List Of Tax Deductible Vehicles For Business Web This comprehensive guide and eligible vehicle list provide clear concise and authoritative information on Section 179 and business vehicles Maximizing your tax savings by taking all deductions available to you is always a good strategy Table of Contents Section 179 Vehicle Eligibility List What is the Section 179 tax deduction

Web Privileges for electric vehicles BEV PHEV For the taxation of the private use of electric and hybrid electric vehicles purchased as company cars after December 31 2018 and before January 1 2031 the gross list price used for the 1 method is reduced by half Web January 7 2022 Section 179 Deduction Vehicle List 2022 2023 As a small business owner you are always looking for ways to lower your taxes Buying a Business Vehicle that is more than 6000 Pounds is an excellent Tax Write Off Section 179 Vehicles can help you save thousands of dollars in Taxes

List Of Tax Deductible Vehicles For Business

List Of Tax Deductible Vehicles For Business

https://i.ytimg.com/vi/Ce-xd007kkc/maxresdefault.jpg

13 Tax Deductible Expenses Business Owners Need To Know About CPA

https://gurianco.com/wp-content/uploads/2018/11/tax-deductions.png

Tax Prep Checklist Tracker Printable Tax Prep 2023 Tax Checklist Tax

https://i.etsystatic.com/31990504/r/il/22f689/3639280950/il_1080xN.3639280950_fitj.jpg

Web 17 Jan 2022 nbsp 0183 32 From 1 January 2020 the private use of electric company cars with a gross list price of up to 65 000 euros which are used more than half for business purposes will only be taxed monthly at 0 25 percent of the gross list price as a non cash benefit 167 6 para 1 no 4 p 2 no 3 and p 3 no 3 EstG For hybrid electric vehicles as Web 18 Apr 2022 nbsp 0183 32 Here are the types of vehicles that are eligible for a Section 179 tax deduction Heavy SUVs Pickups and Vans with a GVWR over 6 000 lbs that are more than 50 business use Work vehicles that have no personal use i e a plumbing van

Web April 19 2022 10 Best Business Vehicles SUV Edition If you re looking to buy new vehicles for your business you re not alone Over 15 million cars were sold in 2021 continuing an increasing trend of car sales year after year With so many models to choose from you may be wondering which is right for your business Web Vor 4 Tagen nbsp 0183 32 The number of electric vehicle models eligible for a consumer tax credit of as much as 7 500 fell sharply as new rules from the Biden administration kicked in on Jan 1

Download List Of Tax Deductible Vehicles For Business

More picture related to List Of Tax Deductible Vehicles For Business

Ergeon How Your Fence Can Be Tax Deductible

https://assets-global.website-files.com/5ad551c41ca0c52724be6c55/6059e280542a77693a187cdc_Tax deductible.jpg

List Of Tax Deductions Here s What You Can Deduct

https://s.yimg.com/uu/api/res/1.2/PZHKfKkv5p.BgGeZMfyACA--~B/aD0xMDgwO3c9MTkyMDtzbT0xO2FwcGlkPXl0YWNoeW9u/http://media.zenfs.com/en-US/homerun/gobankingrates_644/d87a23f0b34a2e279043d0f64d549859

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy

https://i.etsystatic.com/24598192/r/il/e3c7c0/3985544266/il_1588xN.3985544266_82sm.jpg

Web Vor 2 Tagen nbsp 0183 32 What cars qualify for the 7 500 tax credit in 2024 2022 2023 Chevrolet Bolt EUV with an MSRP limit of 55 000 2022 2023 Chevrolet Bolt EV with an MSRP limit of 55 000 2022 2024 Chrysler Web Vor einem Tag nbsp 0183 32 The Nissan Leaf stopped being eligible for tax credits in 2024 with the latest federal guidance No Nissan vehicles qualified for credits Rivian the U S based maker of electric trucks

Web Vor 3 Tagen nbsp 0183 32 Curious about which electric vehicles EVs qualify for the 7 500 tax credit in 2024 According to fueleconomy gov the list of eligible EVs dropped on Jan 1 and the number of greenlit cars fell Web 22 Okt 2023 nbsp 0183 32 Section 179 Heavy Vehicles Any vehicle falling within the weight range of 6 000 to 14 000 pounds or 3 7 tons is categorized as heavy Various commercial vans full sized SUVs and pickup trucks fall under this category Vehicles in this weight class are subject to a Section 179 tax deduction limit of 28 900 in 2023

Understanding Nondeductible Expenses For Business Owners

https://cdn.shopify.com/s/files/1/0070/7032/files/non-deductible-expenses.png?format=jpg&quality=90&v=1666892015

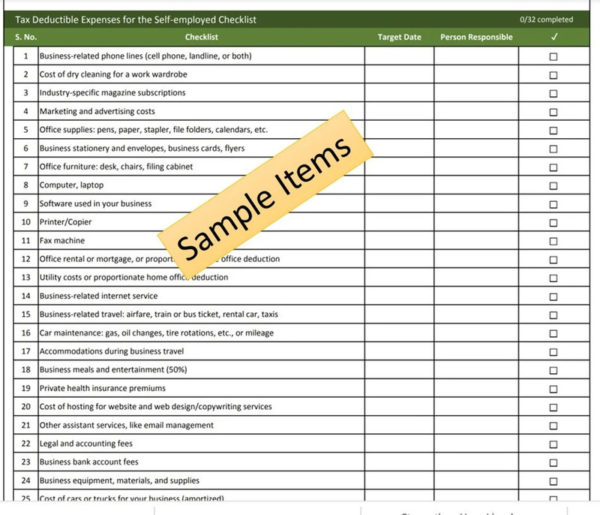

Tax Deductible Expenses For The Self employed Checklist

https://www.checklisted.us/wp-content/uploads/2022/05/Tax-Deductible-Expenses-for-the-Self-employed-Checklist-1-600x515.jpg

https://www.crestcapital.com/section-179-deduction-vehicle-list-over...

Web This comprehensive guide and eligible vehicle list provide clear concise and authoritative information on Section 179 and business vehicles Maximizing your tax savings by taking all deductions available to you is always a good strategy Table of Contents Section 179 Vehicle Eligibility List What is the Section 179 tax deduction

https://www.vda.de/en/topics/economic-policy/taxes/taxation-of...

Web Privileges for electric vehicles BEV PHEV For the taxation of the private use of electric and hybrid electric vehicles purchased as company cars after December 31 2018 and before January 1 2031 the gross list price used for the 1 method is reduced by half

The Deductions You Can Claim Hra Tax Vrogue

Understanding Nondeductible Expenses For Business Owners

Tax Deductible Bricks R Us

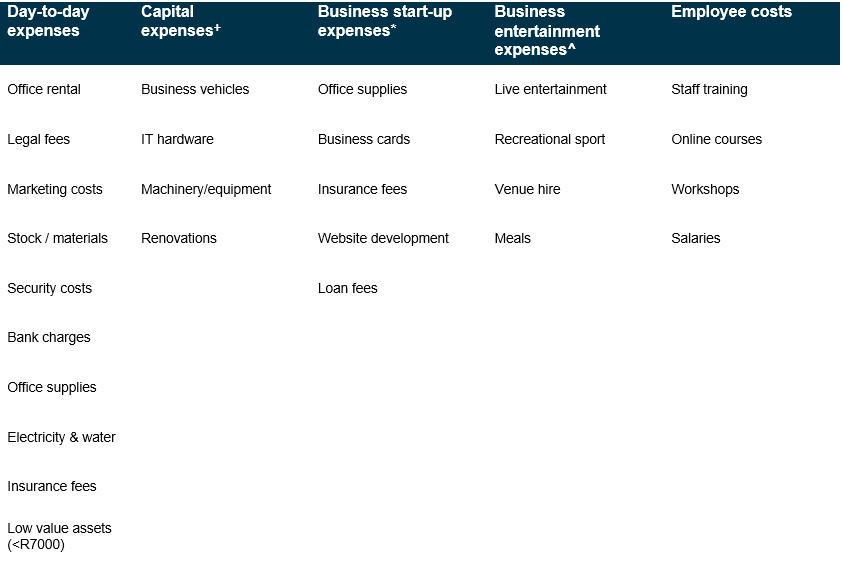

Tax deductible Expenses For Small Businesses On Accounting

Small Business Tax Deductions Cheat Sheet List Deductible Etsy India

8 Tax Preparation Organizer Worksheet Worksheeto

8 Tax Preparation Organizer Worksheet Worksheeto

Track These 5 Tax Deductible Items All Year Pocket Of Money LLC

Itemized Deductions Examples Editable Template AirSlate SignNow

Maximize Your Tax Deductions With Our Printable Donation Receipt Template

List Of Tax Deductible Vehicles For Business - Web 21 Okt 2022 nbsp 0183 32 A 7 500 tax credit for consumers carries many requirements for households and vehicles But one for business owners worth up to 40 000 doesn t have those restrictions Medium and light duty