Land Rent Gst Rate GST is applicable at the rate of 18 on rental income If the Landlord is required to collect GST then the landlord has to charge 18 GST on Rent amount as below Intra state

GST paid on lease rent is eligible for ITC as it is not covered in the list of blocked credit u s 17 5 GST rates on lease transactions If you rent out property to a business and your total annual income including rent and other earnings exceeds 20 lakh you must register for GST and pay tax on the rent This

Land Rent Gst Rate

Land Rent Gst Rate

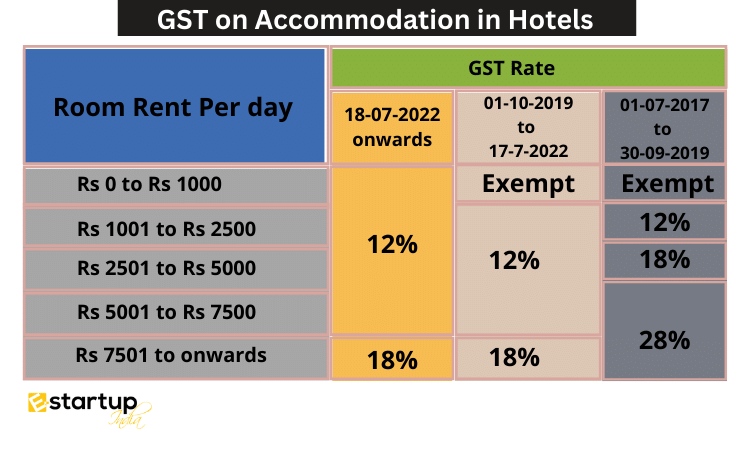

https://www.e-startupindia.com/learn/wp-content/uploads/2022/09/GST-on-Accommodation-in-Hotels-1.png

DIFFERENCE BETWEEN LAND RENT LAND RATE Amcco Properties Limited We

https://amccopropertiesltd.co.ke/wp-content/uploads/2023/06/AMCCO-PROPERTIES-0826-scaled.jpg

GST On Rent Of Residential Property Commercial Property All Scenarios

https://cdn.zeebiz.com/sites/default/files/1_0.jpeg

The Ministry of Finance through Notification No 05 2022 Central Tax Rate dated July 13 2022 introduced new GST on rent residential properties These rules require landlords to charge GST on rent paid by Under the GST guidelines renting out a residential or commercial property is a taxable service supply and landlords and tenants must fulfill their tax obligations Landlords must pay GST on

In case of renting of commercial property or land GST shall be charged at the rate of 18 under the SAC code 997212 if the supplier is already registered under GST and if not The owner of the property which is given on rent has to collect the GST from the person paying rent This GST will be on the rent charged The payer of rent has to deduct income tax at

Download Land Rent Gst Rate

More picture related to Land Rent Gst Rate

GST Rates GST Council Meet Rate Changes On Some Items On Cards

https://img.etimg.com/thumb/msid-92467010,width-1070,height-580,imgsize-49618,overlay-economictimes/photo.jpg

GST Rate HSN Code For Services Chapter 99

https://khatabook-assets.s3.amazonaws.com/media/post/2022-07-01_045037.3724430000.webp

The Rent Today

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100063722945064

GST on rental income is applicable when a landlord receives an annual rent of Rs 20 lakh and effectively becomes liable to pay GST on rental income GST on rent on the other hand is the tax liability on the tenant if they Thus it is clear that both renting and leasing of land is considered as a supply under GST and is thus taxable As per Schedule II of the CGST Act Para 2 a any lease

Rent for commercial properties is subject to an 18 GST which landlords must collect from tenants and remit to the government However residential property rent including Under Section 7 of the CGST Act 2017 the renting of immovable property is considered a supply of services taxable under GST The applicability of GST is differentiated

How To Find New GST Rate Simple Steps To Find Your Item New Tax Rate

https://i.ytimg.com/vi/IgChUHim7mE/maxresdefault.jpg

Rent Road Sro

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100066480176500

https://taxadda.com › gst-on-rent-of-immovable-property

GST is applicable at the rate of 18 on rental income If the Landlord is required to collect GST then the landlord has to charge 18 GST on Rent amount as below Intra state

https://taxguru.in › goods-and-service-tax › …

GST paid on lease rent is eligible for ITC as it is not covered in the list of blocked credit u s 17 5 GST rates on lease transactions

Behind On Your Rent Apply For Assistance Or Face Eviction WCCO CBS

How To Find New GST Rate Simple Steps To Find Your Item New Tax Rate

Singapore Company GST Registration Procedure Importance And

Land Rent Theory 2020 English Version Land Rent Theory J Ja ger

Ravi Associates Ahmedabad Gujarat

Land Rent And Land Use The Geography Of Transport Systems

Land Rent And Land Use The Geography Of Transport Systems

Label For Rent

GST Rate Revised GST Rates Kick in Today Here Is A List Of Items That

Rent 2 Rent Training

Land Rent Gst Rate - The owner of the property that is given on rent has to collect the GST from the person paying rent This GST will be charged on the rent paid and the payer of rent has to