Lhdn Tax Rebate Web Pursuant to the Finance Act 2020 a new Section 6D was introduced into the ITA to provide an income tax rebate of up to RM20 000 per YA for a period of three consecutive YAs

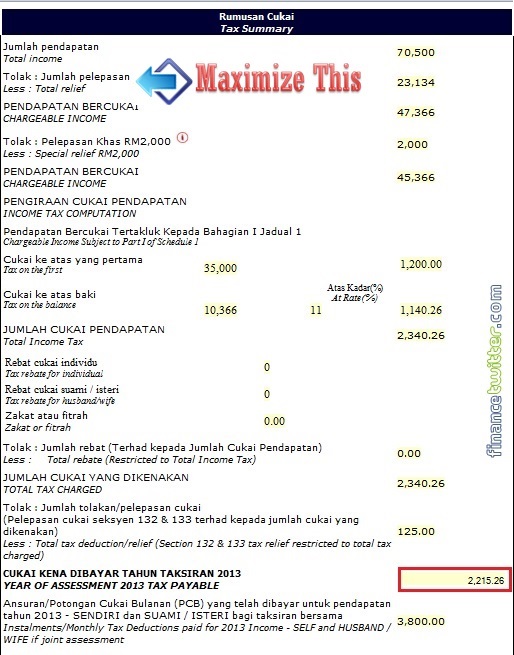

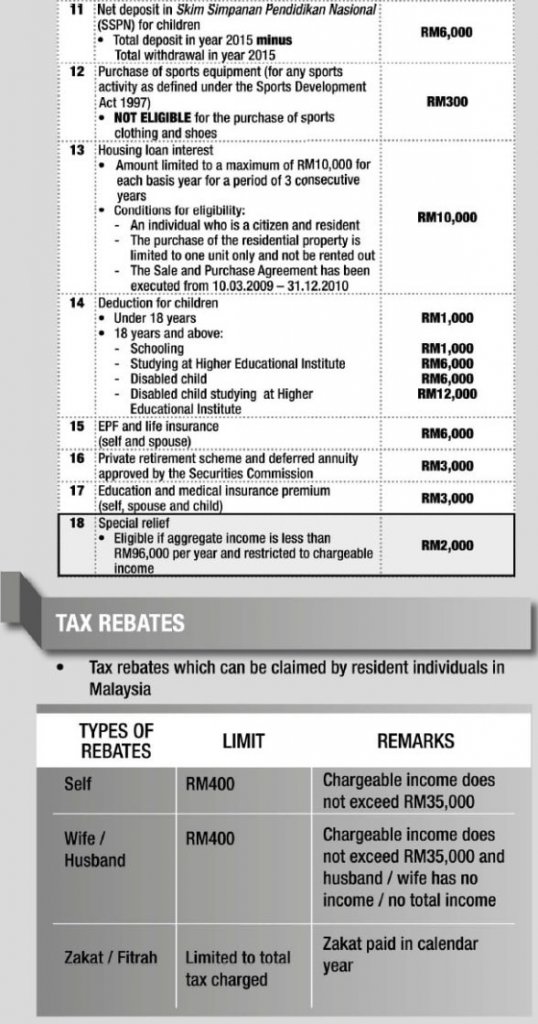

Web Special relief of RM2 000 will be given to tax payers earning on income of up to RM8 000 per month aggregate income of up to RM96 000 annually This relief is applicable Web 23 d 233 c 2021 nbsp 0183 32 An income tax rebate up to RM20 000 per year for 3 years of assessment was given to newly established small and medium enterprises SMEs between 1 July 2020 to 31 December 2021 pursuant to the

Lhdn Tax Rebate

Lhdn Tax Rebate

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

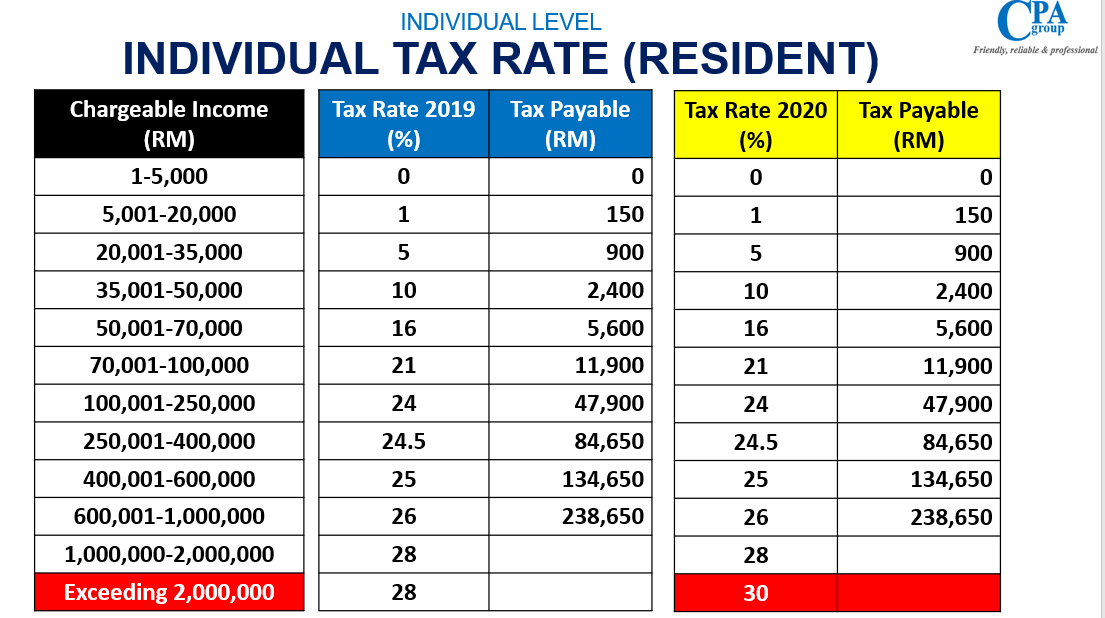

Lhdn Tax Rate 2019 Christopher King

https://static.wixstatic.com/media/6f2a9b_9d21f79054a744008e2bf414958a58f2~mv2.jpg/v1/fill/w_640,h_428,al_c,q_80,usm_0.66_1.00_0.01,enc_auto/6f2a9b_9d21f79054a744008e2bf414958a58f2~mv2.jpg

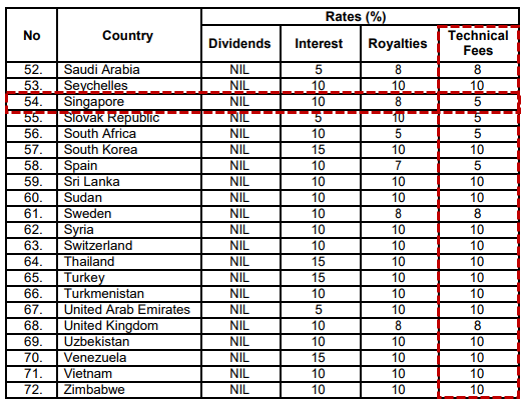

LHDN Personal Tax Relief 2021 Dec 08 2021 Johor Bahru JB

https://cdn1.npcdn.net/image/1638946246de39a808912d7a372ffd3d387b7c964c.png?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1600&new_height=1600&w=-62170009200

Web 3 janv 2022 nbsp 0183 32 From YA 2021 a tax rebate section 6D 4 will be provided to resident Companies or Limited Liability Partnerships LLPs hereinafter referred to as Qualifying Entity incorporated registered in Web 15 mars 2023 nbsp 0183 32 1 Income tax reduction During the recent tabling of the revised Budget 2023 Prime Minister and Minister of Finance YAB Dato Seri Anwar Ibrahim announced a reduction of taxable income for those in

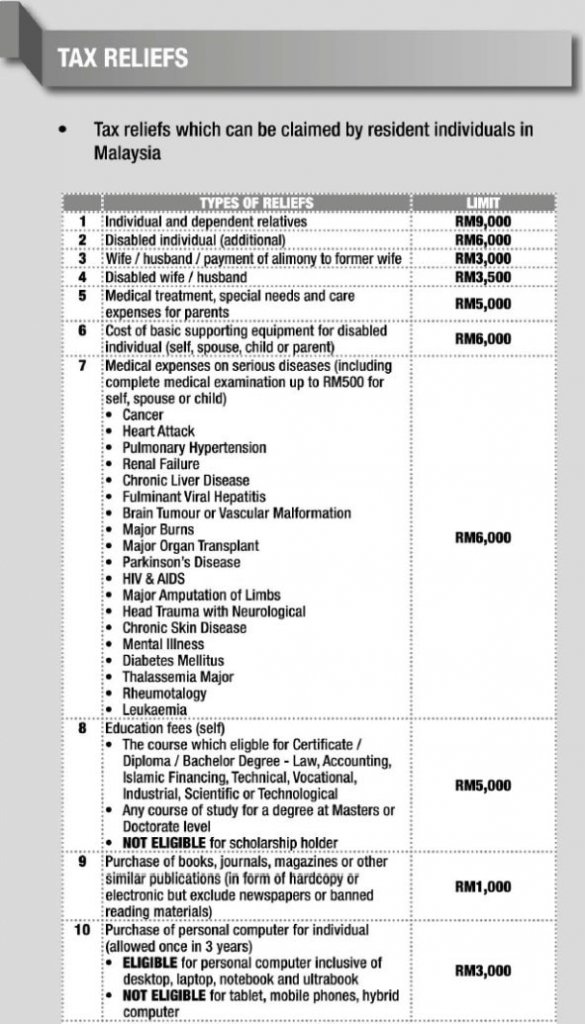

Web 27 f 233 vr 2023 nbsp 0183 32 So what are LHDN s income tax relief that s eligible for taxpayers in 2023 We highlight the top 8 personal income tax updates and reliefs so that you ll know what s Web 5 janv 2022 nbsp 0183 32 With that here s LHDN s full list of tax reliefs for YA 2021 Self parents and spouse 1 Automatic individual relief RM9 000 You re eligible for an automatic tax deduction of RM9 000 just by filling in the

Download Lhdn Tax Rebate

More picture related to Lhdn Tax Rebate

Lhdn Tax Relief 2021 Tax Relief Malaysia LHDN s Full List Of Things

https://wecorporate.com.my/wp-content/uploads/2020/08/malaysia-withholding-tax-on-foreign-service-providers.jpg

Lhdn 2018 Tax Relief This Is Considered Internet Claim Twotrux

http://www.financetwitter.com/wp-content/uploads/2014/03/Income-Tax-Tax-Summary-11.jpg

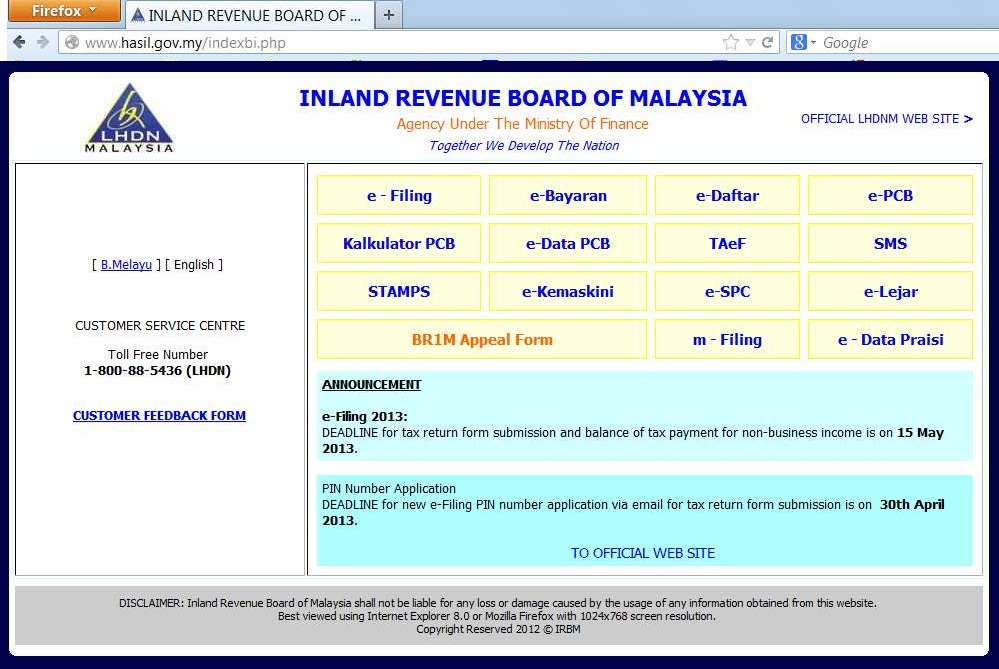

CTOS LHDN E filing Guide For Clueless Employees

https://ctoscredit.com.my/wp-content/uploads/2017/03/malaysiandigest-tax-relief-201612-min-538x1024.jpg

Web 1 nov 2021 nbsp 0183 32 Special tax relief for the purchase of phones computers and tablets extended The ongoing special tax relief of RM2 500 which is allocated specifically for the purchase of phones computers and tablets Web 28 janv 2022 nbsp 0183 32 Gazette Order on Conditions for Tax Rebate for Companies and Limited Liability Partnerships LLPs The Government announced an income tax rebate for new

Web 3 janv 2023 nbsp 0183 32 LHDN tax relief Malaysia YA 2022 claims list for self spouse child 1 Automatic individual relief RM9 000 2 Further education fees self RM7 000 3 Spouses and alimonies RM4 000 4 Medical expenses for Web 4 avr 2023 nbsp 0183 32 The zakat tax rebate allows Muslims to not be required to pay two overlapping compulsory payments each year It is possible to get the entire amount paid out in zakat

E filing Lhdn Deadline Wallpaper

https://lifestyle.prod.content.iproperty.com/news/wp-content/uploads/sites/3/2021/01/20142053/LHDN-income-tax-YA-2020.jpg

No Cukai Jalan Motor

https://3.bp.blogspot.com/-MlGZoBX2dRI/WbAeyIy0coI/AAAAAAAApRQ/80NCMpgo49A6StiXhQV9Xm2Yv3LBbP-jgCLcBGAs/s1600/dta-malaysia-singapore-technical-fees.png

https://www.ey.com/en_my/tax-alerts/income-tax-rebate-for-new-smes-or...

Web Pursuant to the Finance Act 2020 a new Section 6D was introduced into the ITA to provide an income tax rebate of up to RM20 000 per YA for a period of three consecutive YAs

https://www.hasil.gov.my/.../how-to-declare-income/tax-reliefs

Web Special relief of RM2 000 will be given to tax payers earning on income of up to RM8 000 per month aggregate income of up to RM96 000 annually This relief is applicable

Lhdn Tax Rate 2019 Jaame7ntna8eim 2019 Tax Brackets And Tax Rates

E filing Lhdn Deadline Wallpaper

Travelling Expenses Tax Deductible Malaysia Paul Springer

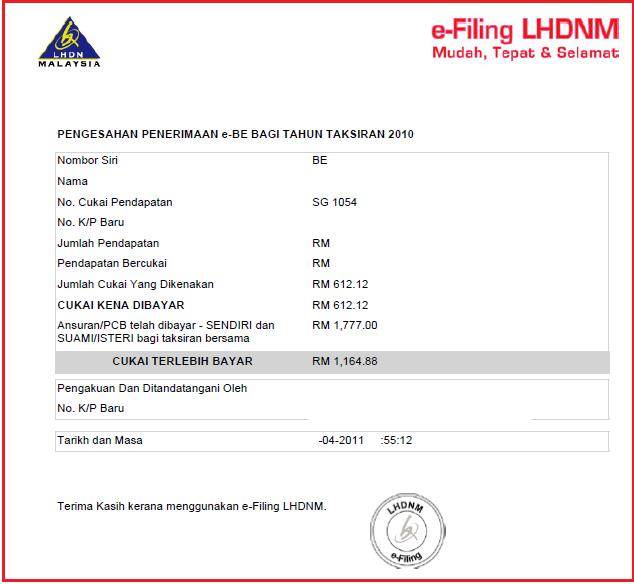

Resit Bayaran Lhdn Online Drake has Mason

UPDATED 2021 Tax Reliefs For YA 2020 And How To File Income Tax In

Lhdn Check Income Tax Number However A Lot Of Us Aren t Even Aware

Lhdn Check Income Tax Number However A Lot Of Us Aren t Even Aware

Best Butterfly Inspirational Quotes

Lhdn Approved Donation List

Lhdn Tax Relief 2021 Tax Relief Malaysia LHDN s Full List Of Things

Lhdn Tax Rebate - Web 5 janv 2022 nbsp 0183 32 With that here s LHDN s full list of tax reliefs for YA 2021 Self parents and spouse 1 Automatic individual relief RM9 000 You re eligible for an automatic tax deduction of RM9 000 just by filling in the