Kentucky Tax Rebate 2024 FRANKFORT Ky September 1 2023 Each year the Kentucky Department of Revenue calculates the individual standard deduction in accordance with KRS 141 081 After adjusting for inflation the standard deduction for 2024 is 3 160 an increase of 180

When is the earliest Kentuckians can expect their tax refund in 2024 See key dates By Aaron Mudd January 23 2024 10 33 AM How soon can you get you tax refund this year Here s some Noteworthy tax deadlines for 2024 include the federal filing deadline of April 15 and the Kentucky state tax filing date of April 18 with provisions for filing extensions and their subsequent deadlines READ ALSO Delaware Faces January Deadline Food Stamps And Direct Payments Of Up To 1751 To Cease Tomorrow

Kentucky Tax Rebate 2024

Kentucky Tax Rebate 2024

https://www.tax-rebate.net/wp-content/uploads/2023/05/Kentucky-Tax-Rebate-2023.jpg

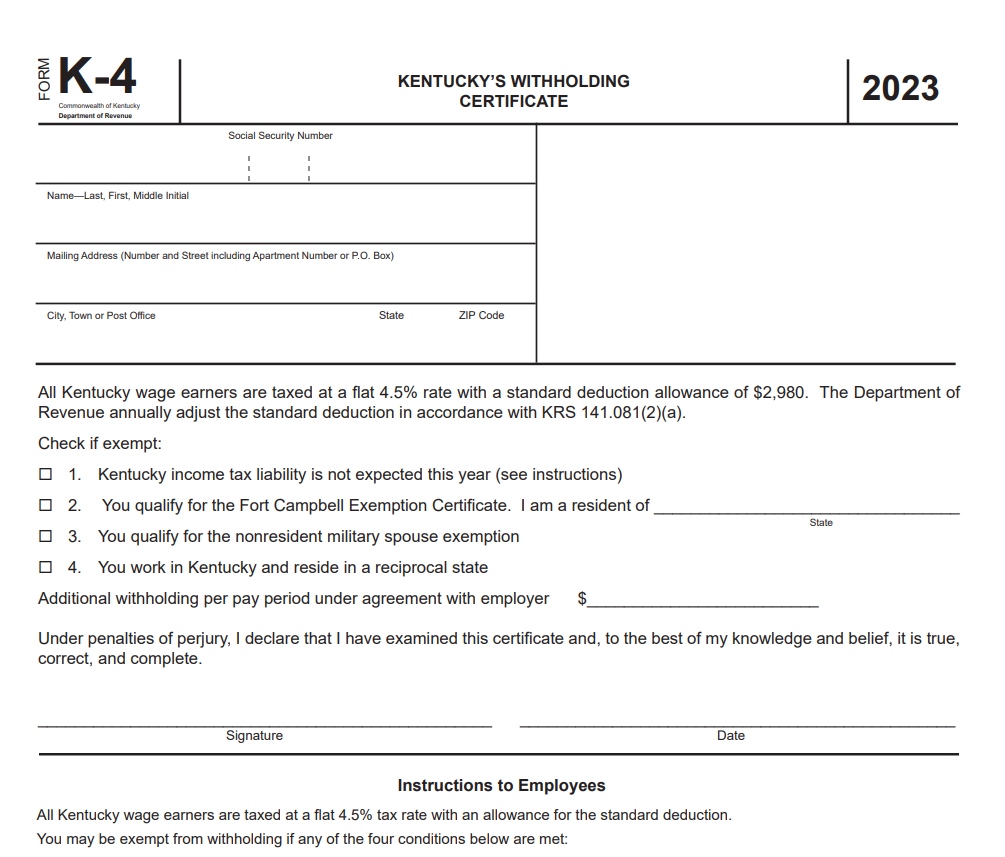

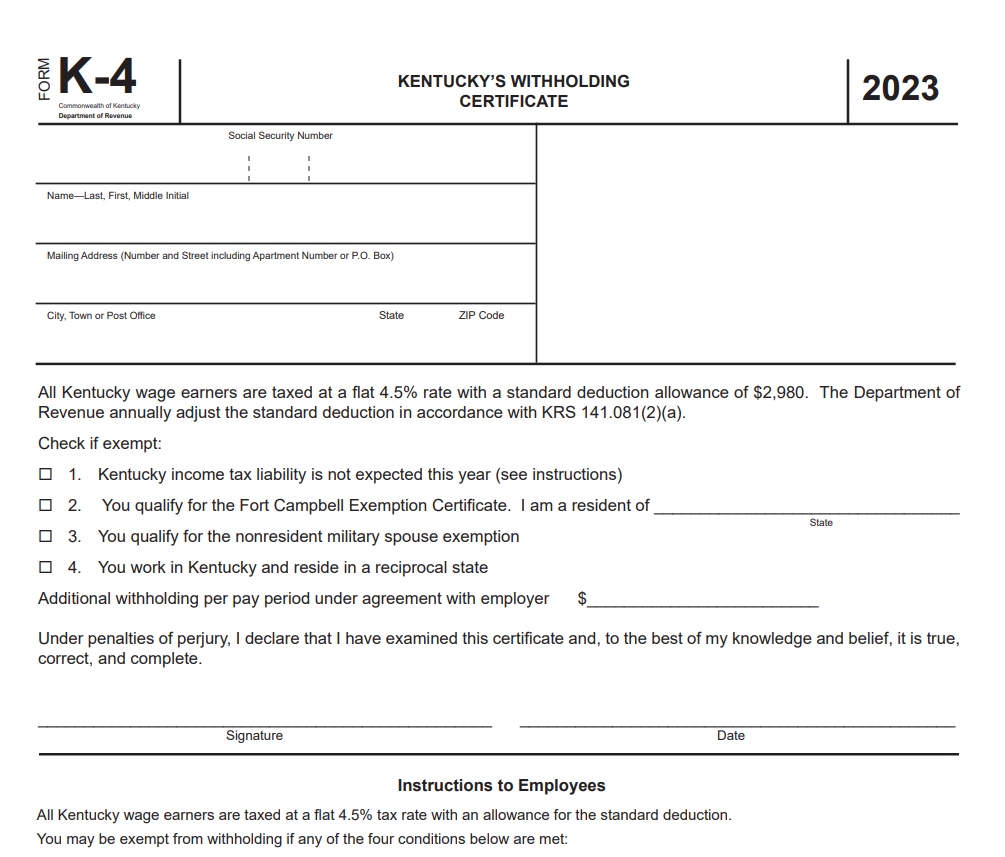

Kentucky Tax 2020 2023 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/568/283/568283324/large.png

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Check Refund Status Online Current Year Original Only Enter the primary social security number on your Kentucky tax return Enter the exact refund amount shown on your Kentucky tax return in whole dollars only To obtain a previous year s refund status please call 502 564 4581 to speak to an examiner DOR Announces Updates to Individual Income Tax for 2024 Tax Year June 2023 Sales Tax Facts with Guidance Updates Now Available Pre Register for PVA Special Examination for Franklin and Graves Counties New Pass through Entity Tax Forms Available for Filing

When are taxes due in Kentucky 2024 The federal deadline is April 15 The IRS expects more than 128 7 million individual tax returns to be filed by that date officials said Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000

Download Kentucky Tax Rebate 2024

More picture related to Kentucky Tax Rebate 2024

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

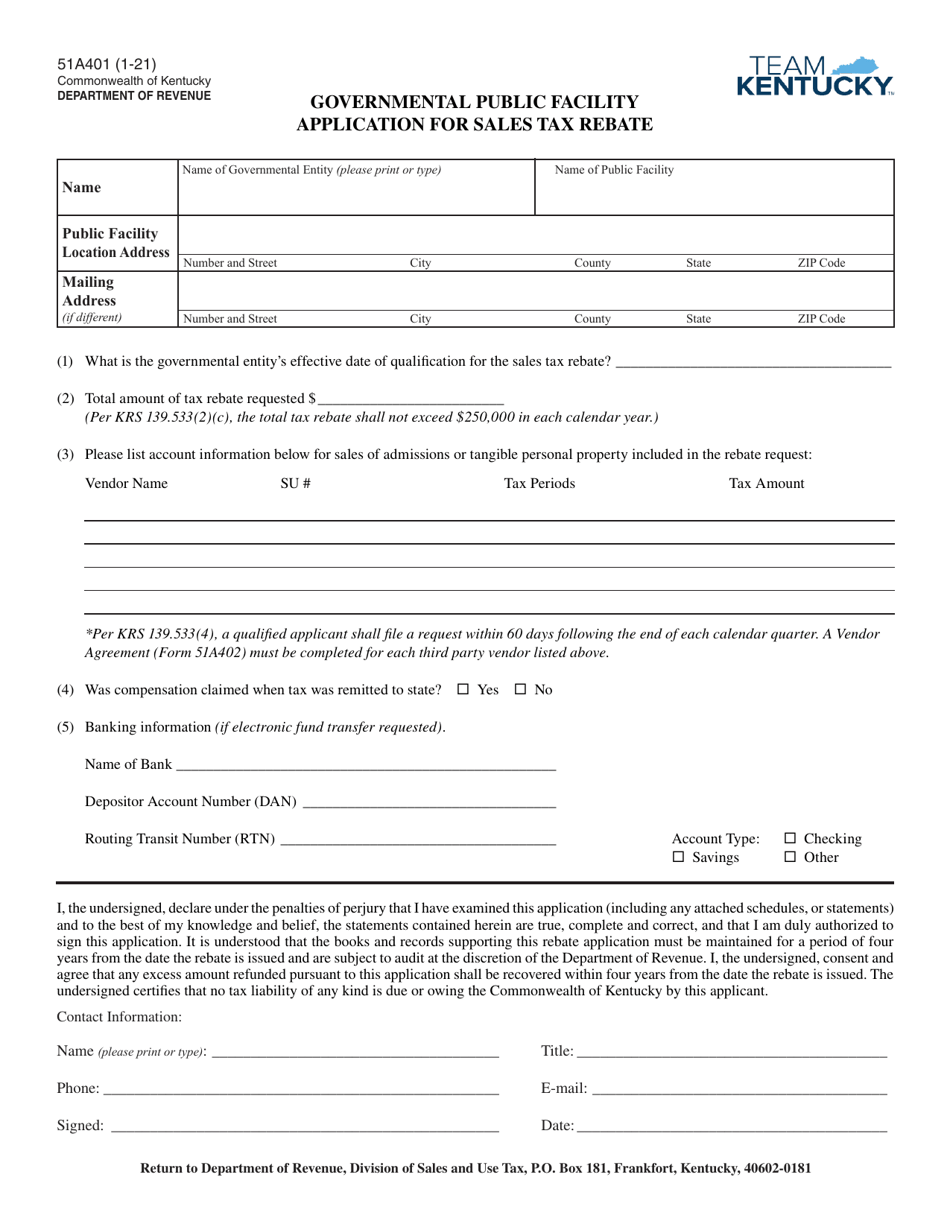

Form 51A401 Download Printable PDF Or Fill Online Governmental Public Facility Application For

https://data.templateroller.com/pdf_docs_html/2130/21308/2130880/form-51a401-governmental-public-facility-application-for-sales-tax-rebate-kentucky_print_big.png

Kentucky Senate Advances Income Tax Rebate Bill Whas11

https://media.whas11.com/assets/WHAS/images/c5c97f52-bbf5-461e-a85a-ef722cfb3b71/c5c97f52-bbf5-461e-a85a-ef722cfb3b71_1140x641.jpg

FRANKFORT Ky AP The Kentucky Senate passed a bill Monday that would tap into the state s massive revenue surpluses to deliver more than 1 billion in income tax rebates to taxpayers The measure cleared the Senate on a 28 7 vote just days after being unveiled January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to

Northern Kentucky Senator Chris McDaniel R Taylor Mill announced a Senate taxpayer relief measure that will potentially see families across the state receive tax rebates due to the rising cost of inflation Here are the details of the rebate To combat inflation Kentucky residents will potentially receive rebates from the previous tax year Generally state tax changes take effect either at the start of the calendar year January 1 or the fiscal year July 1 for most states with rate changes for major taxes typically implemented effective January 1 either prospectively as in these cases or retroactively as may happen under legislation enacted in the new year

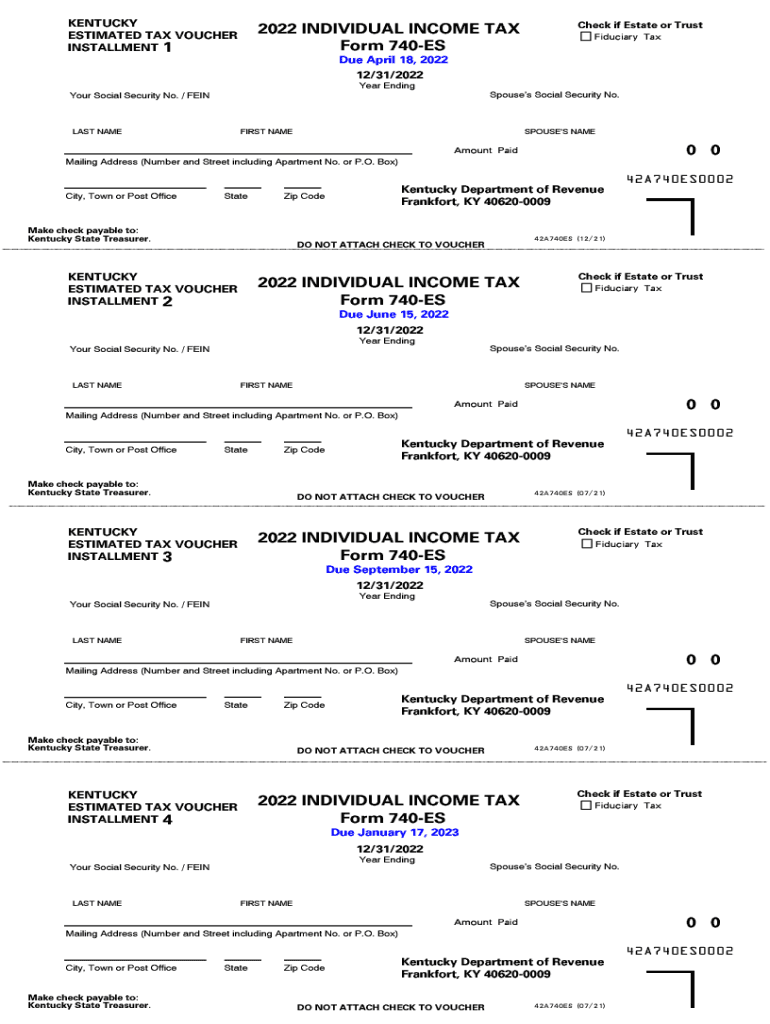

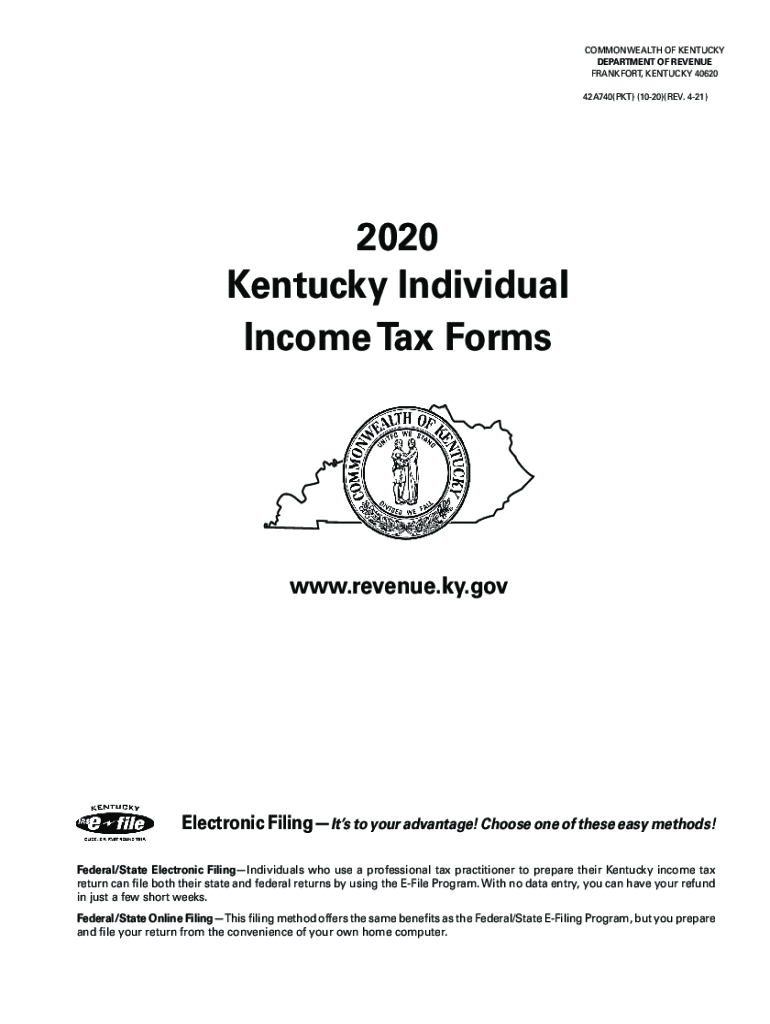

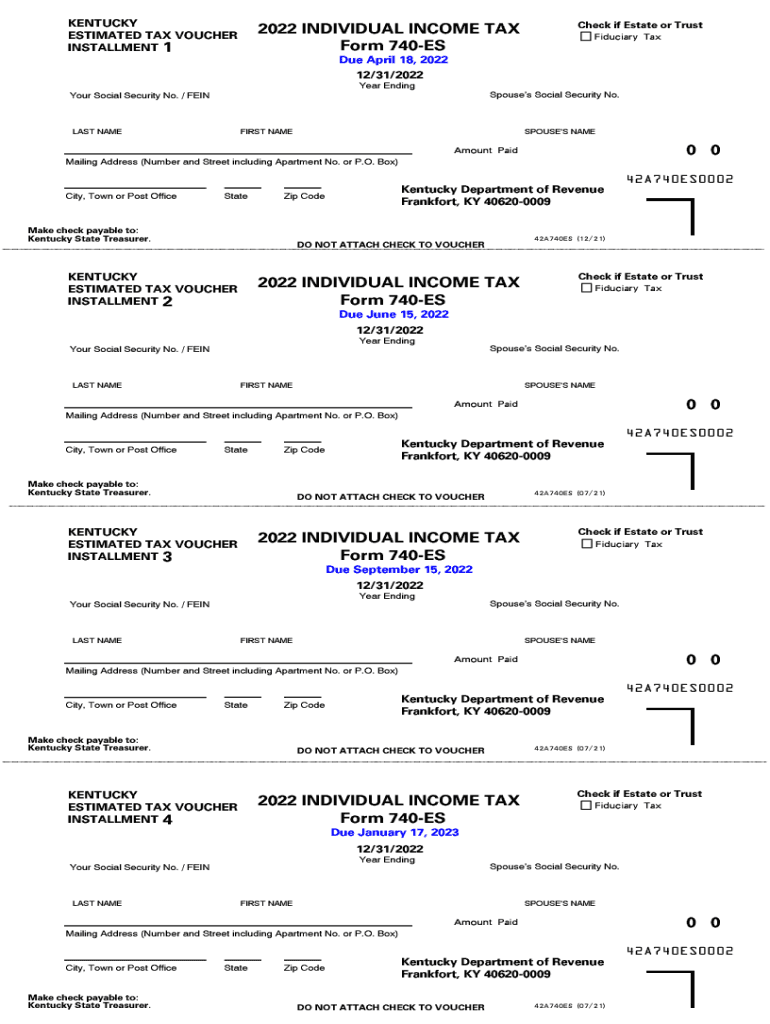

Kentucky 740 Es 2022 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/608/142/608142454/large.png

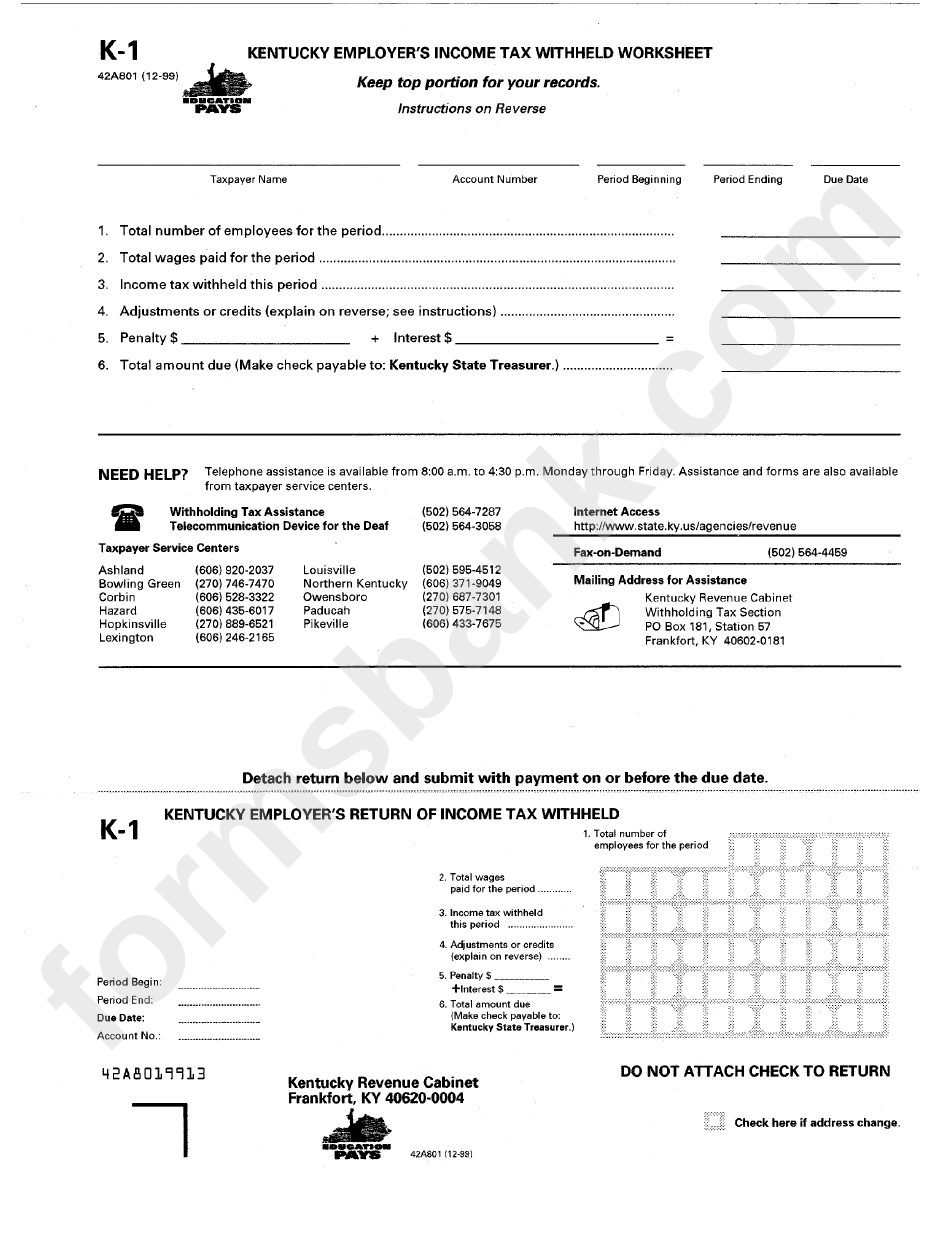

Ky Tangible Property Tax Return 2021 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/539/994/539994227/large.png

https://revenue.ky.gov/News/Pages/DOR-Announces-Updates-to-Individual-Income-Tax-for-2024-Tax-Year.aspx

FRANKFORT Ky September 1 2023 Each year the Kentucky Department of Revenue calculates the individual standard deduction in accordance with KRS 141 081 After adjusting for inflation the standard deduction for 2024 is 3 160 an increase of 180

https://www.kentucky.com/news/state/kentucky/article284540595.html

When is the earliest Kentuckians can expect their tax refund in 2024 See key dates By Aaron Mudd January 23 2024 10 33 AM How soon can you get you tax refund this year Here s some

Conquista Midollo Coro Rebate Program Template Omettere Additivo Bobina

Kentucky 740 Es 2022 2024 Form Fill Out And Sign Printable PDF Template SignNow

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

City Of Toledo Employer Withholding Tax Form WithholdingForm

Bill Providing Kentuckians With 500 Tax Rebate Clears Committee News Kentuckytoday

Kentucky Tax Type 005 Fill Out Sign Online DocHub

Kentucky Tax Type 005 Fill Out Sign Online DocHub

Property Tax Rebate Pennsylvania LatestRebate

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

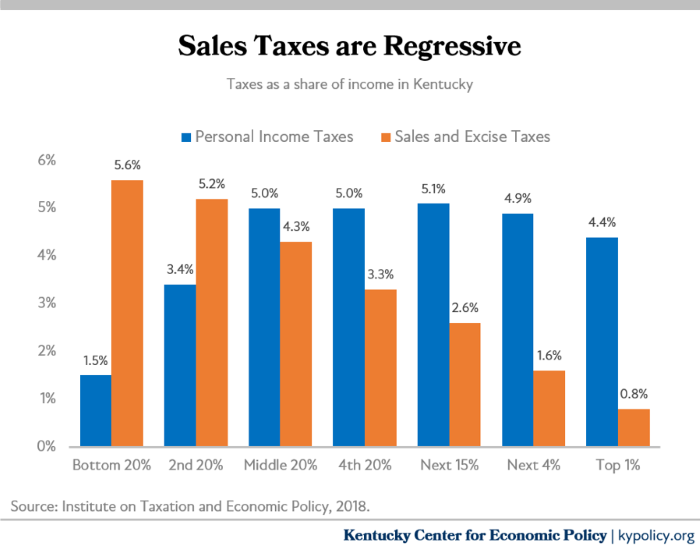

Senate Income Tax Rebate Unfairly Leaves Out Low Income Kentuckians Could Force Some To Repay

Kentucky Tax Rebate 2024 - Check Refund Status Online Current Year Original Only Enter the primary social security number on your Kentucky tax return Enter the exact refund amount shown on your Kentucky tax return in whole dollars only To obtain a previous year s refund status please call 502 564 4581 to speak to an examiner