Louisiana Enterprise Zone Sales Tax Rebate Web SALES USE TAX REBATE GUIDELINES Louisiana Department of Revenue Taxpayer Compliance Division SSEW Economic Development Unit P O Box 66362 Baton

Web If you have any questions regarding your Claim for Rebate of Louisiana State Sales Use Taxes Paid please contact the Office Audit Division at 225 219 2270 State of Web 8 janv 2021 nbsp 0183 32 Effective November 5 2020 S B 62 provides an opportunity for eligible entities to claim excess tax credits as a one time refund for the 2020 tax year instead of

Louisiana Enterprise Zone Sales Tax Rebate

Louisiana Enterprise Zone Sales Tax Rebate

https://www.salestaxhelper.com/images/ls-txrtc.2209201107550.jpg

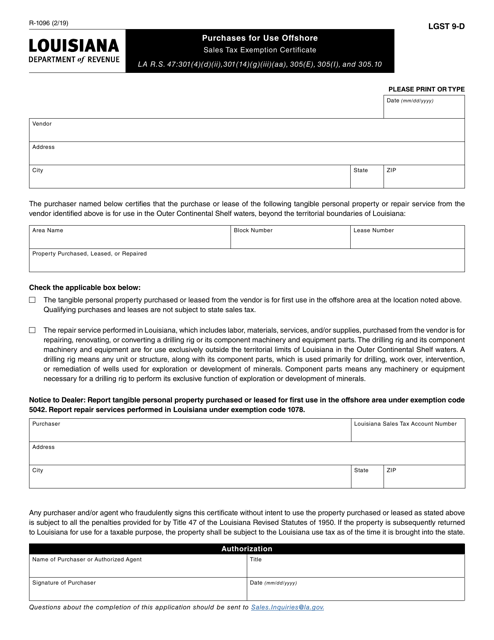

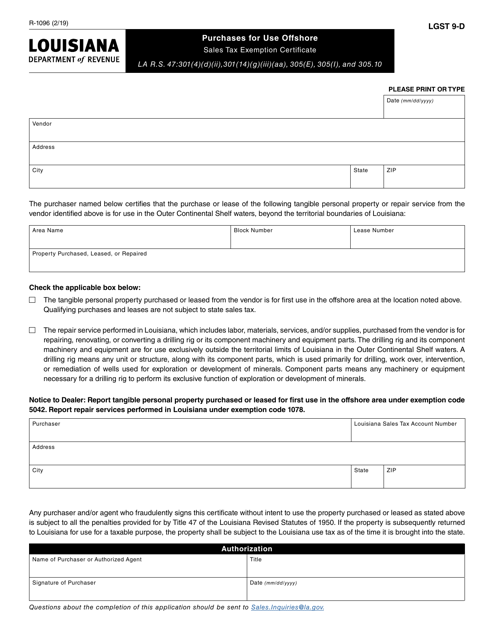

Form R 1096 Download Fillable PDF Or Fill Online Purchases For Use

https://data.templateroller.com/pdf_docs_html/1898/18980/1898065/form-r-1096-purchases-use-offshore-sales-tax-exemption-certificate-louisiana_big.png

Louisiana Separate Property Agreement Form Awesome Sales Taxes In The

https://www.flaminke.com/wp-content/uploads/2019/02/louisiana-separate-property-agreement-form-awesome-sales-taxes-in-the-united-states-of-louisiana-separate-property-agreement-form.jpg

Web ENTERPRISE ZONE Either a 3 500 or 1 000 tax credit for each certified net new job created and either a state sales use tax rebate on capital expenses or 1 5 percent Web 20 juil 2023 nbsp 0183 32 Section I 733 Sales and Use Tax Rebate Requests A The Enterprise Zone Program contract will not authorize the business to make tax exempt purchases from

Web 5 juin 2022 nbsp 0183 32 The Louisiana Department of Revenue has issued Revenue Ruling 01 011 to explain when applications for sales and use tax rebates under the Enterprise Zone Web Up to a 6 percent rebate on annual payroll expenses for up to 10 years and either a state sales use tax rebate on capital expenses or a 1 5 percent project facility expense

Download Louisiana Enterprise Zone Sales Tax Rebate

More picture related to Louisiana Enterprise Zone Sales Tax Rebate

Title Page

https://revenue.louisiana.gov/TaxpayerEducationCourses/OrthoDisabilitySalesTaxRebate/images/600pxseal_of_louisiana_2010.png

The Many Types Of Taxes That Museums May Be Subject To Museum Of

https://museum.arnabontempsmuseum.com/are_non_profits_taxexempt_in_louisiana.png

Enterprise Zone Tax Credit Office Of Treasurer And Tax Collector

https://www.yumpu.com/en/image/facebook/29715466.jpg

Web Electronic Submission of Enterprise Zone and Quality Jobs Sales Tax Rebate Claims Beginning August 1 2015 rebate requests for the Enterprise Zone and Quality Jobs Web Lease purchases may be eligible for a sales and use tax rebate upon Department of Revenue s approval The property acquired through lease purchase must be used

Web The Department of Revenue is not authorized to issue and absent a judicial order cannot issue a rebate of sales or use taxes under the Louisiana Enterprise Zone Act to any Web 225 342 3571 Quality Jobs Up to a 6 percent rebate on annual payroll expenses for up to 10 years and either a state sales use tax rebate on capital expense or a 1 5 percent

Illinois Tax Rebate Tracker Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/illinois-tax-rebate-2022-cray-kaiser-1.png

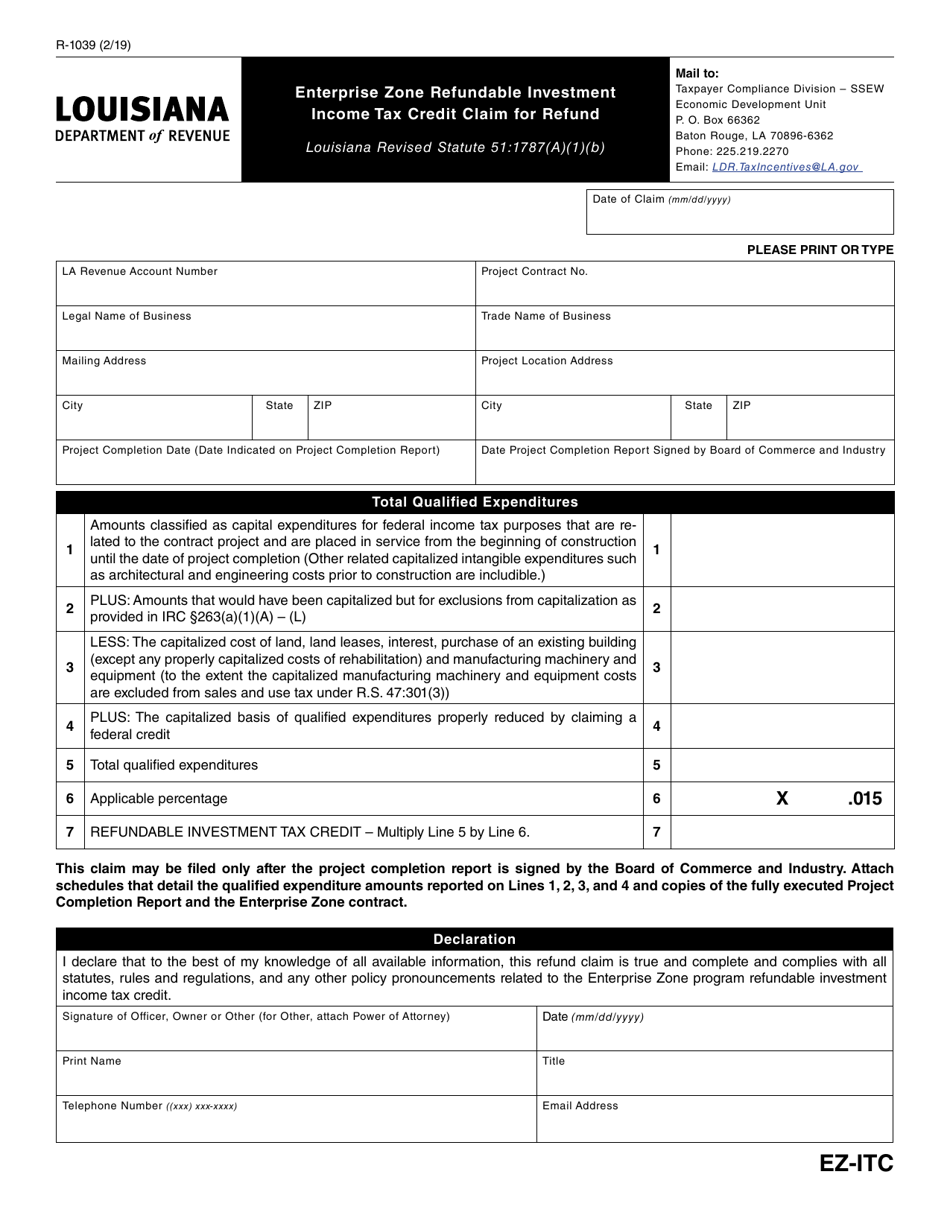

Form R 1039 Download Fillable PDF Or Fill Online Enterprise Zone

https://data.templateroller.com/pdf_docs_html/2060/20607/2060704/form-r-1039-enterprise-zone-refundable-investment-income-tax-credit-claim-for-refund-louisiana_print_big.png

https://revenue.louisiana.gov/Publications/1052(8_20)F.pdf

Web SALES USE TAX REBATE GUIDELINES Louisiana Department of Revenue Taxpayer Compliance Division SSEW Economic Development Unit P O Box 66362 Baton

https://revenue.louisiana.gov/publications/1052(2_03).pdf

Web If you have any questions regarding your Claim for Rebate of Louisiana State Sales Use Taxes Paid please contact the Office Audit Division at 225 219 2270 State of

Australian Tax Rebate Zones In 1981 Download Scientific Diagram

Illinois Tax Rebate Tracker Rebate2022

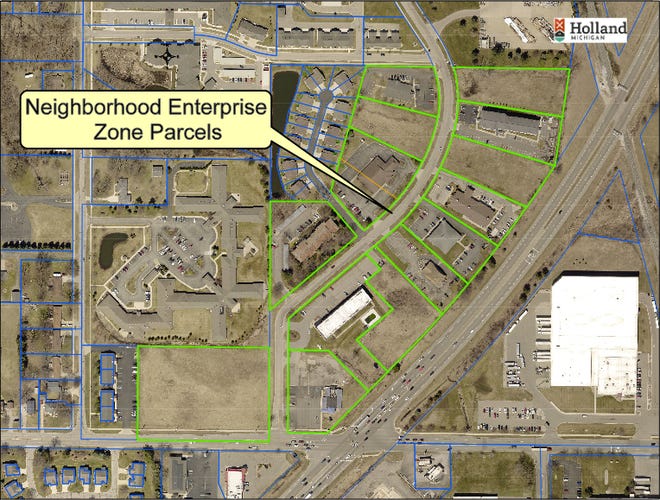

Enterprise Zone Created Around Former Goog s Pub Site

Tax Rebate For Small And Medium Enterprise Battchoo Yong

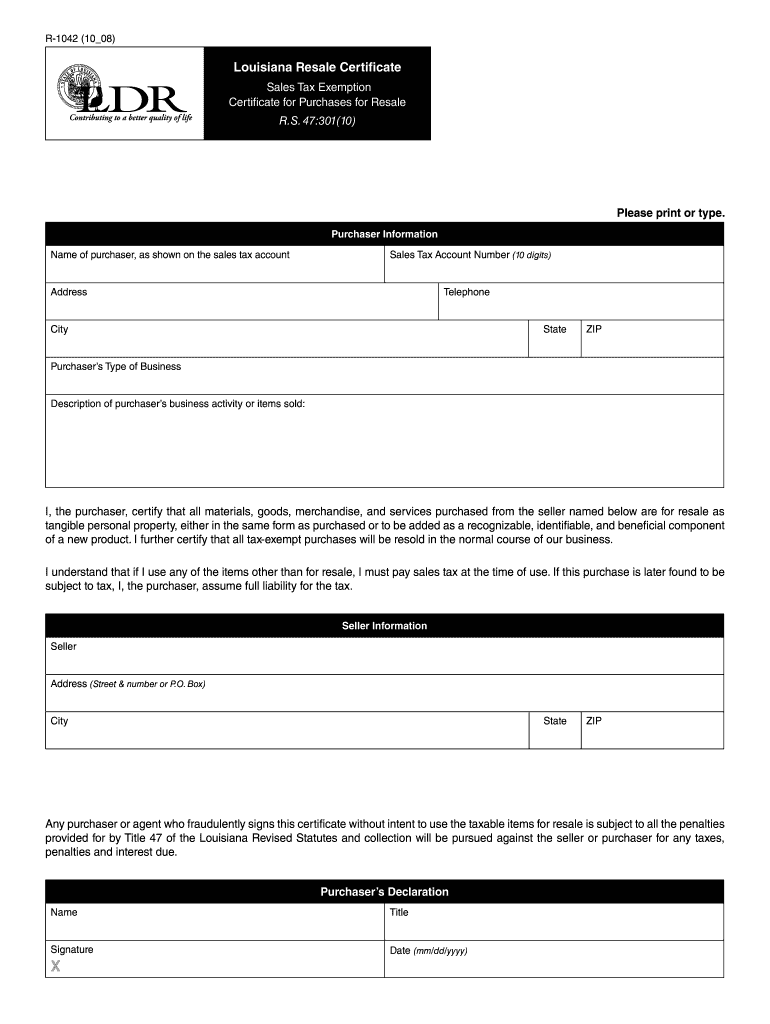

Louisiana Resale Certificate Pdf Fill Online Printable Fillable

Business Incentives Louisiana Economic Development

Business Incentives Louisiana Economic Development

Tulsa Sales Tax Rebate Form Fill Online Printable Fillable Blank

Tax Exempt Form Louisiana Fill Out Sign Online DocHub

Two Bethlehem Projects Receive Enterprise Zone Tax Credits Lehigh

Louisiana Enterprise Zone Sales Tax Rebate - Web Enterprise Zone or Quality Jobs Refundable Investment Income Tax Credit Claim for Refund Mail Taxpayer Compliance Division SSEW Economic Development Unit P O