Lottery Rebate Tax Web December 31 It is expected this will be the final filing deadline for rebate applications on property taxes or rent paid in 2023 How to File All eligible Pennsylvanians are

Web The Property Tax Rent Rebate Program is one of five programs supported by the Pennsylvania Lottery Since the program s 1971 inception older and disabled adults Web 28 f 233 vr 2019 nbsp 0183 32 Feb 28th 2019 P EOPLE PAY taxes because governments say they must and society says they should But what if tax compliance became fun Governments

Lottery Rebate Tax

Lottery Rebate Tax

https://media.vocativ.com/photos/2016/01/LotteryTaxes.r23699281692.png

150 Council Tax Rebate Branded A postcode Lottery As Families

https://i2-prod.somersetlive.co.uk/incoming/article6991475.ece/ALTERNATES/s1200/1_00council.jpg

More Victories 56

http://losthorizons.com/tax/taximages2/GZeltCA2016.jpg

Web 27 juil 2023 nbsp 0183 32 How much exactly depends on your tax bracket which is based on your winnings and other sources of income so the IRS withholds only 25 You ll owe the Web Taxes on Winnings 101 Did you know taxes on winnings should be reported as ordinary income Yes it s true Generally the U S federal government taxes prizes awards sweepstakes raffle and lottery

Web Property Tax or Rent Rebate Claim 05 21 FI PA Department of Revenue P O Box 280503 Harrisburg PA 17128 0503 OFFICIAL USE ONLY Your Social Security Number Web 3 juil 2023 nbsp 0183 32 The current maximum standard rebate is 650 but supplemental rebates for certain qualifying homeowners can boost rebates to 975 The Department of Revenue

Download Lottery Rebate Tax

More picture related to Lottery Rebate Tax

Taxes On Lottery Winnings Calculator TaxProAdvice

https://www.taxproadvice.com/wp-content/uploads/tax-calculator-on-lottery-winnings-qatax.jpeg

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/pdfresizer.com-pdf-crop-page-001.jpg?resize=720%2C400&ssl=1

Smart Tax Strategies For Lottery Winners Tax Insider

https://www.thetaxadviser.com/content/dam/tta/newsletters/lottery-lump-sum.png

Web 12 juil 2016 nbsp 0183 32 Winners who received monetary prizes between January 1 and July 12 2016 may be required to make estimated tax payments to the Department of Revenue Web Les joueurs sont tax 233 s 224 hauteur de 10 sur les prix valant plus de 2280 zl Slov 233 nie Il existe une taxe de 15 sur les prix sup 233 rieurs 224 300 Italie Les joueurs sont tax 233 s 224

Web 27 juil 2021 nbsp 0183 32 Any income received by you in the form of lottery or of similar nature is taxable at the flat rate of 30 per cent under Section 115BB of the Income Tax Act The motor Web 27 nov 2018 nbsp 0183 32 Thus basic exemption of one lakh fifty thousand would not be available where the only income is income from lottery referred to in s 115BB This section

PAcast

https://filesource.wostreaming.net/commonwealthofpa/mp4_podcast/18488_REV_PropTaxRebate_02.jpg

If There s A Winner In Saturday Night s Powerball Drawing And They Pick

https://i.pinimg.com/originals/20/88/fa/2088fa28d2616fd03346ad4bf7c09a72.jpg

https://www.revenue.pa.gov/IncentivesCreditsPrograms/PropertyTaxRent...

Web December 31 It is expected this will be the final filing deadline for rebate applications on property taxes or rent paid in 2023 How to File All eligible Pennsylvanians are

https://www.revenue.pa.gov/IncentivesCreditsPrograms...

Web The Property Tax Rent Rebate Program is one of five programs supported by the Pennsylvania Lottery Since the program s 1971 inception older and disabled adults

Do You Pay Taxes On Powerball Jackpots H R Block

PAcast

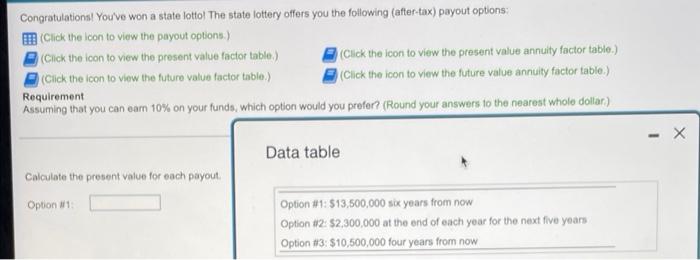

Solved Congratulations You ve Won A State Lotto The State Chegg

Taxes On Lottery Winnings Calculator TaxProAdvice

Ptr Tax Rebate Libracha

Pin On

Pin On

Cpa For Lottery Winners Lineartdrawingswallpaper

Solved Congratulations You ve Won A State Lotto The State Chegg

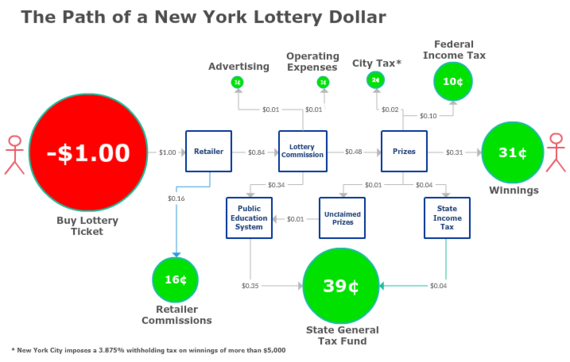

The Lottery Is A Tax An Inefficient Regressive And Exploitative Tax

Lottery Rebate Tax - Web 27 juil 2023 nbsp 0183 32 How much exactly depends on your tax bracket which is based on your winnings and other sources of income so the IRS withholds only 25 You ll owe the