Lic Comes Under 80c Or 80d The maximum limit of deduction available under Section 80C Section 80CCC and Section 80 CCD 1 for a contribution towards the National Pension System is INR 1 5 lakhs Deduction under Section 80D of the Income Tax Act Section 80D is available if you invest in LIC s health plans

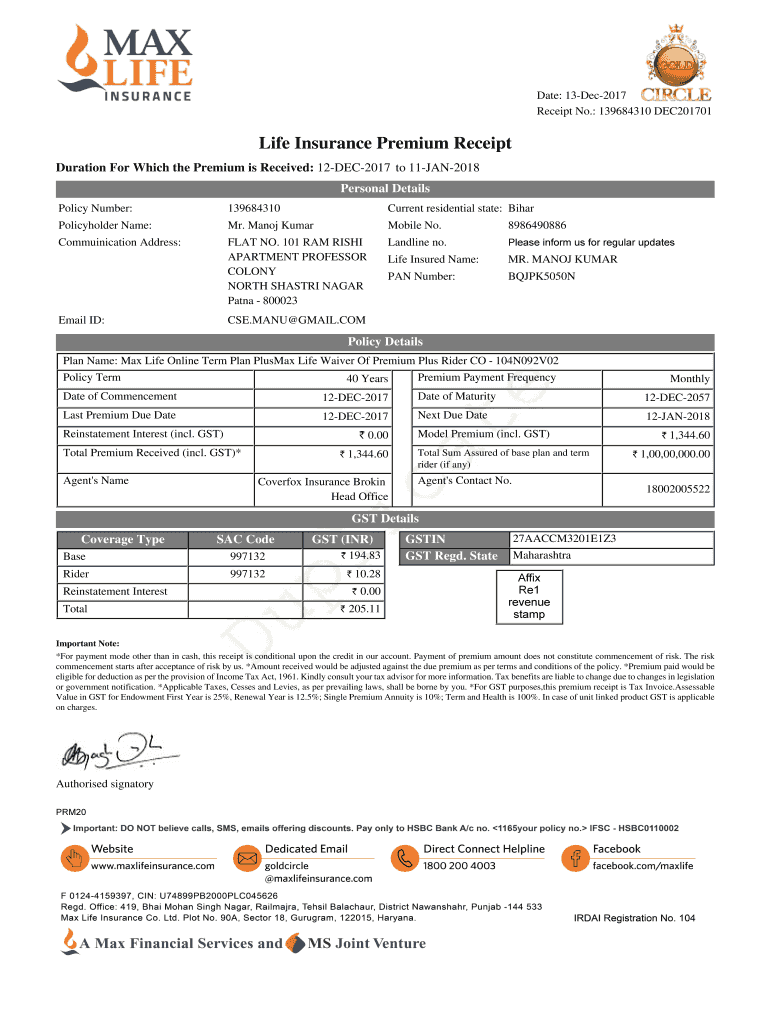

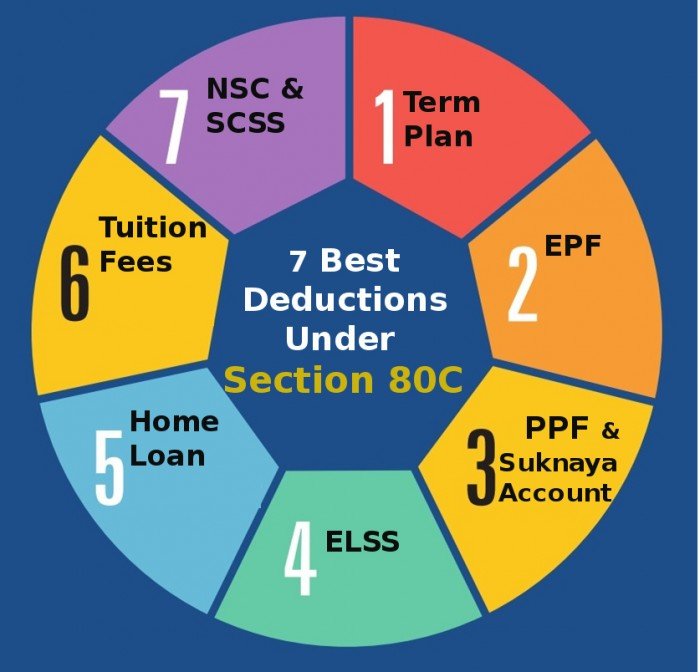

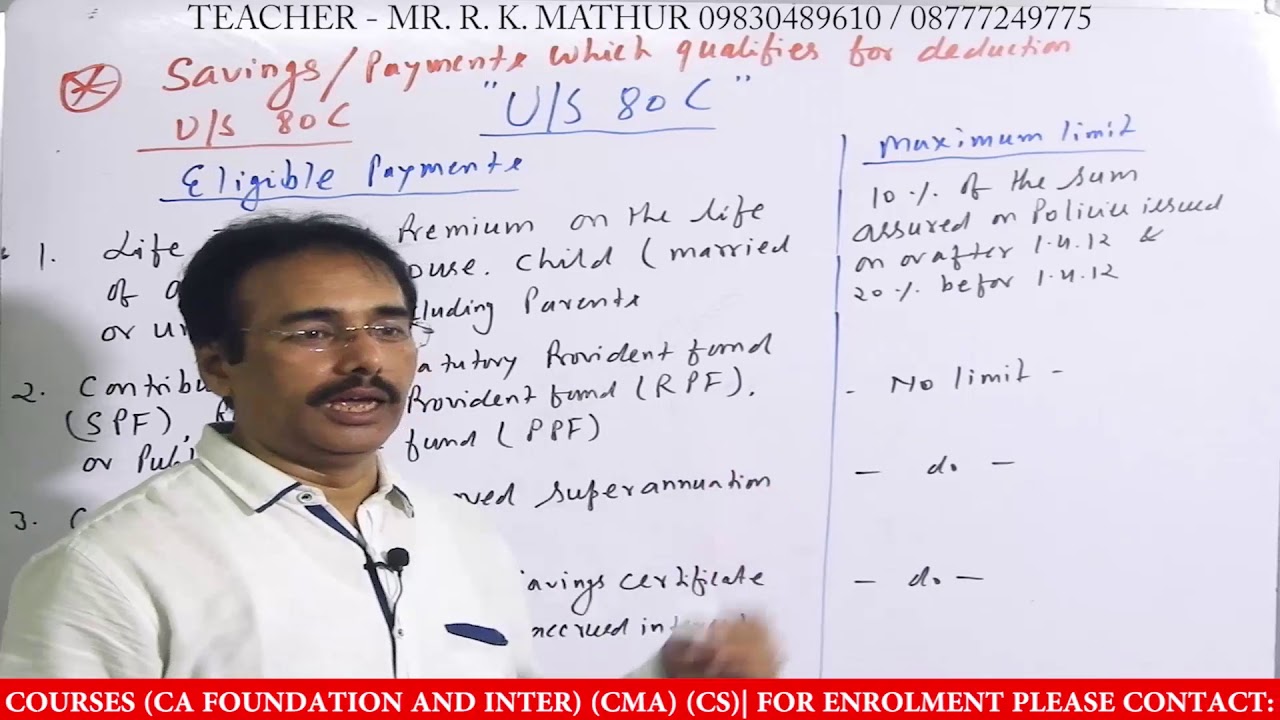

Section 80C of the Income Tax Act allows an individual and a Hindu Undivided Family HUF to claim a deduction of Rs 1 50 lakh on certain eligible expenditures and investments One of the items is the premium paid for a life insurance policy Tax benefits on LIC insurance policies under section 80DD Section 80DD of the Income Tax Act comes under section 80D and deals with tax exemption for any person who is depositing a certain amount with LIC for maintenance of a handicapped person The limit for this deduction is Rs 50 000

Lic Comes Under 80c Or 80d

Lic Comes Under 80c Or 80d

https://savedaughters.com/public/ckimages/ck_1636360500.jpeg

UNDER SECTION 80C TO 80U deductions 80c lic nps donation medical

https://i.ytimg.com/vi/5M1YKYGiLQc/maxresdefault.jpg

How Car Insurance Claims Process Works Forbes Advisor INDIA

https://thumbor.forbes.com/thumbor/fit-in/x/https://www.forbes.com/advisor/in/wp-content/uploads/2021/12/pexels-mikhail-nilov-7736045-Cropped-scaled.jpg

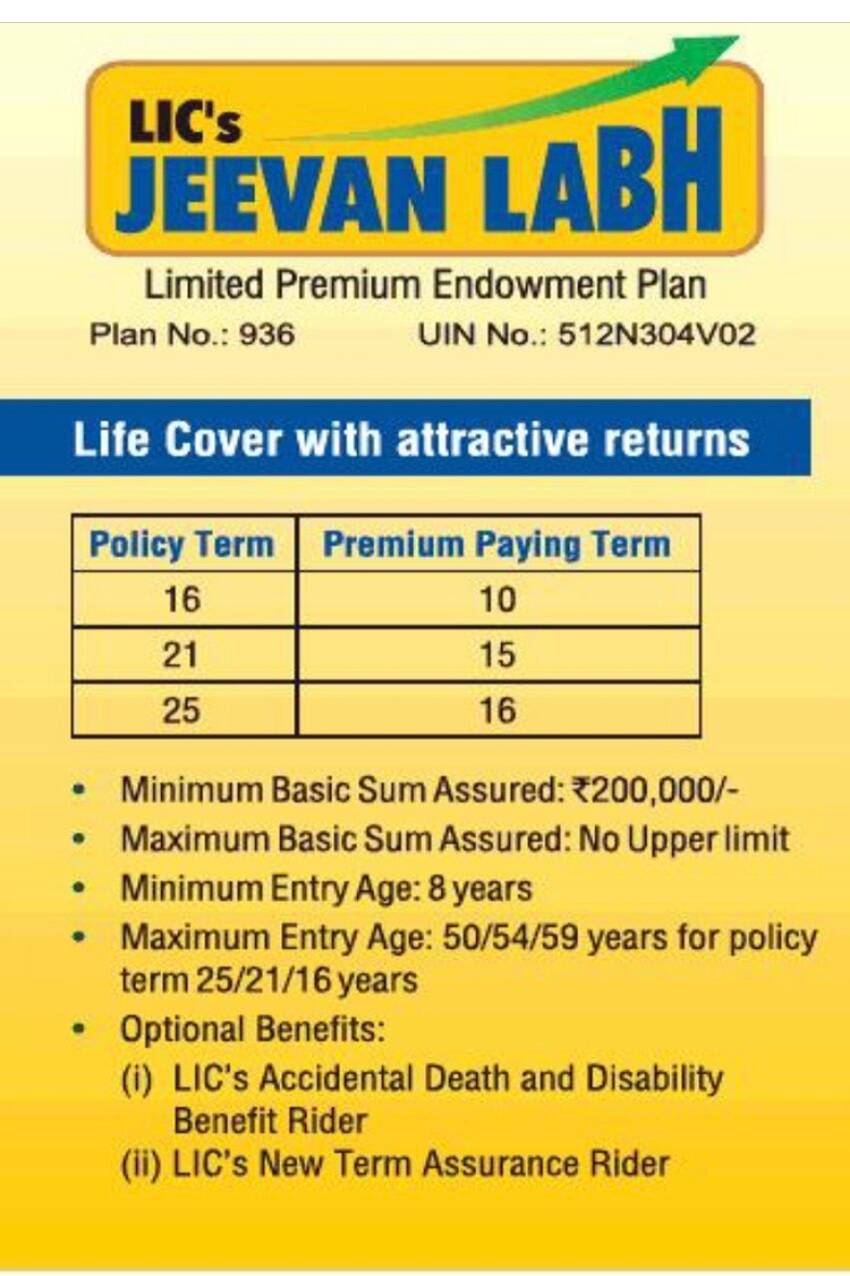

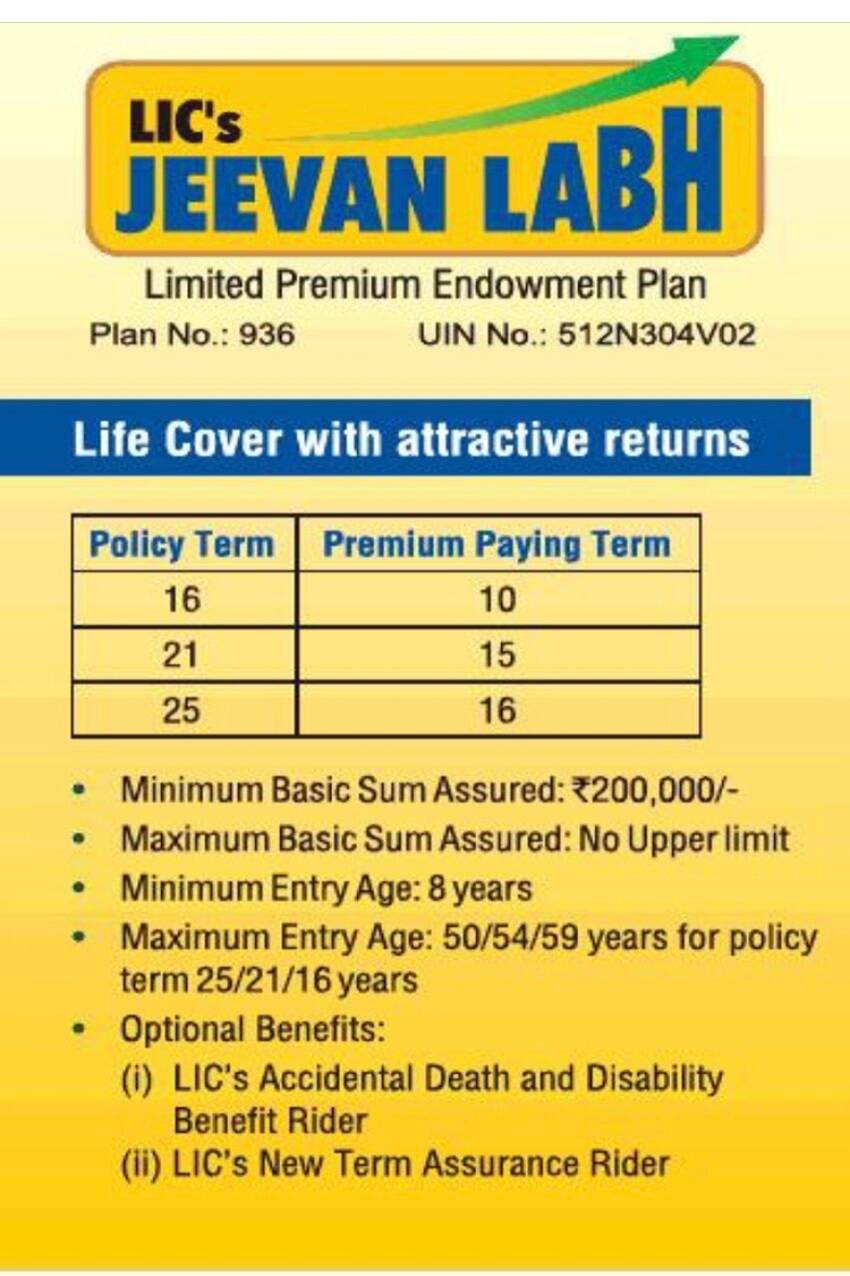

Moreover it offers other benefits such as death benefits loan facilities etc The tax benefits for this policy are available under Section 80C and Section 10 10D of the Income Tax Act 1961 LIC New Jeevan Anand Besides being a tax saving policy LIC New Jeevan Anand is the best LIC policy for middle class family Under section 80C premiums that you pay towards a life insurance policy qualify for a deduction up to 1 5 lakh while Section 10 10D makes income on maturity tax free if the premium is not more than 10 of the sum assured or

Important Note The date for making various investment payment for claiming deduction under Chapter VIA B of the IT Act which includes section 80C LIC PPF NSC etc 80D Mediclaim 80G Donations etc has Tax exemption offered under section 80C on life insurance policies from LIC If you have purchased a life insurance policy on or before 31st March 2012 in your own name or in the name of your spouse or child then up to 20 of tax deduction can be availed on the premium paid towards the life insurance policy

Download Lic Comes Under 80c Or 80d

More picture related to Lic Comes Under 80c Or 80d

Deductions Under Section 80C Does PF Come Under 80C

https://vakilsearch.com/blog/wp-content/uploads/2022/08/PF-under-80C.jpg

Mediclaim Premium Receipt PDF Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/470/590/470590793/large.png

Section 80C Of Income Tax Act Tax Deduction AY 2023 24

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2020/01/section-80c.jpg

80C allows deduction for PPF EPF LIC ELSS NSC repayment of home loan tution fees etc 80CCC allows deduction for any amount paid towards the annuity plan of LIC or any other insurer 80CCD allows deduction for pension contributions made by employee employer contribution or voluntary self contribution The LIC Jeevan Aadhar plan comes under this section 3 Section 10 10D Section 10 10D of the Income Tax Act allows tax benefits if an individual receives death benefits or maturity benefits on a selected LIC plan However it is important to note that the maximum tax benefits offered go up to Rs 1 50 000 4

Section 80C of the Income Tax Act 1961 is the most preferred and valuable tax saving provision based on investments in financial products Individuals and HUFs can claim a tax deduction of up to 1 50 000 under this section from the total gross income Last Updated on 05 12 2023 Discover the tax benefits of LIC insurance plans Maximize your savings with comprehensive policies that offer financial security and tax advantages

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

https://i.ytimg.com/vi/Q6z6wI7m9Eo/maxresdefault.jpg

Is Term Insurance Covered Under 80C Or 80D

https://d3h6xrw705p37u.cloudfront.net/articles/main_image_680x309/is-term-insurance-covered-under-80c-or-80d-1658815168.png

https://www.turtlemint.com/lic-premium-tax-deductions

The maximum limit of deduction available under Section 80C Section 80CCC and Section 80 CCD 1 for a contribution towards the National Pension System is INR 1 5 lakhs Deduction under Section 80D of the Income Tax Act Section 80D is available if you invest in LIC s health plans

https://news.cleartax.in/it-conditions-attached...

Section 80C of the Income Tax Act allows an individual and a Hindu Undivided Family HUF to claim a deduction of Rs 1 50 lakh on certain eligible expenditures and investments One of the items is the premium paid for a life insurance policy

Deduction Under Section 80C Its Allied Sections

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

Why Is 80C The Best Tax Saving Instrument

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Deduction US 80C Deduction Under Section 80C Everything About

Deduction US 80C Deduction Under Section 80C Everything About

Tax Deductions Under Sections 80C 80CCC 80CCD And 80D Academy

LIC Jeevan Vriddhi New Advertisement ApnaPlan Personal Finance

Invest In These 3 LIC Schemes For Higher Returns

Lic Comes Under 80c Or 80d - Important Note The date for making various investment payment for claiming deduction under Chapter VIA B of the IT Act which includes section 80C LIC PPF NSC etc 80D Mediclaim 80G Donations etc has