Limited Company Dividend Tax Free Allowance From only 54 50 per month Learn more How much tax will I pay on my dividends The amount of tax you pay on any dividends you receive depends on your

It is important to note that dividends are counted alongside your salary as part of your income As such there are two tax free allowances which affect them the Yes the tax free dividend allowance is available against your dividend income even if you have another source of income too For the 2023 24 tax year the

Limited Company Dividend Tax Free Allowance

Limited Company Dividend Tax Free Allowance

https://www.outsourcedacc.co.uk/wp-content/uploads/2020/03/dividends-image.png

UK Dividend Tax Rates And Thresholds 2021 22 FreeAgent

https://freeagent-res.cloudinary.com/image/upload/c_limit,w_1200/dpr_auto,f_auto/website-images/rates/dividend-tax-rates-and-thresholds_2021-22.png

All Dividends Taxed Through The Dividend Distribution Tax The Wealth

https://1.bp.blogspot.com/-IGPIUHH-8Ds/WKquMrlNmAI/AAAAAAAACus/-U69nIWk2WwNT6IEtILW5gH30b87kFObACLcB/s1600/dividend-tax-on-distribution.jpg

Details This measure reduces the tax free allowance for dividend income the dividend allowance from 2 000 to 1 000 from 6 April 2023 and then to 500 General description of the measure This measure reduces the tax free allowance for dividend income the Dividend Allowance from 2 000 to 1 000 from

A limited company must pay Corporation Tax on its taxable profits 25 in 2023 24 It does not pay any tax on dividend payments it makes to shareholders The first 1 000 A shareholder owning 35 percent of the company s shares for example would have the right to receive 35 percent of any dividend declared However the decision can be more

Download Limited Company Dividend Tax Free Allowance

More picture related to Limited Company Dividend Tax Free Allowance

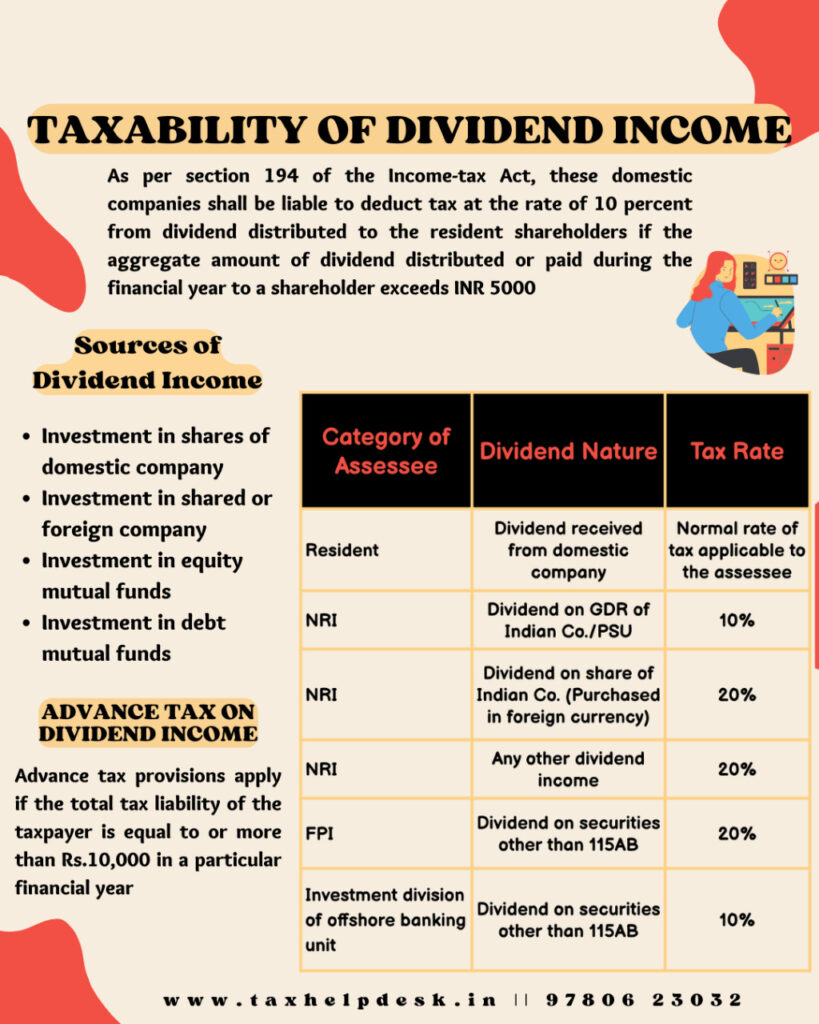

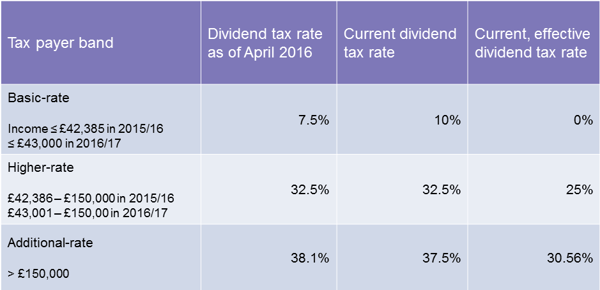

Changes To Dividend Tax 2017 1Stop Accountants

https://1stopaccountants.co.uk/wp-content/uploads/2017/05/dividends-tax.jpg

Save Tax Using The Dividend Allowance AccountingWEB

https://www.accountingweb.co.uk/sites/default/files/istock_7851553_medium.jpg

Dividend Certificate Template

https://www.informdirect.co.uk/wp-content/uploads/2021/11/Modern.png

The first 3 470 of dividends use up the rest of the 12 570 tax free personal allowance The dividend allowance covers the next 1 000 of dividends but uses up Each individual has a dividend tax free allowance for 2022 23 the dividend tax free allowance is 2 000 as well as a personal tax free allowance Once the personal and

Dividend Tax Rates for the 2023 24 tax year and the previous three tax years in the UK Once you ve used up your Personal Allowance and the tax free Indeed when your company is making enough profits it s advisable and tax efficient to make sure that you draw enough dividends to use up your 1 000 UK tax

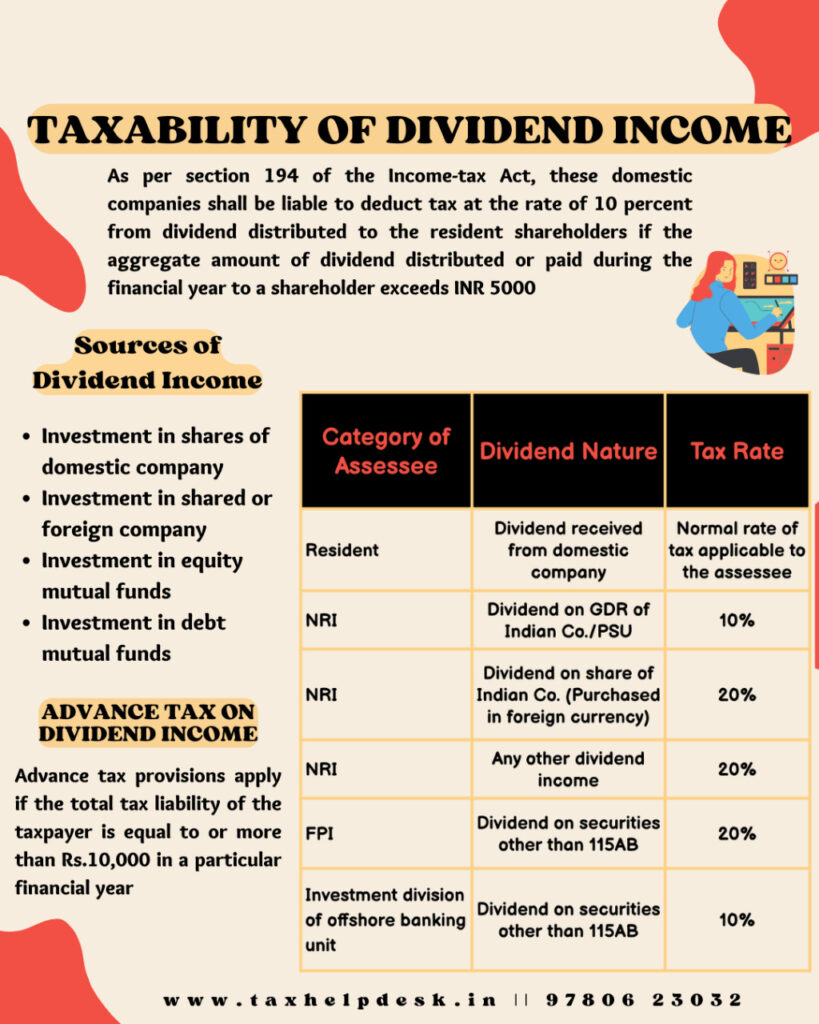

Taxability Of Dividend Income Everything You Need To Know

https://www.taxhelpdesk.in/wp-content/uploads/2022/02/Taxability-of-dividend-income-819x1024.jpeg

Dividend Tax free Allowance Cut risks Family Businesses Campden FB

https://www.campdenfb.com/sites/campdendrupal.modezero.net/files/divid.jpg

https://www.theaccountancy.co.uk/limited-company/...

From only 54 50 per month Learn more How much tax will I pay on my dividends The amount of tax you pay on any dividends you receive depends on your

https://uwm.co.uk/dividend-tax-free-allowance-limited-companies

It is important to note that dividends are counted alongside your salary as part of your income As such there are two tax free allowances which affect them the

How Much Is The Dividend Tax Free Allowance The Private Office

Taxability Of Dividend Income Everything You Need To Know

How Much You ll Save With The Dividend Tax Credit

Ultimate Guide To Dividend Tax 2020

Best Tax Breaks 12 Most Overlooked Tax Breaks Deductions 2021

Limited Company Dividend Tax Before 6th April 2016 Contract Eye

Limited Company Dividend Tax Before 6th April 2016 Contract Eye

Dividend Tax How To Calculate Dividend Tax In UK For 2020 21 DNS

Marriage Tax Allowance How To Combine Your Tax free Allowance YouTube

Beware Your Dividend Tax Rate Is Changing Here s What You Need To Know

Limited Company Dividend Tax Free Allowance - The taxation of dividends for the 2023 24 tax year is contingent upon the individual s Income Tax bracket and any dividends received above the Dividend