Late Filing Fee For Itr Ay 2022 23 Belated ITR filing penalty According to the Income Tax rules the penalty for belated ITR filing could be up to Rs 5 000 However for taxpayers whose total income is

From the financial year 2021 onwards the income tax department has reduced the maximum amount of penalty for late filing of returns to Rs 5 000 from Rs 10 000 To For example for the AY 2023 24 corresponding to FY 2022 23 a belated return can be filed until 31 December 2023 Is there a penalty for filing belated return

Late Filing Fee For Itr Ay 2022 23

Late Filing Fee For Itr Ay 2022 23

https://www.taxmann.com/post/wp-content/uploads/2021/12/01_Blog-Post-2.jpg

INCOME TAX RETURN DUE DATE FY 2021 22 AY 2022 23 WILL ITR DUE DATE

https://i.ytimg.com/vi/_z-Z3hV2SmQ/maxresdefault.jpg

Trending News Holiday In Banks On The Last Day Of Filing ITR What

https://images.news18.com/ibnkhabar/uploads/2022/07/ITR-Filing-Last-Date-12x9.jpg

December 31 2022 is the last day to file the belated and revised income tax returns ITRs for FY 2021 22 AY 2022 23 Under income tax laws an individual who has missed the If you have missed filing the income tax return ITR for the FY 2021 22 AY 2022 23 before the last date of July 31 2022 it can now cost you even if you do

According to section 234F of the Income Tax Act filing the ITR past the due date can attract a late fee of Rs 5 000 for people having an annual income of over Rs 5 As per Section 234F a penalty of Rs 5 000 needs to be paid if one files belated ITR after July 31 by taxpayers with total income of Rs 5 lakh and up For taxpayers with less than Rs 5 lakh total income the fine

Download Late Filing Fee For Itr Ay 2022 23

More picture related to Late Filing Fee For Itr Ay 2022 23

ITR Filing FY 2021 22 Know Last Date And Penalty If You Miss DEADLINE

https://cdn.zeebiz.com/sites/default/files/2022/07/18/190204-itr.jpg

ITR Filing Last Due Date FY 2023 24

https://static.wixstatic.com/media/a64f72_d07e6b0e5f6a4fd9ab73f487ed58b899~mv2.jpeg/v1/fill/w_1000,h_563,al_c,q_85,usm_0.66_1.00_0.01/a64f72_d07e6b0e5f6a4fd9ab73f487ed58b899~mv2.jpeg

Itr Filing Online2022 23 Itr Date Extend File Itr After Due Date No

https://i.ytimg.com/vi/ZJp8BILEYfU/maxresdefault.jpg

ITR filing after due date may lead to 5 000 late fee if a taxpayer s taxable income is more than 5 lakh Income tax return or ITR filing may attract 10 000 late Missed ITR 2022 23 deadline Under section 234F of the IT Act a late filing will be imposed on taxpayers after the due date July 31 2022 How many penalties

Income Tax Penalty Calculator for Late ITR Filing under Section 234F Calculator on Section 234F Helps you to calculate late Fees on delayed filing of income tax return for This article explains the consequences of belated ITR filing fees and penalties Belated ITR Fee For belated ITR filing you will have to pay a late fee of up to Rs 5000

I T Return Filing Interest Penalties On The Cards If Failed To File

https://images.moneycontrol.com/static-mcnews/2022/07/Penalties-2-belate-returns-ITR-.jpg

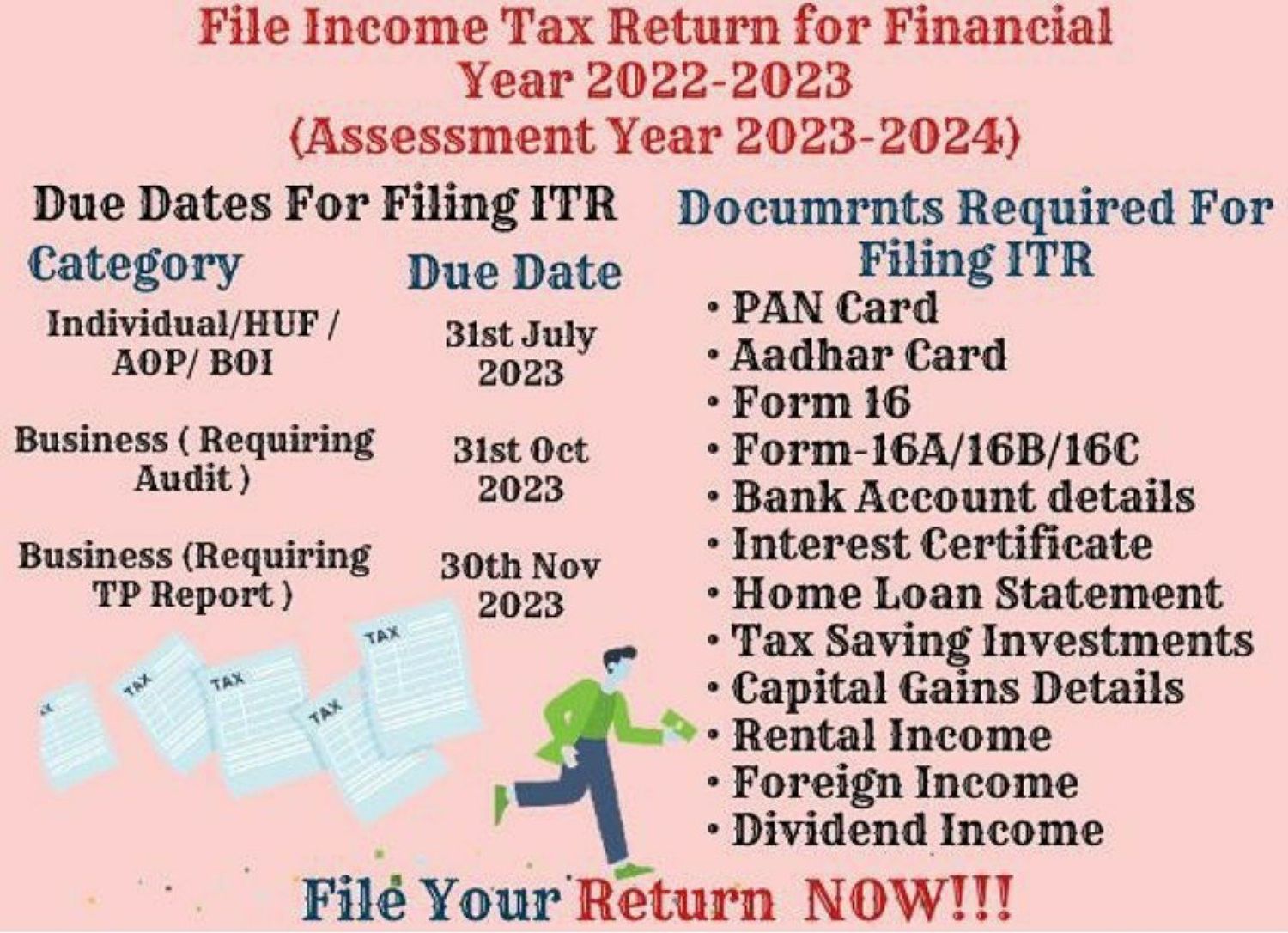

Last Date To File Income Tax Return ITR For FY 2022 23 AY 2023 24

https://academy.tax4wealth.com/public/storage/uploads/1681121464-last-date-to-file-income-tax-return-itr-for-fy-2022-23-ay-2023-24.jpg

https://www.financialexpress.com/money/income-tax...

Belated ITR filing penalty According to the Income Tax rules the penalty for belated ITR filing could be up to Rs 5 000 However for taxpayers whose total income is

https://cleartax.in/s/late-tax-return

From the financial year 2021 onwards the income tax department has reduced the maximum amount of penalty for late filing of returns to Rs 5 000 from Rs 10 000 To

ITR Filing These Taxpayers Can Still File Income Tax Return Without

I T Return Filing Interest Penalties On The Cards If Failed To File

Due Date ITR Fiing For AY 2023 24 Is July 31st 2023 Academy Tax4wealth

Penalty Section 234F For Late Income Tax Return Filers

Explained All About Belated Filing Of Income Tax Returns

Penalty For Late Filing Of ITR Everything You Need To Know

Penalty For Late Filing Of ITR Everything You Need To Know

Types Of ITR Forms For AY 2021 22 In 2023 Financial Literacy Form

ITR Filing Online 2023 24 Last Date Last Date Of ITR Filing AY 2023

Income Tax Return Filling Online Online ITR Filing Amendment

Late Filing Fee For Itr Ay 2022 23 - As per Section 234F a penalty of Rs 5 000 needs to be paid if one files belated ITR after July 31 by taxpayers with total income of Rs 5 lakh and up For taxpayers with less than Rs 5 lakh total income the fine