 a Active Duty means the day you assemble at your armory or other designated place until the Web Vor 4 Tagen nbsp 0183 32 Tax Interest Rate Update for 1 1 24 DOR Announces Updates to Individual Income Tax for 2024 Tax Year June 2023 Sales Tax Facts with Guidance Updates Now Available Pre Register for PVA Special Examination for Franklin and Graves Counties New Pass through Entity Tax Forms Available for Filing

State Lodging Tax Exempt Forms ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/ny-hotel-tax-exempt-fill-online-printable-fillable-blank-pdffiller-8.png

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

https://www.sanpatricioelectric.org/sites/sanpatricioelectric/files/inline-images/SPEC SALES TAX FORM Example.jpg

https://revenue.ky.gov/Individual/Individual-Income-Tax

Web Current Individual Income Tax Forms Schedule P Kentucky Pension Income Exclusion For all individuals who are retired from the federal government the Commonwealth of Kentucky or a Kentucky local government with service performed prior to January 1 1998 you may be able to exclude more than 31 110

https://revenue.ky.gov/Individual/Individual-Income-Tax/Pages/Do-I...

Web No you do not have file a Kentucky return because your Kentucky adjusted gross income will be below the threshold amount given for filing a return Kentucky allows a pension exclusion of 31 110 and none of the Social Security income is taxable therefore your Kentucky adjusted gross income is 0 Q

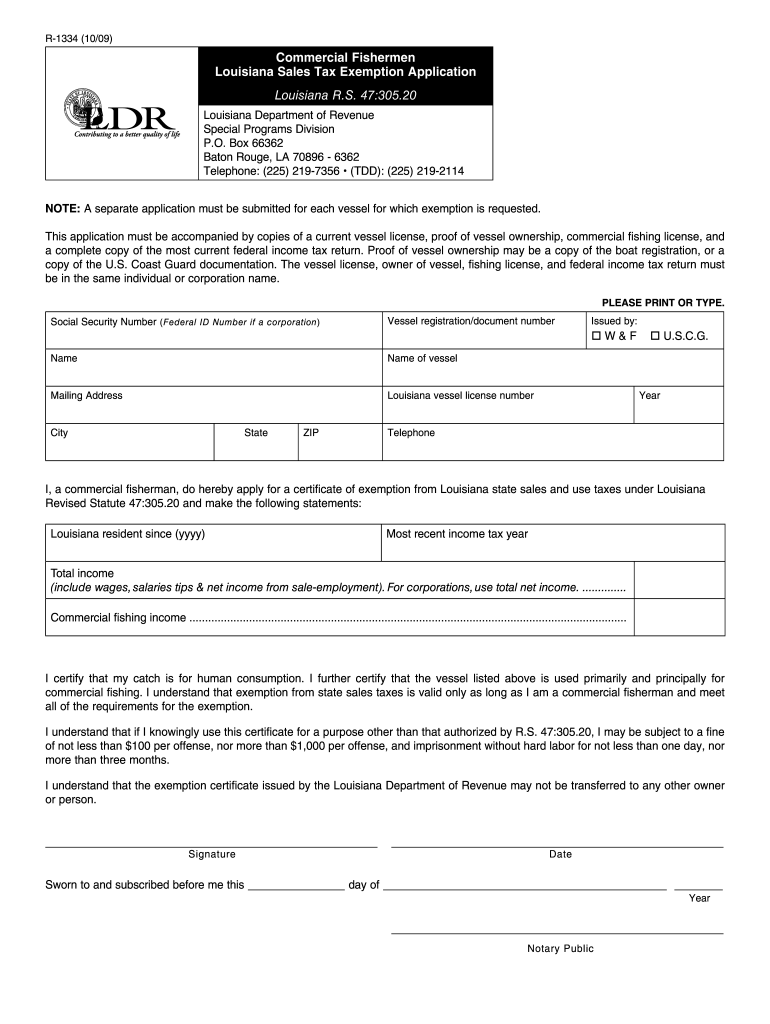

Louisiana Resale Certificate PDF Form Fill Out And Sign Printable PDF

State Lodging Tax Exempt Forms ExemptForm

Income Tax Exemption Form 5 Here s What No One Tells You About Income

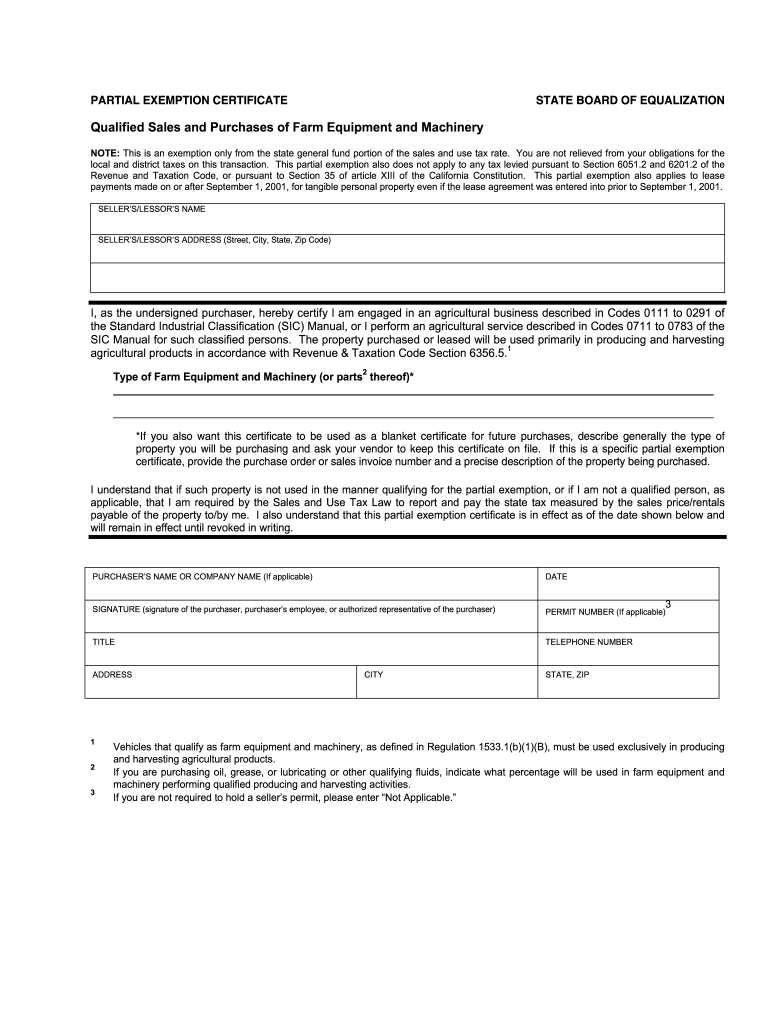

California Farm Tax Exemption Form Fill Out And Sign Printable PDF

Tax Exempt Form Fill Online Printable Fillable Blank PdfFiller

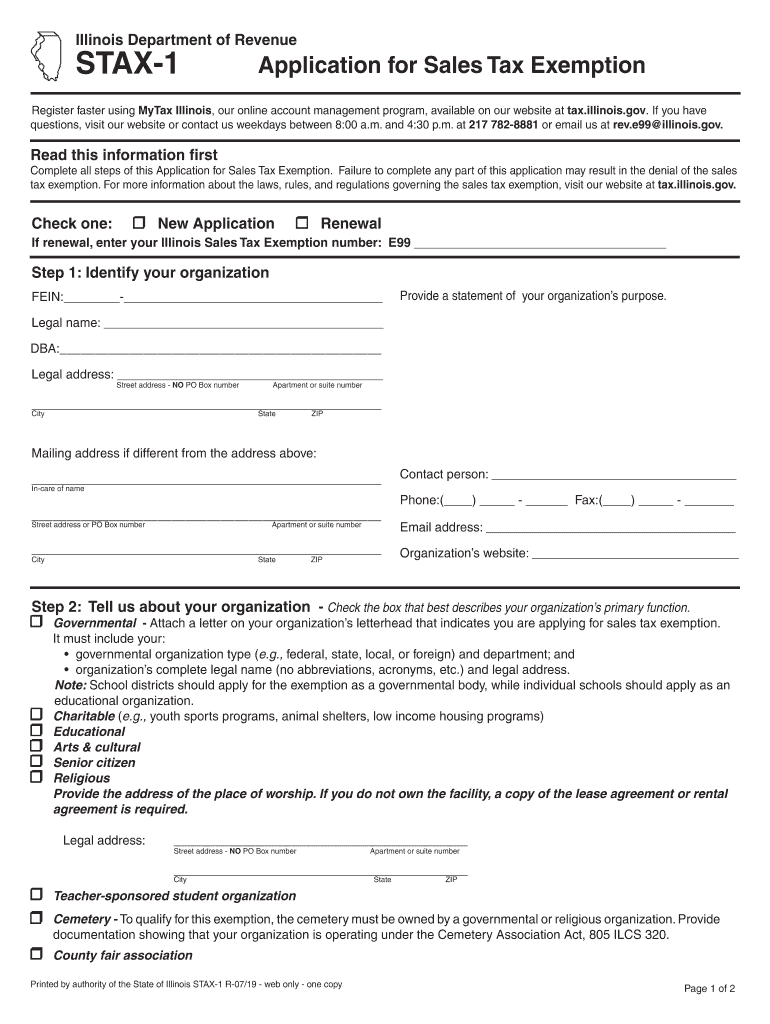

IL STAX 1 2019 Fill Out Tax Template Online US Legal Forms

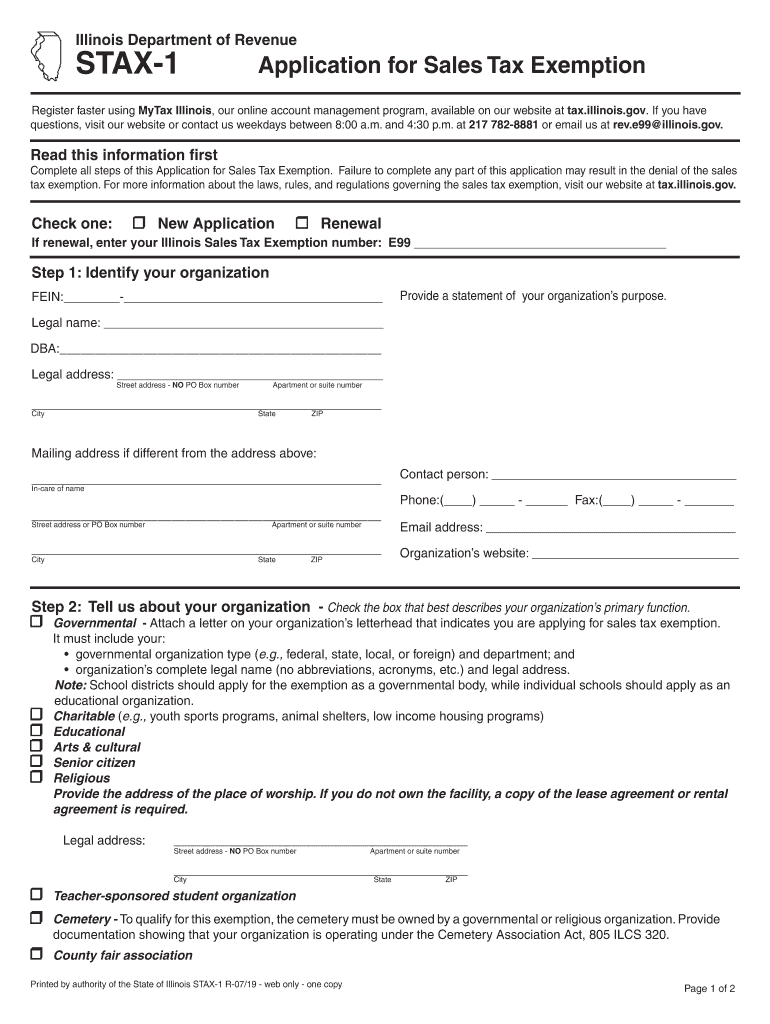

IL STAX 1 2019 Fill Out Tax Template Online US Legal Forms

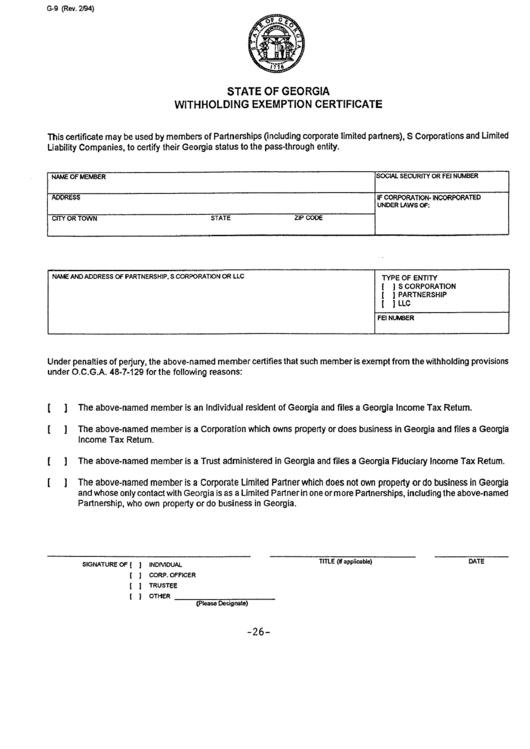

Georgia State Tax Exemption Form ExemptForm

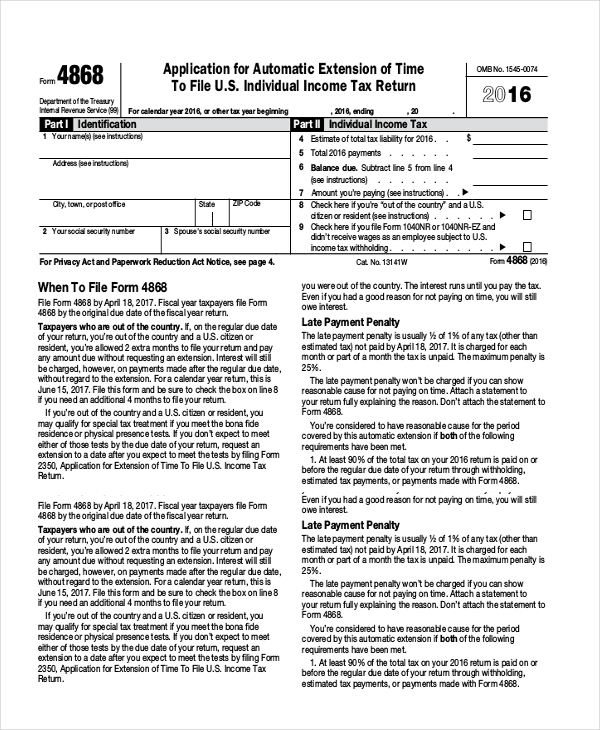

2023 Federal Tax Exemption Form ExemptForm

Sales Taxes In The United States Wikipedia

Kentucky State Income Tax Exemption Form - Web This amount will be incorporated into 2023 tax forms and should be used for tax planning in the new year The new individual income tax rate for 2023 has also been established to be 4 5 a reduction by 5 from the 2022 tax rate Visit our Individual Income Tax page for more information