Low Income Property Tax Rebate Nova Scotia Web 27 juin 2022 nbsp 0183 32 June 27 2022 1 38 PM Applications for the Property Tax Rebate for Seniors which helps low income seniors with their municipal residential property taxes

Web 30 juin 2023 nbsp 0183 32 Service Nova Scotia June 30 2023 12 19 PM Applications for the Property Tax Rebate for Seniors which helps seniors on a low income with their Web 17 juin 2021 nbsp 0183 32 the budget for the Property Tax Rebate for Seniors increased from 7 78 million in 2020 21 to 8 82 million in 2021 22 in 2018 the eligibility criteria were

Low Income Property Tax Rebate Nova Scotia

Low Income Property Tax Rebate Nova Scotia

https://pbs.twimg.com/media/FcigJ-UXoAAP6SS.jpg

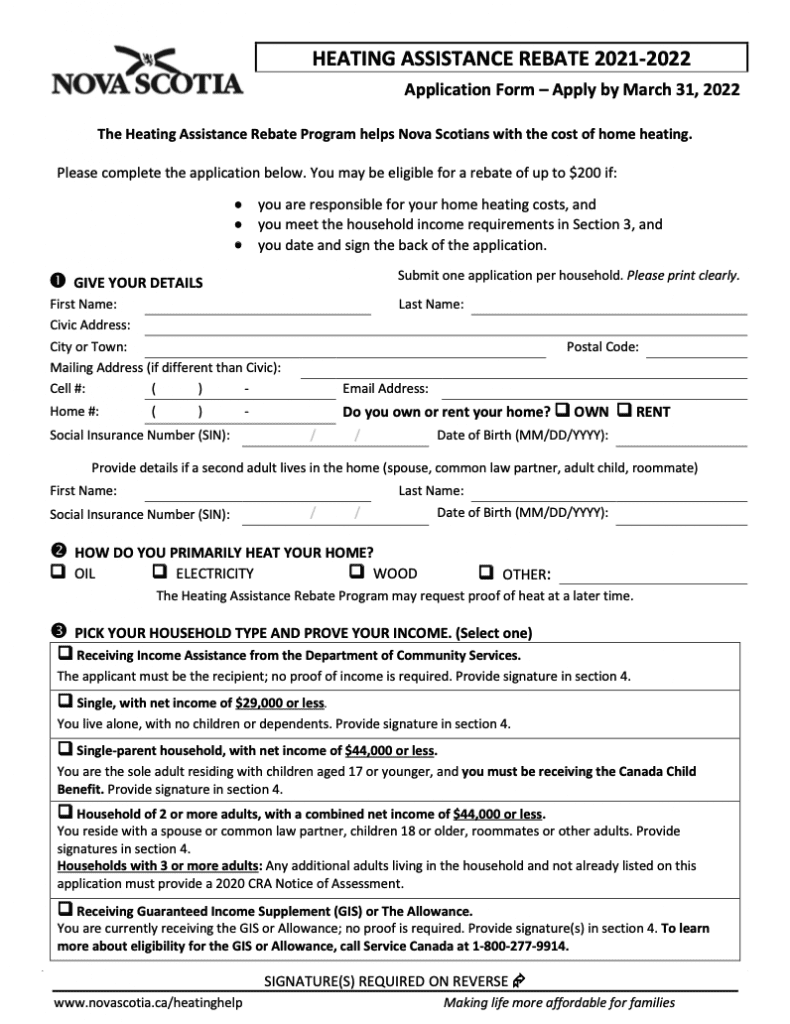

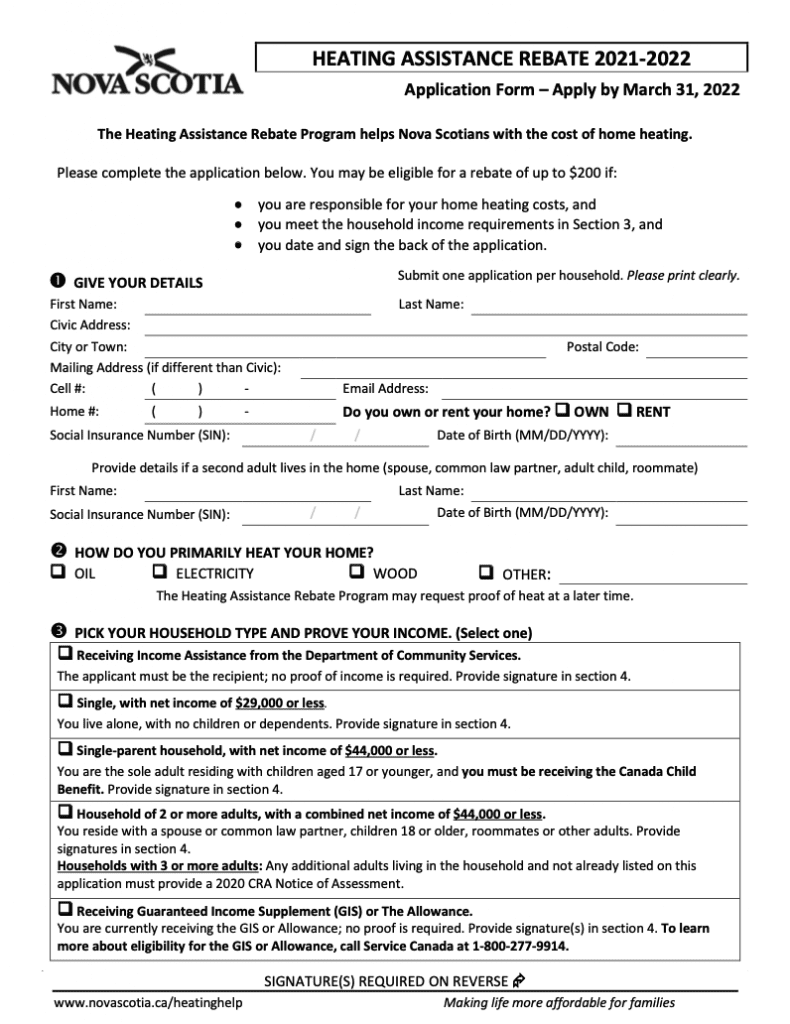

Heating Rebates 2022 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/02/Heating-Rebate-Nova-Scotia-2022-790x1024.png

Nova Scotia Property Assesments Up Over 22 8 Billion 101 5 The Hawk

https://www.propertyrebate.net/wp-content/uploads/2023/05/nova-scotia-property-assesments-up-over-22-8-billion-101-5-the-hawk.jpg

Web 6 juin 2023 nbsp 0183 32 If you need help paying your property taxes the municipality offers a few choices You can apply for Rebate if your household income is less than 45 000 the Web Apply for a property tax rebate Property Tax Rebate for Seniors Property Tax Rebate for Seniors helps low income seniors with the cost of municipal residential property

Web The Property Tax Rebate for Seniors helps low income seniors with the cost of municipal residential property taxes Rebates are 50 of what you paid on last year s property Web This program provides a 50 rebate of residential municipal property taxes paid for 2022 up to 800 To be eligible for the Property Tax Rebate for Seniors you must be at least

Download Low Income Property Tax Rebate Nova Scotia

More picture related to Low Income Property Tax Rebate Nova Scotia

Pin On Quick Saves

https://i.pinimg.com/originals/d6/f2/5f/d6f25fc2c94bd31146ef1cd6dc76ed04.png

Boise Will Offer Property Tax Rebate To Low income Seniors Veterans

https://boisedev.com/wp-content/uploads/2022/03/prop-tax-1024x540-1-768x405.png

Nova Scotia Grants For Homeowners 28 Grants Rebates Tax Credits

https://149688362.v2.pressablecdn.com/wp-content/uploads/2018/06/nova_scotia_grants-for_homeowners.jpg?x74268

Web 17 juin 2021 nbsp 0183 32 To qualify for the rebate Nova Scotians must be 60 or older in 2021 and meet all of the following criteria 2020 municipal residential property taxes are paid in Web Grants are 750 for each household You can apply until 31 March 2024 Apply for the Seniors Care Grant to help with the cost of household and healthcare services and home

Web 4 juil 2019 nbsp 0183 32 Low income seniors will be able to afford to stay in their homes longer thanks to the Property Tax Rebate for Seniors The program provides qualifying seniors up to Web 29 ao 251 t 2023 nbsp 0183 32 The Province is returning almost 17 million in provincial income tax to Nova Scotia seniors through its Guaranteed Income Supplement rebate program More

Property Tax Rent Rebate Program Maximizing Savings And Support For

https://i0.wp.com/www.rentrebates.net/wp-content/uploads/2023/05/Property-Tax-Rent-Rebate-Program.jpg?ssl=1

Low Income Property Tax Exemption Town News

https://www.townofantigonish.ca/images/2023_Applications_for_the_Low-Income_Property_Tax_Exemption_.png

https://novascotia.ca/news/release/?id=20220627004

Web 27 juin 2022 nbsp 0183 32 June 27 2022 1 38 PM Applications for the Property Tax Rebate for Seniors which helps low income seniors with their municipal residential property taxes

https://novascotia.ca/news/release/?id=20230630004

Web 30 juin 2023 nbsp 0183 32 Service Nova Scotia June 30 2023 12 19 PM Applications for the Property Tax Rebate for Seniors which helps seniors on a low income with their

Stadelman Encourages Older Adults To Claim Their Property Tax Rebate

Property Tax Rent Rebate Program Maximizing Savings And Support For

Nova Scotia Electric Vehicle Rebate Program Now Accepting Applications

Nova Scotia Power Rebates On Heat Pumps PumpRebate PowerRebate

Nova Scotia Touts Skilled Trades Income Tax Rebate SaltWire

Low income Elderly And Disabled Sioux Falls Homeowners May Qualify For

Low income Elderly And Disabled Sioux Falls Homeowners May Qualify For

Abington School Board Approves Senior Citizen Real Estate Tax Rebate

Deny Sullivan On Twitter New Blog Nova Scotia s Capped Assessment

Sally Newell On Twitter RT LiteFootPrints What About People On Low

Low Income Property Tax Rebate Nova Scotia - Web Apply for a property tax rebate Property Tax Rebate for Seniors Property Tax Rebate for Seniors helps low income seniors with the cost of municipal residential property