Kentucky State Tax Credit For Solar The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Kentucky If you install your photovoltaic system before the end of 2032

Federal Solar Tax Credit ITC Kentucky residents can take advantage of the Federal Solar Tax Credit and get a discount of 30 applied to their tax returns In Find Energy Related Incentives Looking for incentives for energy projects Incentives include items such as tax credits rebates and other savings mechanisms but can also

Kentucky State Tax Credit For Solar

Kentucky State Tax Credit For Solar

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

When Does Solar Tax Credit End SolarProGuide 2022

https://www.solarproguide.com/wp-content/uploads/when-does-the-federal-solar-tax-credit-expire.png

Quick Facts The ITC is a 26 percent tax credit for solar systems on residential under Section 25D and commercial under Section 48 properties The Section 48 commercial A 30 federal tax credit is available to those who purchase a solar energy system The tax credit is a dollar for dollar reduction in the amount of income tax you would

What Is the Federal Solar Tax Credit Residents of Kentucky qualify for the federal solar investment tax credit ITC if they own their solar panel system through Similar to homeowners across the nation residents of Kentucky are eligible for a one time federal solar tax credit amounting to 30 of the value of their solar panel

Download Kentucky State Tax Credit For Solar

More picture related to Kentucky State Tax Credit For Solar

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

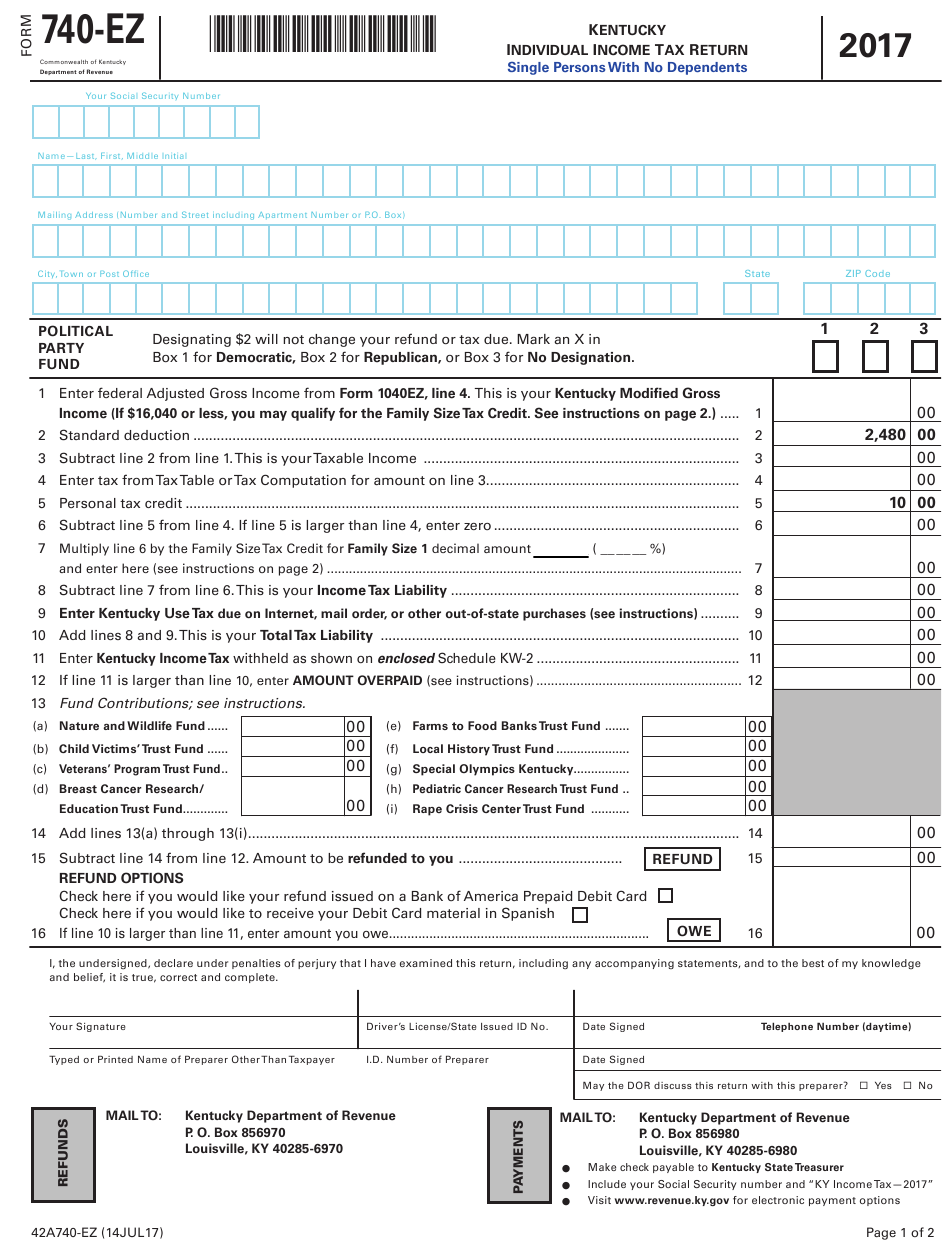

Kentucky State Taxes 2021 Income And Sales Tax Rates Bankrate

https://www.bankrate.com/2016/03/24112530/Kentucky-state-taxes-2021-Income-and-sales-tax-rates.jpeg

Key Details Kentucky receives an average of 2514 hours of sunlight annually The Federal Solar Tax Credit allows for solar users to deduct 30 of the cost of their installation In Kentucky hundreds of thousands of low and moderate income households are eligible for rebates o Rebates for households to make repairs and improvements in single

Kentucky Solar Incentives Tax Credits Rebates Guide 2024 Written by Caitlin Ritchie Edited by Jamie Cesanek Last updated 12 1 2023 Estimate your The federal solar investment tax credit ITC is the biggest factor in reducing the cost of going solar in Kentucky If you install a residential solar panel system by the

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

https://udwa.org/wp-content/uploads/TaxCredit.png

Solar Tax Credit 2022 Incentives For Solar Panel Installations

https://quickelectricity.com/wp-content/uploads/2020/12/Federal-Solar-Tax-Credit-Extension-2022.jpg

https://www.solarreviews.com/solar-incentives/kentucky

The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Kentucky If you install your photovoltaic system before the end of 2032

https://todayshomeowner.com/solar/guides/kentucky-solar-incentives

Federal Solar Tax Credit ITC Kentucky residents can take advantage of the Federal Solar Tax Credit and get a discount of 30 applied to their tax returns In

Schedule M Ky Fillable Form Printable Forms Free Online

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

The Federal Solar Tax Credit What You Need To Know 2022

Schedule M Ky Fillable Form Printable Forms Free Online

Geothermal Tax Credits Incentives

Everything You Need To Know The New 2021 Solar Federal Tax Credit

Everything You Need To Know The New 2021 Solar Federal Tax Credit

Solar Tax Credit In 2021 SouthFace Solar Electric AZ

Federal Solar Tax Credit For Residential Solar Energy

Filing A Kentucky State Tax Return Credit Karma

Kentucky State Tax Credit For Solar - What Is the Federal Solar Tax Credit Residents of Kentucky qualify for the federal solar investment tax credit ITC if they own their solar panel system through