List Of Hsa Eligible Expenses 2024 You can make contributions to your HSA for 2023 through April 15 2024 If you fail to be an eligible individual during 2023 you can still make contributions through April 15 2024 for the months you were an eligible individual

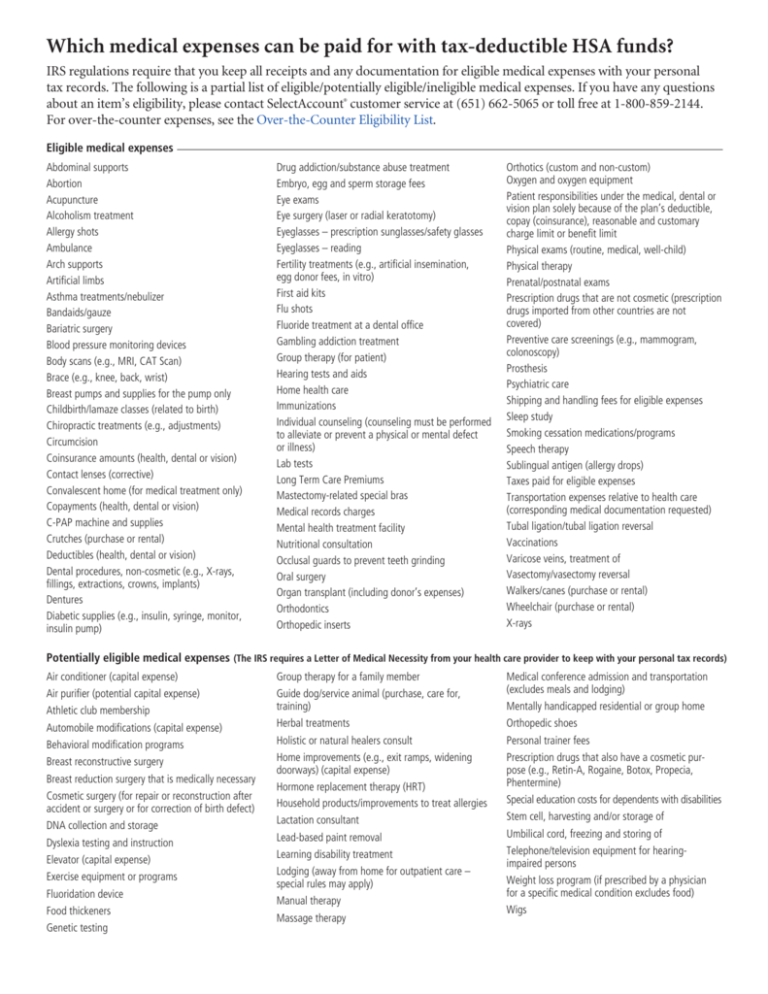

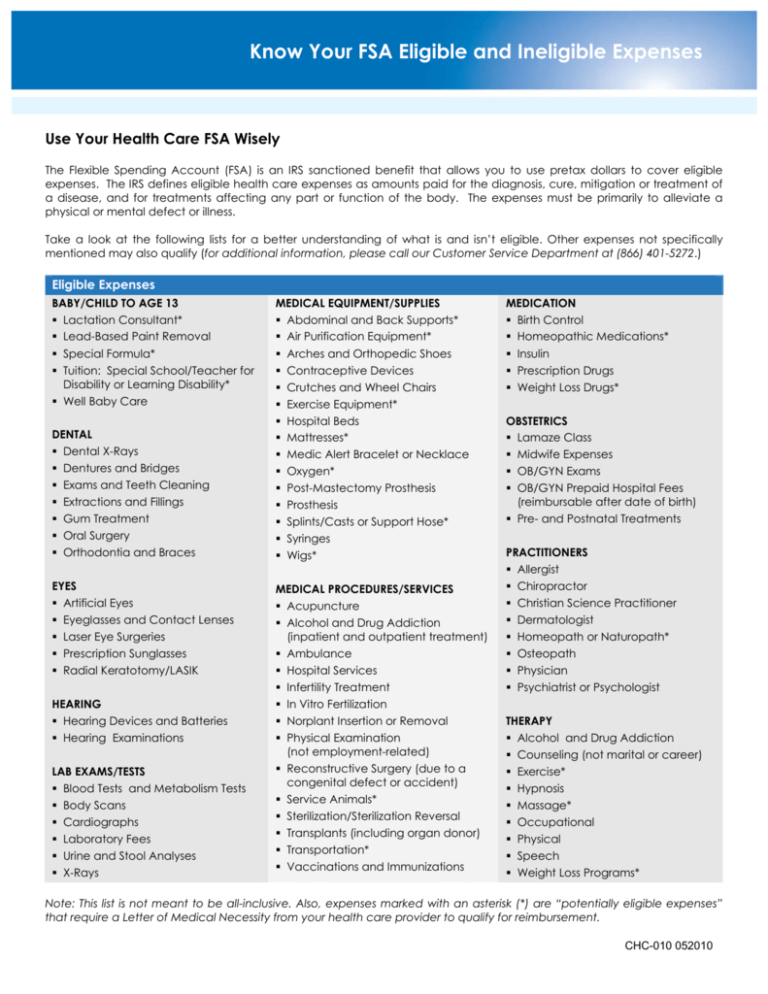

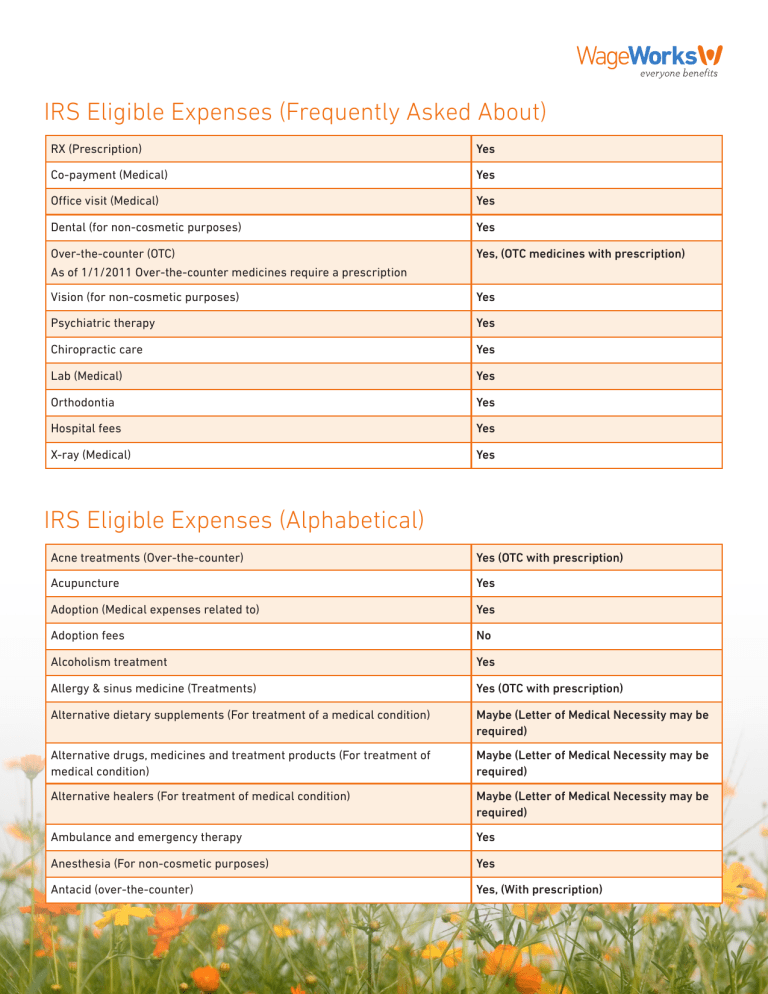

Learn what counts as an eligible health savings account expense HSAs offer tax benefits and cover IRS approved health expenses reducing taxable income Funds for HSAs can be accumulated HSA funds used towards non qualified expenses will be subject to additional tax penalities While HSA expenses do not require the submission of receipts to substantiate expenses you are required to maintain proof that your HSA purchases were for qualified expenses It s recommended to save your receipts with your tax documents

List Of Hsa Eligible Expenses 2024

List Of Hsa Eligible Expenses 2024

https://s3.studylib.net/store/data/008680662_1-893afd69df41ba680d88f4182daf2569-768x994.png

2022 HSA Eligible Expenses SmartAsset

https://dr5dymrsxhdzh.cloudfront.net/blog/images/a0a156a2c/2022/04/hsa-1-1.jpg

New Expenses Now Eligible For Your HSA FSA Funds Flyte HCM

https://flytehcm.com/wp-content/uploads/2020/04/Pharmacy-Over-the-Counter-scaled.jpeg

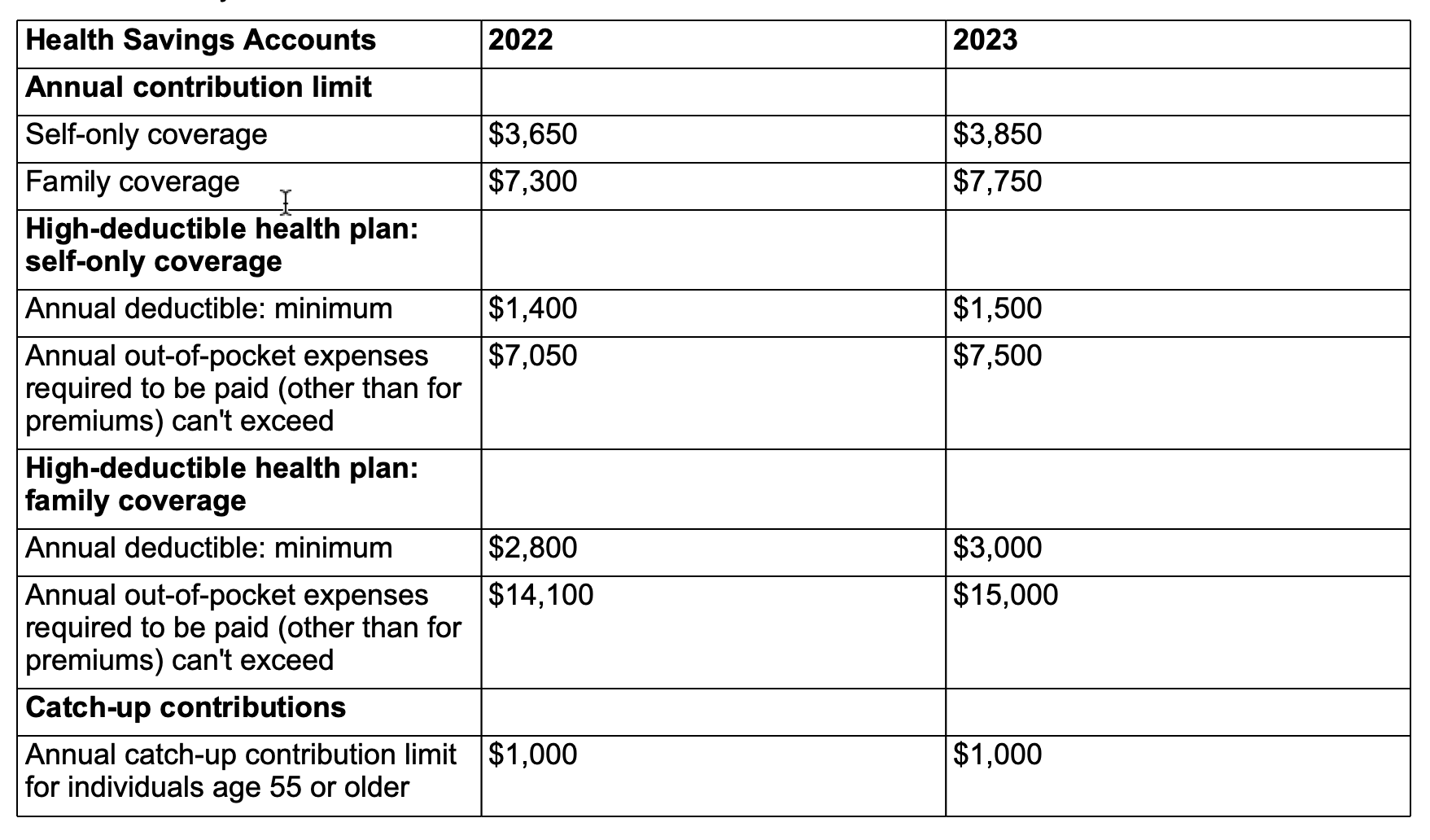

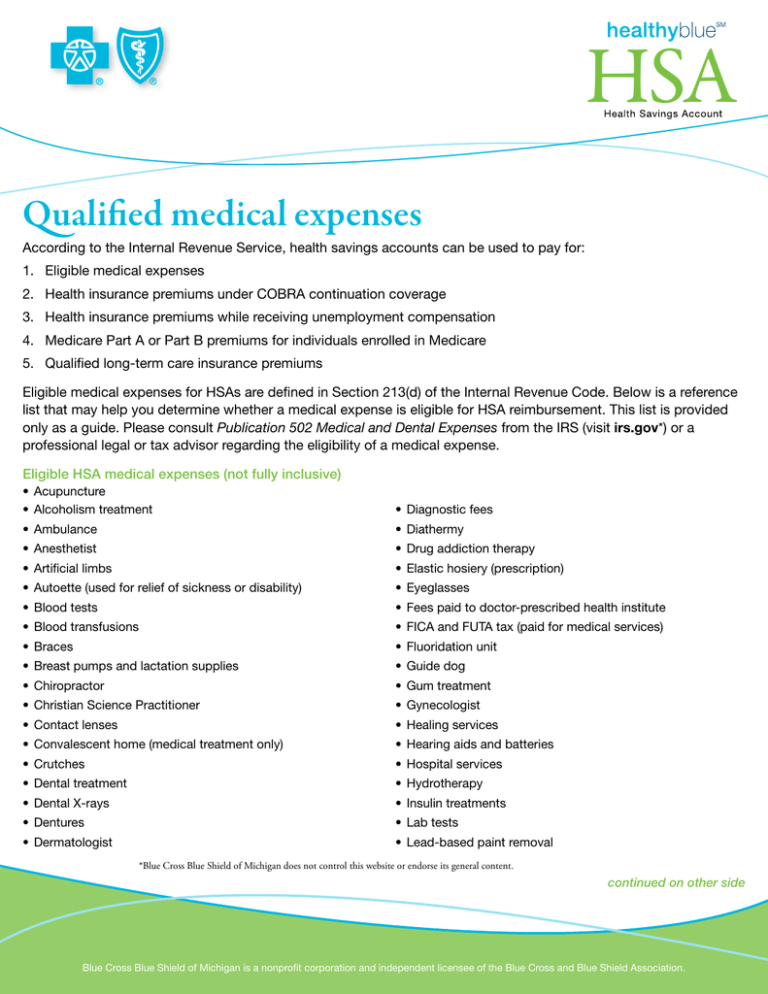

Also an eligible individual remains eligible to make contributions to its Health Savings Account HSA even if the individual has coverage outside of the HDHP during these periods for telehealth and other remote care services Health Flexible Spending Arrangement FSA contri bution and carryover for 2023 HSA Examples of Eligible Expenses Your health savings account HSA may reimburse Qualified medical expenses incurred by the account beneficiary and his or her spouse and dependents COBRA premiums Health insurance premiums while receiving unemployment benefits Qualified long term care premiums

Common HSA eligible expenses HSAs can cover various medical services performed by healthcare professionals travel costs related to attending medical treatments the cost of your prescriptions and other expenses that are related to your medical care Here are some common medical expenses that may qualify for HSA coverage ambulance services Below we ll explain how to use an HSA and provide you with 84 HSA eligible expenses for 2024 How do you use an HSA When you open an HSA you typically contribute pretax dollars to the account If you contribute to your HSA with after tax dollars you ll receive a deduction when you file your tax return

Download List Of Hsa Eligible Expenses 2024

More picture related to List Of Hsa Eligible Expenses 2024

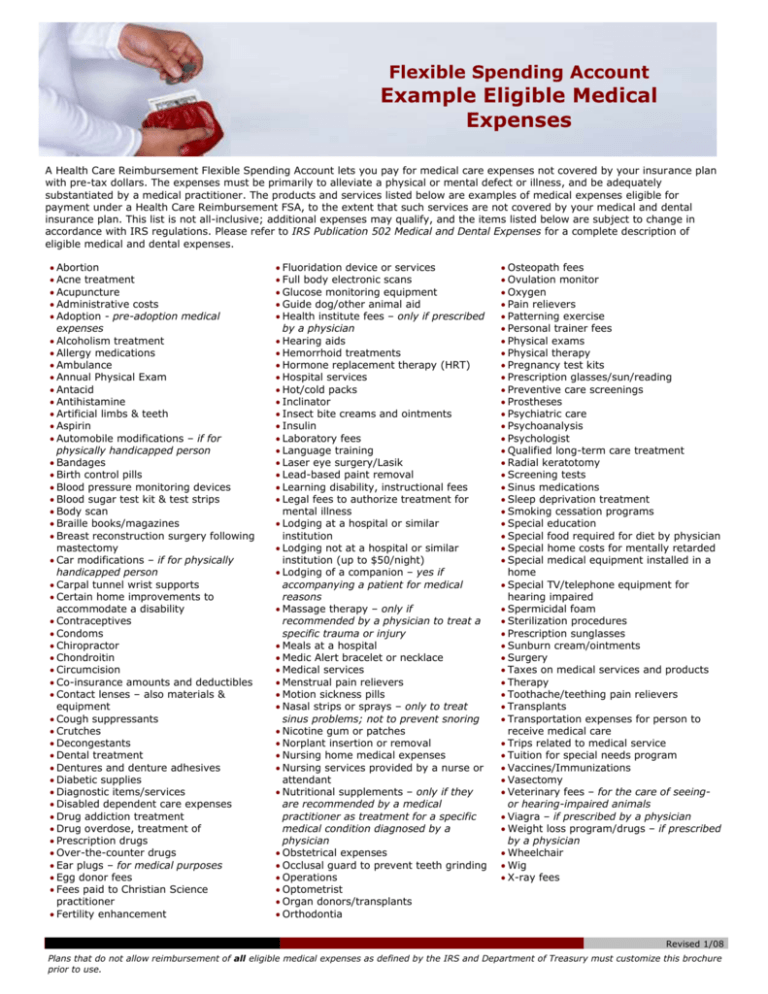

Flexible Spending Account Example Eligible Medical Expenses

https://s3.studylib.net/store/data/007783568_2-ce6693b5ed4cb9d25441e26bfd42732d-768x994.png

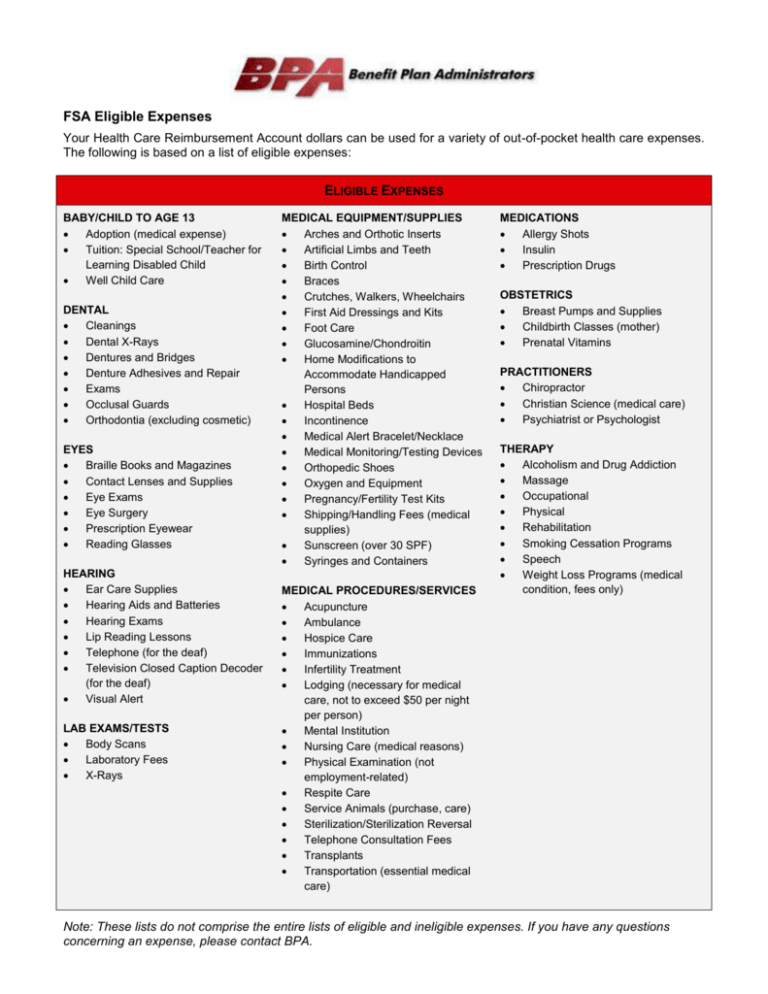

FSA Eligible Expenses Your Health Care Reimbursement Account

https://s3.studylib.net/store/data/007086489_1-0040e0dc9a9cb9861143298c01edaf4f-768x994.png

HSA Eligible Expenses In 2023 And 2024 That Qualify For Reimbursement

https://m.foolcdn.com/media/dubs/images/hsa-eligible-expenses-infographic.width-880.png

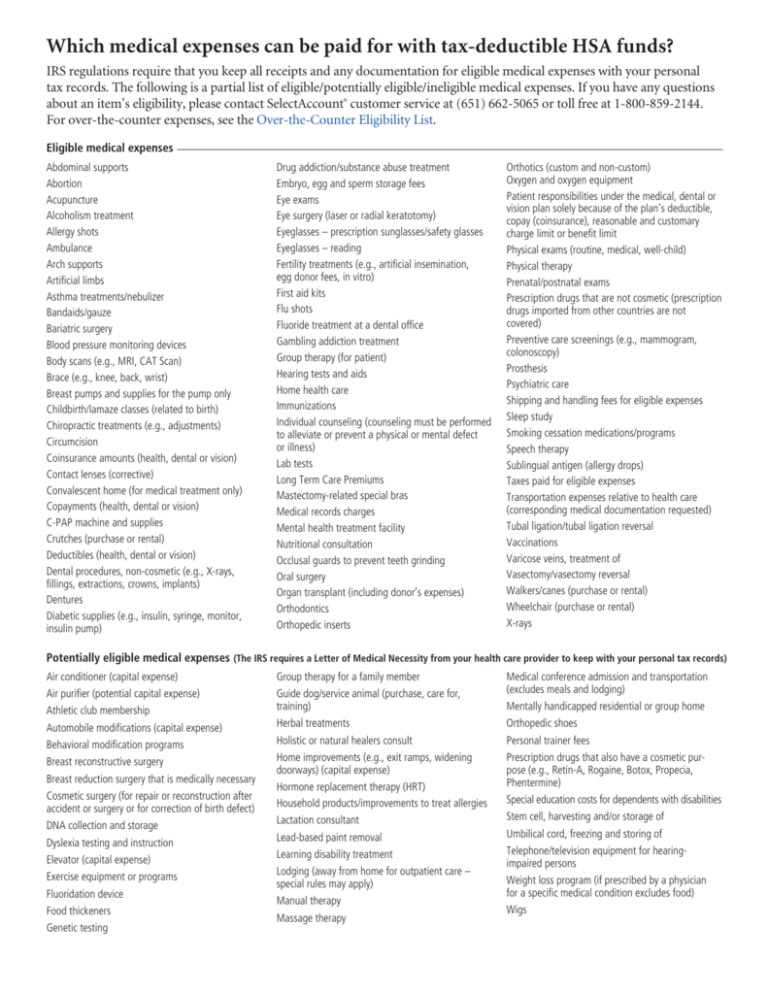

Expenses and Over the Counter Products Effective January 1 2020 The CARES Act treats all OTC drugs medicines and now menstrual care products as qualifying medical expenses that may be paid for or reimbursed on a tax free basis by an FSA or HSA Below is a partial list of eligible expenses that are reimbursable through a Health Savings Account HSA Eligible expenses can be incurred by you your spouse or qualified dependents The HSA can only be used to pay for eligible medical expenses incurred after your HSA was established

IRS qualified medical expenses You can pay for a wide range of IRS qualified medical expenses with your HSA including many that aren t typically covered by health insurance plans This includes deductibles co insurance prescriptions dental and vision care and more Eligible This can be purchased or reimbursed from your medical spending account Potentially Eligible In order to determine eligibility for potentially eligible items Further requires a Letter of Medical Necessity linked below from your health care provider

HSA Eligible Expenses Expanded McKnight Advisory Group Inc

https://static.fmgsuite.com/media/images/244b1686-43f8-41f9-be74-089672d49269.jpg?v=1

IRS Releases 2023 Key Numbers For Health Savings Accounts Ballast

https://ballastadvisors.com/wp-content/uploads/IRS-Key-HSA-numbers-2023.png

https://www.irs.gov › publications

You can make contributions to your HSA for 2023 through April 15 2024 If you fail to be an eligible individual during 2023 you can still make contributions through April 15 2024 for the months you were an eligible individual

https://www.fool.com › retirement › plans › hsa › eligible-expenses

Learn what counts as an eligible health savings account expense HSAs offer tax benefits and cover IRS approved health expenses reducing taxable income Funds for HSAs can be accumulated

Eligible Hsa Expenses 2024 Tessa Fredelia

HSA Eligible Expenses Expanded McKnight Advisory Group Inc

FSA Eligible Expense List Flexbene

HSA Qualified Medical Expenses

Irs List Of Fsa Eligible Expenses 2024 Rorie Claresta

2022 HSA Eligible Expenses SmartAsset

2022 HSA Eligible Expenses SmartAsset

FSA Eligible Health Care Expenses

IRS Eligible Expenses

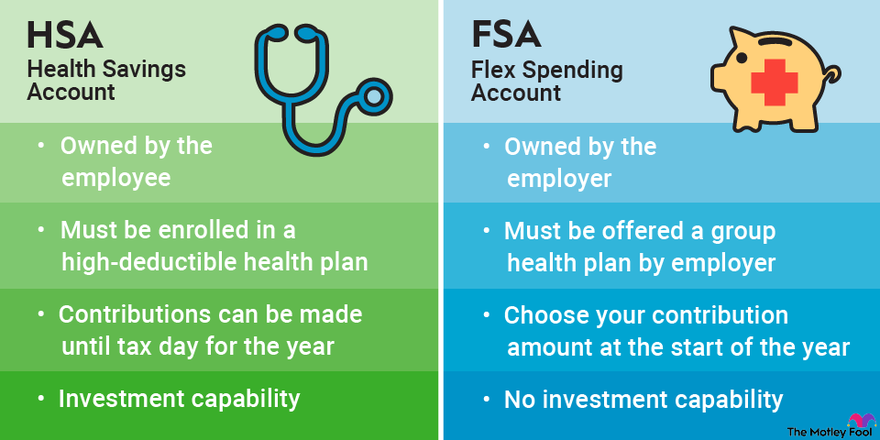

HSA Vs FSA Accounts Side by Side Healthcare Comparison The Motley Fool

List Of Hsa Eligible Expenses 2024 - Check out our list of resources below Use your TASC Card to pay for healthcare qualified expenses at clinics optometrists dentists pharmacies and other merchants with a healthcare inventory information approval system IIAS in place It may also be used for some daycare and transportation account expenses