Leave Encashment Income Tax Rebate Web 12 sept 2023 nbsp 0183 32 Here in this video we will discussWhat is leave encashmentTaxability of leave encashmentTax on leave encashmentTax on amount received as leave encashmentTa

Web 4 mai 2022 nbsp 0183 32 Payroll Leave Encashment Calculation Tax Exemption amp Other Rules May 4 2022 5 Mins Read Leave encashment is the amount of money an employee receives Web 14 f 233 vr 2023 nbsp 0183 32 The new income tax slabs slabs are Rs 3 lakh 6 lakh with 5 tax rate Rs 6 lakh 9 lakh with 10 etc But why is it being said that there is no income tax upto Rs

Leave Encashment Income Tax Rebate

Leave Encashment Income Tax Rebate

https://taxguru.in/wp-content/uploads/2023/01/Leave-encashment-2-1-768x714.jpg

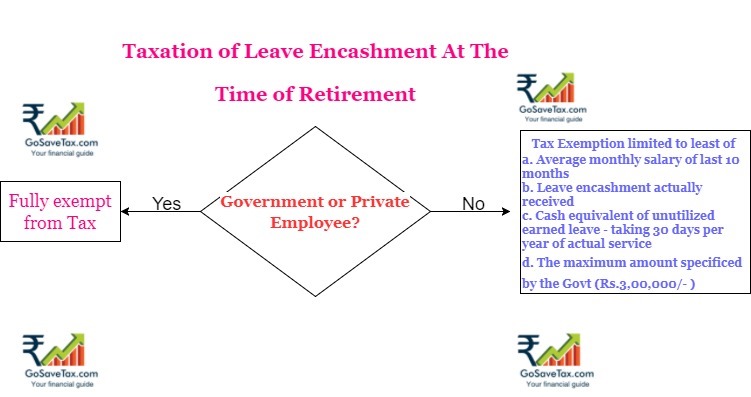

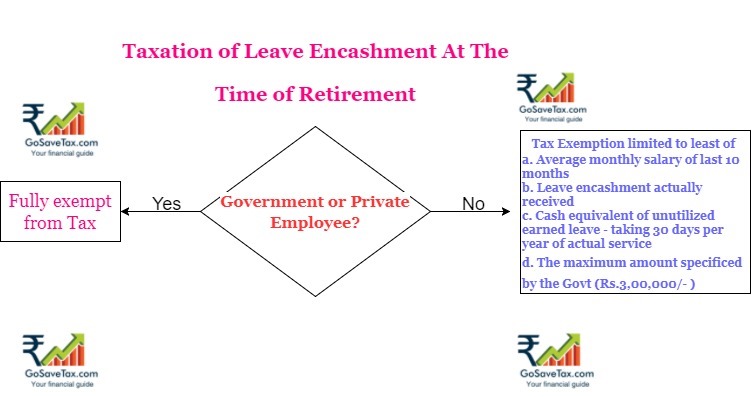

Is Leave Encashment After Retirement Or During Service Taxable

http://gosavetax.com/blog/wp-content/uploads/2017/10/Leave-Encashment-after-retirement-taxation.jpg

Leave Encashment Details Tax Implications

http://www.relakhs.com/wp-content/uploads/2015/06/Leave-Encashment-sample-calculation-template-ex.jpg

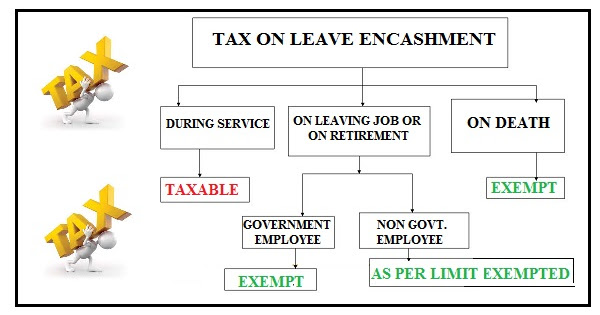

Web 5 sept 2023 nbsp 0183 32 Puneet Gupta Partner People Advisory Services EY India says quot As per the Occupational Safety Health and Working Conditions Code 2020 if the leave balance Web 21 ao 251 t 2023 nbsp 0183 32 The taxation on leave encashment is done by adding it to income from salary after considering all the exemptions depending on the nature of the job when the

Web 22 f 233 vr 2018 nbsp 0183 32 1 Proceeds received towards leave encashment are taxable if received while in service 2 Whether you are employed in the government or private sector the Web 9 sept 2023 nbsp 0183 32 canewsyllabus caintermediate icainewscheme cainter CA New Course UpdateCA Inter New SyllabusCA Inter New SchemeCA InterCA New Scheme 2023CA Intermediat

Download Leave Encashment Income Tax Rebate

More picture related to Leave Encashment Income Tax Rebate

INCOME TAX ON LEAVE ENCASHMENT SIMPLE TAX INDIA

https://1.bp.blogspot.com/-JFxIcvzzom4/WoXByAGS66I/AAAAAAAAEF4/bLan90MC7zYAcFkKEK2HdbSAXkSlnoR2ACLcBGAs/w600-h315-p-k-no-nu/TAX%252BTREATMENT%252BOF%252BLEAVE%252BENCASHMENT.jpg

Leave Encashment

https://i1.wp.com/www.hrknowledgecorner.com/wp-content/uploads/2017/04/LE-1.jpg?fit=1280%2C720

Leave Salary Or Leave Encashment Section 10 10AA Taxability Of Re

https://d1avenlh0i1xmr.cloudfront.net/d3e7c0a5-0298-41d9-a722-19935c206e13/leave-salary-enchashment-exemption.png

Web 8 sept 2023 nbsp 0183 32 Coming to the question of salary calculation for these leaves Gupta from EY India was quoted in the report as saying quot Under the OSH Code the amount of leave Web 10 big income tax rule changes from 1 April 2023 for taxpayers Know here 1 New income tax regime to be default regime Starting 1 April 2023 the new income Pular para

Web Leave encashment tax calculation and here s how a tax on leave encashment by salaried employees will be calculated for income tax return Also we have mentioned a simple Web 11 sept 2023 nbsp 0183 32 Individuals with income up to Rs 5 lakh can avail rebate of Rs 12 500 under both old and new tax regimes Is rebate applicable in the new tax regime Yes

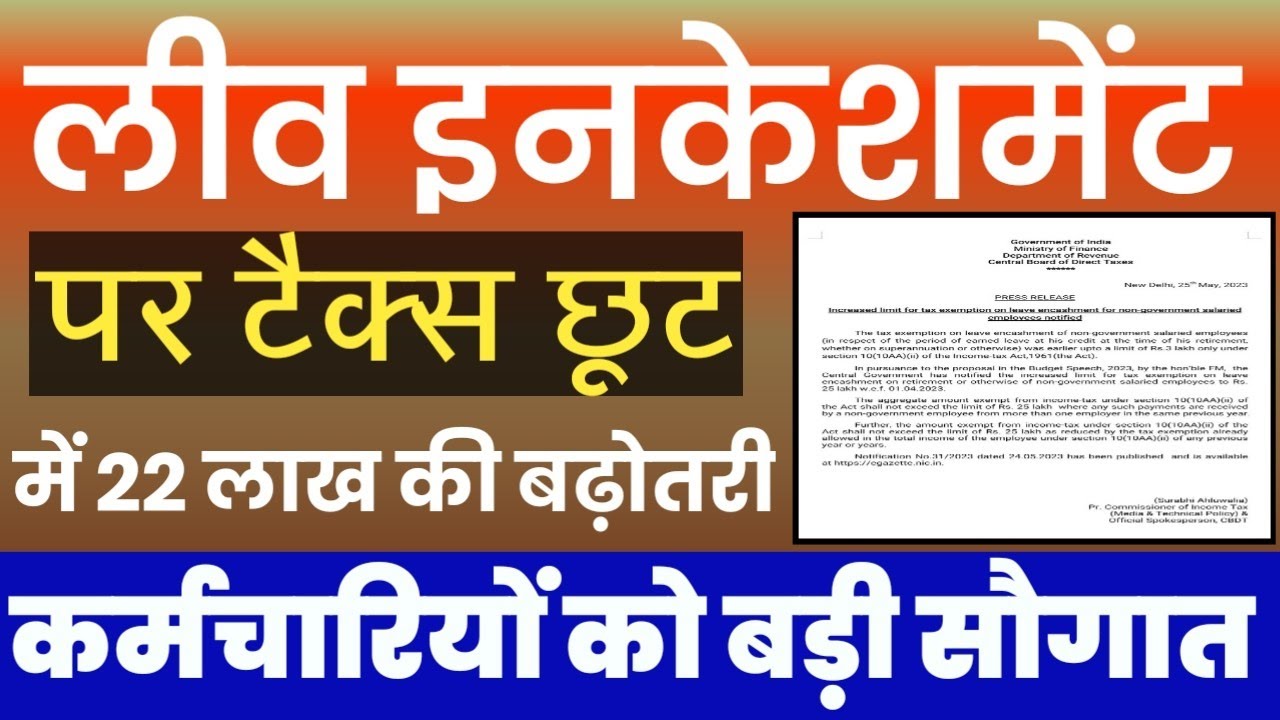

Leave Encashment Tax Exemption Rs 22 Lakh Section 10

https://i.ytimg.com/vi/vgiVNDcHy4o/maxresdefault.jpg

.jpg)

Leave Encashment Rules Exemption Encashment And Tax Calculation

https://global-uploads.webflow.com/6145f7156a1337613524d548/646c4d9e6d7d19a7a405ce0a_leave encashment (1).jpg

https://www.youtube.com/watch?v=Vn1bOXgeW5s

Web 12 sept 2023 nbsp 0183 32 Here in this video we will discussWhat is leave encashmentTaxability of leave encashmentTax on leave encashmentTax on amount received as leave encashmentTa

https://razorpay.com/payroll/learn/leave-encashment-calculation

Web 4 mai 2022 nbsp 0183 32 Payroll Leave Encashment Calculation Tax Exemption amp Other Rules May 4 2022 5 Mins Read Leave encashment is the amount of money an employee receives

Leave Encashment Income Tax Exemption Limit Increased To Rs 25 Lakhs

Leave Encashment Tax Exemption Rs 22 Lakh Section 10

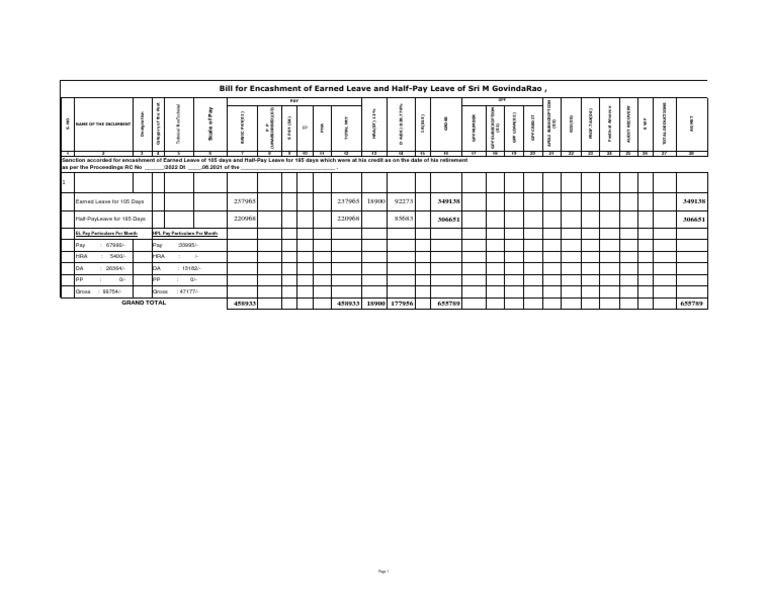

Leave Encashment GovindaRao PDF Taxes Government Finances

Calculation Of Leave Encashment Exemption Using Formula

Leave Encashment Exemption For Government Employees Income Tax Rule

Tax Exemption On Leave Encashment LexComply Blog

Tax Exemption On Leave Encashment LexComply Blog

Leave Encashment Tax Treatment Numericals YouTube

22 LEAVE ENCASHMENT B COM CHAPTER 2 INCOME TAX LAW PRACTICE

Simple Guide To Tax Rule On Leave Encashment While Job Or Quitting

Leave Encashment Income Tax Rebate - Web CBDT issues notification increasing the tax exemption on Leave encashment for Non Government salaried employees w e f 01 04 2023 Here is the synopsis of the amended