Limited Company Tax Rebate Web 12 oct 2022 nbsp 0183 32 Tax reliefs and allowances for businesses employers and the self employed Find out about tax reliefs and allowances available from HMRC if you run a

Web 8 sept 2023 nbsp 0183 32 Tax Deductions By claiming allowable business expenses a limited company can reduce its taxable profit resulting in lower tax liabilities This can help Web Income tax rebate for new SMEs or Limited Liability Partnerships LLPs Pursuant to the Finance Act 2020 a new Section 6D was introduced into the ITA to provide an income

Limited Company Tax Rebate

Limited Company Tax Rebate

https://lbamcl.com/tax-rebate/wp-content/uploads/2023/06/Image-2-768x374.png

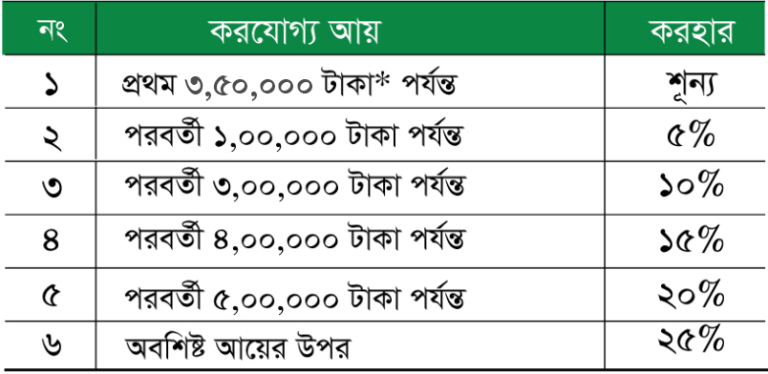

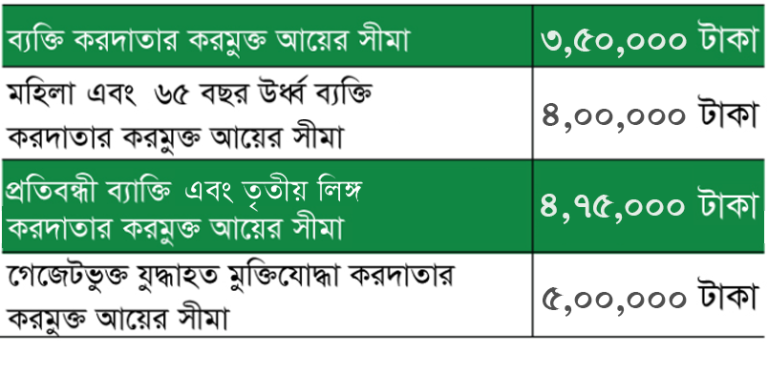

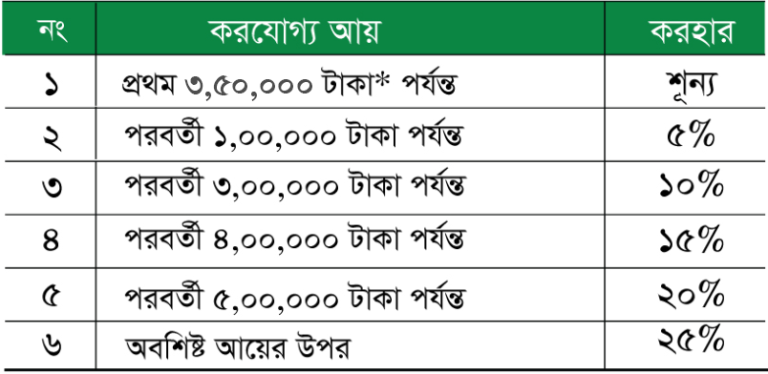

Tax Rebate Lanka Bangla Asset Management Company Limited

https://lbamcl.com/tax-rebate/wp-content/uploads/2023/06/Image-3-768x374.png

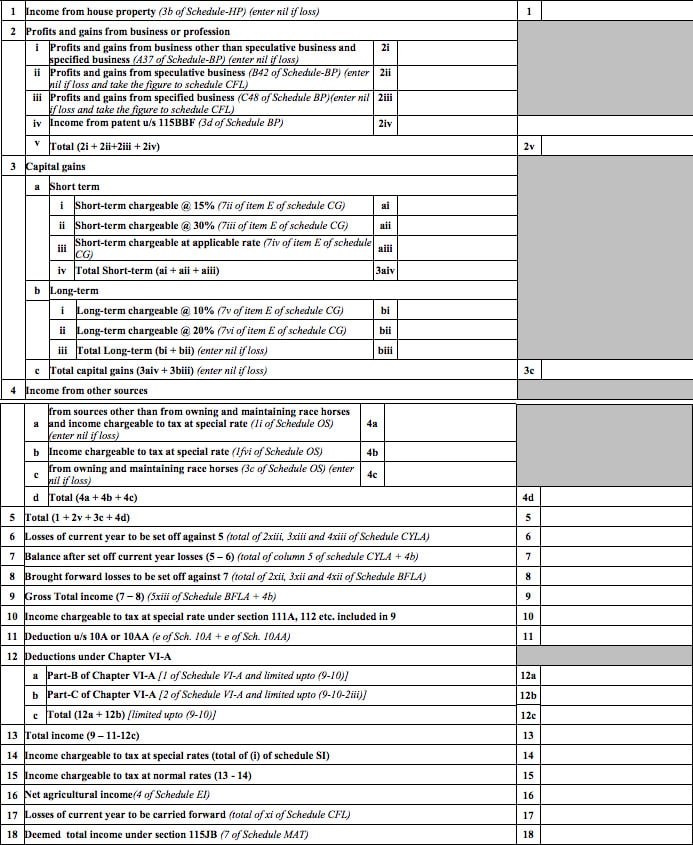

Private Limited Company Tax Rate 2022 IndiaFilings

https://www.indiafilings.com/learn/wp-content/uploads/2022/07/Calculating-Total-Income-for-Private-Limited-Company.jpg

Web 3 mars 2021 nbsp 0183 32 3 March 2021 Get emails about this page Print this page To balance the need to raise revenue with the objective of having an internationally competitive tax system Web Corporation tax Limited companies with a profits under 163 50 000 pay corporation tax at a flat rate of 19 on their profits which is generally lower than the Income Tax rates paid

Web 6 sept 2021 nbsp 0183 32 6 September 2021 Limited company expenses are allowable expenses that your business can claim helping you reduce your corporation tax bill You subtract these limited company expenses from Web Limited companies can also offer a wider range of tax free benefits to directors and employees and open up access to certain tax reliefs that aren t available to sole traders such as R amp D tax reliefs However unlike

Download Limited Company Tax Rebate

More picture related to Limited Company Tax Rebate

Private Limited Company Tax Rate All You Need To Know

https://instafiling.com/wp-content/uploads/2023/02/Topic-41-private-limited-company-tax-rate-1080x675.png

Tax Rebate Lanka Bangla Asset Management Company Limited

https://lbamcl.com/tax-rebate/wp-content/uploads/2022/06/Untitled-1-1536x538.png

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

https://static1.squarespace.com/static/55b79c7fe4b0f338367f9329/t/56f7c11bac962c8475209b2d/1459077422156/50%25-corporate-tax-rebate-for-Singapore-companies

Web 14 janv 2022 nbsp 0183 32 The consumer rights group has identified 208 firms with quot tax reclaim quot quot tax refund quot quot tax claim quot and quot tax rebate quot in their names It found the term quot tax rebate quot gets Web 28 mai 2021 nbsp 0183 32 Any and all profits made will be due a 19 percent corporation tax deduction For example If at the end of the tax year your limited company has earned 163 100 000

Web Advantages of being a Limited Company There are three main benefits to incorporating your business security of your personal assets business reputation and more money in Web 5 juil 2021 nbsp 0183 32 A claim for trading losses forms part of your Company Tax Return If your claim covers the company s latest accounting period then enter 0 in box 155 on form

Tax Rebate For New Incorporated Company Malaysia With New T C Jan 07

https://cdn1.npcdn.net/image/1641535704450e01ff4b818cb77f81d4656ac26d4b.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

Pin On Tigri

https://i.pinimg.com/originals/10/8d/67/108d67ba03bfbe29e6cc964fb355f5ea.jpg

https://www.gov.uk/guidance/tax-reliefs-and-allowances-for-businesses...

Web 12 oct 2022 nbsp 0183 32 Tax reliefs and allowances for businesses employers and the self employed Find out about tax reliefs and allowances available from HMRC if you run a

https://www.goforma.com/tax/allowable-limited-company-expenses

Web 8 sept 2023 nbsp 0183 32 Tax Deductions By claiming allowable business expenses a limited company can reduce its taxable profit resulting in lower tax liabilities This can help

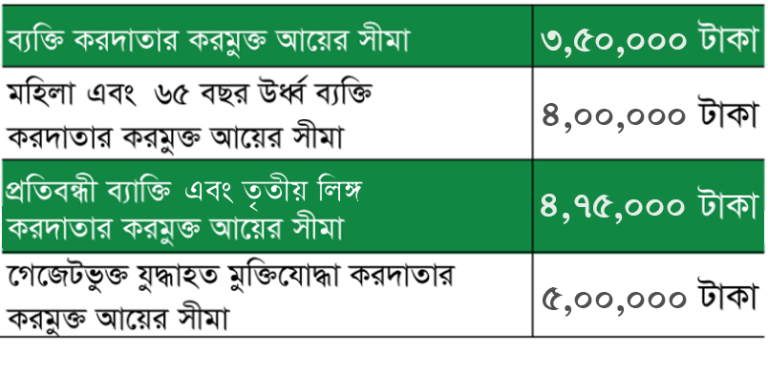

Utility Company Rebates And Government Tax Incentives AEE

Tax Rebate For New Incorporated Company Malaysia With New T C Jan 07

Private Limited Company Tax Rate All You Need To Know

Deferred Tax And Temporary Differences The Footnotes Analyst

Online Tax Rebates Limited Reviews Read Customer Service Reviews Of

Thank You 1986 Rebate Checks May Be Coming With Billions In 2022

Thank You 1986 Rebate Checks May Be Coming With Billions In 2022

Petition TAX CREDITS LIMITED TAX REBATE SCAM Change

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Limited Company Tax Return Swan Saunders

Limited Company Tax Rebate - Web Limited companies can also offer a wider range of tax free benefits to directors and employees and open up access to certain tax reliefs that aren t available to sole traders such as R amp D tax reliefs However unlike