Kvp Tax Deduction Calculator How is income tax on Kisan Vikas Patra KVP calculated Can tax on its interest be paid on a yearly basis

You can efile income tax return on your income from salary house property capital gains business profession and income from other sources Further you can also file TDS returns generate Form 16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing Double your money by using Fintra s KVP calculator or Kisan Vikas Patra Calculator to calculate the interest on the KVP for the time of investment Calculate the maturity period and amount KVP is available in post offices in India

Kvp Tax Deduction Calculator

Kvp Tax Deduction Calculator

https://simple-accounting.org/wp-content/uploads/2021/09/603e8923-3ad2-46a9-932d-fa75cdb7e2e3.jpg

Kisan Vikas Patra KVP Features And Benefits Eligibility Criteria

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgLR8iy-9ZOyzFe-BLtQ7Pk0mbxm6UNPc-GJH9erVEwbWBj4S79-f1WcBxsdJjzn-0cuZhedZJMRttN42PbPgeYOotYD5OmGelI8wOzpQHiOOoIQXbU5-g3uEqrvNENR6lR1RBrQiBYoiAKjRf1l_2Z4oRbIDs-53kKAYav8ob7TIUZjzQlCT8jiQIz/w1600/InShot_20230315_211017002.jpg

Tax Deduction For PF Under 80C Article VibrantFinserv

https://vibrantfinserv.com/kb/wp-content/uploads/2023/06/34.Tax-deduction-for-PF-under-80C.jpg

This Kisan Vikas Patras KVP Calculator requires some data like Your KVP Deposit Amount Date of purchase of certificate to check whether the certificate is from old scheme or from the new scheme After calculation you will get the Maturity Amount of your Kisan Vikas Patras KVP at subsequent time interval from 2 years 6 months onwards KVP stands for Kisan Vikas Patra KVP is a savings scheme certificate that you can purchase from a Bank or Post Office In this scheme the deposit amount gets doubled in 9 years and 7 months This scheme was discontinued back in 2011 But it was re launched in November 2014

Trusted by 3 Crore Indians See all Products KVP Calculator Know more about the benefits of kvp calculator how does it work uses maturity interest rates calculation and other important details Kisan Vikas Patra KVP Calculator Interest Rate Chart Run by the Department of Posts KVP is a small savings government scheme It is considered very safe and is a long term investment option The scheme was discontinued in 2011 but later relaunched in 2014 KVP is of the following types

Download Kvp Tax Deduction Calculator

More picture related to Kvp Tax Deduction Calculator

Tax Offset V Tax Deduction What s The Difference Sherlock Wealth

https://sherlockwealth.com/wp-content/uploads/2022/05/Tax-offset-v-tax-deduction-.jpg

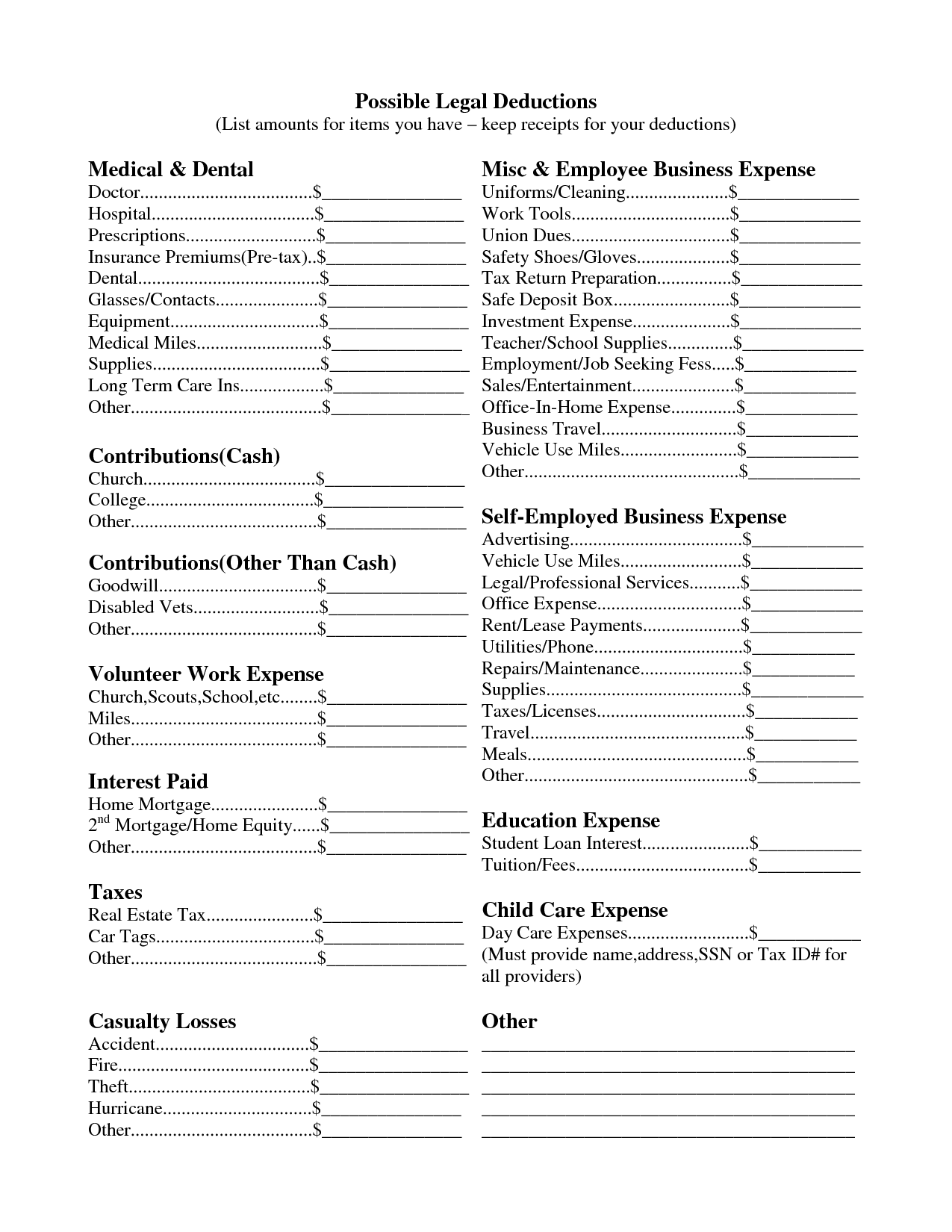

Tax deduction checklist Etsy

https://i.etsystatic.com/37903484/r/il/61e14b/5462529921/il_1588xN.5462529921_cvyy.jpg

100 Tax Deduction On Your Donation In Malaysia Jul 26 2021 Johor

https://cdn1.npcdn.net/image/16272778521a6ef50158b79f67207a9ee7fe2b2eb3.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

The scheme has been amended multiple times and as per the latest amendment the tenure of the scheme is 115 months that is 9 years and 4 months and the prevailing interest rate of KVP is 7 5 per annum One can invest a minimum of Rs 1000 and there is no maximum limit on the investment You can choose to calculate and pay tax on the interest income every year on an accrual basis Another option is to pay the tax on the consolidated interest income you receive at the end of the five years There is no deduction available for investing in

8 Taxation of Kisan Vikas Patra Scheme 2019 There is no incentive for investment in KVP and Interest on KVP is taxable on accrual basis and will be taxed as Income from Other Sources deduction under section 80C is not allowed on this investment TDS is not deductible on Interest on KVP 9 The current annual rate of interest is 6 9 for 124 months The whole interest in KVP is taxable The interest on KVP has to be assessed to income on an accrual basis However the deposits are exempt from Tax Deduction at Source TDS at the time of withdrawal How to use Kisan Vikas Patra Calculator

Tax Deduction Details Of All Post Office Schemes Post Office Saving

https://i.ytimg.com/vi/yHKRlXvkz74/maxresdefault.jpg

Bill C19 Is The Largest Ever Tax Deduction Oaken Equipment

https://oakenequipment.ca/content/uploads/2022/10/Bill-C19-Tax-Deduction.V3-scaled.jpg

https://www. livemint.com /money/personal-finance/...

How is income tax on Kisan Vikas Patra KVP calculated Can tax on its interest be paid on a yearly basis

https:// cleartax.in /s/kisan-vikas-patra

You can efile income tax return on your income from salary house property capital gains business profession and income from other sources Further you can also file TDS returns generate Form 16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing

Example Tax Deduction System For A Single Gluten free GF Item And

Tax Deduction Details Of All Post Office Schemes Post Office Saving

Tax Deduction Planner Graphic By Watercolortheme Creative Fabrica

Tax Deductions Guide Sunlight Tax

What Will My Tax Deduction Savings Look Like The Motley Fool

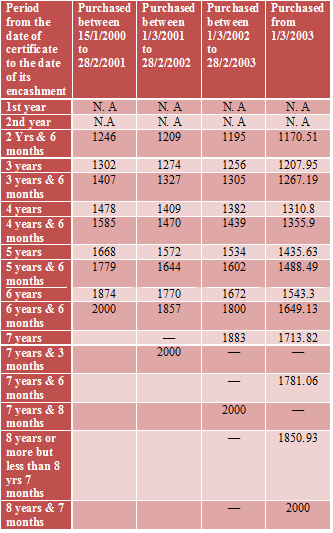

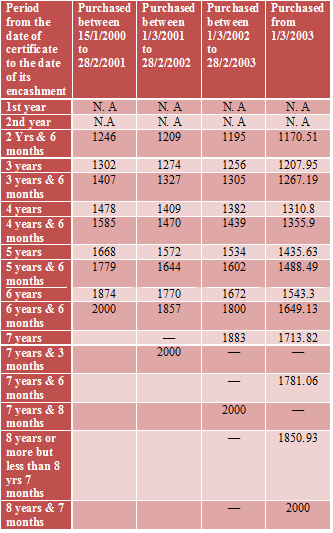

CA SHIV K JINDAL KVP INTEREST RATE CHART

CA SHIV K JINDAL KVP INTEREST RATE CHART

Kurzstudie Tax Deduction Scheme Belgien EUKI

16 Budget Worksheet Self Employed Worksheeto

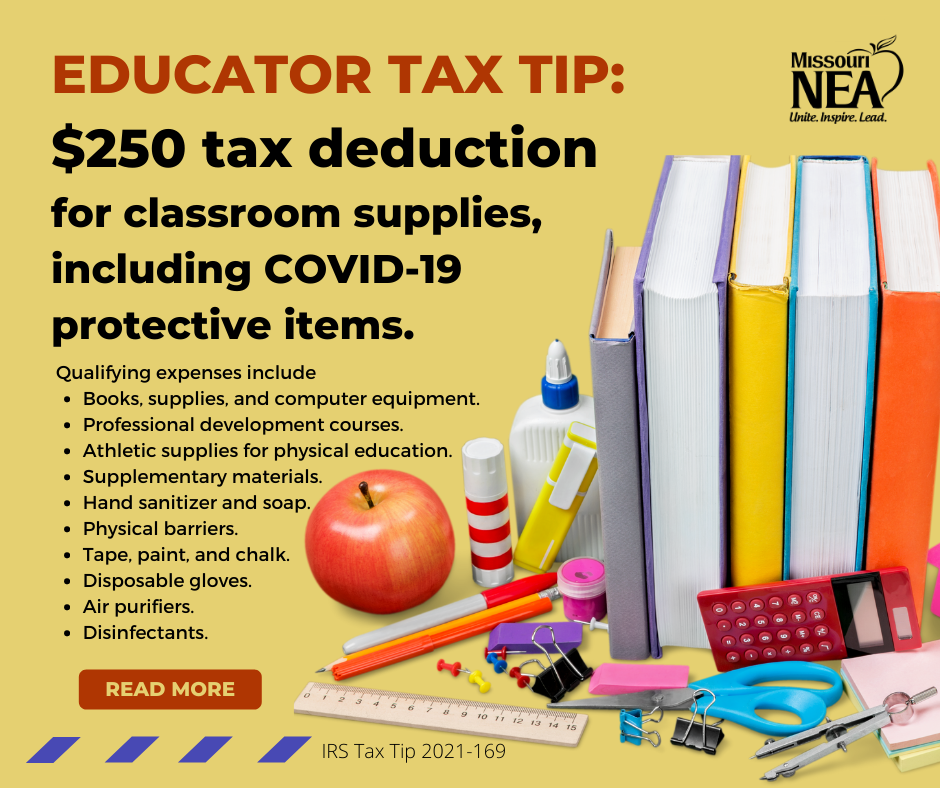

2021 Tax Tip 250 Educator Expense Deduction MNEA Missouri National

Kvp Tax Deduction Calculator - Trusted by 3 Crore Indians See all Products KVP Calculator Know more about the benefits of kvp calculator how does it work uses maturity interest rates calculation and other important details