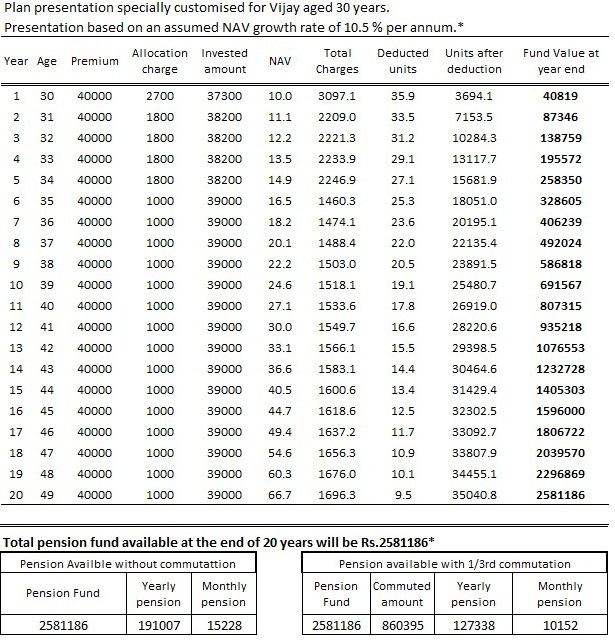

Lic Pension Plan Tax Rebate Web Check out several tax saving life insurance policies from LIC of India and get tax benefits under 80C 80CCC 80DD and 10D of the Income Tax Act 1961

Web 17 nov 2022 nbsp 0183 32 Here is the list of plans with their products for a better interpretation Endowment Plans Whole Life Plans Money Back Plans Term Assurance Plans Rider Web 5 juin 2023 nbsp 0183 32 If a premium of INR 20 000 is paid INR 15 000 would be allowed as a deduction while the remaining INR 5000 would be a part of your taxable income If the

Lic Pension Plan Tax Rebate

Lic Pension Plan Tax Rebate

https://www.basunivesh.com/wp-content/uploads/2016/11/LIC-Jeevan-Akshay-VI-Pension-Rate.jpg

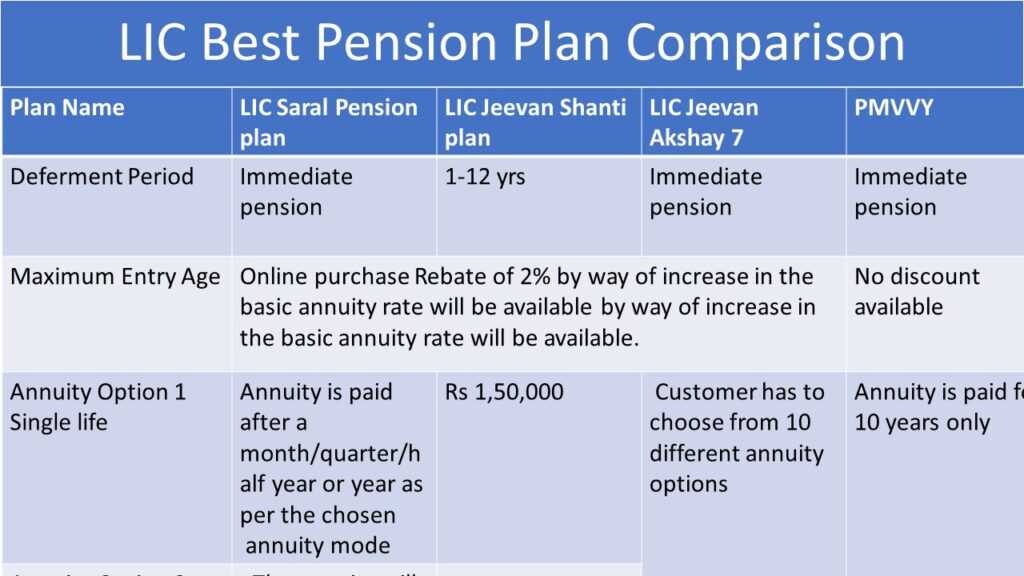

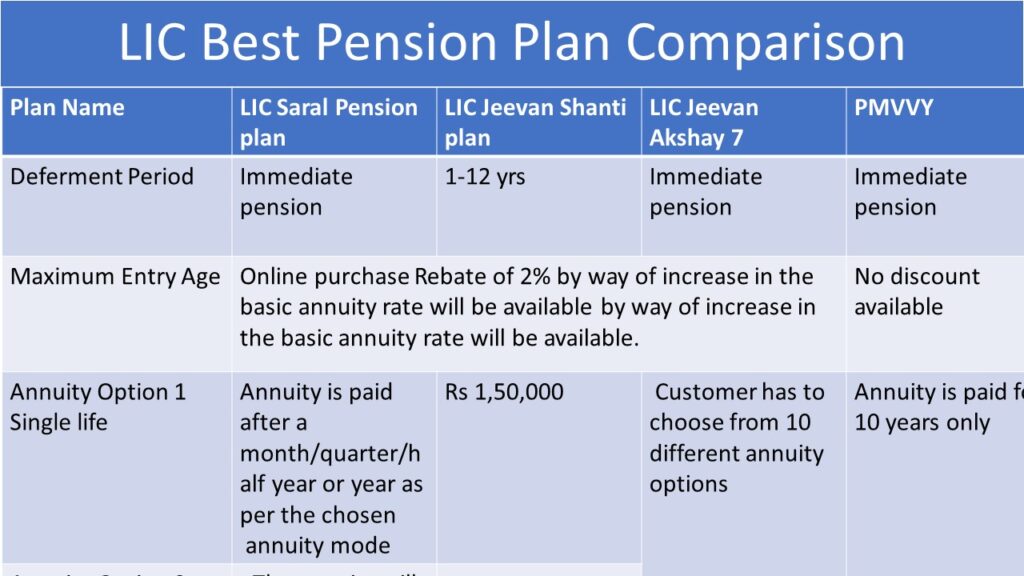

How To Choose Best LIC Pension Plan BestInvestIndia Personal

https://bestinvestindia.com/wp-content/uploads/2021/11/Slide7-2-1024x576.jpg

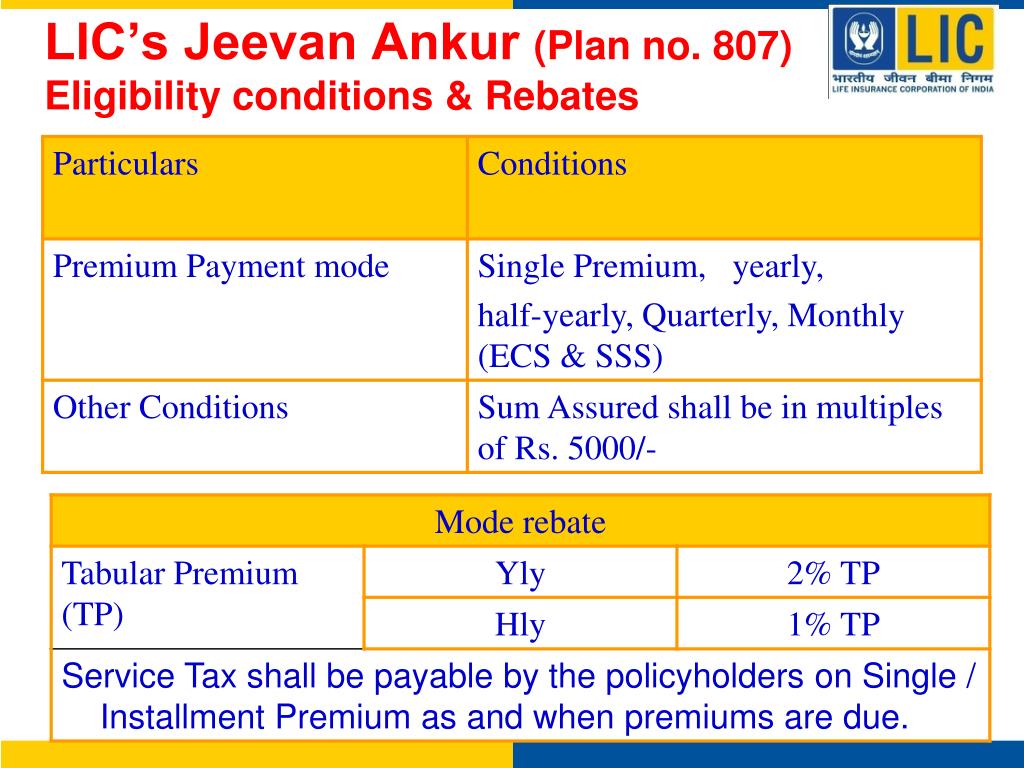

PPT LIC s Jeevan Ankur PowerPoint Presentation Free Download ID 649644

https://image.slideserve.com/649644/lic-s-jeevan-ankur-plan-no-807-eligibility-conditions-rebates-l.jpg

Web Key Features of LIC Tax Saving Plans Tax Benefits The premiums paid towards these plans are eligible for tax deductions under Section 80C up to a specified limit currently Web 17 d 233 c 2020 nbsp 0183 32 Additional deduction for Rs 50 000 for premium paid for pension policy issued by the Life insurance companies similar to that provided in section 80CCD 1B of

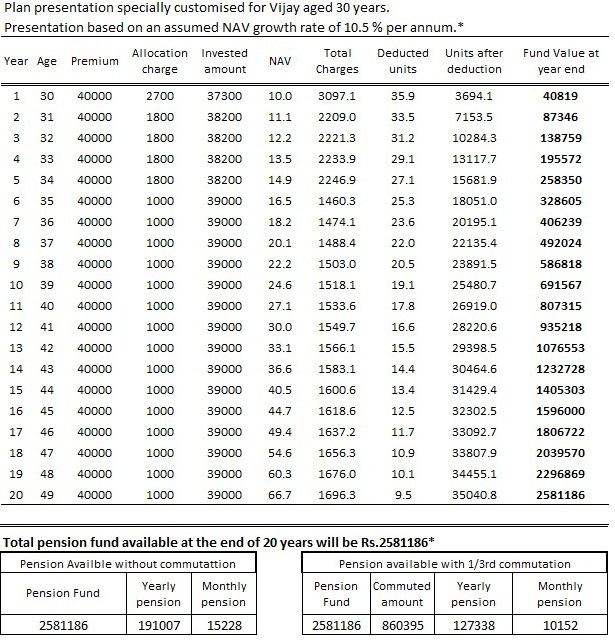

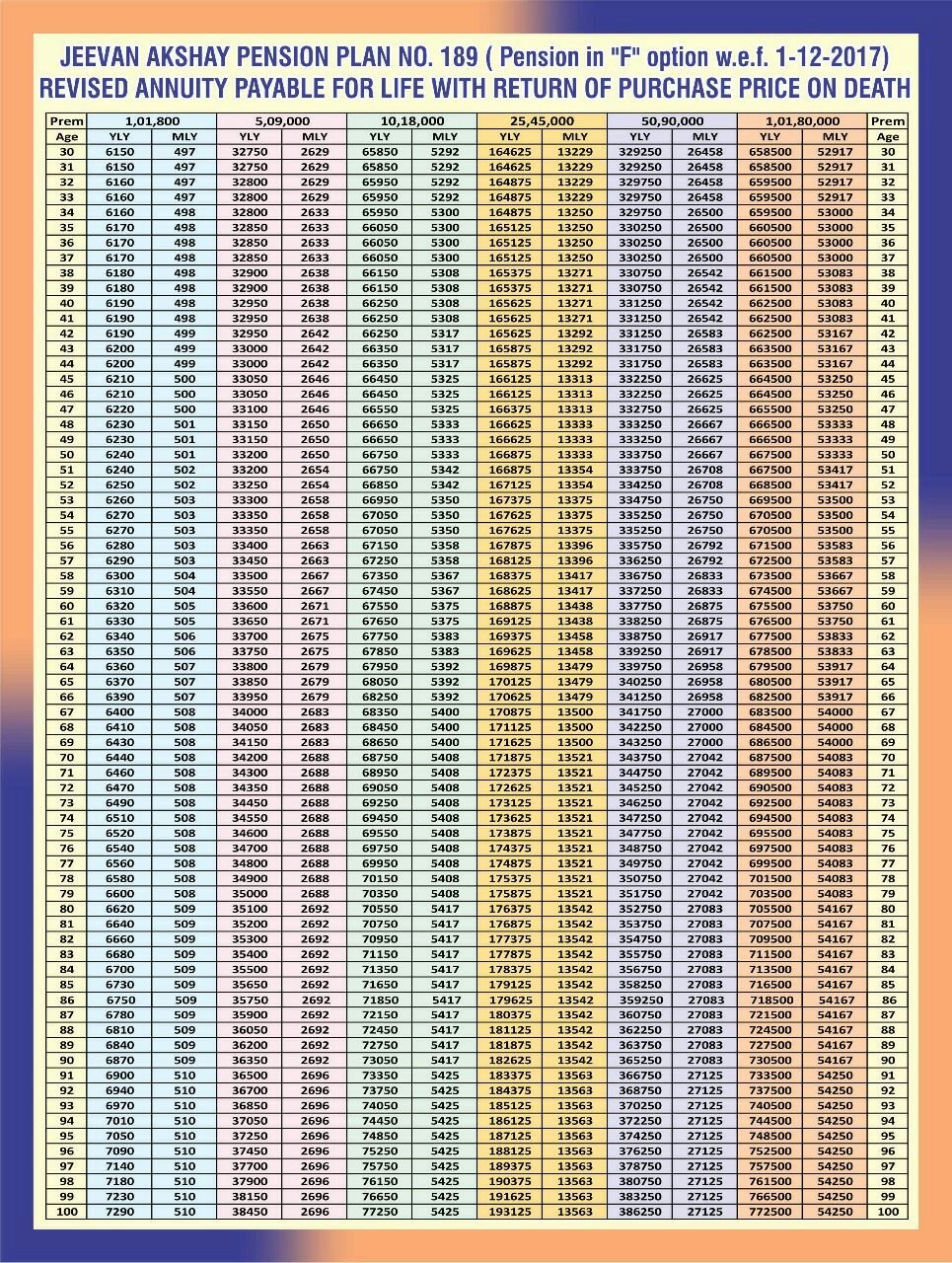

Web 5 sept 2023 nbsp 0183 32 Plan No UIN No 1 LIC s Jeevan Akshay VII 857 512N337V04 2 LIC s New Jeevan Shanti 858 512N338V04 3 LIC s Saral Pension 862 Web Meaning the amount received on surrender of plan including the bonus or interest shall be taxable in the year in which the amount was paid to you However taxable value out of

Download Lic Pension Plan Tax Rebate

More picture related to Lic Pension Plan Tax Rebate

LIC New Plans List 2018 19 Features Snapshot Review Of All Plans

https://www.relakhs.com/wp-content/uploads/2019/01/LIC-New-Plans-List-2018-19-LIC-All-policies-list-table-chart-LIC-latest-plans-in-2018-2019-Money-back-Single-premium-pension-plan.jpg

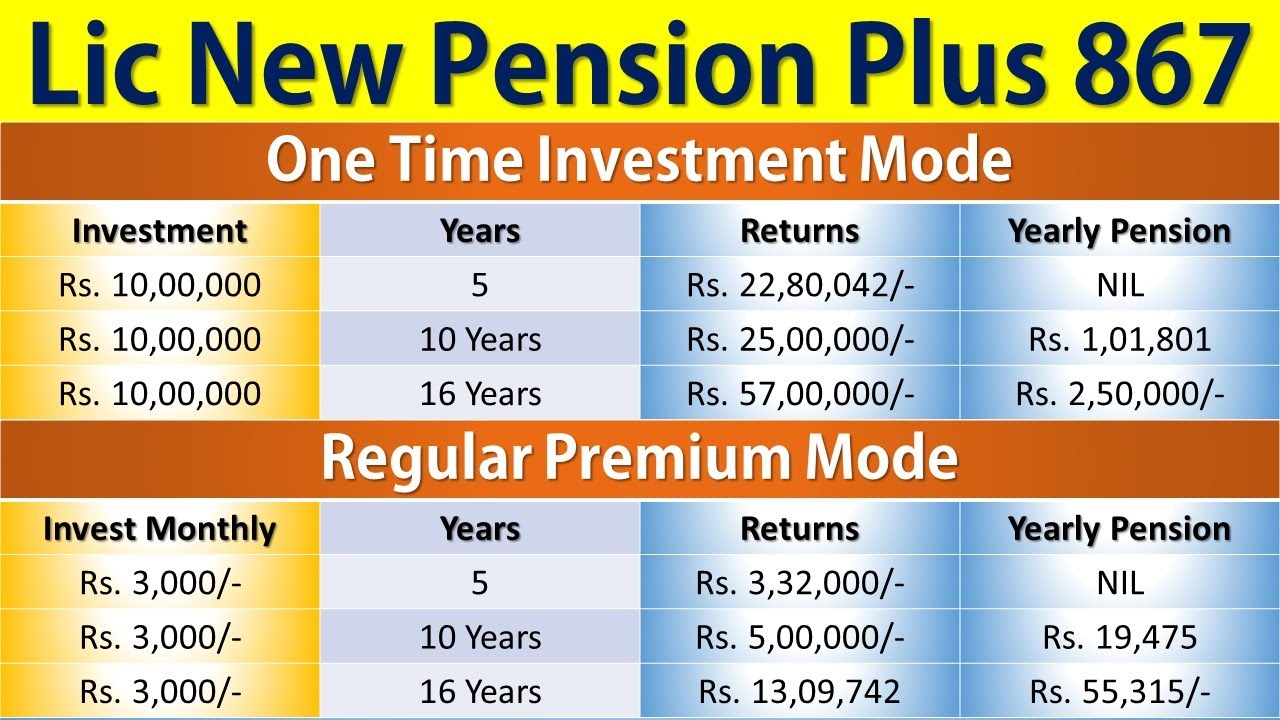

Lic New Pension Plan 867 Lic Pension Plan 2022 Lic New Pension Plus

https://i.ytimg.com/vi/UgXgMp3SCn8/maxresdefault.jpg

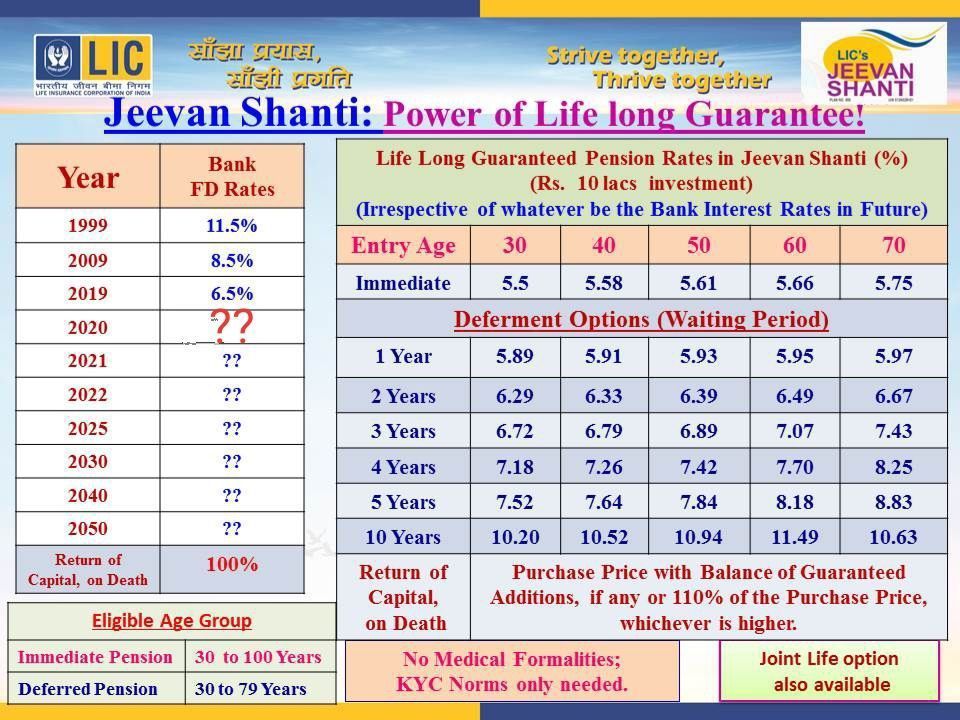

LIC Annuity Plans LIC Jeevan Shanti Best Annuity Plan In India

https://1.bp.blogspot.com/-c1gzo4ycBpw/XyrKu87FNUI/AAAAAAAABb0/CDwcZEPOfKMXp7cc_5dRg9jCAhi59ma6gCLcBGAsYHQ/s960/WhatsApp%2BImage%2B2020-07-30%2Bat%2B3.26.22%2BPM.jpeg

Web 8 juin 2023 nbsp 0183 32 Vous touchez une pension de retraite ou un autre avantage vieillesse Ces sommes sont soumises 224 l imp 244 t sur le revenu Toutefois certaines pensions sont Web 19 f 233 vr 2018 nbsp 0183 32 Pension from LIC policy is taxable I purchased an LIC pension policy in 2000 and the premium is Rs 10 014 per annum At that time an additional rebate in

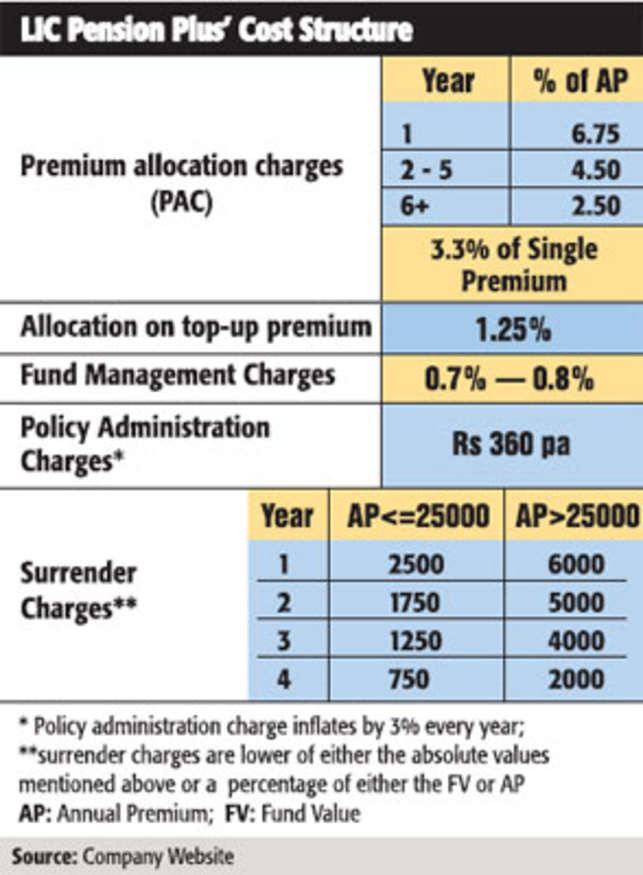

Web 1 janv 2012 nbsp 0183 32 LIC s Pension Plus is a unit linked deferred pension plan which provides you a minimum guarantee on the gross premiums paid The plan is without any life Web 14 f 233 vr 2023 nbsp 0183 32 1 Section 80C As per section 80C of the Income Tax Act 1961 there are tax benefits offered under different LIC plans Under this section the premium paid

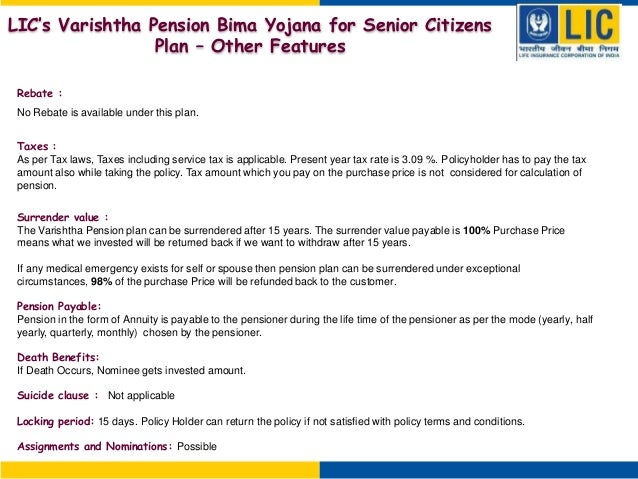

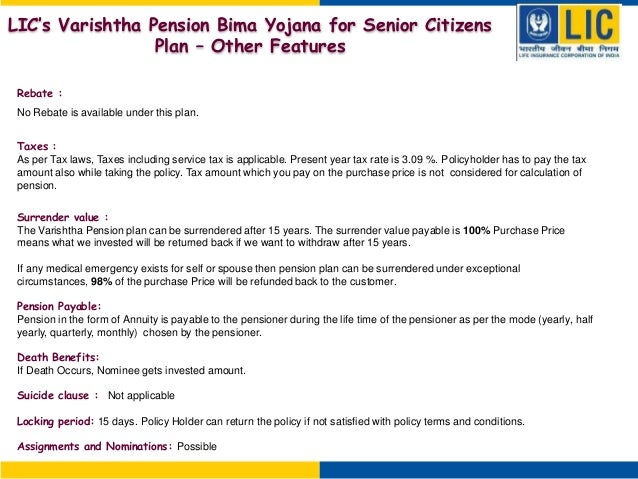

Lic Varishtha Pension Bima Yojana For Senior Citizens Plan 828

https://image.slidesharecdn.com/licvarishthapensionpensionbimayojanaforseniorcitizensplan828-140825045121-phpapp02/95/lic-varishtha-pension-bima-yojana-for-senior-citizens-plan-828-4-638.jpg?cb=1413852320

LIC Pension Plus A Cost effective Plan With Guaranteed Return The

https://img.etimg.com/thumb/msid-6723880,width-643,imgsize-35895,resizemode-4/lic-pension-plus-a-cost-effective-plan-with-guaranteed-return.jpg

https://www.bankbazaar.com/.../lic-policy-with-tax-exemption.html

Web Check out several tax saving life insurance policies from LIC of India and get tax benefits under 80C 80CCC 80DD and 10D of the Income Tax Act 1961

https://cleartax.in/s/lic-policy-list

Web 17 nov 2022 nbsp 0183 32 Here is the list of plans with their products for a better interpretation Endowment Plans Whole Life Plans Money Back Plans Term Assurance Plans Rider

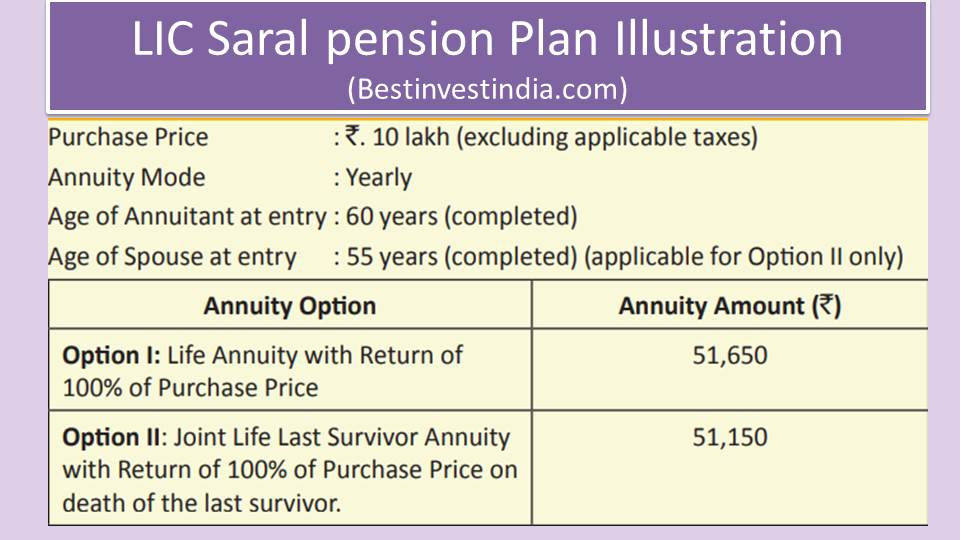

LIC Saral Pension Plan Lifetime Pension Yojana BestInvestIndia

Lic Varishtha Pension Bima Yojana For Senior Citizens Plan 828

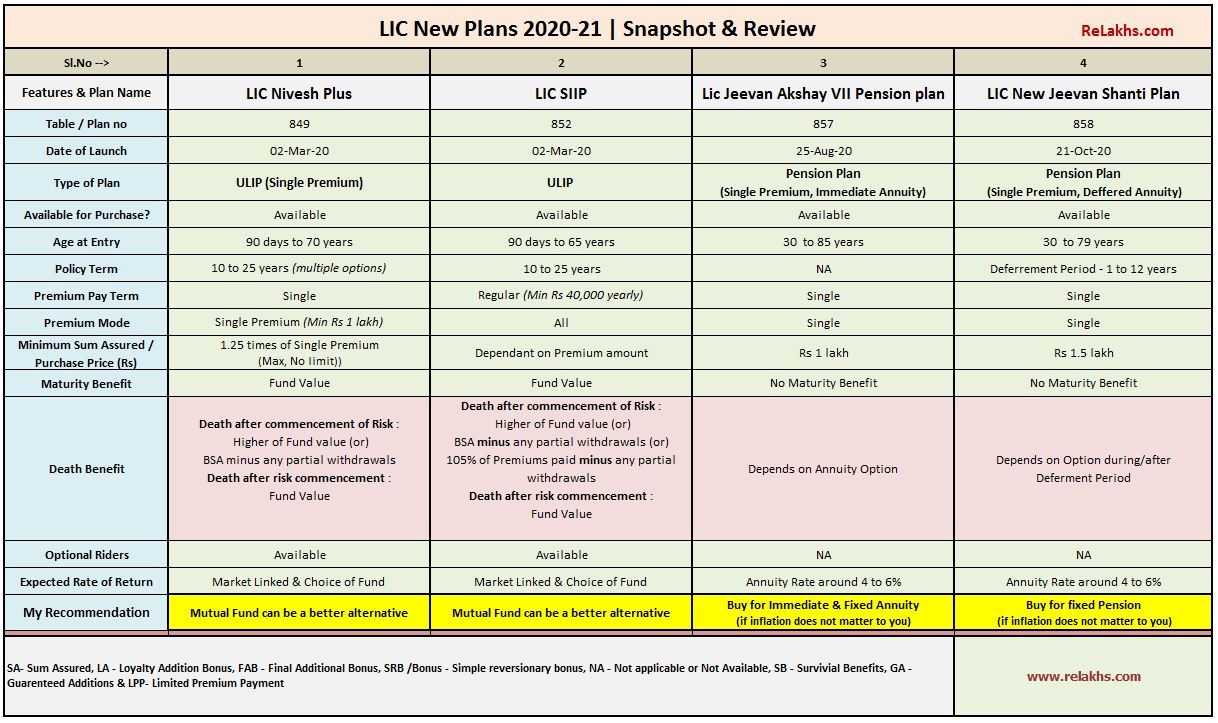

LIC New Plans 2020 2021 List Snapshot Review Of All Plans

LIC Jeevan Shanti Single Premium Guaranteed Pension Plan Features

LIC New Plans 2020 2021 List CapitalGreen

Latest News About LIC Of India Policy Details Photos And Videos

Latest News About LIC Of India Policy Details Photos And Videos

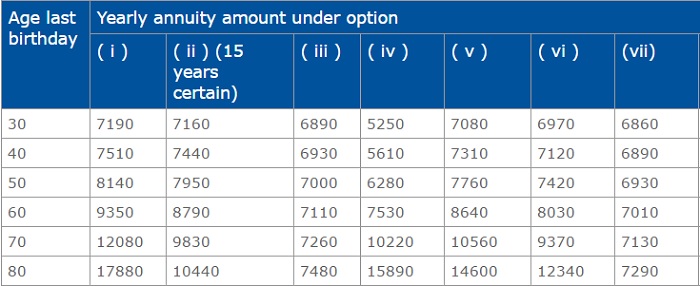

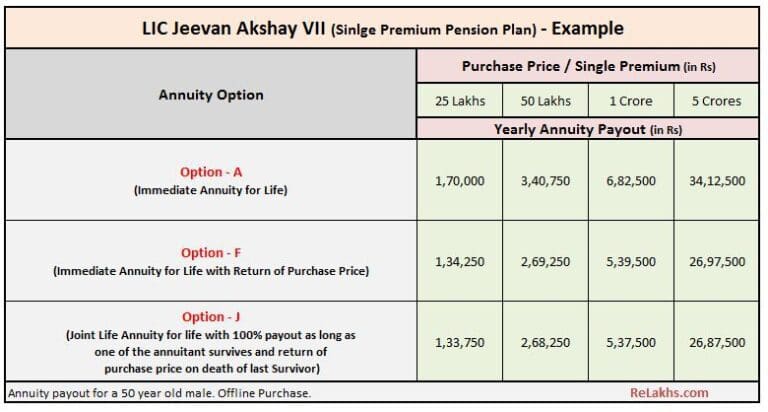

LIC Pension Plans Jeevan Akshay VI Table No 189

LIC New Jeevan Shanti Plan 858 Buy LIC Jeevan Shanti Now Guaranteed

Why NOT To Invest In LIC JEEVAN SHANTI LIC New Pension Plan

Lic Pension Plan Tax Rebate - Web Download LIC Apps 91 22 68276827 8976862090 LICIndiaForever Language Selector Search Explore Menu Display About Us History Target Of LIC Mission Vision Who s