Kvp Income Tax Rules Verkko 2 hein 228 k 2022 nbsp 0183 32 The wage income taxed in accordance with the Act on Key Employees EUR 100 000 impact the progression of the wage income received from the other

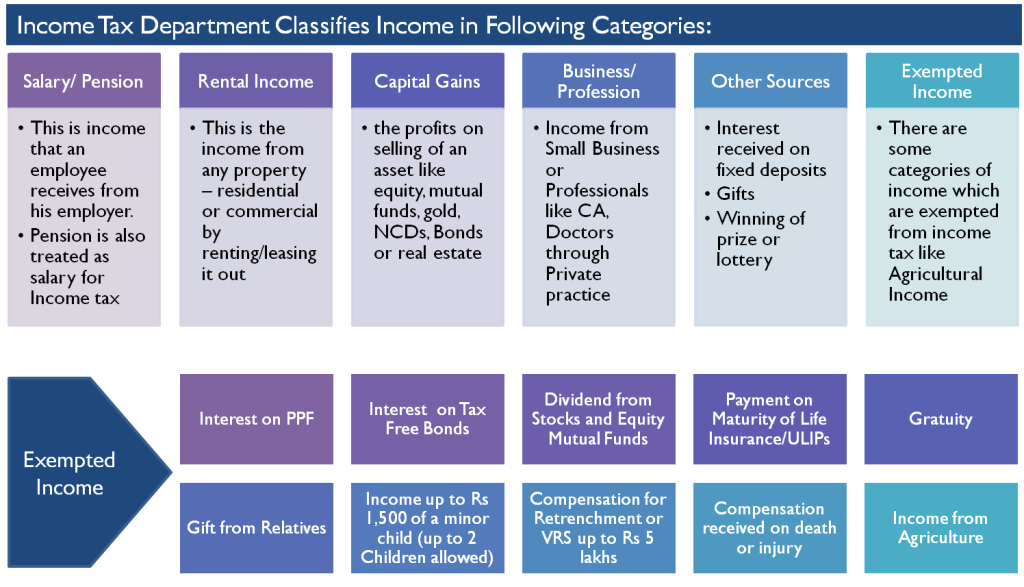

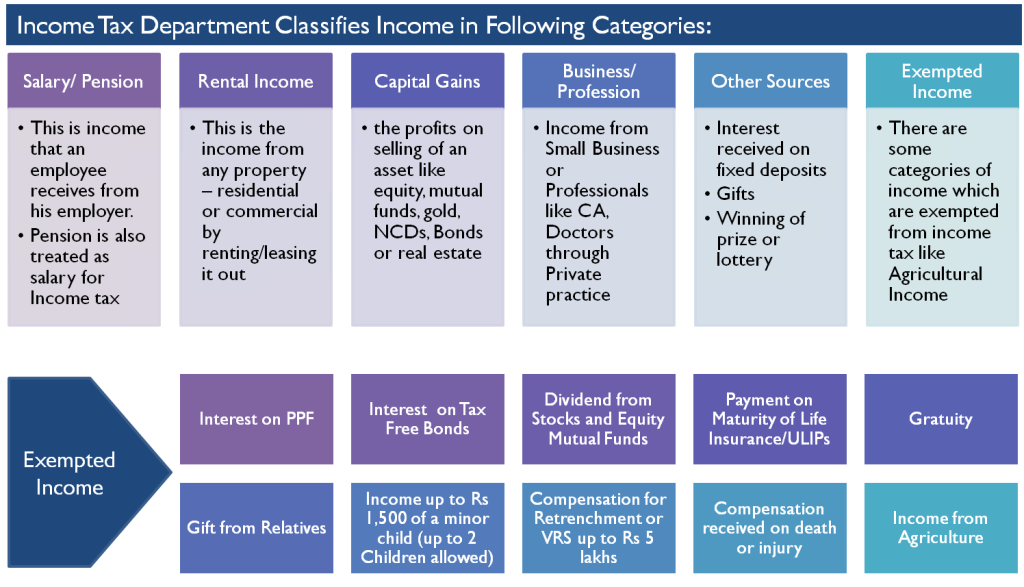

Verkko 19 jouluk 2023 nbsp 0183 32 INCOME TAX Kisan Vikas Patra KVP Eligibility Features Interest Rates amp Returns Updated on Jul 5th 2023 15 min read CONTENTS Show Kisan Verkko 12 helmik 2016 nbsp 0183 32 The interest earned on Kisan Vikas Patra KVP doesn t enjoy any tax exemptions The interest earned from it is taxed as per the Income Tax slab

Kvp Income Tax Rules

Kvp Income Tax Rules

https://i.ytimg.com/vi/mwpJA0CTR4I/maxresdefault.jpg

Which ITR Form To File Tax Returns For AY 2015 16

https://www.apnaplan.com/wp-content/uploads/2015/08/Types-of-Income-as-per-Income-Tax-Rules-1024x587.png

Extended Compliance Due Date Under Income Tax Act 1961 And Income Tax

https://i.pinimg.com/originals/93/d0/55/93d0556c3fd3f87ef00c1e8d1a08686c.jpg

Verkko 31 toukok 2022 nbsp 0183 32 If the taxpayer follows cash basis of accounting interest from Kisan Vikas Patra KVP may be taxed in the year of its maturity pre mature encashment Verkko 13 lokak 2020 nbsp 0183 32 KVP taxation KVP is not eligible for exemption under section 80C of the Income Tax Act which means that the returns are completely taxable However

Verkko 7 huhtik 2023 nbsp 0183 32 The interest earned on KVP is added to the investor s taxable income on a yearly basis similar to fixed deposits and taxed as per the applicable slab rate Verkko 23 maalisk 2023 nbsp 0183 32 Conclusion TDS Return for Interest on KVP Introduction Tax Deducted at Source TDS is a tax collection system where a person responsible for

Download Kvp Income Tax Rules

More picture related to Kvp Income Tax Rules

Kisan Vikas Patra KVP Interest Rate 2021 Calculator Online

https://sarkariyojana.com/wp-content/uploads/2019/11/kisan-vikas-patra-online-application-form.jpg

Income Tax Rules 5th e Buy Income Tax Rules 5th e Online At Low Price

https://n3.sdlcdn.com/imgs/d/n/3/Income-Tax-Rules-5th-e-SDL076879114-1-da7d7.jpg

Taxmann s Income Tax Rules 2 Vols Buy Taxmann s Income Tax Rules 2

https://n4.sdlcdn.com/imgs/h/s/4/Taxmann-s-Income-Tax-Rules-SDL023588796-1-02ac7.jpg

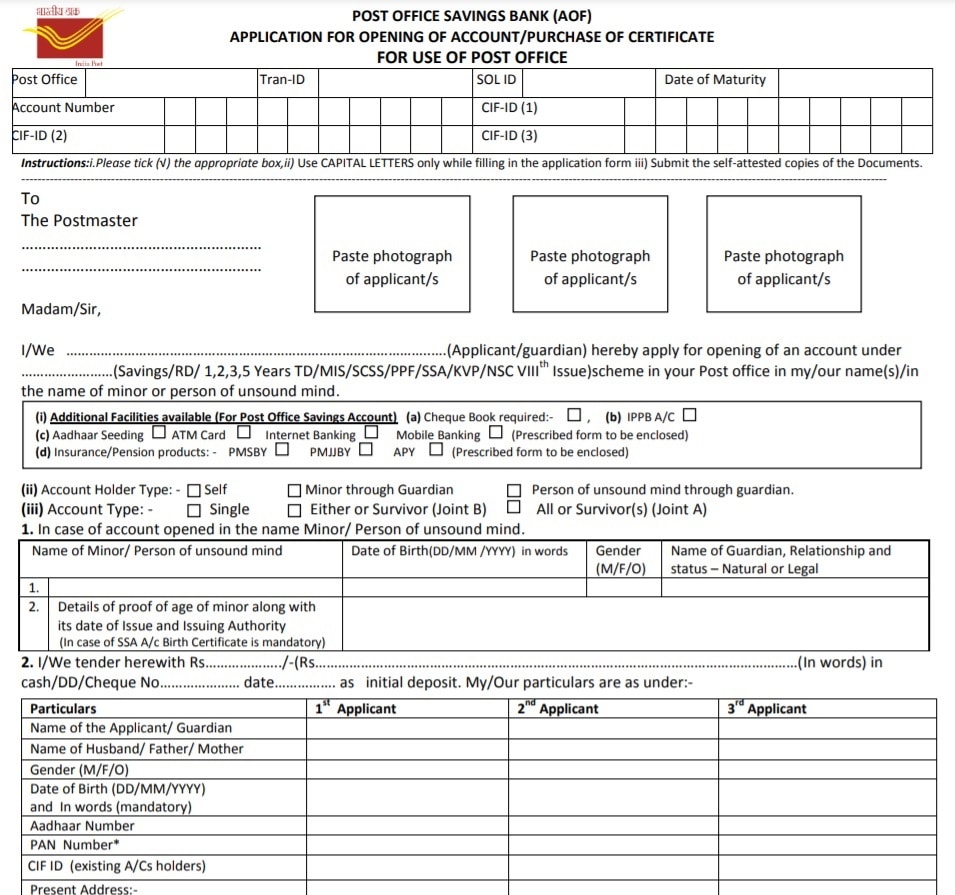

Verkko Saving Schemes Kisan Vikas Patra KVP Kisan Vikas Patra A savings certificate scheme Kisan Vikas Patra KVP was originally launched in the year 1988 by India Verkko 15 toukok 2023 nbsp 0183 32 One can receive the tax benefits under Section 80C of the Income Tax Act 1961 The minimum amount of investment is Rs 1 000 There is no maximum

Verkko 15 tuntia sitten nbsp 0183 32 Entrepreneurs earning over Dhs1 million per year through their individual business activities will need to register for corporate tax and appropriately declare Verkko 12 hein 228 k 2023 nbsp 0183 32 Here are the features of Kisan Vikas Patra Security KVP Kisan Vikas Patra is a secure investment option as it is backed by the government of India The

Understanding CSR Expenditure And Deductions Under Income Tax

https://1.bp.blogspot.com/-Fs8cI8GB-N8/Xh203d_qRVI/AAAAAAAAAuQ/Z-sZsVhuvwsu1yHic4FR5KIbCTUMnJx5ACLcBGAsYHQ/w1200-h630-p-k-no-nu/understanding-csr-expenditure-and-deductions-under-income-tax.jpg

Other Electronic Modes Of Payments Prescribed Under The Income Tax Act

https://1.bp.blogspot.com/-WH4P76JQtwA/XjP7GLq3VmI/AAAAAAAAAzI/Dqo1NRi4K2UjnII7rDDkly0Y5zutEzARACLcBGAsYHQ/w1200-h630-p-k-no-nu/other-electronic-modes-of-payments-prescribed-under-the-income-tax-act.jpg

https://www.vero.fi/en/detailed-guidance/guidance/106825

Verkko 2 hein 228 k 2022 nbsp 0183 32 The wage income taxed in accordance with the Act on Key Employees EUR 100 000 impact the progression of the wage income received from the other

https://cleartax.in/s/kisan-vikas-patra

Verkko 19 jouluk 2023 nbsp 0183 32 INCOME TAX Kisan Vikas Patra KVP Eligibility Features Interest Rates amp Returns Updated on Jul 5th 2023 15 min read CONTENTS Show Kisan

Personal Income Tax 2023 Government PH

Understanding CSR Expenditure And Deductions Under Income Tax

Taxation Of Resident Welfare Association Or Apartment Owners

CBDT Issues Further Clarification On TDS TCS Section 194 O 194Q And

Section 139 8A Filing Of Updated Return Budget 2022

Procedure Of PAN Allotment Through Common Application Form

Procedure Of PAN Allotment Through Common Application Form

Analysis Of Changes In Notified ITR 1 And ITR 4 For AY 2020 21

Income Tax Rules For Non Residential Indians NRIs

Income Tax Diary

Kvp Income Tax Rules - Verkko 23 maalisk 2023 nbsp 0183 32 Conclusion TDS Return for Interest on KVP Introduction Tax Deducted at Source TDS is a tax collection system where a person responsible for