Low Income Property Tax Rebate Nh Web What is Low amp Moderate Income Homeowners Property Tax Relief When and where do I apply for relief How do I qualify for relief What if I file my claim after June 30th can I

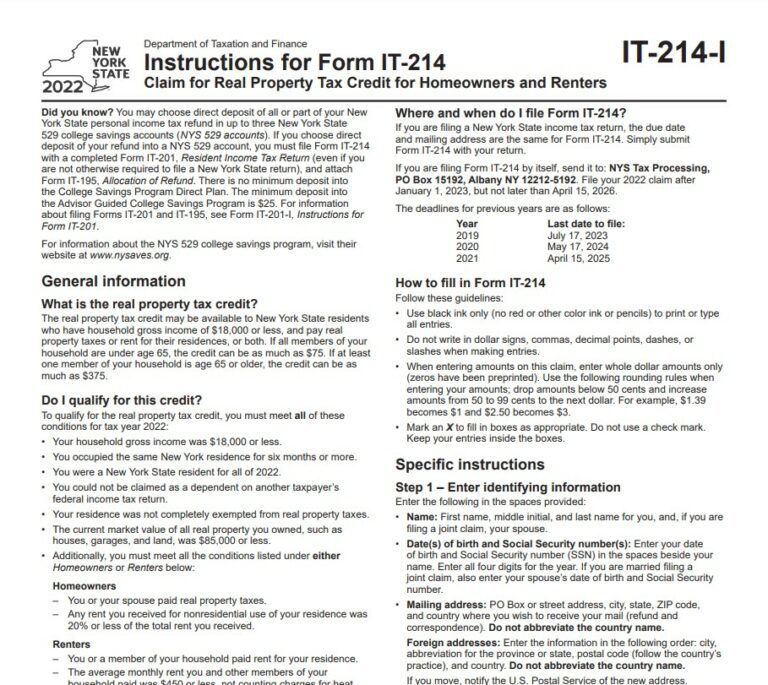

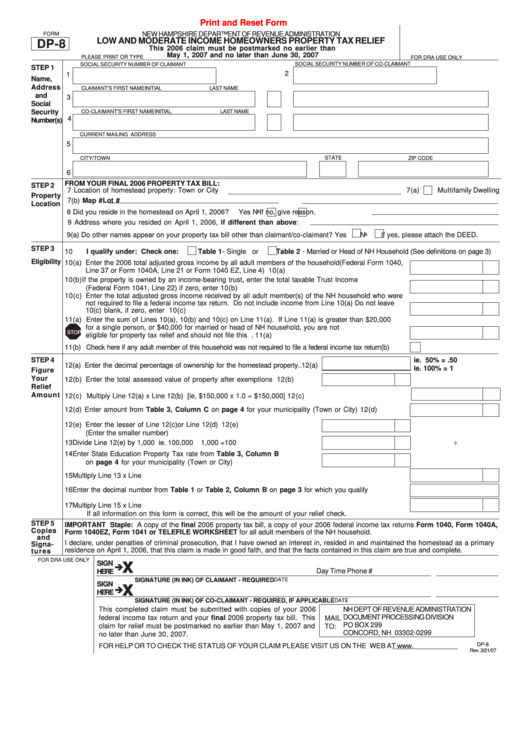

Web Form DP 8 fillable Low and Moderate Income Homeowners Property Tax Relief Form DP 8 print Low and Moderate Income Homeowners Property Tax Relief Note 2022 Web 7 mai 2021 nbsp 0183 32 An eligible applicant for Low and Moderate Income Homeowners Property Tax Relief is a person who is Single with adjusted gross income less than or equal to

Low Income Property Tax Rebate Nh

Low Income Property Tax Rebate Nh

https://www.incomeprotalk.com/wp-content/uploads/nh-towns-with-lowest-property-taxes-property-walls.jpeg

Property Tax Rebate New York State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/New-York-Renters-Rebate-2023-768x685.jpg

Property Tax Rent Rebate Program Maximizing Savings And Support For

https://i0.wp.com/www.rentrebates.net/wp-content/uploads/2023/05/Property-Tax-Rent-Rebate-Program.jpg?ssl=1

Web 5 mai 2022 nbsp 0183 32 May 5 2022 DOWNLOAD AS PDF Tags Income amp Poverty Revenue amp Tax The Low and Moderate Income Homeowners Property Tax Relief program is a rebate Web To be eligible for 2021 New Hampshire property tax rebate which is filed in May or June of 2022 Income Qualifications Single AGI of 37 000 or less Married NH HoH AGI of

Web AARP AARP States New Hampshire Finances 50 NH Property Tax Relief Available for Low and Moderate Income Homeowners You may qualify for a rebate up to 250 Web 19 juin 2023 nbsp 0183 32 In 2021 about 1 in 4 New Hampshire households or roughly 151 000 had incomes below 50 000 per year The program provides a rebate calculated based on income and the home s value up to a

Download Low Income Property Tax Rebate Nh

More picture related to Low Income Property Tax Rebate Nh

Low income Seniors In Burlington Eligible For Property Tax Rebate Insauga

https://www.insauga.com/wp-content/uploads/2021/02/taxes-e1667493632829-2048x1024.jpg

Boise Will Offer Property Tax Rebate To Low income Seniors Veterans

https://boisedev.com/wp-content/uploads/2022/03/prop-tax-1024x540-1-768x405.png

Homeowners Property Tax Rebate PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/adams-signs-bipartisan-bill-granting-property-tax-rebate-to-low-middle-1.png?fit=1280%2C800&ssl=1

Web 1 mai 2023 nbsp 0183 32 NH Department of Revenue Program Offers Property Tax Relief to Low and Moderate Income Homeowners NHDRA distributed 1 4 million in tax relief to eligible Web LOW AND MODERATE INCOME HOMEOWNERS PROPERTY TAX RELIEF This 2019 claim must be postmarked no earlier than May 1 2020 and no later than June 30 2020

Web 6 sept 2023 nbsp 0183 32 Chapter 95 Session Laws of 2021 HB 486 amends RSA 198 57 go increasing the income limits for the receipt of a Low amp Moderate Income Property Tax Web Property owners who resided in their home as of April 1st in the year for which the claim is made and had total household incomes of 37 000 or less if single and 47 000 or less if

Star Rebate Check Eligibility StarRebate

https://i0.wp.com/www.starrebate.net/wp-content/uploads/2022/10/new-york-state-star-rebate-checks-25-scaled.jpg

Illinois To Begin Sending Out Property Tax And Income Tax Rebates

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/illinois-to-begin-sending-out-property-tax-and-income-tax-rebates-youtube-2.jpg?resize=1024%2C576&ssl=1

https://www.revenue.nh.gov/faq/low-moderate.htm

Web What is Low amp Moderate Income Homeowners Property Tax Relief When and where do I apply for relief How do I qualify for relief What if I file my claim after June 30th can I

https://www.revenue.nh.gov/forms/low-moderate.htm

Web Form DP 8 fillable Low and Moderate Income Homeowners Property Tax Relief Form DP 8 print Low and Moderate Income Homeowners Property Tax Relief Note 2022

House Panel Backs 1 2 Billion Tax Rebate Kills Separate Relief For

Star Rebate Check Eligibility StarRebate

Fillable Form Dp 8 Low And Moderate Income Homeowners Property Tax

Nys Property Tax Rebate Checks 2023 Eligibility Application Process

Stadelman Encourages Older Adults To Claim Their Property Tax Rebate

Nova Scotia Gov On Twitter RT ns servicens Applications For The

Nova Scotia Gov On Twitter RT ns servicens Applications For The

What To Know About Montana s New Income And Property Tax Rebates

Low Income Property Tax Exemption Town News

Low Income Property Tax Rebate Nova Scotia Lowesrebate

Low Income Property Tax Rebate Nh - Web 19 juin 2023 nbsp 0183 32 In 2021 about 1 in 4 New Hampshire households or roughly 151 000 had incomes below 50 000 per year The program provides a rebate calculated based on income and the home s value up to a